Editor: Peter_Techub News

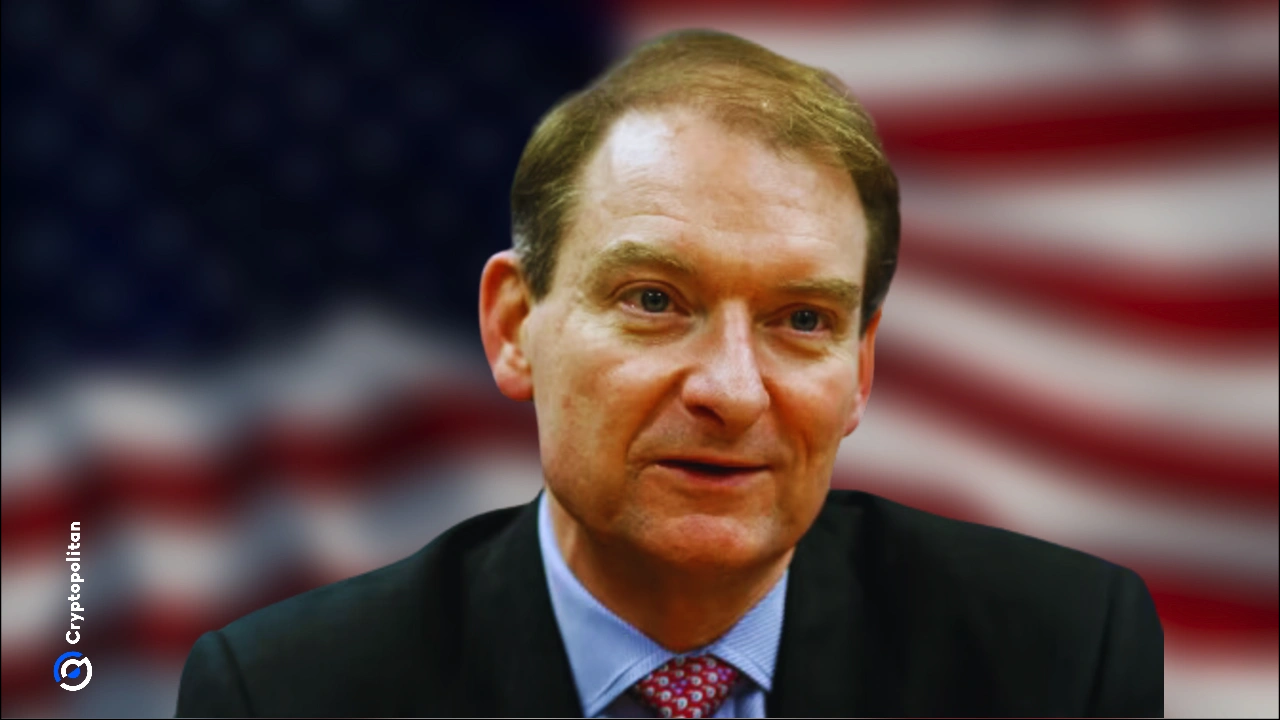

Paul Atkins, the chairman of the U.S. Securities and Exchange Commission (SEC), recently stated that Ethereum ($ETH) "is not a security," and that securities laws do not apply to the Ethereum blockchain. This statement has allowed Ethereum to successfully avoid the regulatory challenges faced by Ripple (XRP), boosting market confidence in Ethereum. Atkins further pointed out that the SEC has informally classified Ethereum as a commodity, similar to Bitcoin, rather than a security. He emphasized that the Ethereum blockchain is a key component of many other digital currencies and cannot be separated from the cryptocurrency ecosystem.

Atkins stated that companies have the freedom to decide where to allocate funds and choose strategies, and he has no authority to interfere. This supportive stance towards cryptocurrency sends a positive signal for industry development. He believes that the freedom of choice for enterprises will lay a solid foundation for the future development of cryptocurrency. Atkins also expressed that the increasing acceptance of cryptocurrencies like Ethereum by corporate entities and institutional investors is "encouraging," predicting that this heralds a "bright future" for industry development and innovation.

Meanwhile, Ethereum has successfully avoided the regulatory troubles faced by Ripple (XRP). Looking back to May of this year, the New York Attorney General had requested the SEC to publicly declare Ethereum as a security, rather than a commodity, in its lawsuit against KuCoin in 2023. Shamiso Maswoswe, the head of the Investor Protection Bureau, stated that while whether Ethereum is a security is not a decisive factor in the case, classifying it as a security would help protect investors. However, the SEC ultimately did not adopt this suggestion. In contrast, Ripple was previously classified as a security due to SEC allegations that it raised over $1.3 billion through unregistered XRP sales, leading to litigation disputes, delisting from exchanges, and a loss of investor confidence. Nevertheless, XRP has maintained its market leadership, demonstrating its resilience.

In terms of market performance, Ethereum is being fervently pursued by institutional investors. Since July, inflows into Ethereum ETFs have exceeded $1 billion, with BlackRock's performance being particularly notable. The 3-4% yield from ETF subscriptions has made Ethereum more attractive for conservative portfolios. Recently, the ETH ETF broke the record for single-day inflows, reaching an all-time high, and is gradually narrowing the gap with Bitcoin ETF sizes. Driven by this positive news, the price of Ethereum has risen to $3,782, with an increase of over 25% in the past week, making it one of the best-performing altcoins.

Meanwhile, XRP's trading price is $3.59, with a daily increase of 3.73%, and a 22% rise over the past seven days, with daily trading volume increasing by 26% to $10 billion, indicating sustained investor interest. The strong performance of both ETH and XRP is leading the altcoin market surge, and the enhanced confidence from institutions may determine the direction of the next cryptocurrency bull market.

Paul Atkins' clear statement has removed regulatory barriers for Ethereum, solidifying its status as a commodity. At the same time, Ethereum and XRP have shown strong market vitality driven by institutional funds, injecting confidence into the future development of the cryptocurrency industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。