Source: insights4.vc

Translation: Shaw Golden Finance

From July 17 to 24, 2025, the United States took milestone actions in digital currency policy. Congress advanced three significant measures: the "GENIUS Act" established a unified federal framework for the issuance and reserves of stablecoins; the "CLARITY Act" clarified the jurisdiction of the U.S. Securities and Exchange Commission (SEC) and the U.S. Commodity Futures Trading Commission (CFTC) over crypto assets; a provision in the 2026 fiscal year defense bill stipulated that the Federal Reserve could not issue a central bank digital currency (CBDC) without explicit congressional approval. This article analyzes the provisions and timelines of each bill, assesses their immediate impact on major stablecoins and money markets with a market capitalization exceeding $250 billion, and examines the systemic risks emphasized by regulators—from the "uniqueness" of currency and dynamics of bank runs to illicit financial activities and monetary sovereignty. We quantified the adoption trends of stablecoins in retail and institutional use cases (the dominance of USDT and USDC, foreign exchange use in emerging markets, B2B and payment volumes), and explored the strategic responses of banks, payment companies, merchants, and policymakers (including the Bank for International Settlements' Project Agorá). We conclude with predictions for the best, worst, and stress scenarios for the coming year, assessing how these developments may shape the global use of digital currencies under the influence of the U.S. and Europe.

I. Key Provisions of Recent U.S. Digital Asset Legislation

The key provisions of the recent U.S. digital asset legislation, the "Guidance and Establishment of the U.S. Stablecoin National Innovation Act" (referred to as the "GENIUS Act"), were signed into law on July 18, 2025. This act establishes the first national regulatory framework for payment stablecoins (digital tokens designed to maintain a stable value against fiat currency). Key requirements include: 100% reserve backing with safe, highly liquid assets (U.S. dollars, Federal Reserve deposits, short-term U.S. Treasury securities, repurchase agreements, and money market funds), with monthly disclosures of reserve composition by public accountants. Issuers must maintain a reserve ratio of at least 1:1, with strict limitations on rehypothecation (reusing collateral) to ensure stability. The definition of eligible issuers is very strict: only regulated entities can issue stablecoins in the U.S., such as licensed bank subsidiaries approved by banking regulators, federally chartered stablecoin issuers by the Office of the Comptroller of the Currency (OCC), or state-qualified issuers meeting equivalent regulatory standards. This effectively excludes unregulated or offshore issuers: after the phased implementation of the act, any stablecoin issued by a non-"approved" U.S. issuer or an approved foreign issuer will not be treated as cash or cash equivalents for accounting purposes and cannot be used as collateral in regulated markets. Notably, issuers are prohibited from paying interest to stablecoin holders, preventing the emergence of bank-like yield products. In the event of issuer bankruptcy, the redemption rights of stablecoin holders take precedence over other creditors, adding a layer of consumer protection. The act also requires issuers to comply with financial crime laws: stablecoin operators must register, implement anti-money laundering programs under the Bank Secrecy Act, and possess the technical capability to freeze or "destroy" tokens under lawful orders. Federal and state regulators are responsible for overseeing compliance: the OCC will regulate new federally chartered stablecoin banks, while state regulators can oversee smaller issuers (with token sizes below $10 billion), provided their rules are deemed "substantially similar" to federal standards. Larger state issuers (or issuers in states without equivalent rules) will be subject to joint federal regulation to ensure there are no regulatory gaps.

Timeline and Implementation

The effective date of the GENIUS Act is January 18, 2027, or 120 days after federal regulators issue implementation rules, whichever comes first. Until then, the issuance of stablecoins will remain status quo. From the effective date, new issuances must comply with the regulations (only approved issuers can issue), but as a transitional phase, existing non-compliant stablecoins can still be traded until July 18, 2028. By July 18, 2028, all stablecoins issued in the U.S. must come from regulated issuers, thereby phasing out unregulated stablecoins from the U.S. market. This multi-year transition period reflects lawmakers' balancing of innovation and risk: allowing current major stablecoins time to apply for licenses or cease operations in the U.S. The GENIUS Act passed with bipartisan support in the Senate, indicating that stablecoins are now viewed as a mainstream part of the financial system that requires federal standards. The act aims to enhance confidence in stablecoins as reliable digital cash equivalents, thereby encouraging broader adoption (with U.S. dollar stablecoins solidifying the dollar's dominance).

The CLARITY Act — Division of SEC and CFTC Jurisdiction

In addition to the stablecoin legislation, the House also advanced the "Digital Asset Market Clarity Act" (CLARITY Act) to clarify the regulatory jurisdiction over cryptocurrencies. The act passed the House on July 17, 2025, addressing the long-standing ambiguity regarding when crypto tokens are considered securities (regulated by the SEC) and when they are considered commodities (regulated by the CFTC). The act stipulates that most "digital commodities"—typically referring to crypto tokens inherently related to decentralized blockchains—are subject to CFTC regulation even in the spot market. The act also provides that tokens initially part of investment contracts (e.g., tokens sold for fundraising) can become non-securities after achieving sufficient decentralization or "maturity" of the network. In practice, this provides a migration path for projects: they can notify the SEC that their blockchain has reached "mature" status (no controlling entity), at which point their tokens will be regulated as commodities rather than securities. The SEC retains jurisdiction over initial investment contracts and any tokens still controlled by the issuer and is responsible for anti-fraud enforcement, but must yield trading regulation of truly decentralized tokens and crypto assets similar to commodities to the CFTC. The act also creates a new regulatory category under the CFTC—digital commodity exchanges, brokers, and dealers—similar to traditional securities intermediaries. These entities will register with the CFTC and comply with customer protection, reporting, and custody rules tailored for the crypto market, thereby bringing currently gray-area crypto trading platforms under clearer regulatory oversight. Additionally, the CLARITY Act strengthens disclosure and protection rules for digital asset companies (e.g., requiring the segregation of customer funds, requiring bankruptcy procedures to protect customers, and disclosing conflicts of interest) to prevent the misuse of customer assets like in the case of FTX.

