Ethereum continues to rise strongly, with the current price reaching a 7-month high of $3,745. Over the past week, the altcoin has surged 27%, as investors actively increase their holdings of ETH, driving its strong momentum.

Despite the market showing strong signs of growth, this rapid pace of increase is pushing Ethereum towards a saturation point, which could determine its next move.

Ethereum Investors Increasing Holdings

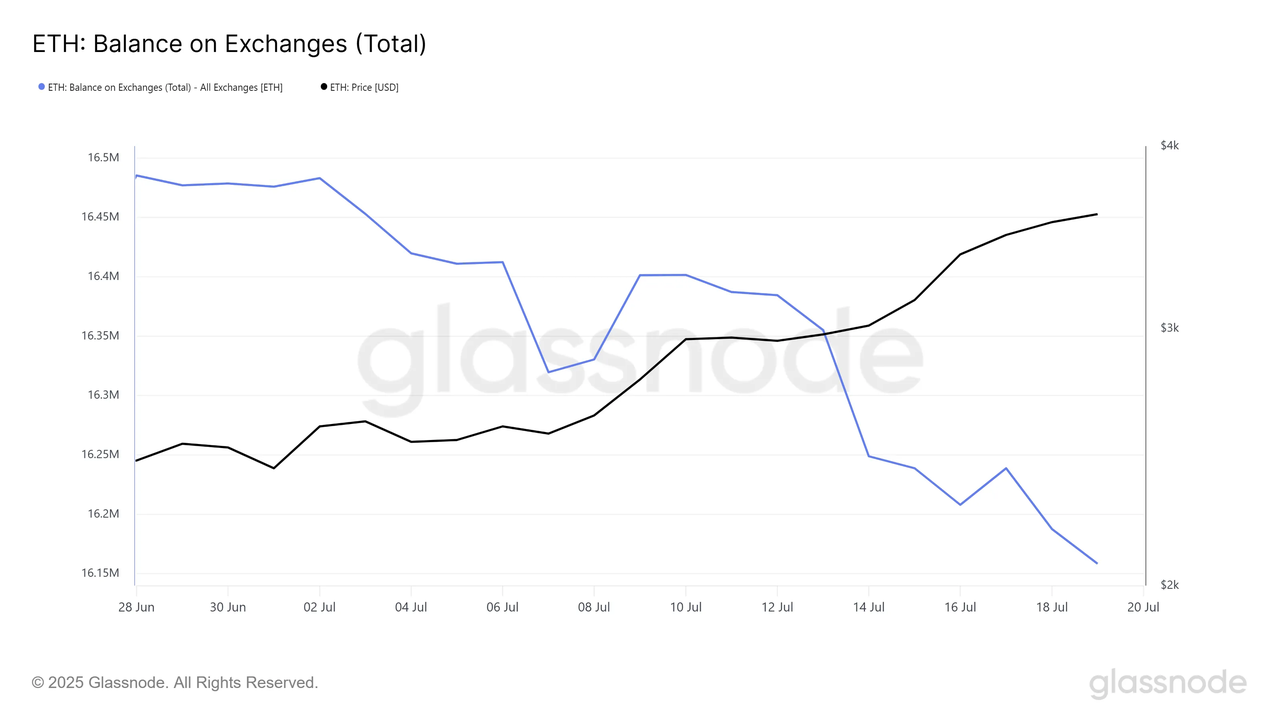

Since early July, the Ethereum balance on exchanges has decreased by over 317,000 ETH. This amount is worth more than $1.18 billion, reflecting a large-scale withdrawal by investors, thereby reducing the available supply. The price drop indicates strong market confidence that prices will continue to rise.

With demand exceeding supply, this accumulation trend is driving ETH upwards. Such an aggressive trend suggests that many market participants believe ETH may soon break through $4,000, which would bring more bullish pressure to its price movement.

