Original Title: Time Signature

Original Author: Arthur Hayes, Founder of BitMEX

Original Compilation: xiaozou, Jinse Finance

The highest praise humanity can offer to the universe is the joy born from dancing. Most religions incorporate music and dance into their worship rituals. The "House Music Church" I believe in does not "shake your body" in a Sunday morning church, but rather at Club Space around the same time.

During college, I joined a ballroom dance club. Each type of ballroom dance has strict paradigms (for example, in standard rumba, you cannot move your feet while bending your knees), and for beginners, the hardest part is completing the basic steps on the beat, with much of the effort spent finding the rhythm.

My favorite time signature is 4/4, while waltz is in 3/4. Once you master the beat, your ears must also catch the downbeat of the main instrument and count the remaining measures of the instrumental parts. If all music were to mechanically repeat "one, two, three, four" like a drumbeat, it would be monotonous. It is the layering of different instruments and sound effects by composers and producers that gives depth and richness to the music. However, when dancing, these unimportant sounds do not help in accurately hitting the beat.

Like music, price charts are also manifestations of human emotional fluctuations, and our investment portfolios dance along with them. Just like ballroom dancing, the decisions to buy and sell various assets must align with the specific rhythm of the market. If you step out of rhythm, you will incur losses. Just like a dancer who missteps, losing money is always a clumsy affair. The question is: if we want to maintain elegance and wealth, which instrument in the financial market should we listen to?

If there is a core principle that supports my investment philosophy, it is this: understanding the changes in fiat currency supply is the most important variable in profitable trading. This is even more critical for cryptocurrencies—at least for Bitcoin, as a fixed supply asset, its price increase rate directly depends on the pace of fiat currency supply expansion. Since early 2009, the flood of fiat currency creation relative to Bitcoin's minuscule supply has made Bitcoin the best-performing asset in human history when priced in fiat.

The jarring noise created by the current intertwining of financial and political events is akin to auxiliary sounds in music. Although the market continues to rise, it is accompanied by severe negative catalysts that could trigger discordant notes. In the face of tariffs and threats of war, should we remain still? Or are these merely insignificant distractions? If the latter, can we hear the bass drum that guides the direction—namely, credit creation?

The impacts of tariffs and war are quite significant, just as important instruments being out of tune can ruin an entire piece of music. However, these two issues are interrelated yet have no effect on Bitcoin's slow ascent. President Trump cannot impose substantial tariffs on China because China would cut off the supply of rare earths to the "American Empire" and its vassal states. Without rare earths, the U.S. cannot manufacture weapons to sell to Ukrainian President "Slavic Butcher" Zelensky, nor can it supply Israeli Prime Minister "Bedouin Butcher" Netanyahu. Thus, both the U.S. and China find themselves in a deadly tango, maintaining a delicate balance on economic and geopolitical levels. This is why the current situation—though brutally deadly for the people in both wars—will not temporarily have a substantial impact on the global financial market.

Meanwhile, the drum of credit continues to beat its rhythm. The U.S. needs industrial policy—essentially a euphemism for state capitalism, that dirty word: fascism. The U.S. must shift from semi-capitalism to a fascist economic system because the war materials produced by its industrial giants are far from meeting current geopolitical demands. The Iraq War lasted only twelve days because Israel exhausted the missile stockpiles provided by the U.S. and could no longer maintain an impeccable air defense system. Russian President Putin dismisses the threats of increased U.S. and NATO aid because they cannot match Russia's weapon production levels, keep up with the production pace, or possess Russia's cost advantages.

The U.S. also needs a more fascist economic arrangement to boost employment and corporate profits. From a Keynesian perspective, war is highly beneficial to the economy. The weak organic demand from the public is replaced by the endless demand for weapons produced by the government. Most importantly, the banking system is willing to provide credit to businesses because producing materials required by the government ensures profits. Wartime presidents are often very popular (at least initially) because everyone seems to become wealthier. If a more comprehensive method of accounting for economic growth were adopted, it would clearly show that war is extremely destructive in net benefits. But such ideas cannot win elections—every politician's primary goal is re-election (if not for themselves, then for their party members). Trump, like most of his presidential predecessors, is a wartime president, which is why he has transitioned the U.S. economy into a wartime state. At this point, the rhythm becomes clear: we must track the channels through which credit is injected into the economy.

