Written by: Luo Luo

On July 14, Web3's "golden signboard" Bitcoin broke through the $120,000 mark, and Binance, the venue contributing the largest trading volume, also crossed a new milestone on its 8th anniversary: registered users exceeded 280 million, accounting for 50% of global cryptocurrency users.

The figure of 280 million is nearly on par with one of the world's most well-known streaming platforms, Netflix. The veteran internet giant Amazon only surpassed 300 million Prime members this year, 20 years after its inception aimed at "saving users shipping costs."

As early as September last year, external estimates valued Binance at $62 billion, far exceeding its publicly listed peer Coinbase (valued at $47.5 billion at the time).

A $60 billion valuation took the original internet giant Microsoft 21 years; the "post-90s" e-commerce king Amazon took 16 years, JD.com took 20 years, and Google, benefiting from its advertising business, took 9 years; even Baidu, born in the millennium, took 10 years. Now, they are collectively referred to as internet giants.

Starting in 2017, the year of the rise of new internet unicorns, Binance stepped into another river, employing strategies like "cross-industry competition and mergers for completeness" that other giants used to become titans, achieving in 8 years what some internet companies took 10 or even 20 years to accomplish.

Compared to the large Web2.0 conglomerates that span multiple businesses such as social media, search, gaming, e-commerce, video, and finance, how did a company focused solely on cryptocurrency services grow from a market of less than $100 billion with an uncertain future to today's crypto unicorn?

The exploration of entrepreneurial myths is always retrospective, but it is always necessary to summarize. For Binance, "users, focus, and foresight" are the unavoidable keywords used to describe it in the industry.

**

8 years, from 0 to 280M users**

281,876,467, the number of registered users on Binance's official homepage is still climbing, nearing 300 million. At the beginning of this January, this number was 250 million, meaning that in just six months, Binance added over 30 million users, close to the population of two Tokyos or four Hong Kongs.

This is the achievement Binance has accumulated over 8 years.

In these 8 years, its user trading volume exceeded $125 trillion, which is 13% higher than the total global GDP in 2024 (approximately $110.5 trillion). With a transaction execution rate of 2,511 per second, Binance's daily trading volume reached 217 million transactions, and at peak trading times, the requests per second (RPS) could reach 4.475 million, with daily trading volumes exceeding $70 billion, and even surpassing $100 billion at peak times.

Today, Binance is no longer just a "cryptocurrency trading platform"; trading was merely its initial scenario. It now encompasses over 30 functions categorized into payments, lending, investment, social networking, learning, charity, and more, with over 5,000 employees from around the world providing services in more than 40 languages.

Binance users have exceeded 280 million

From various data dimensions, Binance has become a super unicorn in the cryptocurrency industry, with "first" and "largest" being fixed labels when it is mentioned.

If we go back to July 14, 2017, the day Binance launched as a website, it was quite rudimentary—only 5 tokens were listed, and it offered 2 service languages. "Even the customer service team was borrowed from outside; there was simply no marketing team," recalled Binance founder Zhao Changpeng (also known as CZ) about the early days of Binance.

At that time, it was a year when unicorns were emerging in the internet industry. In 2013, venture capitalist Aileen Lee coined the term "unicorn" to describe startups valued at $1 billion or more, and it has been used ever since in the internet startup boom. By the time Binance was founded in 2017, there were already 193 "unicorn" companies emerging globally, with China accounting for 108 of them (according to data from China Investment Network). Well-known names like Ant Financial, Xiaomi, Didi Chuxing, Meituan-Dianping, DJI, and Tencent Music were all on the list.

Binance was also in step with the golden age of internet entrepreneurship, but it chose not to follow; instead, it embarked on a different, murky path—blockchain. In 2017, this concept was imbued with high hopes by industry participants as "value internet" and distinguished from "information internet" with the term "Web3.0." Believers saw it as the next generation of the internet, a trend, a future. But for many ordinary people, even today, cryptocurrencies and Bitcoin remain foreign concepts.

Zhao Changpeng is also one of the believers. The difference is that Binance was not one of those blockchain token projects that exploded in 2017 with only slogans and white papers; like an online marketplace providing goods, Binance set out during the era of various cryptocurrencies emerging on the blockchain.

On December 18, 2017, just 5 months after Binance launched, Zhao Changpeng's phone was buzzing with congratulatory messages from others. "It took me a few minutes to realize: on that day, Binance became the largest cryptocurrency trading platform in the world."

In just 5 months, Binance topped the cryptocurrency exchange industry, maintaining a leading and even absolute market position for the next 7 years.

