This round of increase is more a result of the combined effects of market sentiment and risk aversion, rather than the singular effect of interest rate cuts.

Written by: Musol

"Interest rates, interest rates, still interest rates!"

Readers who have been in the cryptocurrency market for a while may have some understanding— the crypto market is highly sensitive to the U.S. interest rate decisions. Bitcoin often serves as a signal reflecting the volatility driven by the Federal Reserve, and this phenomenon has intensified with the continuous mention of interest rate cuts this year. Looking back at the previous market, perhaps, since the Federal Reserve began actively raising interest rates in 2022 to combat runaway inflation, digital assets have long begun to reflect the volatility of traditional financial markets, and the Federal Reserve's interest rate decisions have become pivotal moments for the success or failure of the crypto market.

"This correlation will not disappear quickly; if anything, it is becoming the new normal."

In fact, there is a common joke in the market—"We have all become U.S. stock traders," because the crypto market not only closely follows the fluctuations of U.S. stocks, but traders also need to keep a close eye on U.S. economic data.

Among these, the Federal Reserve's interest rate is one of the most important data points. So, why should we pay attention to this data? What does this data mean?

What is the Federal Reserve & Interest Rates?

The Federal Reserve is the central bank of the United States, equivalent to the People's Bank of China, determining bank interest rate policies. However, the Federal Reserve operates with a high degree of independence; in principle, it does not submit to the U.S. government or even the president in formulating interest rate policies. Simply put, even the U.S. president has no authority to intervene in the Federal Reserve's decisions.

The Federal Reserve independently makes interest rate decisions based on its assessment of the macroeconomic situation, either raising or lowering the bank's benchmark interest rate, commonly referred to as tightening or loosening monetary policy.

Generally, the Federal Reserve may take one of the following three actions regarding interest rates:

Maintain interest rates: Market expectations remain stable, and there will be no significant impact on economic signals.

Raise interest rates: To curb inflation, adopting a contractionary monetary policy.

Lower interest rates: To stimulate the economy, adopting an expansionary monetary policy.

Typically, when we mention the Federal Reserve raising or lowering interest rates, we are actually adjusting the U.S. federal funds rate, which is the interest charged between banks for borrowing money.

For example, when the Federal Reserve raises interest rates, it increases the federal funds rate, leading to higher borrowing costs between banks. Consequently, banks will increase their reserves to control costs. The primary means of increasing reserves is by raising deposit rates to attract people to deposit money in banks. The end result is that dollars flow into banks, reducing the amount of currency circulating in the market, thereby achieving the goal of curbing inflation.

When the Federal Reserve raises interest rates, it leads to an appreciation of the dollar (due to supply and demand), resulting in more dollars flowing into banks and a decrease in the money flowing into stock markets and other investment markets, which is negative for those markets.

Conversely, when the Federal Reserve lowers interest rates (commonly referred to as "injecting liquidity"), the amount of circulating dollars increases, leading to a depreciation of the dollar, and more funds will flow into stock markets and other investment markets, which is positive.

This discussion on the Federal Reserve's interest rates serves as a foundation for readers to better understand its relationship with the crypto market. The article will gradually analyze the relationship between its decisions and U.S. Treasury yields, the U.S. dollar index, the dollar index with gold and oil prices, the dollar index with the RMB exchange rate, and the relationship between Federal Reserve or central bank interest rate decisions and economic growth.

1. The Relationship Between Federal Reserve Interest Rate Decisions and U.S. Treasury Yields

U.S. Treasuries refer to U.S. government bonds, commonly the 10-year and 2-year U.S. Treasuries.

Treasury yield refers to the yield obtained by buying U.S. Treasuries and holding them until maturity. The calculation formula is very simple: it is the total interest earned by holding until maturity divided by the purchase price (Treasury yield = interest earned until maturity ÷ purchase price).

The coupon rate of government bonds is usually fixed, meaning that the interest rate is determined at the time of issuance and remains unchanged during the bond's life, calculating the interest that should be paid based on this rate.

Government bonds can be traded in the capital market, just like stocks, so their prices fluctuate at any time. This price is the buying and selling price, not the face value of the bond. The face value and coupon rate are only used to calculate the amount of principal and interest to be paid; the market price of the bond is independent.

Since the price of government bonds fluctuates, the denominator used to calculate U.S. Treasury yields also fluctuates, which determines that U.S. Treasury yields will fluctuate.

When the price of U.S. Treasuries rises, the yield falls; conversely, when the price falls, the yield rises.

Thus, those who are not well-informed may mistakenly believe that rising Treasury yields indicate a booming Treasury market with everyone buying Treasuries. In reality, it is due to everyone selling Treasuries, causing the price to drop, which leads to rising yields. Falling Treasury yields indicate that everyone is buying Treasuries, pushing up the price and causing yields to fall.

The same applies to government bonds in general; whether U.S. Treasuries or Chinese government bonds, a rise in bond yields indicates that people are selling bonds, while a drop in yields indicates that people are buying bonds.

There is an inverse relationship between bond yields and the prosperity of the bond market.

