As of today, according to bitcoin treasury stats collected by Bitcoin Magazine Pro, 64 publicly traded companies are holding bitcoin ( BTC) on their balance sheets, with a combined total tapping 852,328 BTC. From industry titans like Strategy (formerly Microstrategy) and Tesla to mining outfits and fintech upstarts, these firms are betting big that bitcoin belongs on the books.

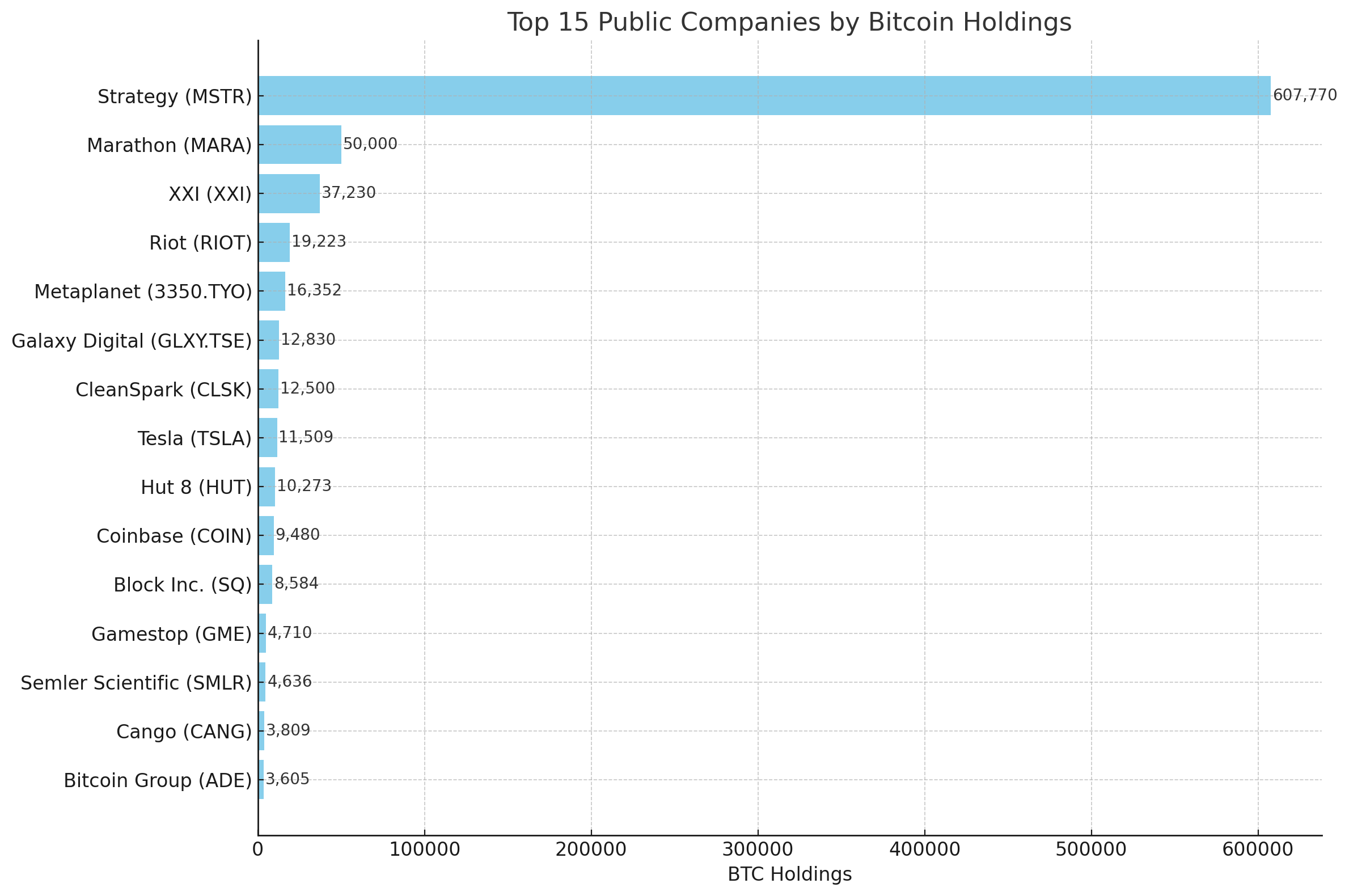

Strategy (Nasdaq: MSTR) remains the undisputed heavyweight, holding a towering 607,770 BTC—currently worth $71.97 billion. The firm just revealed it had amped up its stash by acquiring another 6,220 BTC this week. Not only does this position dwarf all other corporate stashes, but it also makes Strategy the largest publicly known bitcoin holder worldwide.

Next in line is MARA Holdings (Nasdaq: MARA), with a hefty 50,000 BTC valued at approximately $5.92 billion. The bitcoin mining firm has methodically scaled its reserves, aligning its core operations with long-term BTC conviction.