Even after experiencing the fierce competition of 2018 and the market downturn following the cryptocurrency bubble burst in 2019, Binance has always held the "golden signboard," capturing 53.7% of the market share in cryptocurrency spot and derivatives trading volume by the end of 2023, and attracting 50% of the global cryptocurrency user population when Bitcoin reached new highs in 2025.

In comparison to internet financial service companies, Ant Financial's flagship product Alipay surpassed PayPal to become the world's largest third-party payment platform with 200 million users in 2009, six years after it was launched as a transaction guarantee tool for Taobao in 2003. PayPal, on the other hand, only surpassed 277 million users in 2019 after 20 years of operation.

Of course, the current cryptocurrency market, with a market cap of only $3 trillion, is far less than the scale that the internet financial market can support and is not as mature as the services provided by the latter. For example, in terms of mobile payment, China has the highest penetration rate globally at 86%, while the US and Germany account for 48%.

It is precisely because Binance grew in an era of mature internet infrastructure and exploded during a period of rapid development driven by the proliferation of mobile phones, the emergence of online merchants, and the increasing demand for mobile payments that digital mobile payment applications like Alipay and PayPal took root in various fiat currencies such as the US dollar, euro, and renminbi, which people were already familiar with, trusted, and relied upon, becoming indispensable tools in people's lives.

In contrast, in the cryptocurrency market, which is not driven and guaranteed by national credit and requires curious individuals to continuously learn and understand, Binance stands out as particularly challenging. Achieving a 50% market share and user penetration in 8 years is indeed a remarkable breakthrough.

**

From 1 to 30+ functions, relentlessly pursuing crypto services**

In June of this year, the world's largest stablecoin issuer, Circle, went public for the first time, with a total market value of $6.8 billion. Last September, media estimates valued Binance at over $62 billion, surpassing Coinbase, which had been listed on the US stock market for 3 years (valued at $47.5 billion at the time).

Currently, Coinbase's market value is $103 billion. If calculated based on year-on-year growth rates, Binance's valuation exceeds $130 billion, which is close to the market value of the ecosystem token BNB (valued at $110 billion). If we take $60 billion as a standard, the well-known Chinese BAT (Baidu, Alibaba, Tencent) took 10 years, 14 years, and 13 years, respectively.

Starting from a search engine, Baidu (market value $31.7 billion) now views AI as a key technology, upgrading its search, cloud services, and other old businesses; Alibaba Group (market value $287.9 billion), which started from e-commerce, now spans payments, travel, film, cloud services, office, health, and more; Tencent (market value $4.9 trillion) has integrated diverse scenarios including gaming, music, social networking, and payments.

Not to mention earlier tech companies like Microsoft (market value $3.76 trillion) and Alphabet ($2.33 trillion), even the "post-00s" and "post-10s" internet startups are trying to encompass all aspects of human life. Meta (market value $1.77 trillion) has expanded from social networking to the XR hardware field; ByteDance is no longer satisfied with Douyin/TikTok and has extended its reach to AI and e-commerce; and JD.com (market value $53.7 billion), which started in 3C e-commerce, is now competing in the food delivery market.

It seems that giants have entered a strange cycle where only expanding business segments and competing for existing markets can break through development bottlenecks. In contrast to internet companies, Binance stubbornly resembles Sisyphus, with few distractions, wholeheartedly pushing the "boulder" of cryptocurrency services. Internet technology and AI capabilities are tools for it to expand blockchain infrastructure and cryptocurrency application scenarios, and even when expanding, it only does so around the needs and experiences of crypto users.

Binance has now grown into a blockchain ecosystem

In the year it was founded in 2017, as it became increasingly inconvenient for market users to purchase cryptocurrencies with fiat money, Binance quickly launched cryptocurrency-to-cryptocurrency trading, allowing one cryptocurrency to be exchanged for another, such as BTC/ETH. As more and more trading pairs became available, a large number of users flocked to Binance, leading to its first user explosion, forcing even earlier-established trading platforms to follow suit to maintain market share.

In 2019, when the demand for low-cost acquisition of early project tokens exploded, Launchpad was born—a platform for exchanging new tokens using BNB or other cryptocurrencies. Binance Launchpad even led a trend from 2019 to 2020, which is the foundation for the current Binance Launchpool and HODLer Airdrop.

From the beginning of trading, Binance's services around cryptocurrency have become increasingly diversified. By 2024, Binance's commitment to the inclusiveness of crypto finance has translated into breakthrough growth in Binance Pay (payments), fiat channels, and Binance Earn (wealth management), providing users with seamless access to payment, cross-border transactions, and savings based on cryptocurrency.

As of now, Binance Pay has processed 300 million transactions, amounting to $230 billion. Between 2022 and 2024, it has helped users save $1.75 billion in remittance fees, providing an economical alternative for cross-border payments, freelancers, merchants, and families. The vision that Binance had at its inception—to make cryptocurrency not just a holding asset but a tool for everyday use—is being realized.