In my article "Black or White" (refer to Jinse Finance's previous article "If Trump's 'America First' Plan Succeeds, BTC Will Reach $1 Million"), I explained how government profit guarantees for "key" industries lead to bank credit expansion. I call this policy "poor man's quantitative easing," which can create a fountain of credit. I predicted that this would become a means for Trump's team to stimulate the economy, and the MP Materials deal is the first large-scale real-world example. The first part of this article will analyze how this deal expands the dollar credit supply—this template will be used by the Trump administration to produce the key materials needed for 21st-century warfare: semiconductors, rare earths, industrial metals, etc.

War also requires the government to continuously incur massive debts. Even if capital gains taxes increase due to the appreciation of wealthy assets with credit expansion, the fiscal deficit will continue to rise. Who will buy this debt? Stablecoin issuers.

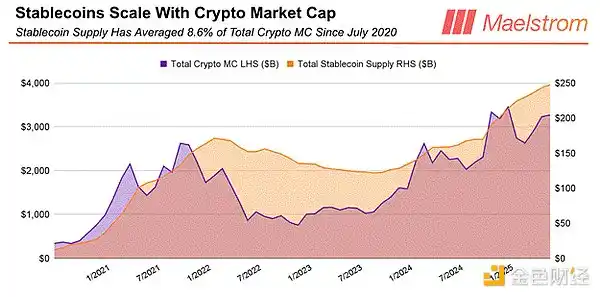

As the total market value of cryptocurrencies rises, a portion of it will be stored in the form of stablecoins. The vast majority of these custodial stablecoin assets are invested in U.S. Treasury bonds. Therefore, if the Trump administration can create a favorable regulatory environment for traditional finance (TradFi) to participate in crypto investments, the total market value of crypto will surge. Subsequently, the custodial stablecoin assets will automatically increase, creating more purchasing power for U.S. Treasury bonds. Treasury Secretary Yellen will continue to issue Treasury bonds far exceeding the scale of Treasury notes and bonds, specifically for stablecoin issuers to purchase.

Let us dance the credit waltz, and I will guide readers to perfectly interpret this financial dance.

1. Poor Man's Quantitative Easing

Central bank money printing cannot create a robust wartime economy. The financial industry has replaced rocket engineering. To correct the failures of wartime production, the banking system is encouraged to provide credit to government-identified key industries (rather than corporate snipers).

American private enterprises operate under the principle of profit maximization. Since the 1970s, it has been more profitable to engage in "knowledge" work domestically while outsourcing production overseas. China was happy to upgrade its manufacturing technology by becoming the world's low-cost (which has evolved into high-quality over time) factory. However, what threatens the elite rule of the "American Empire" is not the $1 Nike shoes, but the empire's inability to produce war materials when its hegemony is severely challenged. This is the root of the uproar over rare earths.

Rare earths are not rare, but their large-scale processing faces significant environmental externalities and capital expenditure requirements. More than thirty years ago, China decided to dominate rare earth production, and today’s China benefits from this foresight. To turn the situation around, Trump is drawing lessons from the Chinese economic system to ensure that the U.S. increases its rare earth production to sustain the empire's warlike nature.

According to Reuters, here are the key points regarding the U.S. rare earth producer MP Materials deal:

● The U.S. Department of Defense will become the largest shareholder of MP Materials.

● This deal will increase U.S. rare earth production and weaken China's dominance.

● The Department of Defense will also set a floor price for key rare earths.

● The floor price will be twice the current market price in China.

● MP Materials' stock price surged nearly 50% due to the news of this deal.

All of this seems wonderful, but where will the construction funds come from?

MP Materials stated that JPMorgan and Goldman Sachs will provide a $1 billion loan to build a facility with ten times the production capacity.