XXI (Ticker: XXI) has carved out the third-largest position, holding 37,230 BTC valued at $4.41 billion. Meanwhile, the mining firm Riot Platforms Inc. (Nasdaq: RIOT) trails with 19,223 BTC worth $2.28 billion, remaining a prominent fixture among institutional miners.

In Asia, Tokyo-listed Metaplanet Inc. (TYO:3350) has taken the title of Japan’s bitcoin bellwether, amassing 16,352 BTC worth $1.94 billion. Alongside this, Canadian-based Galaxy Digital Holdings (TSE:GLXY) is close behind with 12,830 BTC valued at $1.52 billion.

Not listed is the public firm Trump Media, which announced today it has acquired $2 billion in BTC. Some bitcoin treasury websites now say Trump Media ranks fifth overall, holding 18,430 BTC.

The top 15 out of 64 companies listed on Bitcoin Magazine Pro’s “Top Public Bitcoin Treasury Companies” list.

Cleanspark Inc. (Nasdaq: CLSK), another U.S. mining firm, holds 12,500 BTC—just shy of Galaxy’s total—worth $1.48 billion. And despite selling a portion in past quarters, Elon Musk‘s Tesla Inc. (Nasdaq: TSLA) still holds 11,509 BTC, equal to $1.36 billion in value.

Hut 8 Mining Corp (Nasdaq: HUT) controls 10,273 BTC, while Coinbase Global Inc. (Nasdaq: COIN)—the lone major U.S. crypto exchange on this list—owns 9,480 BTC. Both positions are valued at over $1 billion each. Block Inc. (NYSE: SQ), led by Jack Dorsey, follows with 8,584 BTC worth just over $1 billion.

Further down the list, Gamestop Corp. (NYSE: GME) has entered the mix with 4,710 BTC, followed closely by Semler Scientific (Nasdaq: SMLR) holding 4,636 BTC. China’s Cango Inc. (CANG) owns 3,809 BTC, while Germany’s Bitcoin Group SE (ADE) holds 3,605 BTC.

Other notable holders include Hong Kong’s Boyaa Interactive (3,183 BTC), Hive Digital (2,805 BTC), Microcloud Hologram (2,353 BTC), Sequans (2,317 BTC), and France’s The Blockchain Group (1,955 BTC). Exodus Movement Inc. (OTCMKTS: EXOD) adds another 1,900 BTC to the public treasury pool.

Singapore’s Bitfufu (FUFU) maintains 1,800 BTC, Cipher Mining (Nasdaq: CIFR) owns 1,730 BTC, and Japanese gaming giant NEXON Co. Ltd. (TYO:3659) holds 1,717 BTC. The U.K.-based Smarter Web Co. (AQSE: SWC) manages 1,600 BTC, while Fold Holdings Inc. (FLD) commands 1,485 BTC.

Canaan Inc. (CAN) holds 1,231 BTC, and Norwegian firm Aker (AKER) sits on 1,170 BTC. Bitfarms Limited (Nasdaq: BITF) and Bitdeer Technologies Group (BTDR) round out the list of BTC whales with 1,152 and 1,143 BTC, respectively.

The mid-tier players are equally intriguing. LQWD (Canada) holds 238.5 BTC, WEMADE (South Korea) owns 223 BTC, and DeFi Technologies (DEFI.NE) has 204.3 BTC. U.S.-based Rumble Inc. (RUM) sits on 188 BTC, while Prenetics (Nasdaq: PRE) has 187.4 BTC.

Smaller yet still active firms include Cypherpunk Holdings (CSE: HODL) with 166 BTC, Funding America (LMFA) with 160.5 BTC, and FRMO Corp. (OTCMKTS: FRMO) with 158 BTC. Two Japanese companies—Value Creation (TYO:9238) and ANAP Holdings (TYO:3189)—hold 153 BTC each.

Other entries include Banxa Holdings Inc. (BNXAF) with 136 BTC, Neowiz Holdings (South Korea) with 123 BTC, and The Brooker Group (BKK: BROCK) in Thailand with 122 BTC. Norwegian firm K33 (K33.ST) holds 121 BTC, and LQwD Technologies Corp. (TSXV: LQWD) closes the list with 112 BTC.

From software to semiconductors, fintech to gaming, these firms span the globe and a variety of industries. What unites them is their shared belief that bitcoin is more than a speculative play—it’s a strategic asset worth locking down. So far, the bet is paying off and the $100 billion worth of BTC value was acquired for a lot less.

While Strategy’s gargantuan bet remains the headline, the broader trend paints a deeper picture: bitcoin isn’t just being hoarded by crypto-native companies. It’s becoming part of global treasury diversification strategies. As regulation stabilizes and institutional frameworks mature, more boardrooms may soon follow.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。