In addition to focusing on product experience, Binance is also a company that consistently translates innovative technologies within the industry into user adoption, enabling sustainable development of emerging models, even if it is not the original creator.

These products include MegaDrop, which emerged from the popular token generation event (TGE) model based on on-chain tasks, as well as HODLer Airdrops, derived from the interest-bearing mechanisms available on various trading platforms, and Pre-Market Trading, learned from traditional financial market practices. These products, supported by underlying technology, provide millions of users on Binance with opportunities to access early selected Web3 projects.

If you have recently been using Binance's new asset airdrop platform, Alpha, some seasoned cryptocurrency users might mention an old term, "trading mining." This was a gameplay popularized by a dazzling new exchange in 2018—earning the exchange's platform token through trading cryptocurrencies, with 100% of the fees returned. This gameplay allowed the platform to rise rapidly but ultimately led to a collapse due to a lack of transparency and sustainability, resulting in a broken capital chain and the founder fleeing. The star quickly fell.

Today, as on-chain transaction costs decrease and the transparency of information such as issuance becomes more accessible, Alpha, integrated into the Binance main site from the Binance wallet, has become an observer for new assets listed on Binance. By setting point rules, it tests users' trading interest and loyalty towards various new projects through multiple new token airdrops, directly compensating users who contribute to trading with the costs of listing new projects on Binance, forming a cycle of project exposure, platform verification, and user earning early returns.

"Rewards for trading contributions"—the same model that destroyed the company that initiated it seven years ago has now become a popular product on Binance. According to statistics, eligible users on the Alpha platform can average $2,569 in airdrop rewards and $1,651 in TGE allocations between mid-February and the end of May 2025.

Some demands may be limited by technical bottlenecks both on-chain and off-chain, but Binance has not forgotten.

In 2019, a user named @LukasBydzovsky asked CZ, "How about logging into binance.com using Wallet Connect?" At that time, Zhao Changpeng confidently said it was a good idea, but because "Binance is a high-frequency trading platform, this demand requires centralized trading platforms to handle a large amount of clearing, and we need to custody/clear funds before trading, so it is still difficult to achieve now."

Today, innovative technologies such as Binance Connect (wallet connection) and Login with Binance (using Binance to log in) have realized interoperability between Binance and various on-chain digital asset ecosystems by expanding third-party integrations. As of now, Binance Wallet has been used by over 20 million people worldwide, becoming the cornerstone of Binance's decentralized products.

The "whimsical" idea of users six years ago has now become a reality at Binance, and the Q&A recorded on the Binance Blog seems to be a shining milestone that reflects the path Binance has taken.

Foreseeing Compliance "Tailwinds" Amidst Resistance

Whether in the Web2.0 realm or the Web3.0 world, for startups, growing strong in response to trends is not an easy task, and maintaining stability is even more challenging. Even giants like Google and Apple have faced regulations and constraints from regulatory orders, and the blockchain and cryptocurrency industry, which has been around for less than 20 years, is no exception.

Binance has also experienced several dark moments due to regulatory constraints, including exiting the Chinese market in September 2017, suspending services for Japanese users multiple times between 2018 and 2021, and pleading guilty to charges of violations from the U.S. Department of Justice in 2023.

After several ups and downs, Binance transitioned from being forced to go overseas and migrate during its first 3 to 4 years towards a proactive approach to security and compliance.

In recent years, Binance has frequently engaged with regulators, actively educating decision-makers in various countries about the pros and cons of cryptocurrencies and related technologies, inviting experienced former members of regulatory agencies to take key positions at Binance, expanding its security team, and cooperating with law enforcement to combat risks that undermine industry development and threaten investor safety.

From a timeline perspective, Binance's efforts to protect user asset security and privacy predate its proactive compliance.

In July 2018, just one year after Binance was founded, the trading platform launched the "Secure Asset Fund for Users (SAFU)" and publicly disclosed its address, deciding to allocate 10% of the trading fees earned into this fund regularly. To this day, the total amount in the fund wallet remains at $1 billion, aimed at preemptively setting aside funds to address unpredictable risks and prioritize user fund safety.