Stablecoins under the CLARITY Act

The intersection of this act with stablecoins is the confirmation that as long as they meet the regulatory requirements set forth in the GENIUS Act, payment stablecoins are neither securities nor commodities. This clarity exempts compliant stablecoins from being classified as investment securities by the SEC while also avoiding being viewed as commodities by the CFTC, thus establishing stablecoins as a new, unique category of regulated payment instruments.

The CLARITY Act received strong bipartisan support in the House (294 votes in favor, 134 against), but as of the end of July 2025, it was still awaiting action in the Senate. The fate of the act in the Senate remains uncertain; opponents argue that it may overly weaken SEC protections for investors. However, the passage of the act in the House reflects a strong industry demand for regulatory certainty. Observers note that reaching consensus on a legal framework may help the U.S. catch up with comprehensive regulatory regimes abroad, such as the European Markets in Crypto-Assets Regulation (MiCA), keeping crypto innovation domestic. The act proposes the CFTC as the primary regulatory body for cryptocurrency trading, marking a significant adjustment in U.S. cryptocurrency regulation, limiting the SEC's recent broad claims of regulatory authority over digital assets. If the act is passed, the SEC and CFTC will have to jointly develop rules and coordinate, which presents a challenging but potentially stabilizing development for market participants.

Anti-CBDC Measures — Blocking the "Digital Dollar"

The third development was the inclusion of anti-central bank digital currency (CBDC) provisions in the 2026 fiscal year National Defense Authorization Act (NDAA). House Republicans, led by Majority Leader Tom Emmer, pushed the "Anti-CBDC Surveillance State Act" (H.R. 1919), aimed at prohibiting the issuance of U.S. central bank digital currency without congressional consent. This reflects political resistance to a retail "digital dollar." The provision was ultimately attached to the must-pass defense bill amid intense debate in the House, prohibiting the Federal Reserve from directly or indirectly issuing CBDC to individuals and requiring any CBDC project to receive explicit authorization from Congress, effectively blocking the Federal Reserve from unilaterally launching a "digital dollar." The provision also stipulates that the Federal Reserve cannot use CBDC to implement monetary policy or control the money supply in new ways. Supporters view this as a protection of privacy and freedom: critics argue that unlike decentralized cryptocurrencies, centralized CBDCs would enable the government to monitor and control private transactions.

The political context is noteworthy: President Trump has issued an executive order prohibiting the federal government from engaging in CBDC-related work, and this bill aims to codify that ban into law. Many Republicans believe that a U.S. CBDC would threaten the role of the private sector and the anonymity of cash.

House leaders attempted to link the anti-CBDC bill to the NDAA to force its consideration. However, it remains uncertain whether the measure will pass in the conference between the two chambers. The Federal Reserve has also maintained a cautious stance on advancing a digital dollar, repeatedly stating that it will not act rashly without clear congressional support. However, this House initiative sends a clear signal: if the Federal Reserve attempts to launch a CBDC for the general public, it will face significant legislative hurdles. This position has prompted U.S. digital dollar efforts to shift towards other alternatives (such as private sector stablecoins or bank-issued digital deposits), as detailed in Section 5. Notably, the anti-CBDC provisions do not directly affect ongoing wholesale CBDC or payment system improvements (the Federal Reserve continues to explore these improvements, such as the FedNow instant payment service). Their primary function is to convey a policy signal—tilting U.S. law towards private innovation (perhaps including tokenized bank deposits) rather than centrally managed retail currency. In the short term, this reassures stablecoin issuers and cryptocurrency advocates that government competitors are temporarily sidelined, thus maintaining the role of stablecoins in the digital dollarization process.

The combined effect of these three initiatives is to incorporate stablecoins into the regulated financial system while delineating them from certain state-controlled digital currency models. The remainder of this article will assess how these changes will impact the market, along with the associated risks and opportunities.

II. Short-term Impact of the GENIUS Act on Stablecoins and Financial Markets

The direct impact of the GENIUS Act on major stablecoin issuers is significant. Tether (USDT), the largest stablecoin with about 60% market share, faces a choice: either comply with the new act or exit the U.S. market. Tether's issuer is based overseas and has historically operated with low transparency. According to the new act, by 2027, Tether needs to register a U.S. entity (or partner with a U.S.-regulated issuer) and fully back its reserves with approved assets, undergoing monthly audits. Otherwise, after the transition period ends, its USDT tokens will no longer be legally offered to U.S. users. Tether has already withdrawn from some heavily regulated jurisdictions (it exited the EU rather than comply with the new licensing requirements under the European Markets in Crypto-Assets Regulation). If it deems compliance costs too high or fears excessive information disclosure, it may similarly restrict its operations in the U.S. However, given that Tether is dollar-backed and holds a significant proportion of U.S. Treasury securities in its reserves, even an overseas issuer will be indirectly affected by U.S. policies. Tether may increase transparency and bolster its reserves to maintain confidence—it has a strong incentive to demonstrate 100% reserve backing to avoid redemptions, especially since the act explicitly states that non-compliant stablecoins cannot be considered cash equivalents in regulated venues.