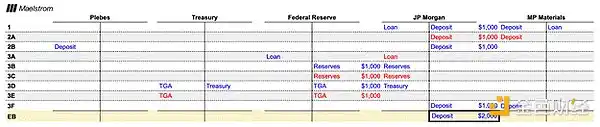

Why are banks suddenly willing to lend to the real industry? Because the U.S. government guarantees that this "vanity project" will allow borrowers to make a profit without risk. The T-shaped table below will analyze how this deal drives economic growth through the creation of credit out of thin air.

MP Materials (MP) needs to build a rare earth processing facility and obtains a $1 billion loan from JPMorgan (JPM). This lending action creates $1 billion in new fiat currency, which is deposited into JPMorgan's account.

Then MP begins to build the rare earth processing facility. To do this, it needs to hire plebeian workers. In this simplified model, let’s assume all costs are labor expenses. MP must pay the workers' wages, resulting in a debit of $1 billion from its account, while the plebeian workers' accounts at JPMorgan are credited with $1 billion.

The U.S. Department of Defense (DoD) needs to pay for these rare earths. The funds are provided by the Treasury, which must issue bonds to finance the Department of Defense. JPMorgan converts the MP corporate loan asset into reserves held by the Federal Reserve through the discount window. These reserves are used to purchase bonds, leading to a credit to the Treasury's General Account (TGA). The Department of Defense then procures rare earths, and this payment becomes MP's revenue, which ultimately returns as a deposit to JPMorgan.

The final fiat balance (EB) is $1 billion higher than the initial loan amount from JPMorgan. This expansion stems from the money multiplier effect.

Government procurement guarantees achieve the construction of new facilities and job creation through this method, utilizing commercial bank credit funds. Although not mentioned in this example, JPMorgan will now issue loans to plebeian workers with stable jobs for purchasing assets and goods (real estate, cars, iPhones, etc.). This again creates new credit, which ultimately flows into other American enterprises and returns as deposits to the banking system. It is evident that the money multiplier must be greater than 1, and this wartime production will stimulate economic activity, being counted as "economic growth."

The money supply, economic activity, and government debt expand simultaneously. Everyone is happy—the plebeians gain jobs, and financiers/entrepreneurs enjoy government-guaranteed profits. If such economic policies can create welfare out of thin air for everyone, why have they not become a universal policy in countries around the world? Because it will trigger inflation.

The human resources and raw materials needed to produce goods are limited. The government creates money out of thin air through the commercial banking system, which will crowd out financing channels and even production capacity for other goods, ultimately leading to shortages of raw materials and labor. However, the supply of fiat currency is never exhausted, and the inevitable result is wage and commodity inflation, leaving those individuals and entities not directly connected to the government or banking system in distress. If in doubt, one can refer to the daily historical materials of the two world wars.

The MP Materials deal is the first typical case of the "poor man's quantitative easing" policy. The brilliance of this policy lies in the fact that it does not require congressional approval—under Trump and his 2028 successor, the Department of Defense can directly issue guaranteed procurement orders in routine business. Profit-seeking banks will naturally follow suit, fulfilling their "patriotic duty" by funding enterprises that are dependent on government finances. In fact, politicians from all parties will rush to argue why the businesses in their constituencies should receive Department of Defense orders.

Since this credit creation model can circumvent political resistance, how should we protect our investment portfolios from the ensuing erosion of inflation?

2. Crypto Bubble

Politicians know full well: stimulating credit growth to drive "key" industries will inevitably lead to inflation. The real challenge lies in guiding the excess credit to inflate an asset bubble that will not shake social stability. If wheat prices were to soar like Bitcoin has over the past 15 years, most governments would have been overthrown by popular revolutions. Therefore, the government encourages the public—these groups whose actual purchasing power continues to shrink—to participate in the credit game by investing in inflation-resistant assets backed by the state.

