Written by: John Wang

Translated by: Yangz, Techub News

For the first time in decades, Initial Public Offerings (IPOs) have become a legalized form of front-running.

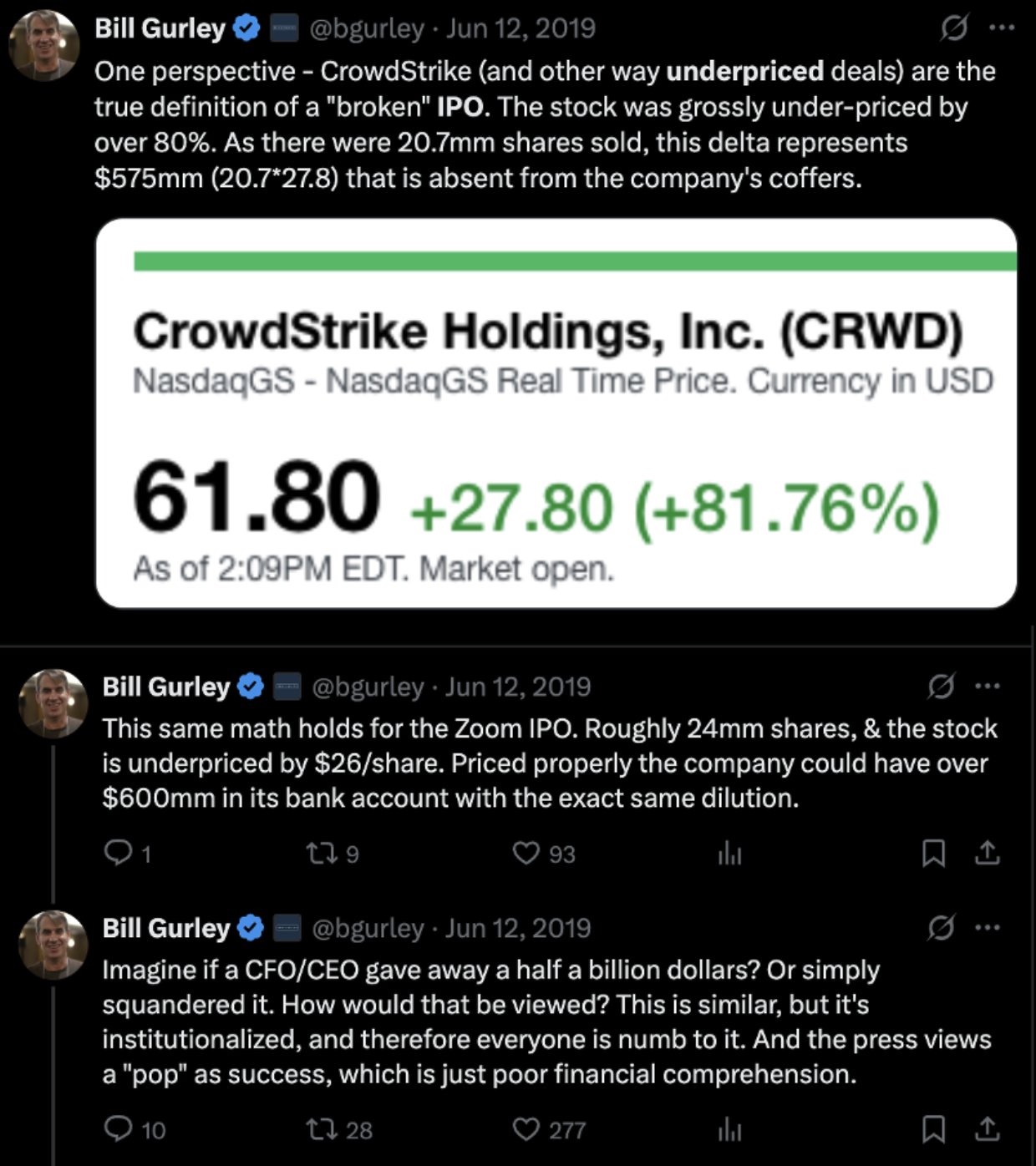

Investment banks deliberately lower the offering price by 20% to 40%, selling at a discount to institutional investors, and artificially create scarcity to ensure that their long-term clients secure substantial profits on the first day of trading. By the time retail investors are finally allowed to enter, the arbitrage opportunity has long since vanished. The reason companies continue this system is not due to its efficiency, but simply because it is the default option.

