In the midst of strategizing, we decide the outcome from a thousand miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

Last night's drop left many people in panic, and Lin Chao also received private messages from some fans inquiring about the market situation, most of which stemmed from the fear of the sudden market movement. However, fans familiar with Lin Chao should know that I had actually been waiting for last night's drop for some time. According to data from Coinglass, the market was somewhat prepared for this drop, with a total liquidation amount of $831 million, which did not lead the market into extreme panic. Today, Lin Chao will review the current market situation and the key operational directions for the future.

Since April 8, Bitcoin has gone through three major phases of increase: Phase One: From April 8 to May 22, the price rose from a low of 74,620 to a high of 111,980, an increase of nearly 50%; Phase Two: From May 23 to June 22, the price fell from a high of 119,980 to 98,200, a decrease of about 12%; Phase Three: From June 22 to now, the price has risen from 98,200 to a high of 123,218, an increase of about 25%. The increase in Phase One was led by Bitcoin, aimed at recovering the previous drop due to the tariff war, brutally liquidating shorts, and repairing the sentiment that had been compressed to a low. The crazy rise of CRCL's listing brought FOMO sentiment and the passing of stablecoin legislation, injecting new vitality into the relationship between the cryptocurrency market and the stock market, with stock tokenization and the crazy purchase of ETFs leading to a wave of increases based on the concept of third-party stablecoins. Public chains that are likely to be linked to stablecoins have become the main force in the rise of Phase Three, such as ETH, XRP, etc. Technical indicators analysis shows that there is no market that only rises without falling: Bitcoin's main upward wave that started in October 2023 has also experienced several pullbacks before reaching the current position.

Against the backdrop of Bitcoin reaching new highs, market attention has begun to refocus on mainstream altcoins, including ETH and SOL. These tokens, which possess strong infrastructure attributes and ecological value, present undervalued investment opportunities. This repricing represents not only a return on the technical analysis level but also a strategic transformation of institutional investment logic from mere value storage to diversified ecological investment.

Three core driving factors influencing price trends in the coming quarter are forming a synergy: First, the SEC may approve new single-name spot ETFs, including XRP, SOL, etc. This will provide a more convenient and compliant channel for institutional funds to enter; Second, the high likelihood of integrating staking functions into ETF investment tools will provide investors with an additional source of income, enhancing investment attractiveness; Finally, the increase in institutional capital inflows from sources such as corporate funds reflects the trend of diversifying corporate balance sheets.

Lin Chao often sees debates in some crypto communities framed as an "either-or" investment choice between Ethereum and Solana: faster or even faster, modular or holistic. However, Lin Chao believes that the narratives and investment cases for ETH and SOL have become more differentiated and are not necessarily mutually exclusive.

Ethereum is undergoing a profound identity transformation. In the eyes of institutional participants, ETH is increasingly being positioned as a core infrastructure investment target for the real-world asset (RWA) theme. The strategic significance of this shift is that Ethereum is no longer just a representative of a technical platform but a symbol of the bridge between traditional finance and decentralized finance.

The investment argument for Solana focuses on its advantages in speed, user engagement, and revenue generation compared to competitors. Although its activity is primarily dominated by meme coin trading, it has also gained traction in other areas.

In this round of rising market, we clearly see that ETH is leading some altcoins in a crazy surge, while SOL has also risen but is mainly following the trend. This is because many retail investors on the SOL chain have suffered significant losses over the past year from trading meme coins and long-tail altcoins. This traumatic experience has led to two distinctly different outcomes: some investors lack the ability to continue buying new altcoins due to capital losses; others, although still having funds, are extremely cautious about re-entering the market.

I am still relatively optimistic about SOL's performance in the latter half of this round of market. First, this round of ETH's rise is led by institutions. In this case, although SOL also has institutional involvement, the lack of an ETF channel means that the institutions that can hold it are limited, and its exposure is also lower. If SOL can lead the decline during this round of pullback, it would make me think that it will have a significant surge before the ETF approval at the end of the year.