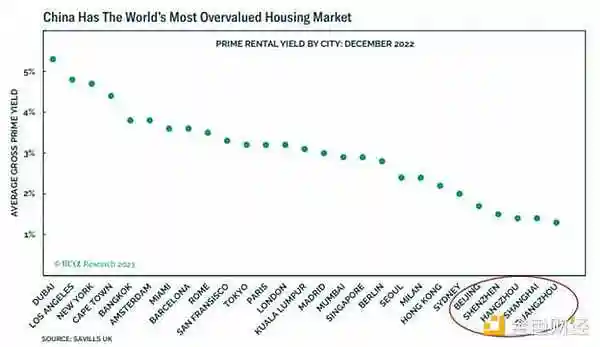

Let’s look at a real-world non-crypto example: since the late 1980s, China's banking system has created the largest scale of credit in the shortest time in human history, primarily directed towards state-owned enterprises. They have successfully built the world's low-cost, high-quality factories, with one-third of global industrial products now produced in China. If you still think Chinese manufacturing is of poor quality, try test-driving a BYD and then compare it to a Tesla.

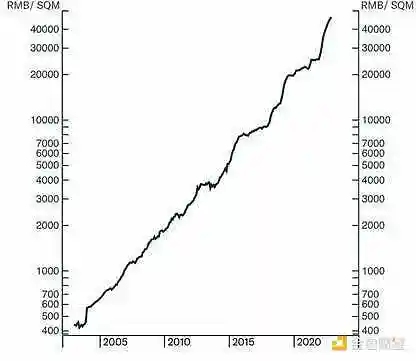

From 1996 to now, China's M2 money supply has surged by 5000%. Ordinary citizens trying to escape credit inflation face extremely low bank deposit interest rates, leading them to flock into the real estate market—exactly what the government's urbanization strategy encourages. By 2020, the continuously rising housing prices effectively suppressed the public's desire to hoard physical goods. Measured by the income-to-housing-price ratio, housing prices in China's first-tier cities (Beijing, Shanghai, Shenzhen, Guangzhou) are now among the highest in the world.

Land prices have increased 80 times over 19 years, with a compound annual growth rate of 26%.

This housing price inflation has not shaken social stability because ordinary middle-class individuals can purchase at least one apartment through loans. Therefore, everyone is involved. An extremely important second-order effect is that local governments primarily fund social services by selling land to developers, who then build apartments to sell to the public. As housing prices rise, land prices and land sales tax revenues grow in tandem.

We might conclude that the Trump administration's excessive credit growth must create a bubble that allows ordinary people to profit while also providing funds for the government. The bubble that the Trump administration is about to create will center around cryptocurrencies. Before delving into how the crypto bubble will achieve the various policy goals of the Trump administration, let me first clarify why Bitcoin and cryptocurrencies will surge as the U.S. moves towards a fascist economic model.

I created a custom index called .BANKUS Index > on the Bloomie platform (in white). This index combines the reserves held by the Federal Reserve Bank with the total deposits and liabilities of the banking system, serving as an alternative indicator for loan growth. Bitcoin is marked in gold, and both benchmark lines are set to 100 basis points as of January 2020. As the scale of credit doubles, Bitcoin's price has increased 15 times—its fiat price is highly leveraged in relation to credit growth. At this point, no retail or institutional investor can deny: if you believe more fiat currency will be issued in the future, Bitcoin is the best investment target.

Trump and Yellen have also been conquered by the "orange pill" (i.e., Bitcoin). From their perspective, the most significant advantage of Bitcoin and cryptocurrencies is that the ownership rate among traditionally non-stock-holding groups (young people, low-income individuals, and non-white populations) has surpassed that of wealthy white baby boomers. Therefore, the prosperity of cryptocurrencies will win broader and more diverse support for the ruling party's economic agenda. More critically, according to the latest executive order, to encourage various savings to flow into the crypto space, 401k pension plans are now explicitly permitted to invest in crypto assets—these plans manage about $8.7 trillion in assets. It's about to take off!

The ultimate trump card is the capital gains tax exemption proposal for cryptocurrencies put forth by "Emperor Trump." Trump is pushing for: war-driven crazy credit expansion + regulatory green lights for pension funds to enter the market + full tax exemption policies. It's a celebration for all!

