Ether ETFs Hit 13-Day Streak While Bitcoin ETFs Struggle With Another $68 Million Exit

The shift in investor focus toward ether exchange-traded funds (ETFs) is becoming hard to ignore. For the second day in a row, bitcoin ETFs faltered, logging $67.93 million in outflows, while ether ETFs surged ahead with $533.87 million in fresh inflows.

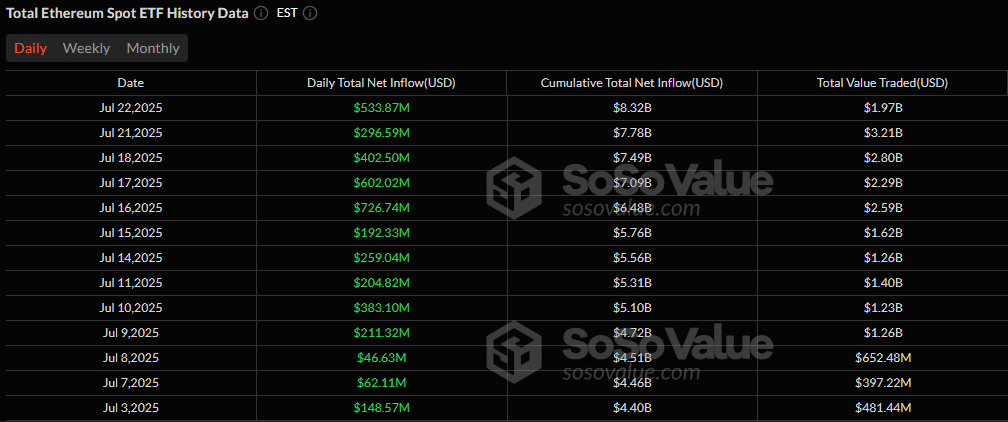

Ether ETFs continued their green march, securing their 13th straight day of inflows and pulling in a staggering $533.87 million. Blackrock’s ETHA dominated, attracting $426.22 million, while Grayscale’s Ether Mini Trust added $72.64 million and Fidelity’s FETH chipped in $35.01 million. Notably, no ether ETF recorded an outflow, a clear indication of unrelenting bullish sentiment.

13-Day Streak for Ether ETFs. Source: Sosovalue

Trading volumes for ether ETFs remained steady at $1.97 billion, and net assets climbed to $19.85 billion, inching ever closer to the $20 billion milestone.

On the flip side, bitcoin’s dip was driven by significant redemptions from Bitwise’s BITB, shedding $42.27 million, and Ark 21Shares’ ARKB, which lost $33.18 million. A minor $7.51 million inflow into Grayscale’s GBTC barely dented the overall negative tone.

Despite the outflows, trading activity remained robust at $4.01 billion, and net assets stood resilient at $154.77 billion, suggesting this may be another brief cooling-off phase rather than a trend reversal.

As ether ETFs maintain their historic inflow streak and bitcoin ETFs face minor turbulence, the market narrative may be tilting decisively toward ether dominance in the short term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。