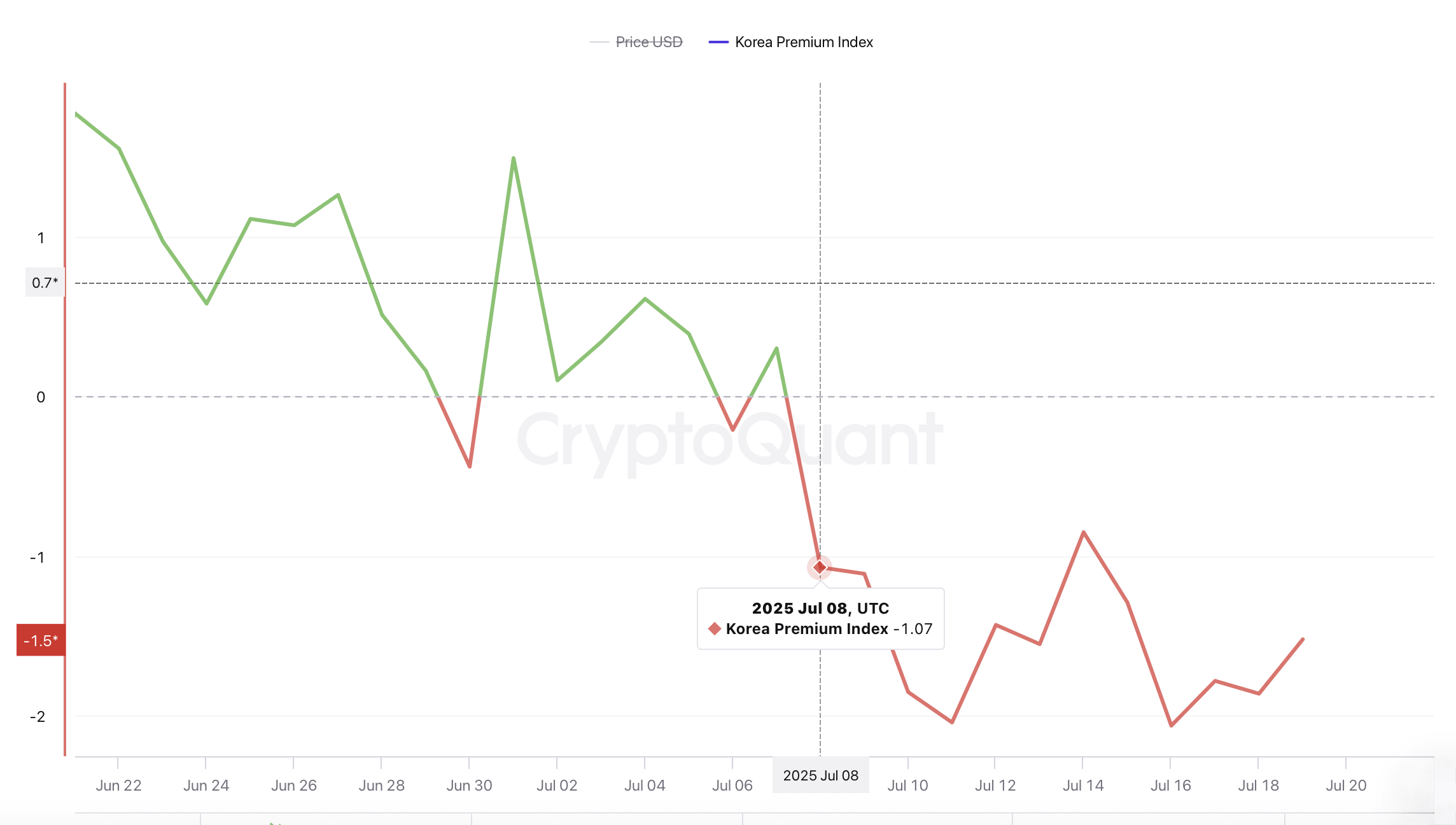

There’s usually a gap between South Korean prices and the rest of the world, with bitcoin (BTC) more often than not fetching a higher price locally. Since December 2024, cryptoquant.com data shows BTC has mostly maintained a premium, with only brief dips into discount territory in April, May, and July 2025.

South Korea has witnessed a bitcoin ( BTC) discount for 12 consecutive days.

Each of those months featured at least one moment when bitcoin traded below the global rate. But since July 8, that trend has flipped. For example, at 4:43 p.m. Eastern on Sunday afternoon, July 20, the global weighted average from coinmarketcap.com listed bitcoin at $118,189 per coin, while over on South Korean exchange Upbit, it was selling for $115,620.

That’s a 2.18% ($2,569) difference—well below nearly every other exchange rate at the time. Cryptoquant’s figures show discounts topped 2% on both July 11 and July 16. That’s a sharp contrast to the 1.49% premium seen on July 1.

These 2% discounts are the steepest seen this year in South Korea, though not quite as deep as the Dec. 7, 2024, drop, when bitcoin traded 2.42% below the global average. South Korea’s sustained markdown—unusual in both size and duration—suggests a clear deviation from its normal pricing pattern.

While bitcoin is traded globally, these local price gaps show how much regional conditions like sentiment, liquidity, and regulation still shape the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。