All of this seems perfect, but there is a fatal problem: the government must issue more debt to fulfill procurement guarantees to private enterprises from departments like the Department of Defense. Who will take on this debt? Cryptocurrencies will once again emerge as the winner.

Once capital enters the crypto capital market, it typically does not withdraw. If investors want to take a wait-and-see approach, they can hold USDT or other dollar-pegged stablecoins. And since USDT aims to earn custodial fund returns, it will inevitably invest in the safest traditional financial income-generating instruments: short-term Treasury bonds. These bonds have maturities of less than a year, with near-zero interest rate risk and liquidity comparable to cash. The U.S. government can print money for free indefinitely, and nominally, there is no possibility of default. Currently, short-term Treasury yields range between 4.25% and 4.50%. Therefore, the higher the total market value of crypto, the more funds stablecoin issuers will absorb—ultimately, most of these custodial funds will flow into the short-term Treasury bond market.

On average, for every $1 increase in the total market value of the crypto market, $0.09 flows into stablecoins. If Trump successfully drives the total market value of crypto to reach $100 trillion by the time he leaves office in 2028—equivalent to a 25-fold increase from current levels—if you think this is impossible, it only shows that your understanding of the crypto market is still too shallow. By then, the influx of global funds will enable stablecoin issuers to generate about $9 trillion in purchasing power for short-term Treasury bonds.

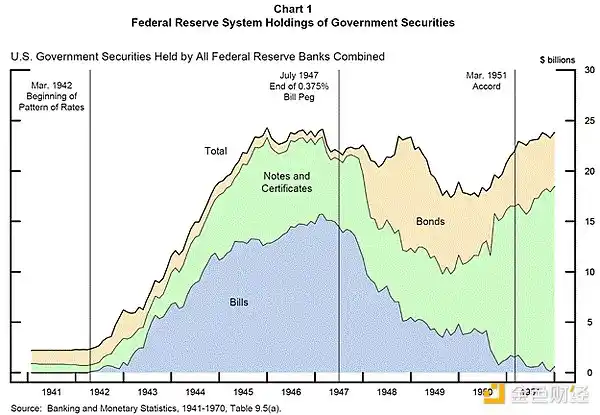

Historically, the Federal Reserve and the Treasury also significantly increased the issuance of short-term Treasury bonds rather than long-term bonds to finance the U.S. participation in World War II.

Now Trump and Yellen have completed a perfect loop:

They have created an American-style fascist economic system to produce wartime materials needed for indiscriminate bombing;

The financial asset inflation impulse triggered by credit growth directly points to cryptocurrencies, and the prices of cryptocurrencies have soared, allowing many ordinary people to gain substantial profits and feel wealthier. They will vote for the Republican Party in 2026 and 2028… unless they have teenage daughters at home… but the lower classes have always voted with their wallets.

The booming cryptocurrency market has brought massive inflows of funds to stablecoins pegged to the dollar. These issuing institutions will invest their custodial dollar stablecoins in newly issued Treasury bonds to cover the expanding federal deficit.

The drumbeat is deafening, and credit limits continue to rise. Why wouldn't you invest fully in cryptocurrencies? Don't be intimidated by tariffs, wars, or various social issues.

3. Trading Strategy

It's simple: Maelstrom is fully invested. Because we are degens, the altcoin market offers excellent opportunities beyond Bitcoin (the crypto reserve asset).

The upcoming Ethereum bull market will completely tear the market apart. Since Solana surged from $7 to $280 from the ashes of FTX, Ethereum has become the most hated large-cap cryptocurrency. But now it's different—Western institutional investors led by Tom Lee have fallen in love with Ethereum. Regardless of anything else, just buy first. Or you can choose not to buy and then sulk in a corner of the nightclub, sipping on bland beer, watching a group of people you think are less intelligent than you throw money on sparkling water at the next table. This is not financial advice, so do as you see fit. Maelstrom's strategy is: All in on Ethereum, All in on DeFi, All in on ERC-20 altcoin-driven degen ecosystems.

My year-end price targets:

Bitcoin: $250,000

Ethereum: $10,000

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。