In contrast, Circle (USDC) is a U.S. company that has been lobbying for clear regulation. Circle's USDC has invested most of its reserves in short-term Treasuries and cash, with monthly attestations. The GENIUS Act recognizes Circle's approach and provides a pathway for it to become a federally approved issuer (potentially through a charter from the OCC). As Circle seeks the coveted federal license, its market position may strengthen, making it a more favored option for institutions as a fully compliant token (FCC). In fact, the act's prohibition on paying interest means that stablecoin holders will not receive direct compensation; this preserves the current model where seigniorage revenue flows to the issuer. Currently, both Tether and Circle earn substantial interest from their reserve asset investments. In fact, the profits Tether earns from reserve investments are now comparable to those of large financial institutions. With regulation, this revenue model has been legitimized but also attracts competition from traditional finance.

Emerging Issuers and Banks

The stablecoin legislation opens the door for banks and fintech companies to enter the competition. In the face of regulatory uncertainty, large banks have been hesitant to issue their own stablecoins. Now, banks (or their affiliates) can issue "payment stablecoins" with the permission of federal regulators. We may see large custodial banks, payment companies, or tech firms (if permitted) launch stablecoins, but they must adhere to safety measures. A notable restriction on large tech companies is that publicly traded non-financial companies cannot issue stablecoins unless a high-level regulatory committee unanimously determines they will not pose systemic risks and comply with strict data privacy rules. This provision is clearly aimed at projects like Facebook's past Libra/Diem initiative. This means that companies like Amazon or Meta will find it difficult to issue stablecoins directly and will need to collaborate with licensed issuers or banks.

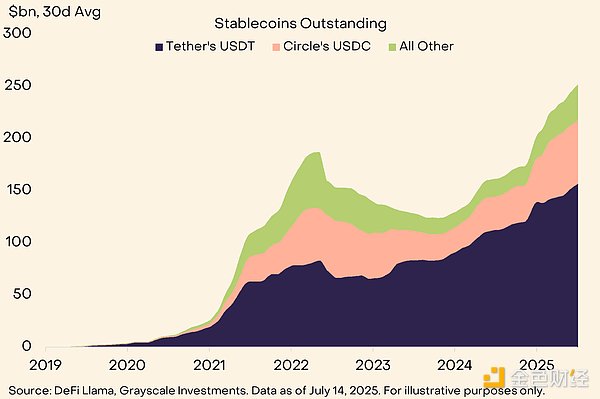

In the short term, changes in market structure may include competition for GENIUS Act licenses, consolidation of smaller businesses, and the exit of non-compliant currencies from U.S. platforms. For example, as deadlines approach, offshore dollar stablecoins or algorithmic tokens (which do not meet the act's definition of full reserve) may delist from U.S. exchanges. In contrast, tokens backed by U.S. Treasuries are expected to gain favor. Circle and Paxos (the issuer of USDP) have positioned themselves as transparent, regulated brands, which may help them capture market share lost by Tether. Early data shows that the market is rebalancing: USDC's market share, which declined in 2022, has rebounded to about 25% by mid-2025, taking several percentage points from USDT. In the coming months, we may see Tether reduce risk assets in its reserve portfolio and shorten investment durations to comply with the act's restrictions (only allowing highly liquid, short-term instruments). All issuers may hold a larger proportion of U.S. Treasuries, both for compliance and to demonstrate their stability to investors.

Impact on the Treasury Market and Money Market Rates

The core premise of the GENIUS Act is that bringing stablecoins under regulation will increase demand for U.S. Treasuries, thereby solidifying the dollar's status as a reserve currency. In fact, the mandatory backing with Treasuries and bank deposits makes stablecoins a significant source of demand for safe assets. Currently, the circulating dollar stablecoins exceed $260 billion, with hundreds of billions held in short-term Treasuries. Analysis from the Bank for International Settlements indicates that the flow of stablecoin reserve funds can influence money market rates. One study found that an inflow of about $3.5 billion into stablecoins could lower the yield on three-month Treasuries by about 2 to 2.5 basis points within ten days. These effects are temporary, but noteworthy, highlighting the growing influence of stablecoins in the short-term financing market.

Conversely, large-scale outflows or redemptions of stablecoins would significantly raise yields, indicating that a sudden run on stablecoins could quickly tighten the money market. This has practical implications: regulatory changes prompting large-scale USDT redemptions could lead Tether to liquidate its Treasury holdings, causing yields to spike. The restrictions in the GENIUS Act aim to reduce the risk of runs by ensuring that stablecoins are as good as cash. In the short term, money market investors are closely monitoring the liquidity of stablecoins. The passage of the act has sparked expectations of increased stablecoin issuance, which means more Treasury purchases, leading to a narrowing of Treasury yield spreads.

