Written by: Liu Jiaolian

MicroStrategy has announced the public offering of a new preferred stock, STRC, officially named "Variable Rate Series A Perpetual Stretch Preferred Stock." The planned issuance is 5 million shares, with a par value of $100 per share, raising approximately $500 million in total. The annualized dividend for STRC starts at 9% and is paid monthly. If payments are delayed, unpaid dividends will accumulate with monthly compounding interest until fully paid. MicroStrategy can adjust the dividend monthly within a reasonable range based on SOFR rate changes to keep the stock price close to the par value of $100.

This product is intriguing. Unlike previous preferred stock products, the price of STRC will be controlled within a narrow fluctuation range of $99 to $101, primarily returning benefits to holders through high monthly dividend payments.

Yes, you heard that right. STRC sounds very much like the well-known synthetic stablecoins or algorithmic stablecoins. However, while traditional stablecoins are pegged at 1 coin to 1 dollar, STRC is pegged at 1 STRC to 100 dollars.

The backing asset for STRC is BTC. This inevitably brings to mind the collapse of Luna/UST. If Luna/UST had successfully transitioned to BTC, would it have survived instead of collapsing? Unfortunately, history has no "what ifs." Or perhaps, Luna/UST was merely a preview of what is about to happen with BTC/STRC?

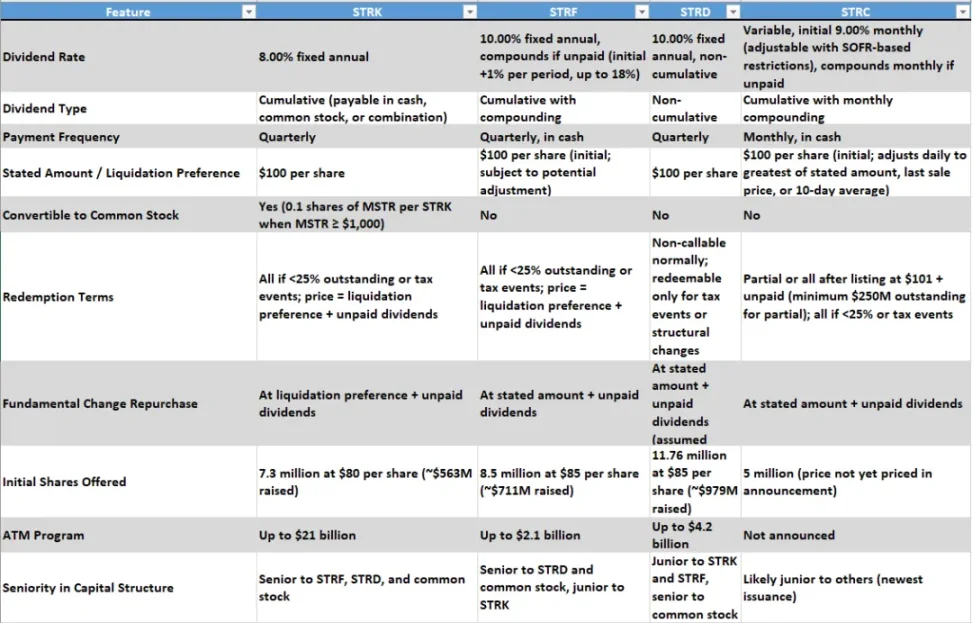

The following is a comparison table of the product characteristics of STRC, STRK, STRF, and STRD.

What mechanism does STRC use to keep its price fluctuation range consistently controlled between $99 and $101?

The answer is simple: it operates through open market operations similar to those conducted by the Federal Reserve to intervene in market exchange rates.

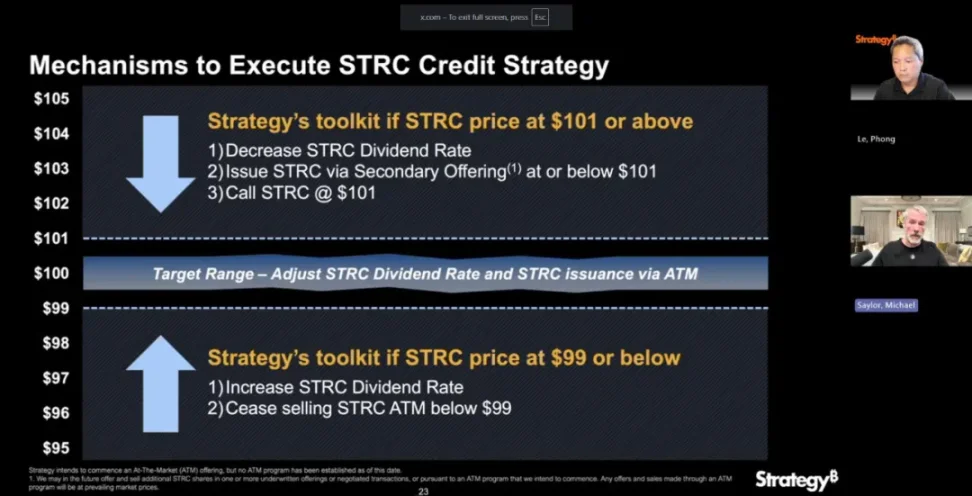

As shown in the image above:

When the price of STRC exceeds $101, MicroStrategy worries that the stock price is too high, leading investors to buy at inflated prices or making arbitrage difficult, so it will:

(1) Lower the dividend rate of STRC (reducing attractiveness, causing the stock price to decline)

(2) Issue additional STRC in the secondary market at $101 or lower

(3) Redeem already issued STRC at $101 (repurchasing high-priced notes to avoid expanding interest burdens)

These three steps can release more liquidity into the market and lower dividend costs, thereby pushing the price back to the target range.

When the price of STRC falls below $99, it indicates a lack of market confidence and increased selling pressure. To prevent a severe decline, MicroStrategy will:

(1) Raise the dividend rate of STRC (enhancing attractiveness to bring investors back)

(2) Stop issuing STRC at market prices below $99 (i.e., pause the sale of new shares through the ATM (At-The-Market) mechanism to avoid suppressing prices)

These two steps are tightening measures, reducing supply and increasing returns to support the price.

Could the BTC/STRC structure experience a death spiral? Theoretically, it is possible:

- STRC falls below $99, and the market expects the dividend to be raised (the company promises to maintain the price and will be forced to raise rates)

- Raising dividends = increasing burdens; if BTC falls or finances tighten, the company's ability to continue raising rates weakens

- Investors realize "limited room for rate increases + buybacks are far off," leading to panic selling of STRC

- STRC falls even further, and the company can no longer use ATM to issue additional financing (sales stop due to being below $99)

- A funding drought occurs, preventing further BTC purchases, the market loses narrative support, and STRC becomes a high-yield zombie note

- It remains in a discounted range for a long time, degenerating into a "de facto junk bond," completely losing its peg

However, it is important to note that STRC is a "perpetual preferred stock," not a regular debt instrument. It has no maturity date and no mandatory repayment obligation, theoretically allowing for indefinite delays in paying unpaid dividends, merely accumulating book liabilities, thus becoming a heavy quasi-debt structure.

So, under what circumstances could systemic risks trigger a death spiral?

- A sharp drop in Bitcoin (BTC falls to $50k or lower), leading to a shrinkage of MicroStrategy's balance sheet, making dividends unsustainable

- Overall tightening of liquidity in the preferred stock market, with no new buyers to take over

- A downgrade in credit ratings or regulatory intervention (e.g., SEC questioning disclosures) leading to collective selling pressure from holders

- STRC falls to the $95-$90 range, completely losing its peg, and MicroStrategy is unable to adjust rates or repurchase

The financial structure of BTC/STRC is fundamentally different from that of the collapsed Luna/UST:

First, as the backing asset for UST, Luna could be algorithmically and infinitely minted, while BTC, as the backing asset for STRC, clearly cannot be infinitely minted under MicroStrategy's control.

Second, as a stablecoin, UST is essentially a liability; it must maintain its peg (1 UST = 1 USD) to settle its liabilities, whereas STRC, pegged at 100 USD, is essentially a stock (preferred stock) rather than a bond (liability), and the product has no mandatory redemption commitment. Therefore, MicroStrategy will not be dragged down by default clauses and can choose to remain passive in extreme risk situations.

First, STRC is a "perpetual preferred stock" rather than debt. It has no maturity date, and MicroStrategy has no obligation to repay the principal at any time. It has no fixed payment obligations, unlike bonds or loans, and unpaid dividends do not trigger default. Even if dividend payments stop, it is not a default but merely "accumulated preference," meaning that future dividend payments must be prioritized.

Second, MicroStrategy can freely adjust dividends. The interest rate is floating, and MicroStrategy can moderately raise it, but it is not an unlimited obligation. Once it determines that the cost of maintaining stability is too high, MicroStrategy can stop adjustments or no longer support the price.

Third, STRC has no mandatory redemption mechanism. STRC is not a "putable" instrument; ordinary investors do not have the right to demand the company repurchase. "Call @ $101" (redeem at $101) is a selective right of the company (callable), not an obligation.

Finally, STRC does not have conversion rights linked to common stock. STRC cannot be converted into common stock (unlike convertible bonds), so it will not lead to forced dilution.

From a legal and structural design perspective, MicroStrategy has no obligation to maintain STRC within the $99-$101 range. Even if STRC falls to $80 or $50, the company will not automatically default. However, this flexibility brings a high dependence on market trust—once the "price support is abandoned" is confirmed by the market, the consequence is not a technical default but a complete collapse of confidence.

The collapse of Luna/UST was the loss of the backing asset (Luna) for the stablecoin (UST), resulting in the failure of both. In contrast, if BTC/STRC collapses, it would mean the loss of the backing asset (BTC) for the stablecoin (STRC), but at least BTC would still survive.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。