Since 2020, this interest group has siphoned off over $100 billion that should have belonged to true value creators, including founders, employees, and retail investors. Hyperliquid's HIP-3 and Hyperps provide a fundamental transformation solution for the capital formation mechanism of traditional finance through "Pre-IPO perpetual contracts." These tools allow investors to trade futures on private companies months before the IPO, achieving preemptive price transparency and continuous price discovery. This move breaks the long-held structural price suppression mechanism controlled by investment banks, opening up profit opportunities that were once exclusive to institutional insiders for retail investors.

The logic of arbitrage is simple: IPOs create a price gap between the institutional offering price and the true market clearing price, while Hyperps makes this price gap public and tradable.

Why has the IPO scam been able to persist for so long?

The root cause lies in the lack of a transparent and liquid pre-listing price discovery market.

Choosing Goldman Sachs means gaining a credit endorsement; breaking the norm could result in losing future trading opportunities, analyst coverage, and eligibility for index inclusion. Therefore, companies prefer to pay investment banks underwriting fees of up to 7% of the fundraising amount, cooperating with them to hold closed-door roadshows, collecting bids from institutional allies, and determining the offering price through verbal commitments. Retail investors are excluded from this original book-building system and can only buy in at a high premium on the opening day. This is theft cloaked in legality, protected by outdated regulations and reputation games, dominated by beautified intermediaries.

The rent-seeking game in the cryptocurrency world manifests as VCs grabbing shares in private rounds, centralized exchanges charging exorbitant listing fees, and market makers harvesting retail investors during token generation. Traditional finance is no different; the players have simply changed to investment banks, hedge funds, Nasdaq, and Citadel, with the scale magnified a hundredfold.