Ethereum balance on exchanges. Source: Glassnode

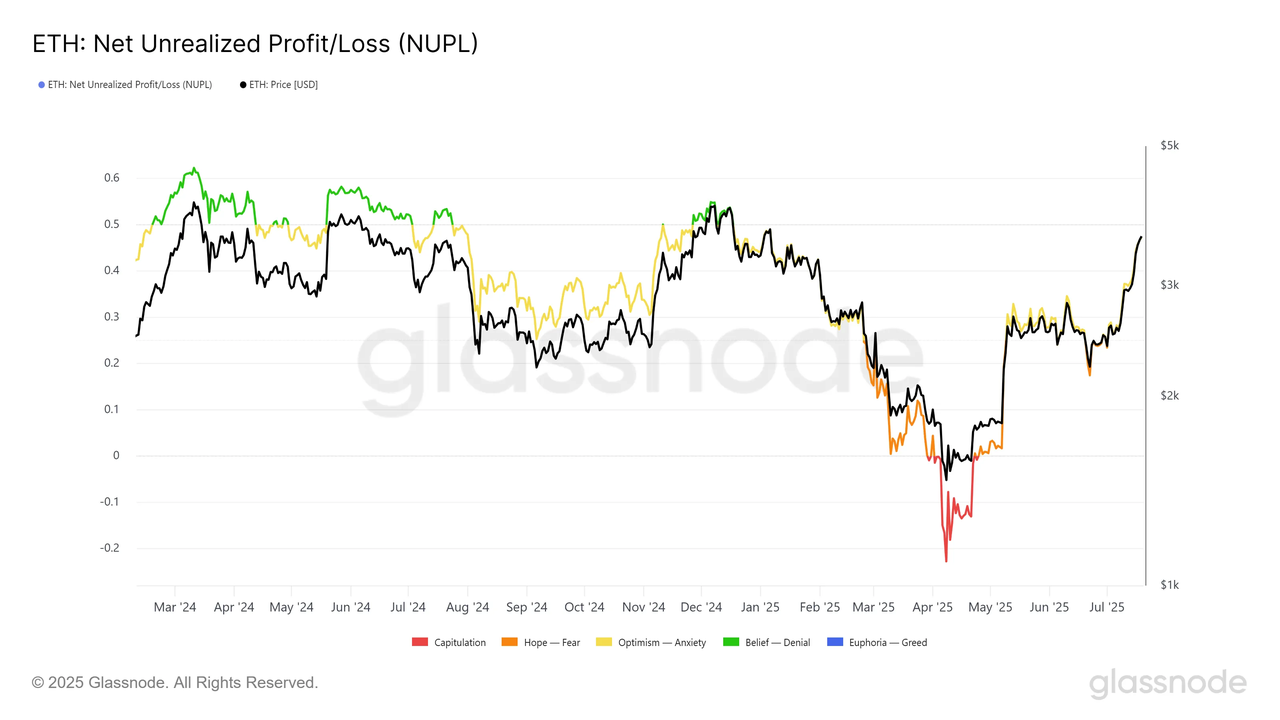

The network value to transaction volume (NUPL) ratio of Ethereum is currently approaching the "belief-denial" zone. This indicator can indicate whether investors are in profit and helps identify potential reversal areas. Historically, whenever NUPL enters this zone, Ethereum's price experiences short-term corrections.

The belief-denial level typically acts as a saturation point where optimistic investors begin to take profits. If Ethereum breaks through $4,000, this psychological level could trigger significant selling pressure. This pattern has been repeating over the past 16 months, and if ETH's bullish trend continues without correction, this pattern may repeat.

ETH Price May Not Surge Significantly

As of the time of writing, the trading price of Ethereum is $3,745, just 6.8% away from the $4,000 mark. This level has previously been a strong psychological resistance point during past bull markets. The current rebound momentum places ETH in a solid position to test this resistance level in the coming days.

However, if the market enters a profit-taking phase, Ethereum may struggle to break through $4,000. A resulting pullback could lead to a price drop to $3,530. Losing this support level could widen the decline to $3,131, erasing recent gains and confirming the start of a short-term reversal.

ETH price analysis. Source: TradingView

On the other hand, if accumulation continues to dominate, Ethereum's bearish outlook may become invalidated. Breaking through $4,000 would support a sustained upward trend, allowing ETH to reach new highs.

This scenario largely depends on the strength of investor confidence and broader market cues.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。