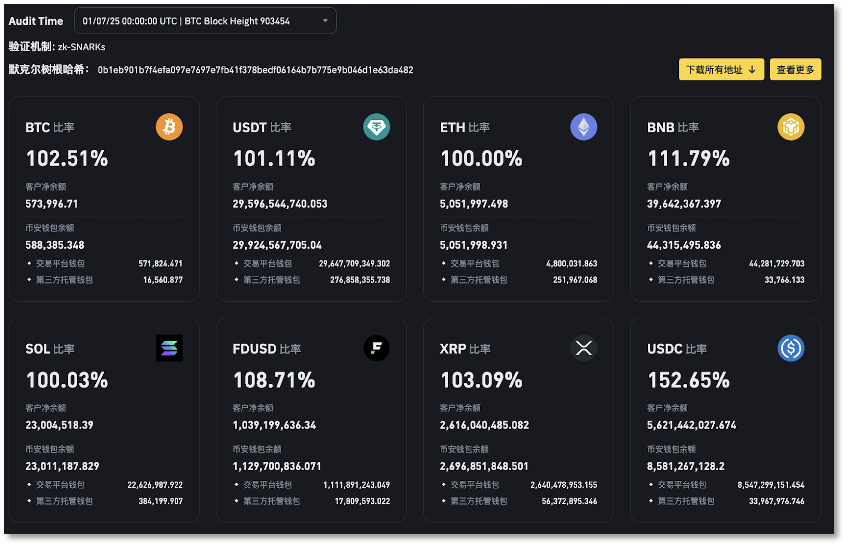

In 2022, Binance publicly disclosed its Proof of Reserves (PoR), allowing users to verify at any time whether it has sufficient reserves of at least 1:1 for the assets it holds in custody, ensuring that the debt in Binance's capital structure is zero. As of July 1 of this year, Binance's PoR showed that asset reserve ratios were all above 100%, with BNB's reserve ratio at 111% and USDC's reserve ratio as high as 152%.

Binance's Excess Reserves Backing User Assets

In addition to financial backing, Binance is also strengthening technical safeguards. Its risk and security teams continuously optimize detection systems to monitor malicious activities earlier and respond more quickly, while regularly publishing security guidelines to help users identify risks and even prevent losses. From December 2022 to May 2025, Binance avoided nearly $10 billion in potential fraud losses and directly assisted 7.5 million users through freezing and recovery operations as well as real-time threat detection.

As Binance built its firewall, the regulatory and enforcement environment surrounding cryptocurrencies has also changed in recent years.

In 2019, Zhao Changpeng revealed that financial regulatory agencies and officials from multiple countries he had interacted with clearly stated that cryptocurrencies were not within their jurisdiction. However, after 2020, the situation changed, with countries and regions, including the United States, Japan, and various European countries, beginning to pay attention to cryptocurrencies, especially in the areas of investor fraud and anti-money laundering.

After 2023, places like Singapore and Dubai began allowing licensed operations, and by 2024 and 2025, more countries and regions, including the United States, the United Kingdom, and Hong Kong, started exploring the establishment of laws and regulations specifically targeting cryptocurrencies.

Around 2021, Binance clearly recognized the trend, stating, "The regulatory process presents a great opportunity for proactive companies like Binance to lead industry development." Zhao Changpeng publicly stated that by collaborating with regulators and policymakers to establish clear regulatory and legal frameworks, actively engaging in self-regulation, and prioritizing user interests, "we can certainly help the next billion users enter the world of cryptocurrency."

That year, Binance expanded its compliance team by 500% and launched the Law Enforcement Request System (LERS) to establish cooperation with governments and law enforcement agencies, reviewing individual cases while also standardizing Binance's legal applicability and information disclosure.

This year, Binance's internal compliance expert team has grown to 1,270 members (21.8% of the total staff), and they have responded to over 240,000 law enforcement requests, conducting over 400 training sessions for agencies worldwide to help law enforcement utilize blockchain transparency to dismantle criminal networks, recover stolen funds, and shut down harmful platforms.

Under the strategy of active compliance and proactive construction, Binance has obtained regulatory authorization in 21 different jurisdictions, meaning it can legally provide cryptocurrency services in these areas.

This year, Binance still plans to increase compliance spending by 33%, hiring more compliance talent dedicated to related functions, including trading monitoring, legal consulting, investigations, and policy implementation. "This is Binance's firm commitment to transparency, accountability, and close cooperation with global regulators," said Binance CEO Richard Teng.

Step by step, Binance has grown from 0 to 280 million users and $125 trillion in trading volume; it has helped 7.5 million users avoid a total of $10 billion in losses; it has enabled users to earn and save over $50 billion in value from its products; and it has invested $40 million in crypto philanthropy for education and disaster relief, benefiting 4 million people worldwide…

Predictions indicate that by 2025, the number of internet users is expected to reach 6.54 billion, and Binance's next goal is to "enable 1 billion users to benefit from cryptocurrency assets." At the pace of Binance, achieving this milestone may not take another 8 years.

_ (Disclaimer: Readers are advised to strictly comply with the laws and regulations of their location; this article does not constitute any investment advice.) _

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。