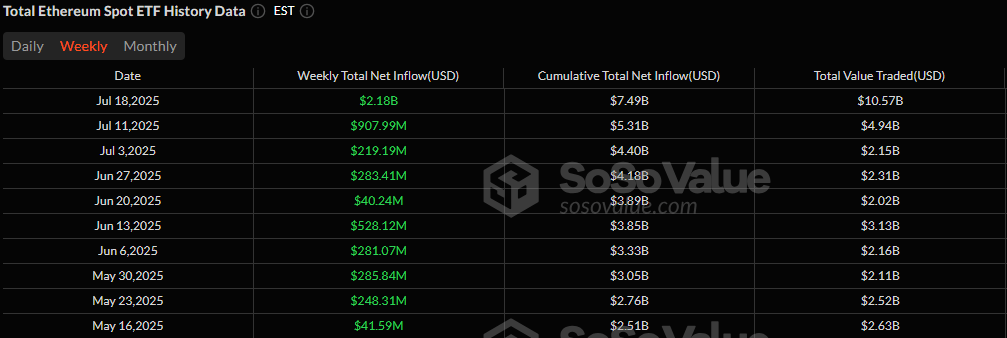

In a week that rewrote the record books, ether ETFs posted a staggering $2.18 billion in net inflows, the highest ever recorded for ether-based funds. That performance not only marks a tenth straight week of inflows but also signals a maturing institutional appetite for ETH exposure.

Wednesday, July 16, was the high point, delivering $726.74 million into ether ETFs and $799.40 million into bitcoin ETFs, making it the most explosive single day for both products this year. It was all green on the net weekly inflows for the ether ETFs:

ETHA (Blackrock): +$1.76 billion

Ether Mini Trust (Grayscale): +$201.71 million

FETH (Fidelity): +$128.77 million

ETHW (Bitwise): +$43.09 million

ETHV (Vaneck): +$12.88 million

EZET (Franklin): +$10.79 million

ETHE (Grayscale): +$14.05 million

CETH (21Shares): +$3.78 million

QETH (Invesco): +$3.72 million

10 Weeks of Inflow for Ether ETFs. Source: Sosovalue

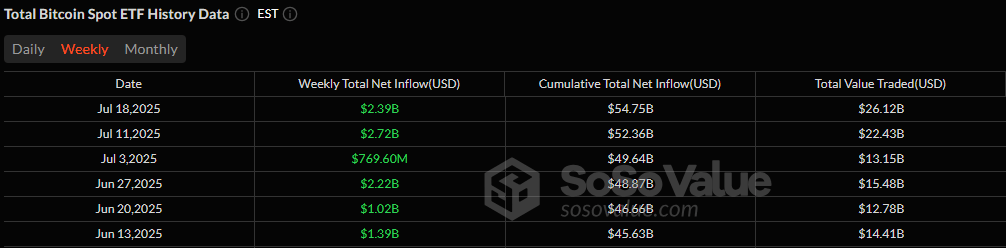

Bitcoin ETFs were no slouch, locking in $2.39 billion in net inflows, stretching their green streak to six consecutive weeks. Unsurprisingly, Blackrock’s IBIT dominated the leaderboard with $2.57 billion in net inflows, outshining the rest of the field. Here’s how bitcoin ETF inflows ranked for the week:

IBIT (Blackrock): +$2.57 billion

Bitcoin Mini Trust (Grayscale): +$41.86 million

HODL (Vaneck): +$30.87 million

BITB (Bitwise): +$17.95 million

BTCO (Invesco): +$7.12 million

EZBC (Franklin): +$6.76 million

BTCW (Wisdomtree): +$3.11 million

Bitcoin ETFs 6 Weeks Inflow Streak. Source: Sosovalue

Not all ETFs were green for the week, with GBTC (Grayscale) seeing a -$122.50 million departure, ARKB (Ark 21shares) registering a -$119.57 million outflow, and FBTC (Fidelity) logging a -$48.76 million outflow.

With over $4.57 billion pouring into crypto ETFs this week, the data is loud and clear: institutional conviction in both bitcoin and ethereum is accelerating, and ether’s rise is no longer in bitcoin’s shadow.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。