Seigniorage and Competitive Dynamics

The prohibition on paying interest to stablecoin holders ensures that issuers can capture all seigniorage profits from their reserve investments. With U.S. short-term Treasury rates around 5%, this profit is quite substantial. For example, USDT's circulating supply of about $130 billion invested in short-term Treasuries could generate approximately $6 to $7 billion in annual returns, comparable to the profits of large financial institutions. In the short term, this dynamic incentivizes issuers to expand supply. We have observed Tether's issuance reaching historical highs, while Circle is also repositioning to expand USDC's scale after a contraction at the end of 2024.

However, as regulated participants like banks enter the fray, if issuers adopt competitive strategies such as fee rebates to indirectly share profits, the seigniorage spread may narrow. Banks may argue that stablecoin issuers should face similar capital or deposit insurance requirements. This debate could influence the regulatory framework governing stablecoin capital and liquidity requirements. Initially, following the passage of the act, market confidence in stablecoins significantly increased, with some stablecoins tightly pegged and exhibiting minimal premiums. Short-term winners include Circle and U.S. money market funds, which indirectly benefit from inflows. Losers or those facing challenges include algorithmic stablecoins and those relying on riskier assets, which may force Tether to further cut non-compliant assets. If demand continues to grow, the demand for stablecoins may impact Treasury issuance. Overall, the clarity of the legislation is merging the liquidity of crypto dollars with traditional markets, influencing issuer behavior, the flow of funds into U.S. Treasuries, and the positioning of financial institutions entering the stablecoin space.

III. Systemic Risk Considerations: Stability, Currency Uniqueness, and Illicit Financing

The rapid rise of stablecoins has prompted warnings from economists and central bank officials about potential systemic risks. The Financial Times has pointed out that while the use of stablecoins is growing, they "cannot replace currency" because they replicate some functions of money but lack comprehensive safeguards. This section will examine, in conjunction with the new U.S. initiatives, the key risk arguments raised by the Financial Times and the Bank for International Settlements, including currency uniqueness (uniformity of currency value), run dynamics, illicit finance, and monetary sovereignty.

Currency Uniqueness and Fragmentation

A fundamental concern is that multiple private stablecoins may undermine the "no questions asked" interchangeability of currency. In a well-functioning monetary system, whether in bank deposits or cash, the value of one dollar is the same and can always be exchanged at face value. However, stablecoins introduce fragmentation: tokens from issuer A may not always trade at a 1:1 ratio with tokens from issuer B or actual dollars, especially under stress. Hyun Song Shin of the Bank for International Settlements compares today's stablecoins to 19th-century wildcat banknotes, which often traded at different discounts based on the issuer's credibility. He notes that stablecoins "often trade at different rates due to the differences in issuers, undermining the principle of central bank money's no-questions-asked nature." This lack of uniformity, or the absence of uniqueness, means that stablecoin holders bear the credit risk of the issuer. In fact, some small deviations have already occurred: during market panic, USDT briefly traded below $1, while USDC also temporarily decoupled to about $0.90 in March 2023. The GENIUS Act attempts to address the uniqueness issue by imposing redemption obligations and reserve transparency to ensure that each regulated stablecoin reliably values at $1. The act also prohibits misleading claims that any stablecoin is official legal tender. However, uniqueness can only be truly realized when stablecoins can be directly exchanged for central bank currency, which is not currently provided. The Bank for International Settlements advocates for a superior solution: the tokenization of central bank currency or bank deposits on a unified ledger, which inherently guarantees uniqueness. Until then, stablecoins remain merely an approximation of currency, carrying the risk of monetary fragmentation.

Operational Dynamics and Sell-off Risks

Stablecoin runs may pose the most severe systemic threat. If holders suspect that a stablecoin's asset reserves are inadequate, large-scale redemptions could force the issuer to rapidly sell off reserve assets. Such sell-offs could impact broader financial markets, especially if the reserve assets include a significant amount of specific assets. For asset-backed stablecoins like USDT and USDC, a run could translate into large sell-off orders for Treasuries or bank deposits, exacerbating market pressure. The Bank for International Settlements has explicitly warned that if stablecoins collapse, their asset reserves may face "fire sales." So far, stablecoins have generally demonstrated strong resilience; even during the USDC decoupling in March 2023, the redemption process was relatively orderly. The bankruptcy provisions in the GENIUS Act grant stablecoin holders priority claims, aiming to reduce the incentive for runs. The act also requires issuers to develop suspension and liquidation plans and mandates holding highly liquid reserves to meet redemption demands. However, major issuer scandals or cyberattacks could still trigger a wave of redemptions. Additionally, if stablecoins are used as collateral in DeFi or settlements, instability could spread. U.S. regulations aim to mitigate this risk by increasing transparency, enhancing oversight, and clarifying redemption rights.

Illicit Financing and Financial Integrity

Concerns about money laundering, sanctions evasion, and illicit fund transfers have been raised due to the near-instant global liquidity of stablecoins. The Financial Times and the Bank for International Settlements have pointed out the "opacity" of stablecoin arrangements, expressing doubts about the integrity of their reserves. The GENIUS Act requires issuers to implement comprehensive Bank Secrecy Act/Anti-Money Laundering compliance programs and strictly adhere to U.S. sanctions laws, including having the technical capability to freeze tokens involved in illegal activities. Major issuers like Tether and Circle have maintained blacklists, although Tether has faced criticism and regulatory fines in the past for insufficient controls. U.S. regulation through agencies like the Financial Crimes Enforcement Network (FinCEN) and the Office of Foreign Assets Control (OFAC) will enhance transparency and compliance monitoring. However, if mainstream stablecoins become too transparent, illicit actors may turn to less regulated stablecoins or privacy-enhanced tokens. Overall, recent regulatory actions have strengthened financial integrity by making it more difficult to hide illicit finance and easier to trace.