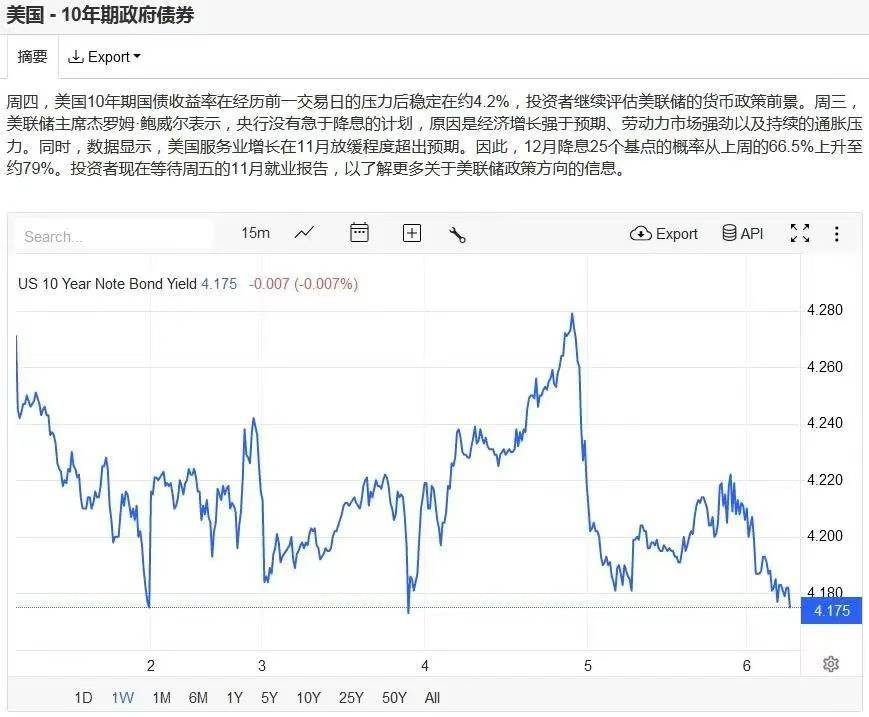

Figure 1 shows the trend of the 10-year U.S. Treasury yield from December 1-6, 2024.

So, what is the relationship between Federal Reserve interest rate decisions and fluctuations in U.S. Treasury yields?

The Federal Reserve's interest rate policy determines the level of bank deposit and loan rates. When the Federal Reserve raises interest rates, bank deposit rates will increase, allowing people to earn higher interest by depositing money in banks. The yield on Treasuries is fixed until maturity, so when bank deposit rates rise, it attracts more people to deposit money in banks or purchase financial products calculated at the new rates, leading to a decrease in demand for Treasuries, causing their prices to fall and yields to rise. Conversely, when the Federal Reserve lowers interest rates, it encourages people to reduce deposits and increase purchases of Treasuries, leading to rising Treasury prices and falling yields.

Typically, the 2-year Treasury is most sensitive to Federal Reserve interest rates because the shorter duration makes the impact of bank rate fluctuations more pronounced, prompting people to compare the interest on deposits over the next two years with Treasury yields. In contrast, the longer duration of the 10-year Treasury means that short-term fluctuations in bank rates have a smaller impact on future deposit interest rates, as there may be many instances of rate hikes and cuts over the next ten years.

Therefore, a rate hike by the Federal Reserve will lead to an increase in Treasury yields, while a rate cut will lead to a decrease in Treasury yields.

