The crypto industry is now transparent and legitimate.

Original author: Zuo Ye, Crooked Neck Mountain

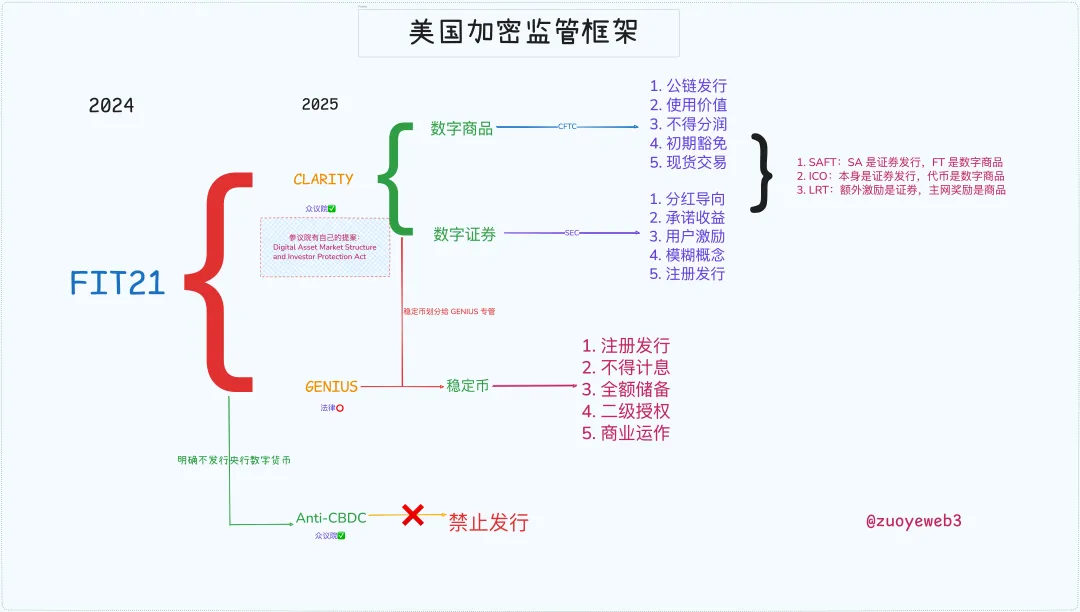

Crypto Week has hit a triple whammy, with the Genius Act specifically governing stablecoins now becoming law, while the anti-CBDC bill and the CLARITY Act are still in the legislative process.

Unlike the Genius Act, the CLARITY Act focuses on the foundational definitions and authority allocations for crypto, especially regarding public chains, DeFi, token issuance, and the powers and responsibilities of the SEC and CFTC, and it is closely linked to the FIT21 Act of 2024.

Accordingly, the U.S. has established a complete regulatory framework derived from past practices; understanding history is essential to clarify the future.

Financial Liberalization, the Wild New West

Monetary sovereignty and inflation; the Fed clings to the former in the name of controlling the latter, while Trump abandons the latter in the name of amplifying the former.

The Genius Act has ushered in the era of free stablecoins, and Powell's insistence on independent monetary sovereignty has been decentralized, returning to the Silicon Valley newcomers and Wall Street old money. However, that is not enough; Peter Thiel demands absolute freedom for libertarians.

In 2008, the financial crisis made financial derivatives the target of criticism, and Obama urgently needed professionals to help him rein in the $35 trillion futures market and the $400 trillion swap market.

Thus, Gary Gensler was nominated as the CFTC chairman, and in 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act was enacted, bringing the derivatives market under the existing regulatory framework.

Gary claimed, "We must tame the Wild West," marking the first time he triumphed over the market from a regulatory perspective.

History is cyclical; in 2021, Obama's ally, then-President Biden, nominated Gary Gensler again as SEC chairman, attempting to cycle into a new frontier—the cryptocurrency space.

There are two focal points:

The SEC has no dispute over BTC/ETH being commodities, but considers other tokens and IXOs as illegal securities, including SOL and Ripple;

Regarding the high leverage behavior of exchanges, Gary believes this is "inducing" users, initiating special regulatory actions against onshore and offshore entities like Coinbase and Binance.

However, amidst the tight regulations, Gary ultimately bent to the ETF, a product that seemed not to be a regulatory focus. In 2021, the SEC approved the Bitcoin futures ETF but remained tight-lipped about the spot ETF proposed by Grayscale and others.

But whether fortunate or unfortunate, after the SEC's partial defeat against Ripple regarding IXOs in 2024, the SEC finally approved the Bitcoin spot ETF, allowing MicroStrategy to openly engage in the cycle of coins, stocks, and bonds.

This time, cryptocurrencies represent the wilder side, conquering the SEC, CFTC, the White House, Congress, the Federal Reserve, and Wall Street, ushering in an unguarded era.