Cross-Border Monetary Sovereignty

The widespread use of foreign stablecoins may undermine national monetary sovereignty, especially in emerging markets. The Bank for International Settlements warns that unregulated stablecoins pose risks to monetary sovereignty and may encourage capital flight. Dollar stablecoins have circulated widely in countries facing inflation or capital controls, effectively serving as unofficial dollarization. This undermines the monetary control of local banks and central banks. The GENIUS Act addresses this issue by imposing strict conditions on foreign stablecoin issuers entering the U.S. market, effectively requiring major offshore issuers to accept U.S. regulation or be banned. However, U.S.-regulated stablecoins may still proliferate globally, reinforcing the dollar's dominance and causing tensions abroad. Institutions like the International Monetary Fund suggest that emerging economies strengthen foreign exchange controls or consider issuing their own digital currencies. Overall, the new U.S. framework promotes the global expansion of dollar stablecoins, benefiting U.S. influence but also sparking debates about stability issues abroad.

IV. Trends in Stablecoin Adoption and Usage Metrics

By 2025, the adoption rate of global stablecoins continues to accelerate, with both market size and actual applications reaching new highs. This section quantifies key trends: overall market capitalization, network distribution (Tron vs. Ethereum), usage in emerging markets (including P2P foreign exchange), corporate (B2B) transaction volumes, payment card integration, and cross-border payment metrics.

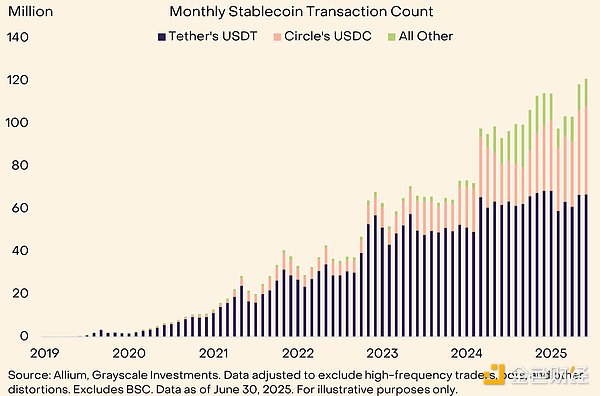

The total value of circulating stablecoins has exceeded $250 billion, with the vast majority denominated in dollars (dollar-backed stablecoins account for about 99% of the stablecoin market by value). This figure has more than doubled from two years ago and is significantly higher than the approximately $160 billion at the beginning of 2024. According to Messari's "2025 State of Stablecoins" report published on July 22, 2025, the market capitalization surpassed the $250 billion mark, driven by clearer regulatory frameworks and increased demand for dollar liquidity. USDT remains the largest stablecoin (accounting for about 60% - 62% of total market capitalization). Circle's USDC ranks second (about 20% - 25%), although it lost ground in 2023, it has since stabilized. A notable new entrant is PayPal's PYUSD (launched in 2023), though its market share remains small. Other entities like TrueUSD (TUSD) and BUSD have shown more volatile development trajectories— for example, BUSD shrank in size in 2023 due to regulatory actions. Legislative progress is expected to solidify the positions of the top two (USDT and USDC) while encouraging the emergence of new regulated stablecoins. Messari notes that as Circle adapts to the new regulations, and some users prefer its regulated status, USDC's share has begun to rise again. In the first half of 2025, the value settled in stablecoins through public chains exceeded $2.6 trillion, reflecting its high velocity of circulation for purposes such as trading and arbitrage.

Tron vs. Ethereum (USDT vs. USDC)

A notable pattern in stablecoin usage is the preference for different networks. In many areas, USDT has become synonymous with the Tron blockchain, while USDC is primarily used on Ethereum and Layer 2 networks. A survey conducted in May 2025 found that USDT accounted for 90% of stablecoin payment transaction volume, with about 60% processed by Tron. Tron offers faster and cheaper transactions than the Ethereum mainnet, explaining its popularity in high-volume, cost-sensitive applications. The daily USDT transaction volume processed by Tron is typically five times that of Ethereum. Retail users in emerging markets tend to prefer Tron-based USDT due to its near-zero transaction fees. Ethereum remains important for exchange settlements and decentralized finance. BSC and Polygon also carry stablecoin trading volumes. Regulators have noted these differences: Tron is less transparent and primarily operates outside U.S. jurisdiction. Regulatory actions may indirectly encourage a migration to more compliant chains, but Tron is expected to maintain its dominance in USDT transaction volume in the short term. Circle is expanding USDC to networks like Arbitrum and Solana, both of which are expected to continue growing and serve different user groups.