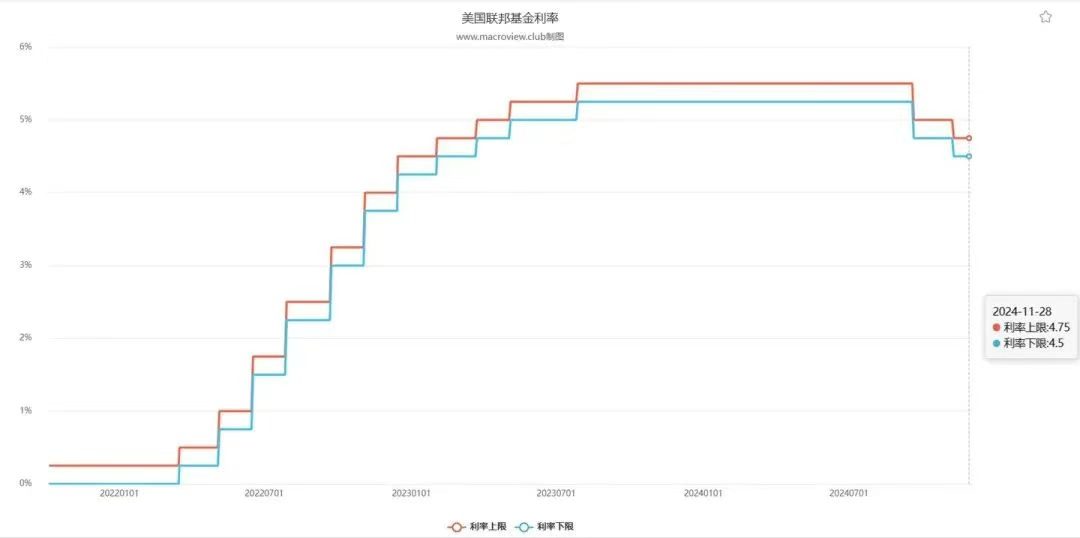

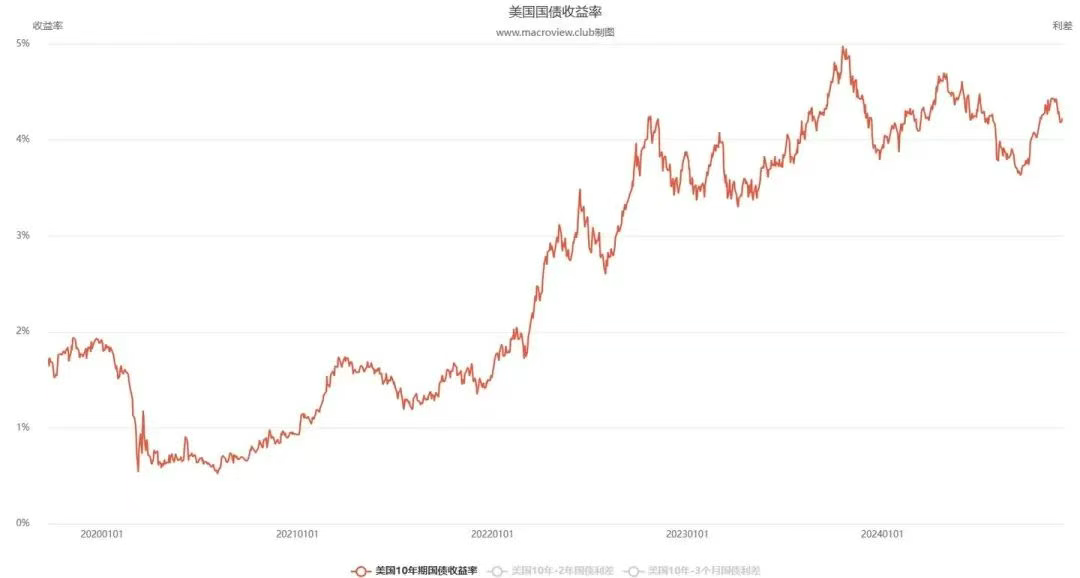

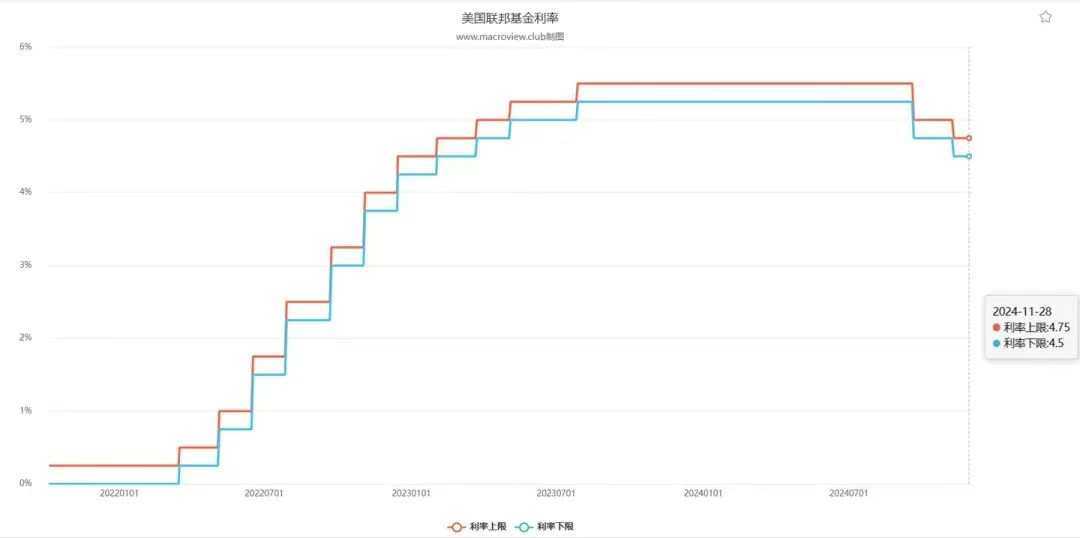

Since 2022, the Federal Reserve has continued to raise rates until the second half of 2024, with rates climbing from 0 to 5.5% (Figure 2). Accompanying this rate hike cycle, the 10-year Treasury yield rose from below 2% to a peak of 5% (Figure 3).

Figure 2 shows the trend of the U.S. bank benchmark interest rate from January 2022 to December 2024.

Figure 3 shows the trend of the 10-year Treasury yield from January 2020 to December 2024.

2. The Relationship Between Federal Reserve Interest Rate Decisions and the U.S. Dollar Index

The U.S. dollar index refers to the index measuring the exchange rate of the dollar against other currencies in the international market. A higher dollar index indicates a stronger dollar, while a lower index indicates a weaker dollar.

A rate hike by the Federal Reserve means that both bank deposit and loan rates will rise. Higher deposit rates will attract more people to deposit money in banks, reducing the amount of currency circulating in the market. The deposit rate is the cost for banks to obtain funds; when rates rise, costs increase, leading banks to raise loan rates. Higher loan rates mean increased borrowing costs for businesses, individuals, and governments, which will reduce borrowing and similarly decrease the amount of currency circulating in the market.

In other words, a rate hike by the Federal Reserve leads to more dollars being deposited in banks, thereby reducing the amount of dollars circulating in the market.

In the foreign exchange market, the appreciation or depreciation of a currency is directly determined by the supply and demand relationship of that currency. A decrease in the supply of dollars ultimately leads to a stronger dollar index.

A rate cut by the Federal Reserve means that both bank deposit and loan rates will fall. A decrease in deposit rates leads to more people unwilling to deposit money in banks, increasing the amount of currency circulating in the market. A decrease in loan rates will encourage more borrowing, similarly increasing the amount of currency circulating in the market.

In other words, a rate cut by the Federal Reserve leads to more dollars flowing into the market, thereby reducing the amount of dollars deposited in banks.

In the foreign exchange market, an increase in the supply of dollars ultimately leads to a weaker dollar index.

Thus, there is a direct proportional relationship between the Federal Reserve's interest rates and the dollar index. The interest rates of banks in each country and the exchange rates of that country's currency in the foreign exchange market share this relationship.

Figure 4 shows the trend of the dollar index from July 2021 to December 2024.

3. The Relationship Between Federal Reserve Interest Rate Decisions, the U.S. Dollar Index, and Gold and Oil Prices

In the international market, gold and oil are priced in dollars, meaning that when the dollar appreciates, its purchasing power increases, allowing the same amount of dollars to buy more gold and oil, leading to a decrease in gold and oil prices. Conversely, when the dollar depreciates, gold and oil prices will rise.