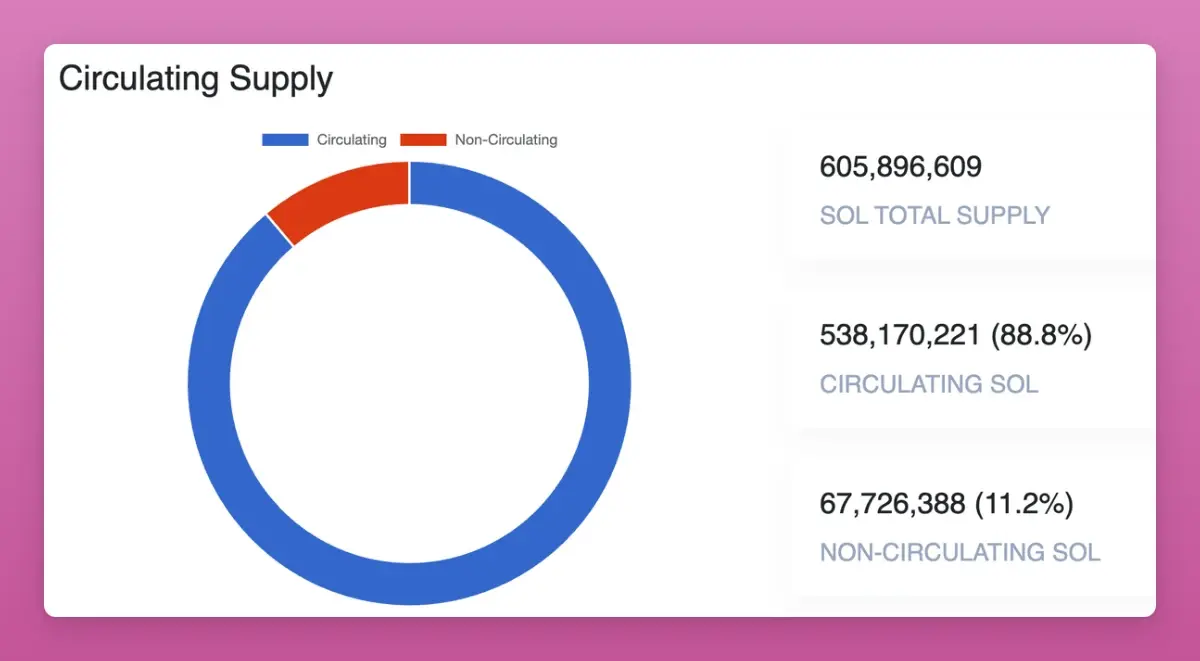

Lin Chao found in on-chain data that 88% of SOL's supply is in circulation, approximately 538.17 million coins, and SOL's total supply has no upper limit (similar to ETH). The inflation rate is 4.395%, with an annual deflation rate of 15%, and the final inflation rate should stabilize at 1.5%. 71% of the circulating supply of SOL is being staked. (While ETH is 30%.) There are as many as 120 wallets holding more than 1 million SOL, with total holdings exceeding 150 million SOL; while the number of wallets holding less than 1,000 SOL exceeds 8.9 million; the average wallet holds 16.8 SOL (leaning towards small holders). In terms of concentration: 0.33% of wallets (30,220) control 54% of SOL's supply (but this includes CEX, custodians, etc.); retail investors: 97.4% of wallets hold less than 1,000 SOL, accounting for 24.8% of the supply. A simple analysis of the above data shows that SOL's circulation is relatively stable, and the main holdings are relatively concentrated in these 30,220 wallets, meaning that retail investors cannot dominate SOL's market sentiment. Even in the event of a pullback, the impact on SOL's price will not be too significant, even in a market sentiment collapse.

Lin Chao's Summary

Recently, Lin Chao has not been trading frequently. Friends who have been following Lin Chao for a long time should also know that as this round of market has progressed, I have basically taken profits from the profitable portions since last week. I have also mentioned multiple times in the article about whether to chase the rising market; my consistent view has been that it is not advisable. I would rather miss out than be the last one to buy in. Therefore, yesterday's drop should not have a significant impact on everyone; it was expected. Or rather, Lin Chao has actually been waiting for a pullback recently; no market only rises without falling. The occurrence of such a short-term pullback is the basis for the market to continue rising. Therefore, Lin Chao is also preparing to start laying out the trading plan for the next round of market, and interested fans can privately message to participate in the discussion.

From a technical perspective, SOL's weekly MACD is healthy and has not entered the overbought zone; it is currently in a healthy sideways consolidation. The bullish trend has deteriorated due to sensitivity, but the moving average arrangement remains standard, and the overall trend has not ended. However, forming a top is a process, and the possibility of forming a top is now emerging. If we continue to increase positions at this point, we may face continuous pullbacks or a double kill of bulls and bears in a choppy top formation.

Although Ethereum has seen a pullback after leading the rise, Lin Chao believes that this round of exploration towards 4,000 should not be a big issue, but I have doubts about directly reaching 4,500. Since April 8, 2025, Ethereum has experienced two phases of increase, with the second phase exceeding the first phase by more than double, and it is currently testing the one-time position without breaking it. 1. The bullish trend has clearly deteriorated, and the smaller levels are also undergoing healthy pullbacks; for contract users, the risk of short positions remains greater than that of long positions before the trend is clear, but the short main force will not quickly retreat in the short term. If there is a need to enter the market, be sure to set a stop loss, or privately message for consultation to arrange positions to avoid risks.

The success of investment depends not only on choosing good targets but also on when to buy and sell. Preserving capital and making good asset allocation is essential for steady progress in the ocean of investment. Life in the world is like a long river flowing into the sea; what determines victory or defeat is never the gains and losses of a single pass or the profits and losses of a moment, but rather planning before action, knowing when to stop and gaining from it.

The global market is ever-changing, the world is a whole; follow Lin Chao to gain a top-tier global financial perspective.

_This article is merely a personal opinion and does not constitute any trading advice. The cryptocurrency market has risks; invest with caution! _

Real-time consultation, feel free to follow: Lin Chao on Cryptocurrency

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。