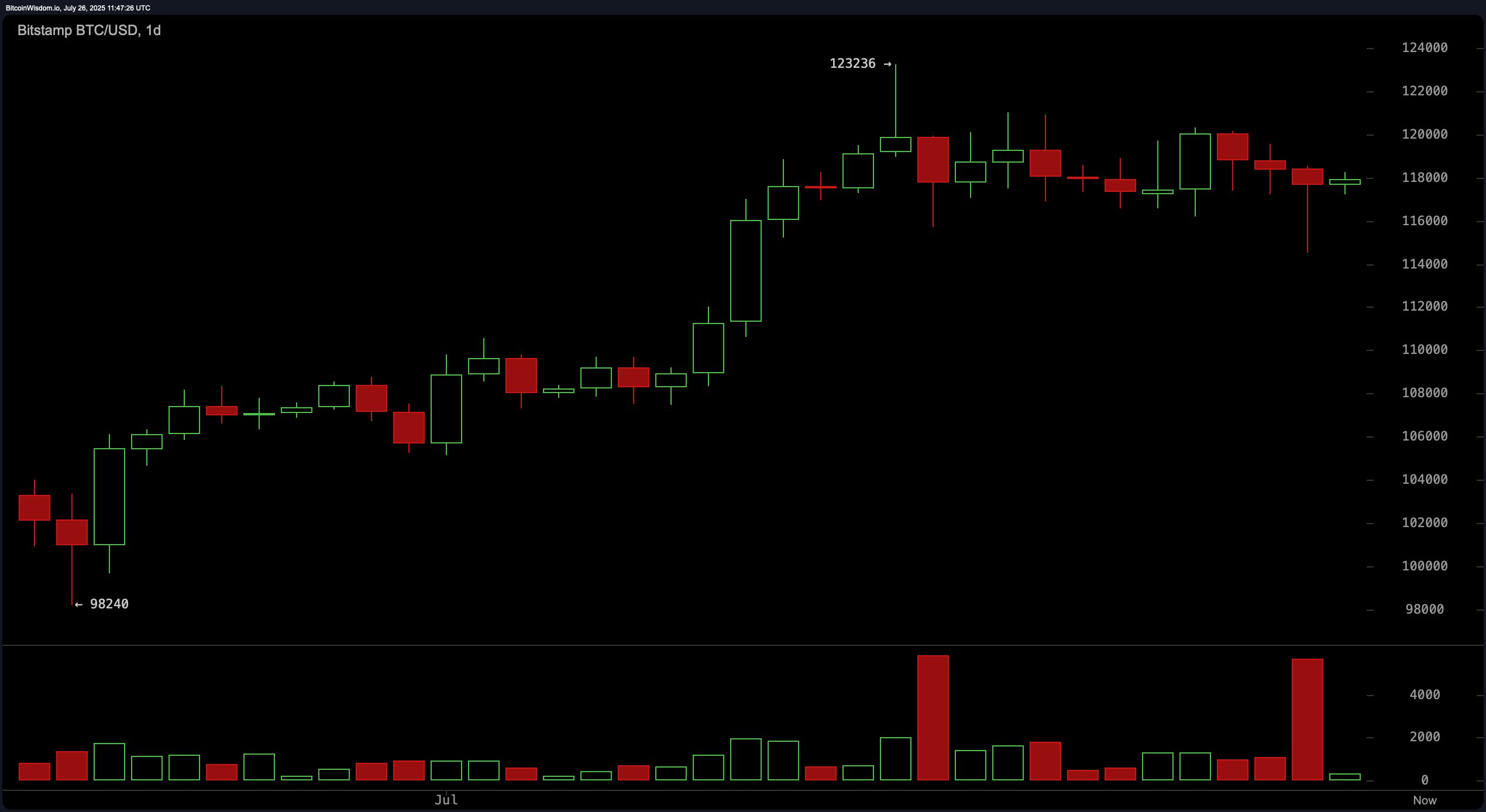

On the daily chart, bitcoin continues to demonstrate a broad uptrend that has transitioned into a consolidation phase following its recent highs near $123,200. This range-bound movement suggests profit-taking at upper levels, as seen from a significant red volume candle indicating distribution activity by institutional players. Support remains firm between $114,000 and $115,000, tested multiple times. Traders are eyeing entries within this zone, targeting a move back toward resistance between $120,000 and $122,000, with risk managed below $113,500.

BTC/USD 1-day chart via Bitstamp on July 26, 2025.

The 4-hour bitcoin chart illustrates a recent recovery from a sharp decline that touched a low of $114,518. A tentative V-shaped recovery has formed; however, the lack of volume confirmation hints at market hesitation. Currently, bitcoin is testing the $118,000 level, which serves as an immediate resistance. A close above $118,500 on volume could trigger a short-term breakout, while failure at this range may invite short-selling down to $116,000. The setup favors tactical positioning based on breakout or rejection signals.

BTC/USD 4-hour chart via Bitstamp on July 26, 2025.