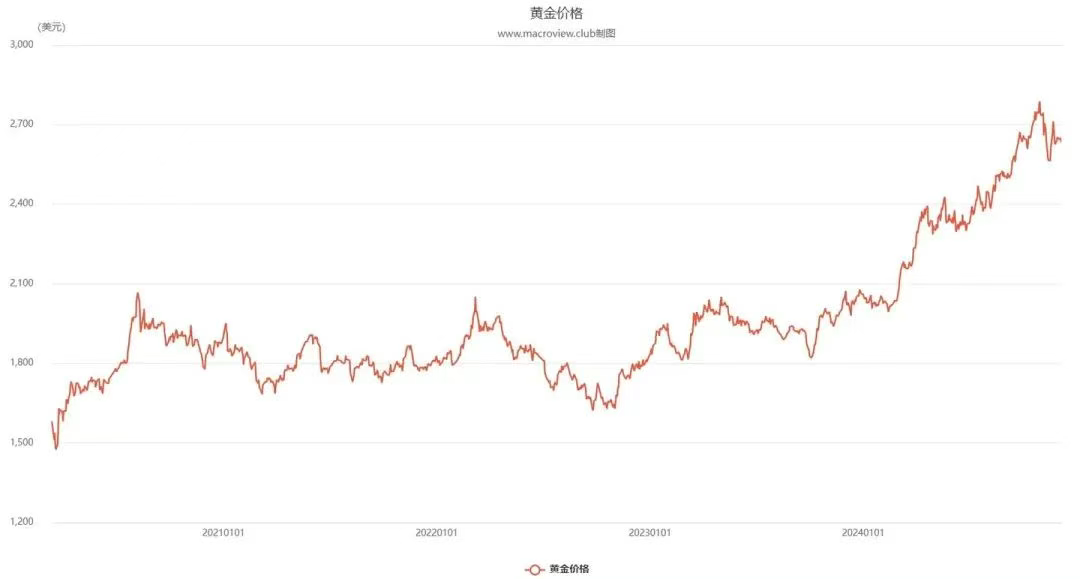

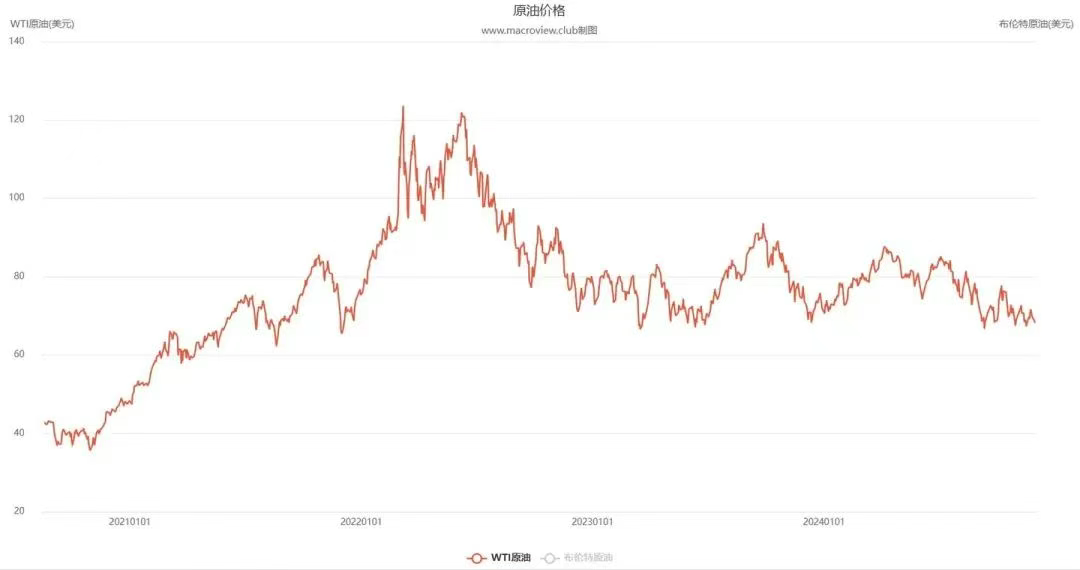

Figure 5 shows the trend of gold prices from January 2021 to December 2024.

Figure 6 shows the trend of oil prices from January 2021 to December 2024.

Understanding this logical relationship helps us recognize the close connection between Federal Reserve interest rate decisions, the dollar index, and gold and oil prices.

When the Federal Reserve raises interest rates, the dollar index strengthens, and gold and oil prices fall; when the Federal Reserve lowers interest rates, the dollar index weakens, and gold and oil prices rise.

This is the theoretical logical relationship between them, as well as the direct impact of Federal Reserve interest rate decisions and the dollar index on gold and oil prices, but it does not mean that the actual trends of gold and oil prices will necessarily conform to this relationship, as their prices depend on a comprehensive set of factors.

4. The Relationship Between Federal Reserve Interest Rate Decisions, the U.S. Dollar Index, and the RMB Exchange Rate

With the foundational knowledge established earlier, this part becomes quite simple. In the foreign exchange market, an appreciation of the dollar means that the currencies of other countries that exchange with it will depreciate; conversely, a depreciation of the dollar means that the currencies of other countries will appreciate.

Therefore, when the dollar appreciates, the RMB depreciates relative to it, and vice versa.

When the Federal Reserve raises interest rates, the dollar index strengthens, and the RMB exchange rate weakens; conversely, when the Federal Reserve lowers interest rates, the dollar index weakens, and the RMB exchange rate strengthens.

Figure 7 shows the trend of the RMB exchange rate from January 2021 to December 2024.

It is important to note: In the foreign exchange market, the RMB is commonly priced in terms of the offshore RMB exchange rate. This pricing is not based on how many dollars can be exchanged for 1 RMB, but rather how many RMB can be exchanged for 1 dollar, because the universal currency in international transactions is the dollar. Therefore, when this index rises, it indicates RMB depreciation, meaning that 1 dollar can be exchanged for more RMB; conversely, when this index falls, it indicates RMB appreciation. It is crucial not to confuse this relationship.

In a market with freely flowing capital and floating exchange rates, when the Federal Reserve raises interest rates, other currencies will passively depreciate against the dollar. To avoid having their own currency depreciate against the dollar, other countries' central banks need to follow the Federal Reserve's lead in raising interest rates to hedge against the impact of the Federal Reserve's rate hikes on exchange rates. Conversely, when the Federal Reserve lowers interest rates, other currencies will passively appreciate against the dollar. To hedge against the impact of the Federal Reserve's rate cuts on exchange rates, other countries' central banks need to follow suit.