A small footnote: SBF successfully donated tens of millions to Biden's campaign, which led him to prison in 2022. This may be a significant reason for Gary's strict stance on the crypto industry.

The CLARITY Act: Crypto Finally Gets a Proper Name

Trump believes in repaying favors; the crypto industry is now transparent and legitimate.

In 2025, as a relic of two Democratic presidents, Trump chose to fire Gary as soon as he took office, appointing Paul Atkins, who had been friendly with him since 2016, to succeed him, initiating complete laissez-faire.

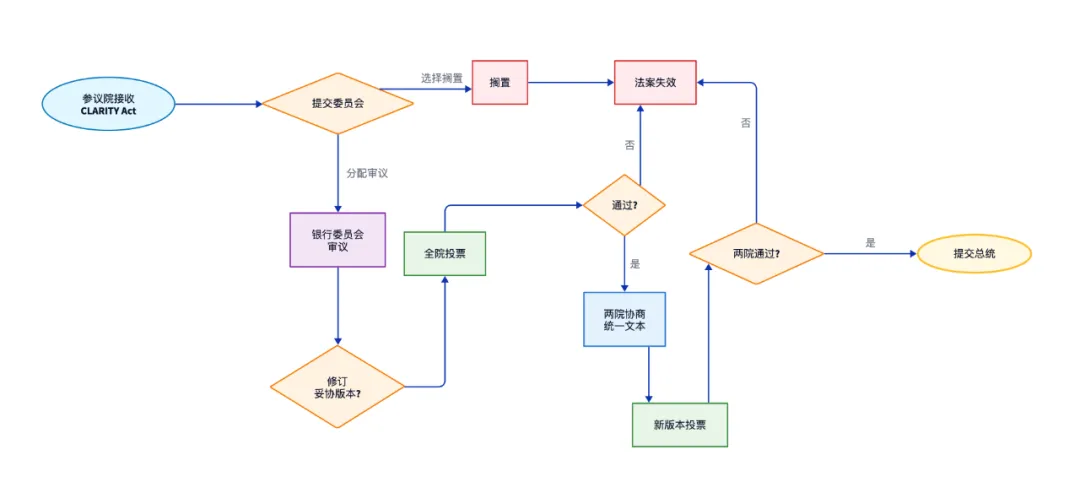

The CLARITY Act was proposed against this backdrop, but it should be noted that the CLARITY Act is still in the legislative process, having completed the House of Representatives' process and still needing to pass Senate review.

The Senate also has its own "Digital Asset Market Structure and Investor Protection Act," but under the Republican-led agenda, crypto-friendliness is inevitable.