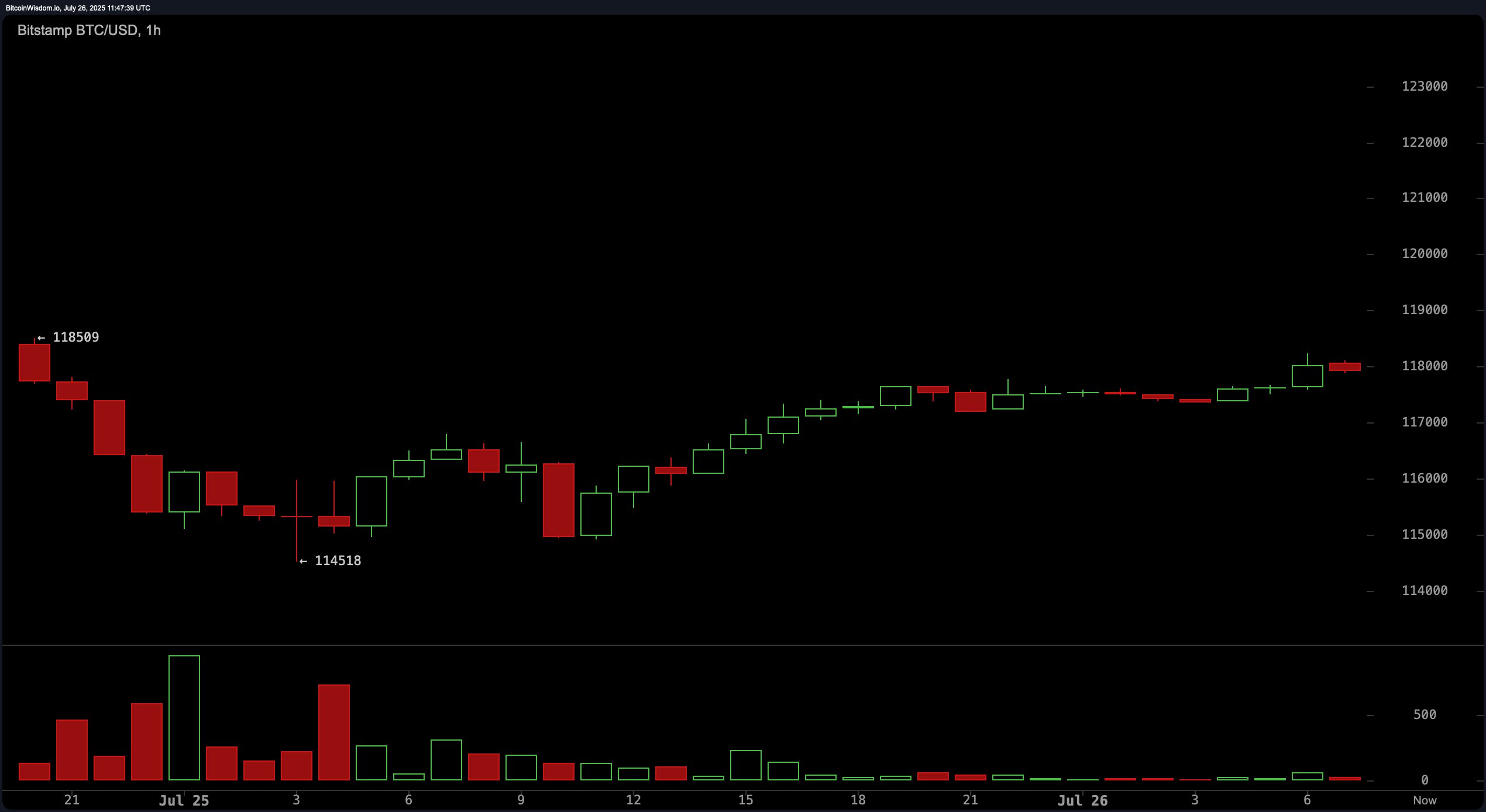

In the 1-hour bitcoin chart, bitcoin marked a micro-bottom at $114,518, which initiated a strong rebound. However, the failure to breach the $118,509 lower high suggests near-term exhaustion. Volume has thinned during the current consolidation, pointing to indecision. Short-term traders are advised to scalp within the $117,800 to $118,200 zone, placing tight stops due to the narrow trading band. A clear break above or rejection from $118,200 will define the next minor trend.

BTC/USD 1-hour chart via Bitstamp on July 26, 2025.

From a momentum and trend-indicator standpoint, oscillators are largely neutral with a slight bearish tilt. The relative strength index (RSI), Stochastic oscillator, commodity channel index (CCI), average directional index (ADX), and Awesome oscillator all show neutral readings. However, the momentum indicator is flashing a bearish signal, and the moving average convergence divergence (MACD) level is also in the negative range, which could hint at an underlying weakness not yet visible on price charts.

Despite neutral oscillator signals, moving averages (MAs) remain decisively bullish. Both the exponential moving average (EMA) and simple moving average (SMA) across 20-day, 30-day, 50-day, 100-day, and 200-day intervals support a longer-term upward trajectory. The 10-period EMA has turned bullish, while the 10-period SMA lags slightly with a bearish signal. This divergence points out the short-term choppiness amid a broader bullish trend. Collectively, these technical cues suggest that while bitcoin is consolidating below resistance, the underlying structure remains constructive for upside resumption if volume returns.

Bull Verdict:

If bitcoin sustains support above $114,000 and decisively breaks above $118,500 with accompanying volume, the broader trend favors a continuation toward the $120,000–$123,000 resistance zone. Strong alignment across longer-term exponential and simple moving averages supports a bullish outlook, suggesting accumulation is ongoing beneath key resistance.

Bear Verdict:

Should bitcoin fail to reclaim $118,200 and break below the $114,000 support zone, a deeper correction may unfold, potentially targeting the $110,000 level. Bearish momentum signals from the momentum indicator and moving average convergence divergence (MACD) level suggest vulnerability to a downside shift if bulls lose their grip at current levels.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。