This results in a loss of independence in domestic monetary policy. For example, countries like Canada, South Korea, Brazil, Argentina, and Hong Kong must either accept the influence of the Federal Reserve's interest rate decisions on foreign exchange market fluctuations or risk losing their monetary policy independence. This is also a manifestation of dollar hegemony.

This is why we often hear criticisms from various countries regarding the Federal Reserve's interest rate policies in the news, because the Federal Reserve's interest rate decisions directly affect the currency exchange rates of many countries and the interest rate decisions of their central banks.

As for whether these criticisms are justified, those who understand will know that any country's monetary policy should and can only be based on its own interests, and it cannot simultaneously consider the interests of other countries. Even if you attempt to take into account the interests of other countries while formulating monetary policy based on your own interests, you will lack the ability to achieve that goal.

Therefore, the criticisms from other countries regarding the Federal Reserve's monetary policy are meaningless and ineffective; only by becoming strong enough can one avoid being constrained by others.

5. The Relationship Between Federal Reserve or Central Bank Interest Rate Decisions and Economic Growth

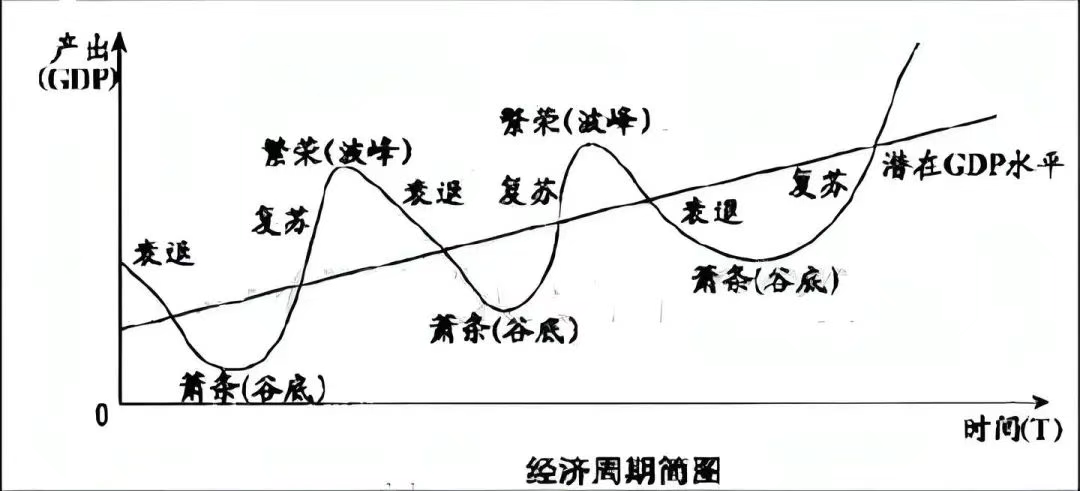

The market is an invisible hand that directs economic trends, but this invisible hand has its inherent flaws, namely, it lacks a braking function. Just like a car without brakes, it cannot anticipate a traffic accident and brake in advance. The market's lack of a braking function means it cannot predict and avoid impending economic recessions and crises. Allowing the market's invisible hand to freely direct economic development will lead to a cyclical pattern of alternating prosperity and recession.

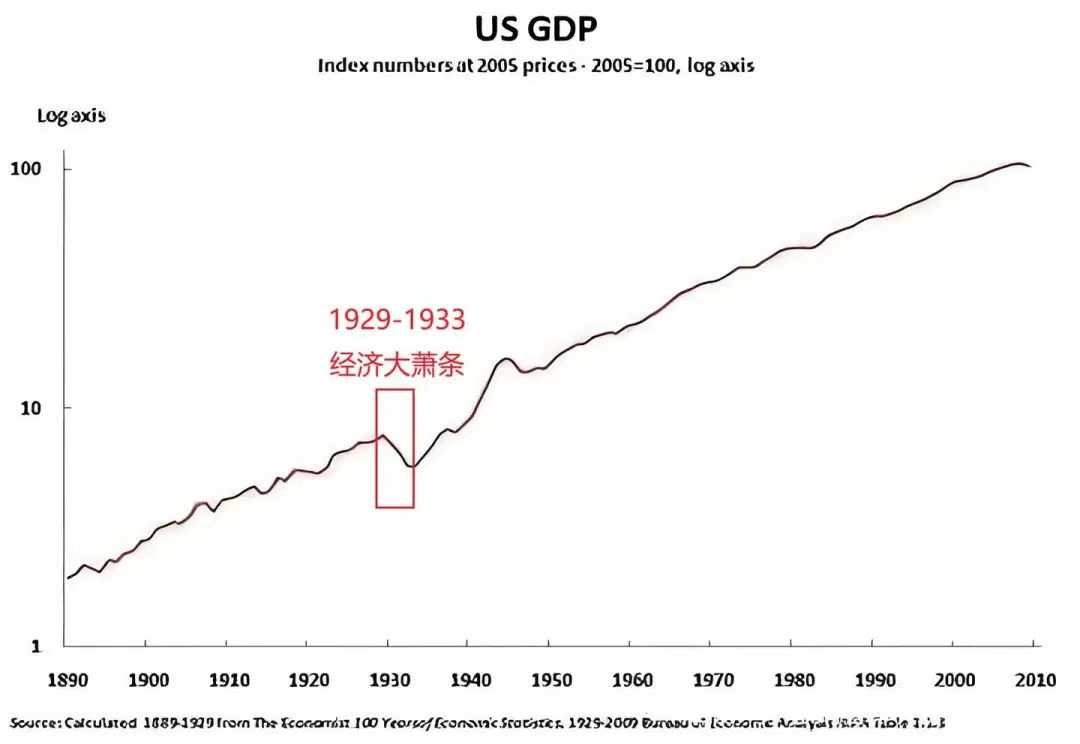

Figure 8 shows the economic cycle diagram (please excuse the outdated image).