Stablecoins in Emerging Markets—P2P Foreign Exchange Trading and Remittances

Stablecoins have had a profound impact on emerging markets, providing access to dollars outside the traditional banking system. Individuals in Africa, Eastern Europe, the Middle East, and Latin America use USDT or USDC through peer-to-peer trading platforms or over-the-counter brokers to hold dollar value or remit funds abroad. Binance's peer-to-peer market trades USDT against local currencies, with narrower forex spreads than banks or remittance services. For example, in Nigeria, the stablecoin market effectively sets the actual foreign exchange rate. Workers abroad send stablecoins home quickly and at low cost, competing with traditional remittance channels, especially in Latin America. Local startups in places like Argentina offer fiat consumption options for stablecoin balances to cope with inflation. A significant portion of B2B payments involving emerging markets is now conducted through stablecoins, reducing forex slippage and bank fees. The adoption of stablecoins in emerging markets has surged, used for payroll, trade settlements, and savings. Chainalysis reports that in certain emerging markets, stablecoins account for over 30% of total cryptocurrency transaction volume.

Corporate (B2B) and Card Payments

The adoption rate of stablecoins in business-to-business (B2B) transactions and consumer payments is steadily increasing. As of early 2025, the annual payment volume of stablecoins is approximately $72.3 billion, covering categories such as B2B, B2C, person-to-person (P2P), card payments, and lending. Businesses use stablecoins to settle invoices, pay suppliers or contractors, especially in cross-border transactions. Circle provides APIs for businesses to integrate USDC into their financial operations. Payment cards linked to stablecoin wallets have emerged, allowing cryptocurrency to be converted into fiat currency for consumption at points of sale via Visa or MasterCard debit cards. Coinbase and Crypto.com offer cards that utilize USDC or USDT balances. Stablecoin transaction volumes are competing with networks like Visa and PayPal on certain metrics, with millions of stablecoin transactions occurring daily. Visa and Mastercard themselves are also piloting stablecoin settlements, viewing stablecoins as a complement to traditional currency flows.

Cross-border payment metrics highlight the growing prevalence of stablecoins, with rapid growth in cross-border flows, especially in high-cost corridors like the U.S.-Mexico and Europe-Africa. The World Bank and various central banks are now tracking stablecoin remittances, recognizing their increasingly important role. Local market premiums for stablecoins indicate strong demand for them for capital flight or savings purposes. Stablecoins have penetrated the foreign exchange trading and settlement space, reducing the costs of currency conversion and remittances, posing a challenge to traditional financial services.

V. Strategic Responses from Banks, Payment Service Providers, Large Merchants, and Policymakers

This has prompted participants in traditional finance and policy sectors to adjust their strategies. This section explores the responses of banks, payment service providers (PSPs), large merchants, and policy institutions, including initiatives like the Bank for International Settlements' Agorá project that offer alternatives.

Banking and Stablecoin Strategies

Initially, banks were cautious about stablecoins, viewing them both as a threat (to deposits) and an opportunity (to provide new services). As the GENIUS Act legalizes stablecoins, many banks are shifting from observation to participation. Large U.S. banks have several potential strategies: (a) issuing their own stablecoins or deposit tokens; (b) collaborating with existing issuers (e.g., acting as custodians or settlement banks); (c) integrating stablecoins into payment services without issuing them themselves. So far, some smaller institutions have ventured in, such as Silvergate Bank (now defunct), which assisted in launching a token, and Signature Bank, which used a signature system, while JPMorgan has launched JPM Coin (a private permissioned stablecoin for corporate clients) since 2019. However, these attempts have been isolated and not widely applied on public chains. The new law paves the way for specialized "narrow banks" focused on digital dollars by providing charters from the Office of the Comptroller of the Currency (OCC) for stablecoin issuers. Banks like Custodia (a digital asset bank registered in Wyoming) faced lawsuits after the Federal Reserve refused to open accounts for them, partly due to a lack of federal law—now, under the framework of the act, they may have clearer grounds to reapply.

Traditional banks are also incentivized by the profits brought by stablecoins. If billions of dollars in interest income flow into Tether's profits, banks believe this could also become part of their business (as they traditionally profit from deposits). We may see efforts for alliances: in fact, in 2024, a group of banks and credit unions in the U.S. explored a stablecoin called USDF, but it stalled due to regulatory reasons. Under the GENIUS model, such alliances could become government-recognized issuers (backed by members insured by the Federal Deposit Insurance Corporation). Banks may find that stablecoins help improve interbank settlement speeds and provide faster liquidity for corporate clients. Many banks in Europe and Asia are already testing tokenized deposits—essentially blockchain-based representations of bank deposits. These are similar to stablecoins but remain on the bank's balance sheet. For example, Standard Chartered and HSBC have piloted such tokens for internal transfers. In the U.S., some experts advocate for a "regulated liability network" model, where banks jointly issue interoperable tokens (which can be seen as each bank issuing its own stablecoin that is 1:1 interchangeable). This regulatory differentiation (the Federal Reserve not issuing a central bank digital currency but allowing private regulated cryptocurrencies) encourages banks to lead innovation. JPMorgan's CEO famously stated that if a stablecoin becomes large enough, banks will get involved—this seems to be becoming a reality. It is expected that in the coming year, one or more large banks in the U.S. will announce the launch of a stablecoin (possibly initially targeting institutional users) or provide stablecoin services to fintech companies.