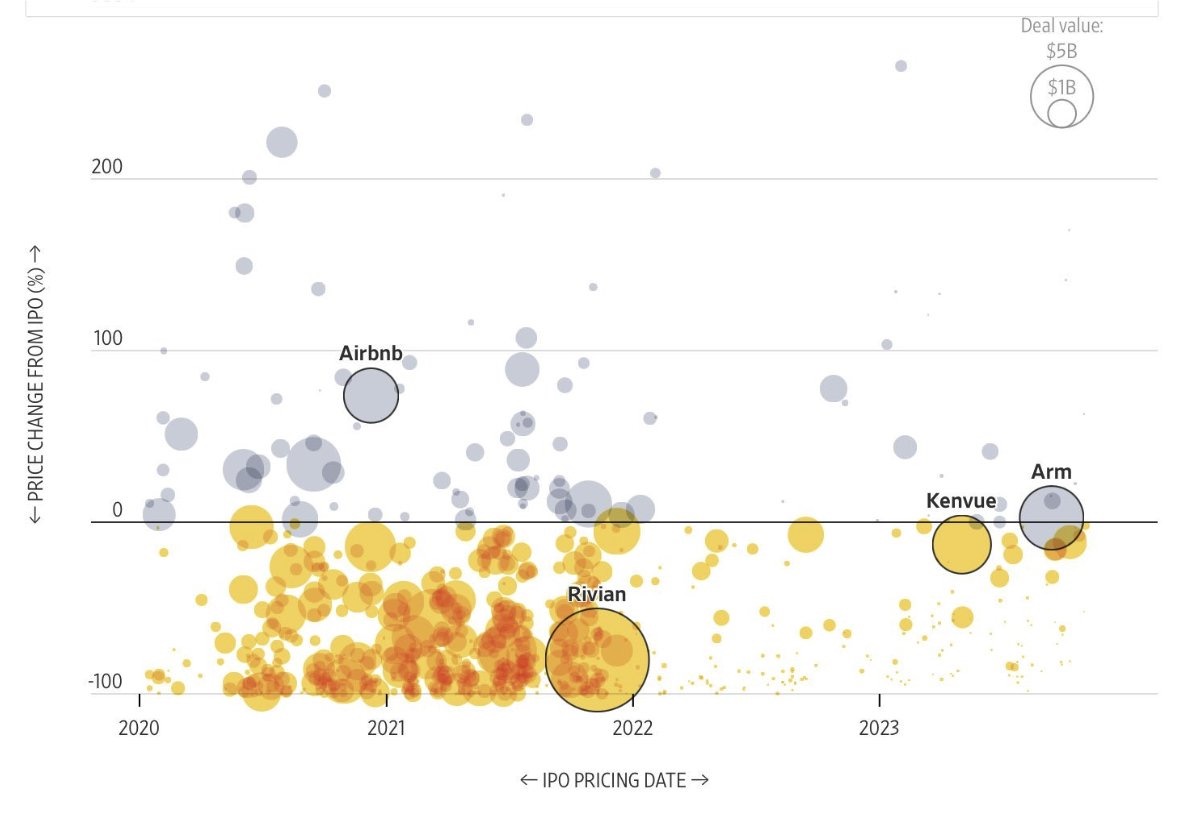

Since 2020, 80% of IPOs have opened below their offering price, with retail investors left to buy at high prices on the first day, becoming exit liquidity.

Typical Cases:

DoorDash surged 85% on its first day = $3.4 billion siphoned off

Airbnb surged 112% on its first day = $3.5 billion siphoned off

In 2021 alone = over $50 billion siphoned off

Benchmark partner Bill Gurley has exposed the decay and stubbornness of this IPO scam.

Benchmark partner Bill Gurley has exposed the decay and stubbornness of this IPO scam.

But what if we could break this system? Hyperliquid has emerged.

Through HIP-3 (permissionless perpetual contracts) and Hyperps, anyone can trade the valuations of private companies months before the IPO. Retail investors can directly participate in price discovery for companies like Stripe, SpaceX, or OpenAI, rather than becoming mere bystanders.

What is Hyperp?

It is not an ordinary perpetual contract but a new type of derivative closer to a prediction market:

No oracle pricing (no need for spot market support)

24-hour continuous trading market

Automatically converts to standard perpetual contracts post-IPO

Reduces manipulation risk through an exponential time-weighted pricing mechanism (funding rates, anchor prices, oracle caps, etc.)

Recent pre-IPO Hyperp trading for PUMP has proven that a free and open price discovery mechanism can quickly break information asymmetry and accelerate the price discovery process through a transparent market. When the market reveals its cards in advance, the advantage of insiders disappears, and the arbitrage opportunity evaporates in an instant.

PUMP's ICO issuance valuation was $4 billion, but Hyperliquid's pre-listing Hyperp trading had soared to $7 billion before the TGE. This revealed the trading tactics, prompting a following trend that caused excess returns to evaporate.

Investment banks deliberately maintain information asymmetry and control IPO quotas to preserve their advantages. Pre-IPO Hyperps represent the next evolution of capital market infrastructure, directly targeting the predatory mechanisms that the traditional IPO system strives to maintain.

Its revolutionary aspects include:

Transparent order flow reveals the actual balance point of supply and demand.

When the trading price of Hyperps reaches 2-3 times that of the private round, if investment banks price too low at the IPO, it will reflect a lack of professional capability.

This breaks the artificial divide between public and private markets, ending the closed scarcity game. Capital continues to flow along the liquidity spectrum, retail investors gain early participation opportunities, price discovery shifts to being public, and speculative behavior is democratized across borders globally.

Currently, derivatives account for 60-85% of price discovery in public markets, but why can't the same apply to private markets?

The answer lies in the risks involved. However, despite resistance from regulatory bodies and the weak liquidity brought by crypto-native users that cannot produce perfect price discovery, the direction of development is clear. Farewell to crony capitalism. Long live the free market. Hyperliquid.

Conclusion

This is not only about ending the wealth plundering of IPOs but also about creating a brand new open market—allowing retail investors to share in the growth dividends early, democratizing speculation, and ensuring that price discovery occurs in the sunlight rather than being hidden behind opaque distribution games.

These innovations bring sustained price discovery mechanisms, transparency, and global participation opportunities to markets that have long been monopolized by insiders, potentially ending the hundreds of billions of dollars in wealth transfer from companies to privileged institutions each year.

The question is not whether Pre-IPO derivatives will rise, but how quickly regulatory bodies and market participants can build the corresponding infrastructure to manage risks while reaping the benefits brought by these innovations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。