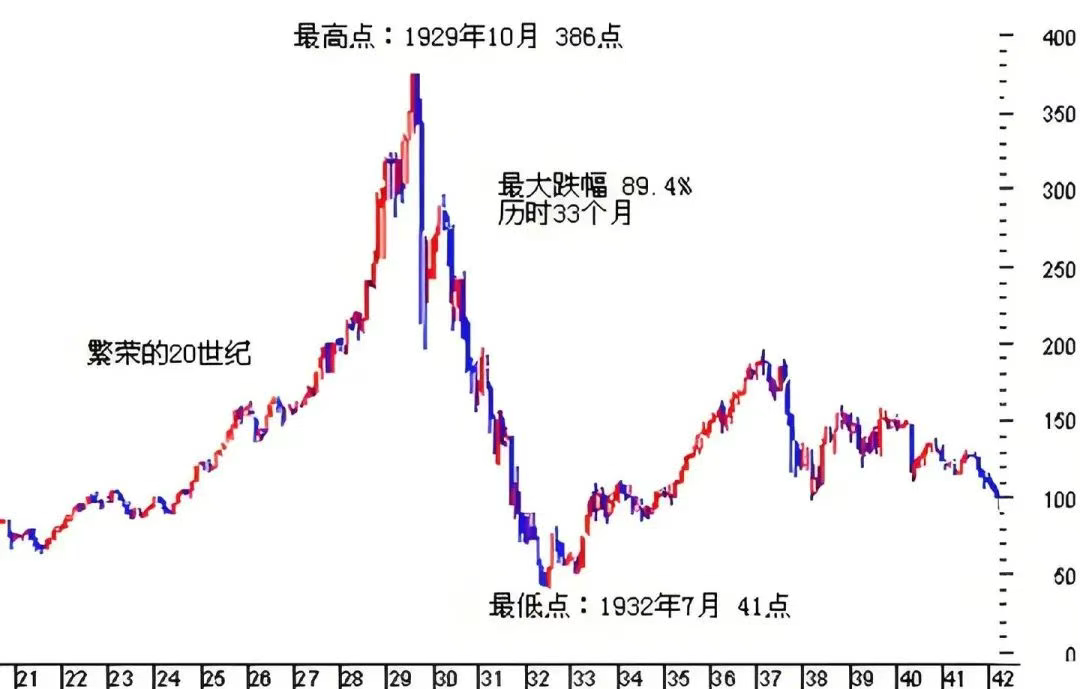

Figure 9 shows the U.S. economic boom before 1929 followed by the Great Depression.

Figure 10 shows the Dow Jones Industrial Average before and after 1929.

The underlying reason is that the lifeblood of the market is capital, and capital seeks profit. Wherever there is money to be made, capital will flow there; where profits are high, capital will rush in. This is the rule by which the market's invisible hand directs the economy.

For example, when an industry emerges with high demand and prices, attracting capital to flood into that industry, supply increases, leading from a state of high demand to balance and eventually to oversupply, causing prices to fall or crash, profits to decline, and ultimately resulting in losses and an industry crisis. After the crisis, the market self-corrects, capital exits, supply decreases until demand exceeds supply again, and this cycle repeats. This is the law of market economics, moving from high demand to balance to oversupply, from growth to saturation to recession to crisis, in a continuous loop.

The entire economic development follows this pattern.

Recognizing this pattern and the inherent flaws of the market's invisible hand, we must install a "brake" on the market economy and not allow it to operate freely. This "brake" is "government macroeconomic regulation."

Before a crisis occurs, we should anticipate and take measures in advance to prevent the crisis, applying the brakes appropriately.

Interest rate policy is an important tool in macroeconomic regulation.

When the economy is experiencing sustained strong growth, to avoid overcapacity leading to recession or even crisis, the Federal Reserve will raise interest rates to contract the money supply in the market, encouraging people to deposit money in banks and reduce consumption, thereby decreasing demand for goods. The rise in interest rates prompts businesses, individuals, and governments to reduce borrowing and investment, leading to a decrease in the supply of goods.

Conversely, when economic growth is weak or in recession, to stimulate economic prosperity, the Federal Reserve will lower interest rates to expand the money supply in the market. People will be less inclined to deposit money in banks and will spend more, increasing demand for goods. The decrease in interest rates encourages businesses, individuals, and governments to borrow and invest more, leading to an increase in the supply of goods.

Thus, the Federal Reserve adjusts the balance of supply and demand in the market through interest rate decisions, striving for healthy economic growth without experiencing overcapacity, hyperinflation, deflation, recession, depression, or crisis.

The ideal state we hope for is stable prices alongside economic growth, or that price growth is far below our income growth, which represents optimal economic growth.

Our income growth should allow us to purchase more and better goods, and businesses should earn more profits. Under this premise, the faster the economic growth, the better, indicating that our social wealth is continuously increasing, and the happiness index is steadily rising, leading to sustained prosperity. This is the virtuous cycle of economic growth.

For example, China's rapid economic growth over nearly 40 years since the reform and opening up is a virtuous cycle, with GDP continuously growing rapidly, people's income levels rising, price increases being far below our income growth rate, and people's purchasing power continuously strengthening.

Readers may also reflect on the current situation.