European Influence: European banks are also exploring this area in light of the Markets in Crypto-Assets (MiCA) directive, which allows them to issue "e-money tokens," and transatlantic consistency may prompt U.S. banks to keep pace. On the other hand, banks have expressed risk concerns: they worry that stablecoins could lead to deposit outflows during a crisis (if people fear bank defaults, they might withdraw funds from banks to invest in stablecoins, which is contrary to the usual concerns about stablecoin runs). Therefore, they may push regulators to establish a level playing field, such as requiring stablecoin issuers to have similar capital buffers. We may see banks requesting stablecoin issuers to gain access to Federal Reserve master accounts to securely store reserves (the law does not specify this, but it is a practical issue). If approved, this would bring stablecoins closer to the model of central bank digital currencies (CBDCs), just managed by private banks. In summary, the strategic response of banks is to embrace and shape: they want to participate in the stablecoin game directly or through infrastructure support while ensuring that the rules do not undermine their competitive position. This is a delicate balance—some smaller banks may support stablecoin innovation to win new business, while larger banks may ensure that any such currency remains under strict control of the banking sector.

Payment Service Providers and Merchants

Payment companies (such as Visa, Mastercard, PayPal, Stripe) and large merchants are also adapting to this change. PayPal boldly launched its own dollar stablecoin (PYUSD) in 2023, becoming the first major tech company to introduce such a product.

Although acceptance has been low so far, PayPal's move indicates that payment service providers (PSPs) see stablecoins as both a threat and a reasonable extension of their business. With clearer legal frameworks, PayPal can now apply for federal licenses or collaborate with issuers (its stablecoin is actually issued by Paxos under New York state regulations, and may transition to a federal framework in the future). Visa and Mastercard are very active in connecting cryptocurrencies with traditional payments. Both companies are collaborating with stablecoin companies to enable conversions at points of sale. Visa's cryptocurrency chief McHenry reiterated in 2025 the company's commitment to using stablecoins for transaction settlements when favorable, essentially viewing stablecoins as a new settlement currency. These credit card networks are also developing messaging and authentication standards to be attached to blockchain transactions— for example, Mastercard launched "Crypto Credentials," which marks blockchain transfers with verified information, making stablecoin transactions easier to accept commercially by reducing anonymity. Stripe and other payment processors have integrated stablecoin payment capabilities: freelancers can now be paid in USDC through Stripe Connect, which is invaluable in countries where Stripe cannot easily remit funds. For large tech retailers (like Amazon and Apple), they have not yet directly accepted cryptocurrencies, but reports suggest that Amazon is exploring this area. If there is customer demand, the legislative environment may encourage them to accept stablecoins, as they can now be assured of consumer protection and legal status. We can imagine that large retailers will soon accept USDC or USDT for online shopping, possibly converting it to fiat currency through third-party payment gateways. Starbucks and some chains have already attempted to accept cryptocurrencies (mainly through conversion apps); stablecoins are easier to accept due to their lack of volatility. Additionally, merchant acquirers—companies that process credit card payments for merchants—may incorporate stablecoin payments as a payment option in their terminal devices. If done outside traditional credit card channels, this could lower merchant fees (cryptocurrency transaction fees may be much lower than credit card fees, especially for cross-border sales). For example, a merchant selling digital goods globally may be more inclined to accept stablecoin payments to avoid a 3% credit card fee and the hassle of currency conversion. Currently, the adoption rate of this practice is still low, but companies like Overstock (an American retailer) have been accepting stablecoins for years, and some travel booking sites also accept USDC. As regulations improve, more mainstream companies may try to enter this space, possibly starting with business-to-business (B2B) use cases (for example, paying suppliers with stablecoins to receive early payment discounts).

Strategic Logic: Merchants and payment service providers (PSPs) will ultimately follow customer demand and cost advantages. If stablecoins can provide near-instant settlements at lower costs (no refunds, etc.), they can improve merchants' cash flow. On the other hand, merchants accepting stablecoins will face foreign exchange considerations—European merchants accepting USDC will face dollar risk unless they immediately convert it to euros. However, stablecoin infrastructure providers now offer automatic conversion and custody services to manage this risk. We see similar situations in Latin America: merchants in countries like Venezuela have begun informally accepting USDT to purchase daily necessities because they trust this currency more than their local bolivar; in hyperinflationary economies, formal businesses may also start pricing in stablecoins. Payment giants do not want to be replaced by crypto networks, so their strategy is to "embrace and extend": incorporating stablecoins into their ecosystems to ensure they remain trusted brands facilitating transactions, and they may even leverage stablecoins to enter new markets (for example, around-the-clock cross-border settlements that are currently difficult for bank networks to achieve).

Policy Institutions and CBDC Alternatives (Agorá Project)

