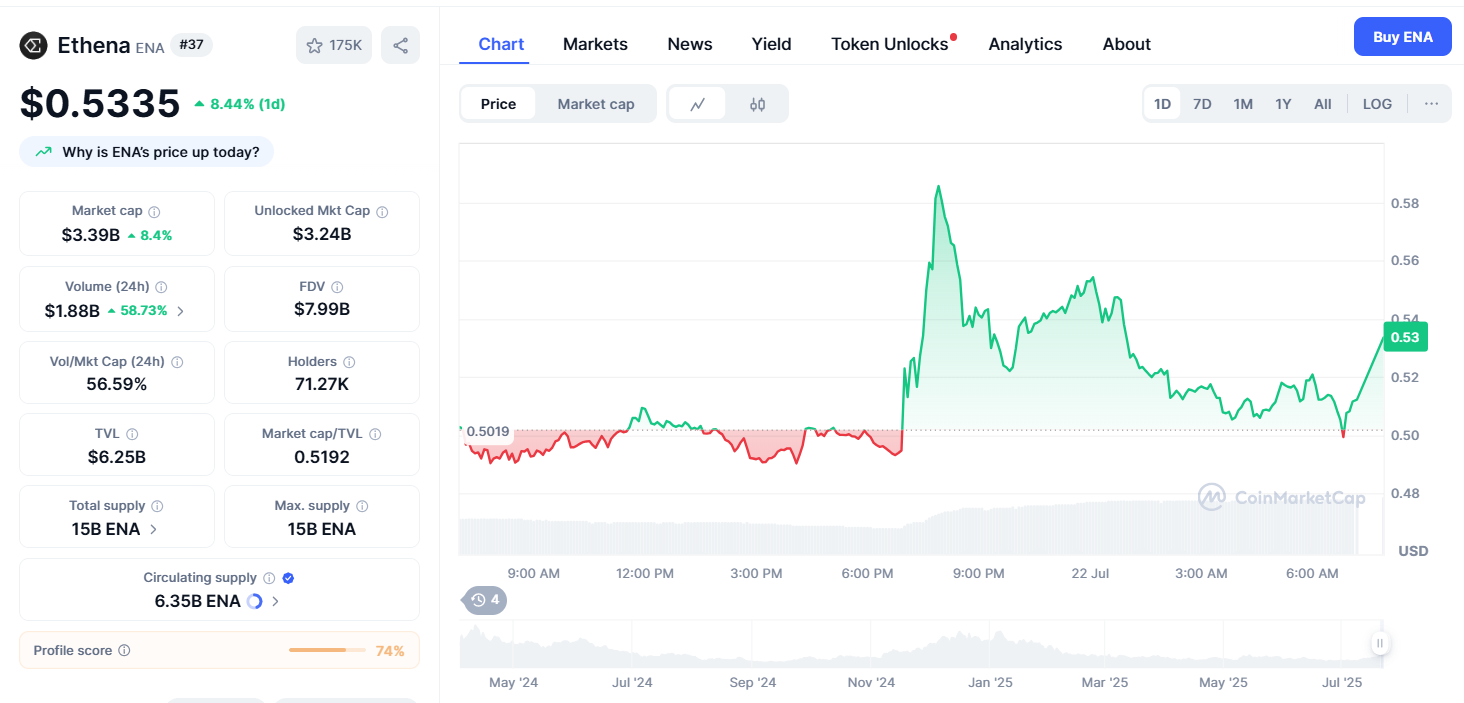

Ethena Pumps as StablecoinX Backs ENA Accumulation

Ethena launches StablecoinX to capitalize on the growing digital dollar trend, with plans to buy back ENA shares as the ENA price rises 8%. The news comes as Wall Street's crypto treasury fever grows stronger, expanding from bitcoin (BTC) to solana (SOL), ether (ETH), and other smaller cryptocurrencies .

Ethena Foundation Announces $360M Coin Buyback via StablecoinX

Source: X

The Ethena Foundation has established StablecoinX Inc., a new treasury company dedicated to stablecoins, in an audacious move into the public markets. According to the X post the firm would combine with TLGY Acquisition Corp. to go public. As part of the agreement, StablecoinX intends to spend $360 million on the acquisition and repurchase of Ethena's native token. The Ethena Foundation will begin a repurchase of ENA tokens on public markets of around $5 million per day for the next six weeks, representing almost 8% of ENA's circulation supply at current pricing.

Ethena-Backed Firm Plans Nasdaq Listing Under 'USDE' Ticker

On Monday, TLGY Acquisition Corp., a shell company registered on the Nasdaq, and SC Assets, a startup validator operator focusing on Ethena, announced their intention to merge to create a new business that will be traded under the "USDE" ticker. According to a press statement, the deal is anticipated to finalize in late 2025.

Pantera Capital, Dragonfly, Galaxy Digital, Polychain, and Blockchain.com are some of the investors from which StablecoinX aims to raise $360 million from in a private investment in public equity (PIPE) round, the businesses said.

A total of $260 million in cash that may be used to buy more locked ENA from an Ethena Foundation subsidiary and $100 million in discounted locked-up tokens make up the new capital.

The foundation stated that it is initiating a token repurchase operation to purchase $260 million worth of ENA tokens straight from exchanges via the subsidiary.

Ranks Third in Stablecoin Issuance Behind Tether and Circle

After Circle and Tether , it is the third-biggest issuer of digital currencies on the chain. This treasury attempt contributes to StablecoinX's goal of producing shareholder value by acquiring a strategic investment in a protocol at the forefront of the growing worldwide demand for digital currency."

ENA Price Surges 52% as Investors React to Token Buyback

Source: Coinmarketcap

ENA's price immediately increased in response to the announcement, indicating that the market was confident in the project's long-term prospects. The current price is $0.511322 USD. In December 2024, the token reached its highest point ever, $1.52. Due to ENA's institutional relationships, $260M repurchase, and 52% weekly increase, traders and investors are positive on the company; nevertheless, they are still wary of resistance levels and whale-driven volatility.

Ethena’s Funding-Rate Harvesting Model Boosts ENA and USDe Appeal

It is a DeFI protocol that is well-known for its $6 billion "digital dollar," or USDe. It makes money by owning spot Bitcoin, Ethereum, and SOL and shorting a corresponding number of derivatives to harvest the funding rate. ENA, the native token of the protocol, is a governance token that grants its holders the ability to participate in decision-making.

With a massive increase over the previous week, token has been among the top-performing cryptocurrencies in recent days. The protocol is also benefiting from increasing interest in USDe as yields rise as a result of growing perp financing rates, in addition to the additional demand brought about by the treasury strategy and token buyback.

Also read: Crypto Market Update: Ethereum, Spark, Solana Lead Gains免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。