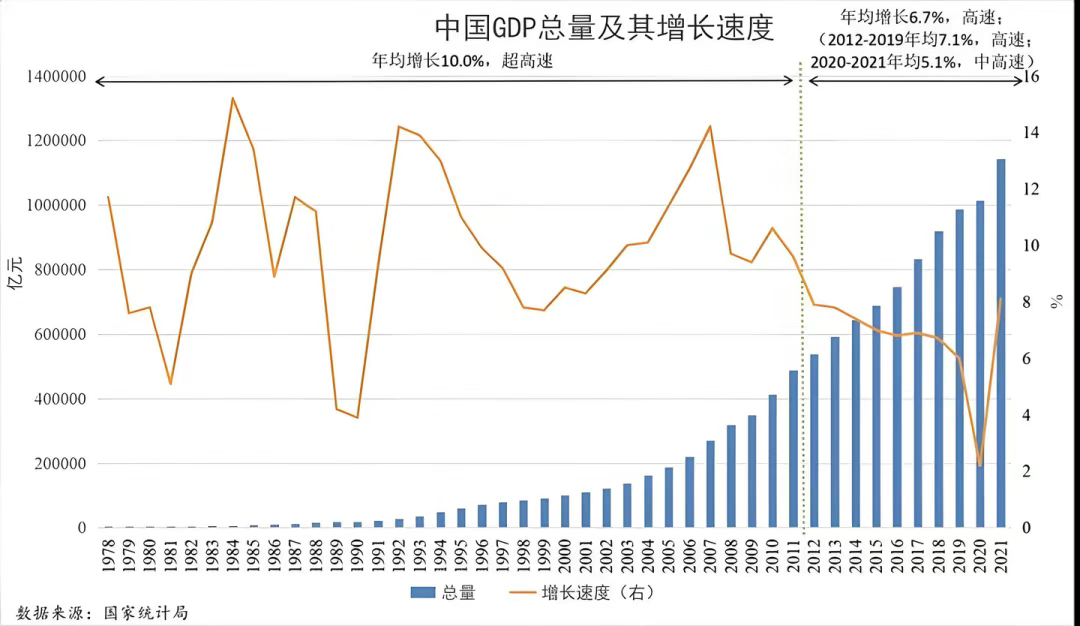

From 1978 to 2017, China's economy (GDP) grew at an average annual rate of about 9.5%, while per capita disposable income grew at an average annual rate of about 8.5%, and the price level increased at an average annual rate of about 4.86%.

Figure 11 shows China's GDP growth after the reform and opening up.

It is important to note that GDP essentially refers to total social output, which can be simply understood as the total amount of goods (services) produced by society. The more produced, the wealthier the society. This output is measured in monetary terms, meaning that total social output is converted into money, which is often expressed in trillions. However, this value is merely a number; the number itself has no real significance. To measure the true wealth of society, one must look at the actual goods (services) represented by this number, which is why there is a distinction between nominal GDP growth rate and real GDP growth rate.

Nominal GDP refers to the GDP growth rate calculated at current prices without considering price changes, which does not necessarily reflect the actual GDP growth rate. For example, if the current price level has risen compared to previous levels, then, assuming total social output has not changed, the calculated GDP will be higher than before, indicating GDP growth. This discrepancy arises from the different prices used to calculate current and previous GDP, meaning that total social output has not actually increased, and social wealth has not changed. In contrast, the real GDP growth rate excludes the effects of price changes, calculating current GDP and previous GDP at the same prices. Under this premise, any change in current GDP compared to previous GDP reflects the true change in total social output and social wealth.

Let’s return to the relationship between interest rate decisions and economic growth.

The Federal Reserve's interest rate decisions depend on its assessment of the current economic situation, with key indicators including GDP growth rate, CPI, and new employment figures. Among these, the core indicator is CPI, the inflation index, which is also the target of regulation.

CPI is regarded as the most reflective indicator of economic conditions. When the economy is growing, people's incomes increase, purchasing demand rises, pushing prices up; when the economy is in recession, people's incomes decline, purchasing demand decreases, leading to falling prices.

Therefore, the Federal Reserve aims to keep CPI within a reasonable range (around 2%-2.5%).

When it exceeds this range, it indicates that economic growth is too fast and overheating. To avoid supply-demand imbalances that could lead to recession and crises, the Federal Reserve will raise interest rates;

When it falls below this range, it indicates weak economic growth or recession. To stimulate economic growth, the Federal Reserve will lower interest rates;

If it remains within this range, it indicates that economic growth is in a virtuous cycle, and the Federal Reserve will maintain its current stance.

Thus, the relationship between the Federal Reserve's interest rates and economic growth speed, as well as CPI, is not an absolute direct or inverse relationship.

When the economy is growing reasonably and sustainably, interest rates may remain unchanged or continue to decrease, and there may also be appropriate rate hikes to control prices. Generally, maintaining low interest rates over the long term is beneficial for stimulating economic growth.

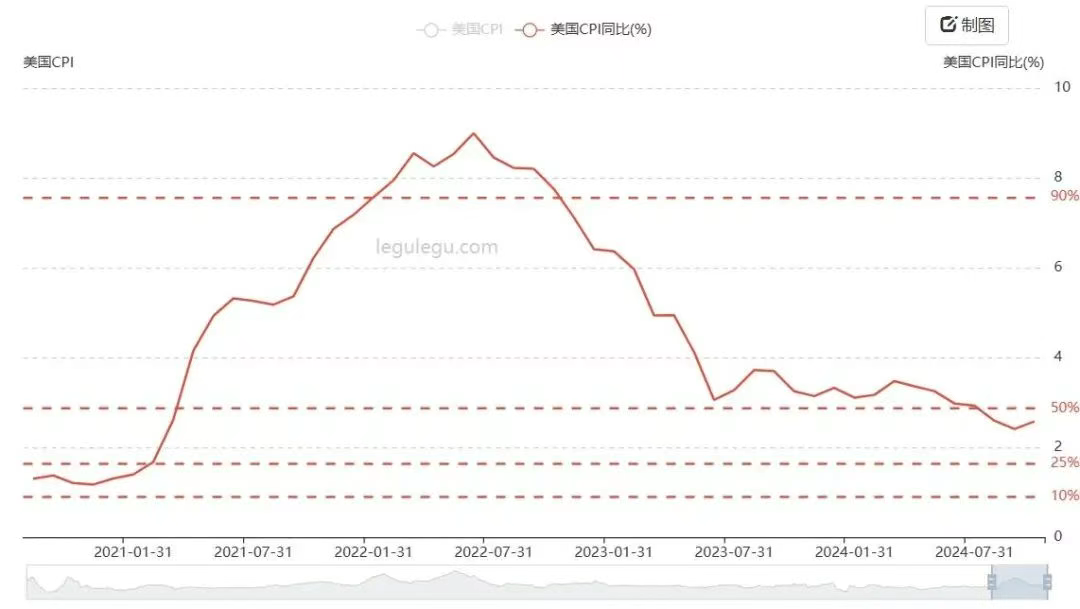

The first chart has appeared previously, so I will not elaborate further. From the first quarter of 2021 to the second quarter of 2022, the year-on-year growth rate of the U.S. CPI rose sharply, even reaching 9%, with inflation levels continuously increasing, while GDP also grew rapidly during the same period, indicating strong economic growth.