In the public sector, central banks and international institutions are developing responses to private stablecoins. As the U.S. temporarily does not consider launching a retail CBDC, the focus has shifted to improving existing systems and exploring hybrid systems. The Bank for International Settlements (BIS) has been leading projects through its Innovation Hub to demonstrate how to leverage sovereign currencies to achieve the advantages of stablecoins (fast, programmable payments). The Agorá project, launched in 2024, involves seven major central banks (France/Eurozone, the UK, Japan, South Korea, Mexico, Switzerland, and the New York Federal Reserve) along with over 40 private financial institutions. The goal of the Agorá project is to create a "unified ledger" that can host different forms of tokenized currencies on an interoperable platform—tokenized central bank wholesale deposits, tokenized commercial bank deposits, and possibly tokenized bonds or other assets. Essentially, this is a blueprint for a public-private coexistence system: banks will issue tokenized deposits (similar to stablecoins but fully regulated by banks), and central banks will provide wholesale central bank digital currency (CBDC) for interbank settlements, with the system enabling seamless cross-border payments in multiple currencies through a unified ledger and smart contracts. The project aims to directly address the fragmentation and trust issues of stablecoins—Agorá seeks to retain the dual banking model (thus preserving the uniqueness of currency) while achieving near-real-time cross-border settlements and programmability. As of mid-2025, Agorá is still in the design phase, but the participation of major players (including the U.S. through the New York Federal Reserve) indicates strong interest in this approach. If successful, it would form a network where a payment could consist of a series of transactions, with tokenized deposits representing dollars and deposits representing euros being atomically exchanged, guaranteed by central banks for final settlement. Its advantage lies in avoiding retail CBDCs while leveraging the strengths of the existing system (bank customer relationships and credit supply), while also achieving cryptocurrency-like efficiency. Other policy responses include enhancing domestic fast payment systems (the FedNow system launched in the U.S. in 2023 provides around-the-clock instant bank transfer services—some view this as a response to the demand for digital cash alternatives). The EU is advancing the digital euro, but primarily for domestic use; however, the EU's MiCA has already imposed strict regulations on stablecoins (for example, limiting the use of non-euro stablecoins for payments within the Eurozone to maintain euro sovereignty). The U.S. approach (promoting private stablecoins) can be seen as one response to the same phenomenon, while the EU's approach (considering a public digital euro and strictly controlling private stablecoins) represents another. The International Monetary Fund and the World Bank are collaborating with countries to modernize foreign exchange controls and consider issuing their own national stablecoins or CBDCs to compete with dollar tokens. For example, Nigeria launched the eNaira, but its usage is low; meanwhile, a group of African tech experts is launching an African stablecoin. China's digital yuan is gradually being promoted, possibly aimed at providing an alternative to dollar stablecoins in "Belt and Road" trade. The BIS's position in its 2025 annual report is that the tokenization of official currencies combined with the regulation of cryptocurrencies is the best path forward. BIS General Manager Agustín Carstens urged central banks to "boldly advance tokenization" to gain efficiency while maintaining control. The Agorá project embodies this idea. Within the next 12 months, we may see Agorá launch prototypes or pilot transactions—possibly involving cross-border settlements using tokenized deposits and wholesale CBDCs among participating central banks. Additionally, there are the Icebreaker project (a smaller BIS pilot project aimed at connecting retail CBDCs for cross-border transactions) and the mBridge project (connecting multiple Asian CBDCs for trade settlements). These indicate that policymakers are taking a cautious approach: even if the development of retail central bank digital currencies is stalled, work on wholesale and cross-border central bank digital currencies is progressing at full speed to ensure that if stablecoins or foreign digital currencies gain too much influence, central banks will have ready alternatives to provide.

The Financial Stability Board (FSB) and the International Monetary Fund (IMF) have also proposed relevant frameworks. In July 2023, the FSB released recommendations for the regulation of global stablecoins, many of which have been adopted by the U.S. "GENIUS Act" (such as redemption rights and prudential standards). The IMF is developing a concept for an interoperable central bank digital currency platform aimed at preventing the emergence of incompatible national systems or the dominance of private currencies.

In summary, the strategic responses revolve around one theme: the public and private sectors leveraging each other. Banks and payment companies are incorporating stablecoins into their business models, providing layers of trust and compliance to prevent their businesses from being marginalized. Policymakers are simultaneously strengthening regulations on stablecoins while accelerating projects like Agora to provide next-generation payment infrastructure, which may one day reduce the significance of current stablecoins. In the meantime, we may even see hybrid models, such as central banks allowing or supporting fully reserved stablecoins issued by banks (sometimes referred to as "synthetic CBDCs").

It is noteworthy that the House majority's alignment with the "anti-CBDC" stance has not hindered the Federal Reserve and its allies from innovating in the wholesale space. For at least the next few years, a possible equilibrium may be that regulated private stablecoins are used for retail, while central bank tokenized currencies are used for wholesale, with both expected to achieve interoperability.

Large merchants and enterprises will benefit from the lower-cost side—many businesses are neutral on this and will adopt the most efficient technology, whether it be Circle's USDC, JPMorgan's deposit tokens, or Federal Reserve products. The legislative choices made in July 2025 firmly push the U.S. towards a model driven by private sector retail innovation while also being regulated—this stance aligns with America's financial tradition but will also prompt regulators to remain vigilant to ensure that public interests (stability, inclusiveness, sovereignty) are safeguarded while private digital currencies flourish.

VI. Conclusion

The possible development path lies between the baseline scenario and the best-case scenario. The legislative progress made in July 2025 enables the U.S. to leverage private innovation while addressing the evident risks present in the stablecoin and cryptocurrency markets. If executed properly, this legislation will make stablecoins a reliable part of retail and wholesale finance—accelerating transaction speeds, expanding the global use of the dollar, and keeping the U.S. at the forefront of fintech innovation.

However, regulators must remain vigilant: stablecoins blur the lines between public and private currencies, necessitating careful oversight to ensure the uniqueness and stability of the currency are maintained, and that the development of fintech does not outpace the regulatory framework of traditional finance. In the coming year, the world will be watching the progress of U.S. experiments. Successful trials could accelerate the arrival of a new era of digital finance led by a robust dollar ecosystem; failures or missteps could trigger a crisis and reinforce voices warning that stablecoins are "dangerous" tools requiring stricter regulation. The risks for global financial markets and the monetary system are immense.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。