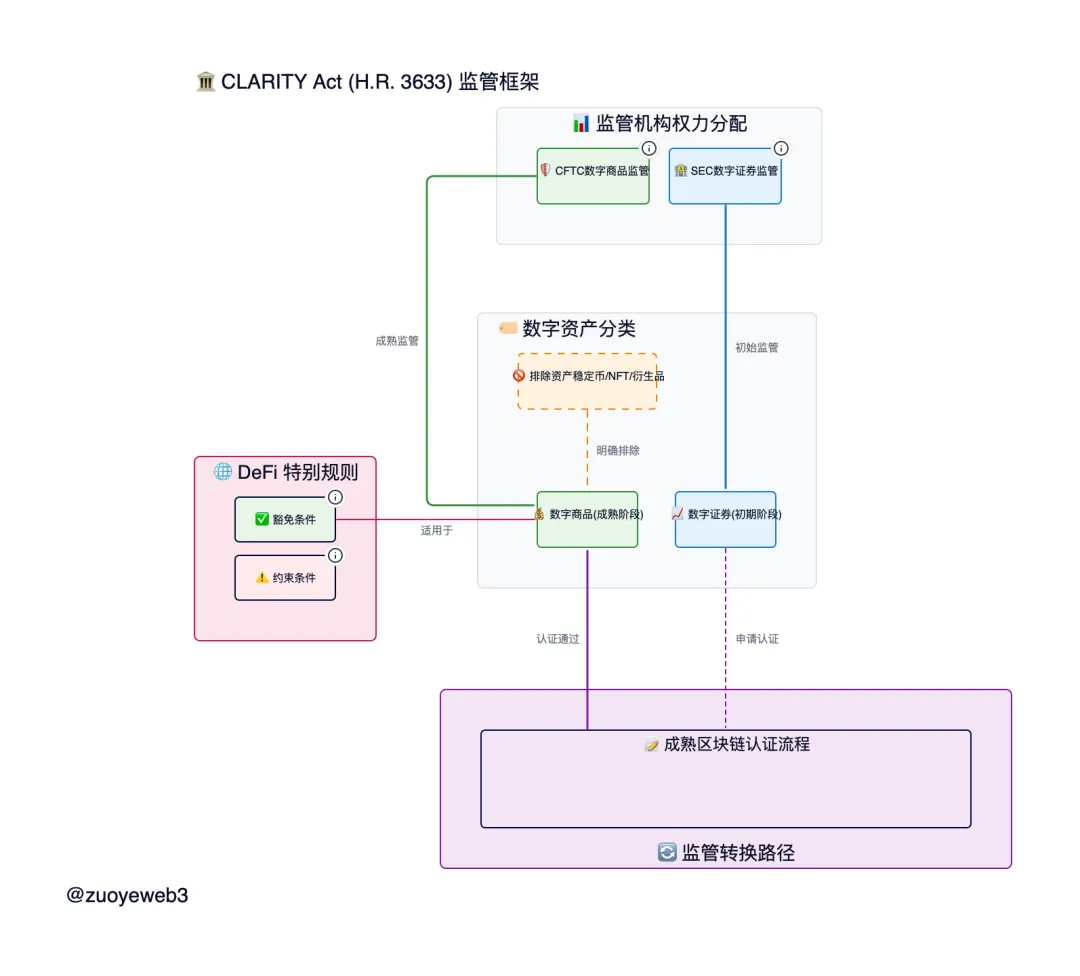

The current CLARITY Act designs a framework for digital commodities, digital assets, and stablecoins, primarily limiting stablecoins to payment forms, with digital commodities managed by the CFTC and digital assets handled by the SEC.

- CFTC Wins Big: Clarifies ETH and CFTC Status, Blurs SEC and Asset Issuance Boundaries.

ETH is a commodity; truly decentralized public chain tokens are commodities, and their trading falls under the CFTC. IXOs, SAFTs, and other financing still belong to SEC management, but there is a $75 million exemption limit, and tokens that become decentralized within four years post-issuance are exempt from penalties.

- Digital commodities are digital in form but commodities in content.

Keeping up with technological development, it no longer crudely divides into "physical commodities" and "virtual assets," acknowledging the existence of digital commodities, as long as they have practical value for public chains, DeFi, and DAO protocol operations, they are no longer securities.

However! NFTs must be assets, not commodities, because each is unique and only possesses "speculative" or aesthetic value, and cannot serve as a unified exchange intermediary like currency. Additionally, interest, rewards, and profit-sharing must provide value for maintaining decentralized operations of the protocol to not be considered assets; otherwise, they fall under SEC management.

This definition is still too abstract; essentially, the CLARITY Act distinguishes between the token issuance process and the token operation process. The following three cases are my categorized situations; please correct me if there are issues:

IXO issuance is a security; if the issued token meets conditions, it is not.

Airdrop points are securities; if the airdropped token meets conditions, it is not.

Exchange distribution is not a security, but promised returns are securities.

Meeting conditions refers to the definitions and bases of digital commodities, and the promise to transition to decentralized protocols in the future without needing intermediaries for trading. However, it should be noted that participating in the project itself is a form of investment; if there is an expectation of returns, it is participating in asset issuance.

How future definitions will unfold remains unclear, but many past cases can provide a basis for differentiation:

ETH is a digital commodity, but using SAFT for project financing is a digital asset issuance, falling under SEC management. However, if it transitions to a fully decentralized protocol in the future, it becomes a digital commodity, managed by the CFTC.

ETH native staking is also a commodity; this is a "system behavior" that maintains the PoS characteristics of the public chain. However, whether tokens issued by third-party DeFi staking protocols can be considered commodities is uncertain. For example, Lido is debatable, while EigenLayer may lean more towards being a commodity, requiring clear regulatory details.

Ethereum is a blockchain, but many L1/L2s issued through SAFTs or IXOs have four years to achieve decentralization, with single centralized control of tokens or voting ratios not exceeding 20%. Current foundations or DAOs may not be exempt, requiring analysis of holding ratios.

The CLARITY Act is indeed very detailed, establishing a framework for joint regulation by the SEC and CFTC, addressing the different characteristics of digital commodities, virtual securities, and physical commodities, which indeed require collaboration to manage.

Conclusion

The CLARITY Act is a crucial part of U.S. crypto regulation, fundamentally defining core issues like tokens and public chains, clarifying the definition of digital commodities. What remains are assets, such as NFTs, stablecoins, and tokenized assets (RWA).

However, the operation of DeFi remains in a gray area. Although the CLARITY Act has amended the definitions in the Securities Act, DeFi is too important. Just like the Securities Act, the crypto market also needs a dedicated DeFi Act, rather than being lumped together with stablecoins, public chains, and tokens.

This is not a matter of inching forward; in the construction of the U.S. crypto regulatory framework, the Tornado Cash case is still ongoing, and the fate of co-founder Roman Storm will become a litmus test for judicially driven legislation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。