Figure 12 shows the year-on-year trend of the U.S. CPI from January 2021 to October 2024.

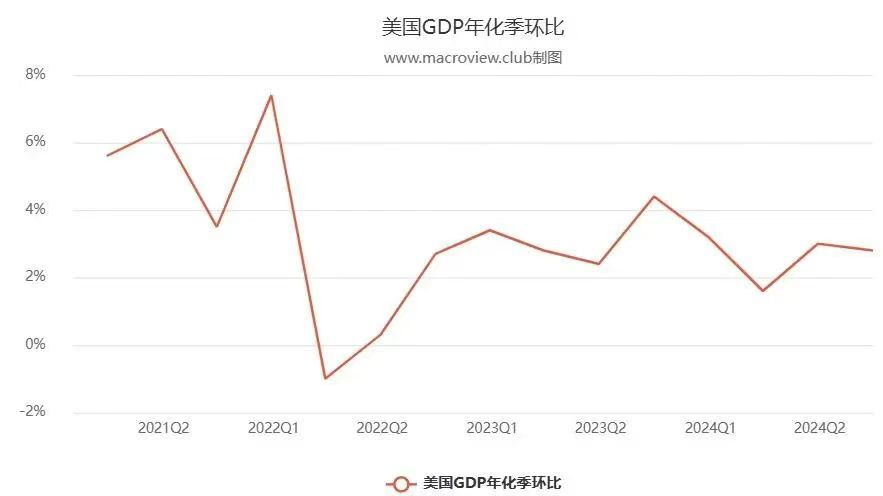

To avoid falling into a vicious cycle of inflation, the Federal Reserve began raising interest rates in 2022 and maintained this rate hike cycle until the first half of 2024. As a result of the continuous rate hikes, the year-on-year growth rate of the CPI fell to 3%, and the GDP growth rate also decreased from a peak of 6%-7% to 2%-3%. Therefore, starting in the second half of 2024, the Federal Reserve will enter a rate-cutting cycle.

Figure 13 shows the U.S. GDP growth rate from Q1 2021 to Q3 2024.

The relationship between central bank interest rate decisions and economic growth in various countries is similar.

First, I would like to thank all readers for reaching this point. If you have made it this far, it indicates that you have a relatively clear understanding of interest rates. Now, let's discuss some of the impacts of the Federal Reserve's rate cuts.

Multidimensional Impacts of Federal Reserve Rate Cuts

In today's increasingly globalized world, the Federal Reserve, as an important barometer of the global economy, we all know that its rate-cutting policy undoubtedly has far-reaching international implications.

Rate cuts directly lead to a decrease in dollar deposit rates, causing capital to flow out of the banking system like a tide, seeking higher-yielding havens. This not only promotes cross-border investment activities but also accelerates signs of global economic recovery.

However, for the cryptocurrency market, the impact of this capital flow is not straightforward; we need to understand that its effects are not immediate but multidimensional.

The Dual Nature of the Market

On one hand, the increase in market liquidity brought about by rate cuts indeed enhances investors' risk appetite, making them more willing to invest in high-risk, high-return areas. Mainstream cryptocurrencies like Bitcoin, due to their unique decentralized attributes and potential for high returns, have become favorites among many investors.

Additionally, rate cuts are often accompanied by a depreciation of the dollar, further enhancing the appeal of cryptocurrencies as safe-haven assets (this is also something that has been subtly happening in the market this year), attracting a large influx of funds seeking to preserve their value.

On the other hand, historical data presents a different picture. Although rate cuts theoretically should benefit cryptocurrency prices, in practice, this impact is often constrained by multidimensional factors—economic uncertainty, fluctuations in market sentiment, shifts in policy expectations, and the complexity of investor behavior can all lead to the cryptocurrency market performing contrary to expectations after rate cuts. For example, during economic recessions or periods of heightened market panic, more people may actually prefer to withdraw funds from high-risk markets, including the cryptocurrency market, to avoid potential losses.

Looking back over the past 35 years of U.S. interest rate cycles, we can see that the impact of rate cuts on the cryptocurrency market is not constant. In the 1980s and 1990s, although the Federal Reserve's rate cuts aimed to stimulate economic growth and combat inflation, asset price rebounds often lagged behind policy implementation and were strongly affected by economic uncertainty.

Entering the 21st century, with the rise of the cryptocurrency market, the impact of rate cuts on it has become more complex and variable—during the 2008 financial crisis, the Federal Reserve's rate cuts and quantitative easing policies indeed provided strong support for risk asset markets, including cryptocurrencies, but this support was neither unconditional nor lasting. The wave of rate cuts following the outbreak of the COVID-19 pandemic in 2020 pushed the cryptocurrency market to unprecedented heights, but this surge was more a result of market sentiment and safe-haven demand rather than the singular effect of rate-cutting policies.

The Federal Reserve's rate-cutting policy has a multifaceted, complex, and uncertain impact on the cryptocurrency market; capital does not act out of charity. While rate cuts can increase market liquidity, enhance investment risk appetite, and potentially support rising cryptocurrency prices, this impact is neither one-directional nor absolute. In the current complex and changing environment, we should approach monetary policy adjustments such as rate cuts with greater calmness and caution, considering the multidimensional factors of the economic environment, market sentiment, and policy expectations. Only in this way can we gradually maintain an undefeated position in the ever-changing market.

Life flows like a tide, and people come and go; one can only sigh at how few return to the rivers and lakes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。