The government of India provided an update early this week in the Lok Sabha, the lower house of India’s parliament, regarding the taxation and oversight of income from virtual digital assets (VDAs) and cryptocurrencies.

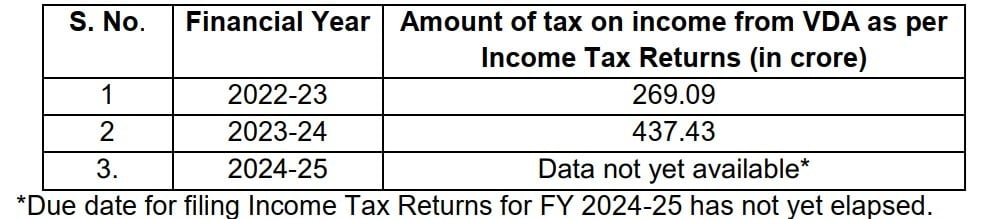

Minister of State for Finance Pankaj Chaudhary stated that tax on such transactions, implemented in fiscal year 2022–23 under section 115BBH of the Income Tax Act, resulted in ₹269.09 crore (approximately $32 million) in collections in its first year, followed by ₹437.43 crore in 2023–24. The figure for 2024–25 is not yet available, as the income tax filing deadline has not elapsed.

While no formal estimates have been made to quantify losses from under-reporting or misreporting of crypto income, the government emphasized its use of advanced surveillance. Chaudhary stated:

The government is utilizing data analytics tools to trace and detect tax evasion from VDA related transactions.

These efforts include leveraging the Non-Filer Monitoring System (NMS), Project Insight, and the Income Tax Department’s internal databases. Though a centralized, real-time matching system between income tax returns and Tax Deducted at Source (TDS) filings by Virtual Asset Service Providers (VASPs) is not in operation, retrospective analyses are being carried out. Discrepancies exceeding ₹1 lakh where TDS was deducted but income was not disclosed prompted outreach under the NUDGE initiative to correct filings.

India’s cryptocurrency taxation is comprehensive. A flat 30% income tax is imposed on gains from transferring VDAs, with no deductions except acquisition cost. A 1% TDS applies to VDA transfers exceeding thresholds to track transactions. Recently, Bybit, an international crypto exchange, announced it is levying 18% Goods and Services Tax (GST) on service fees for Indian users from July 7, aligning with Indian laws requiring GST on services provided to residents.

In parallel, the government is ramping up training infrastructure for its enforcement personnel. Chaudhary explained:

Several capacity-building initiatives are being undertaken by the government to equip officers for effective compliance monitoring and investigation of VDA related transactions.

“Training programs, specialized workshops, Chintan Shivirs and hands-on workshops are regularly conducted by various training institutes under the Income Tax Department. At local level, field offices conduct training sessions and webinars on digital forensics, blockchain analysis, legal frameworks, and handling of digital evidence,” he added. These efforts are further supplemented by partnerships with institutions such as the National Forensic Science University in Goa, offering short-term courses in digital forensics to enhance technical capability in crypto transaction monitoring.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。