Blackrock Dominates As Crypto Funds Pull $766M in Daily Inflows

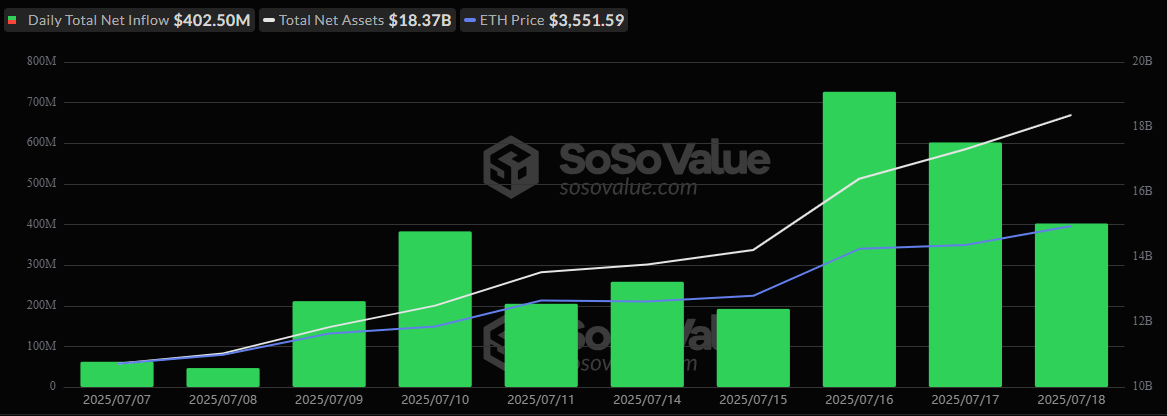

For the second day in a row, ether ETFs outpaced bitcoin ETFs in daily inflows, a feat that highlights growing institutional confidence in ether’s long-term value. A combined $766 million poured into crypto ETFs, with ether funds capturing $402.50 million while bitcoin products brought in $363.45 million.

Out of the $402.50 million inflow into ether ETFs, Blackrock’s ETHA led once more with a huge $394.91 million inflow. Grayscale’s Ether Mini Trust brought in $65.25 million, Bitwise’s ETHW added $13.03 million, and Vaneck’s ETHV chipped in $2.61 million.

Outflows were limited to Fidelity’s FETH (-$45.39 million) and Grayscale’s ETHE (-$27.92 million), but the inflow tide overwhelmed them. Ether ETF trading volume surged to $2.80 billion, and net assets reached a record $18.37 billion.

Ether ETFs Flows. Source: Sosovalue

For bitcoin ETFs, Blackrock’s IBIT continued to be the powerhouse, attracting $496.75 million, single-handedly swallowing a cluster of outflows from other bitcoin ETFs. Only WisdomTree’s BTCW joined the inflow party with a modest $3.11 million.

Meanwhile, Grayscale’s GBTC saw an $81.29 million outflow, followed by ARKB (-$33.61 million), FBTC (-$17.94 million), BITB (-$1.92 million), and HODL (-$1.66 million). Despite this, total bitcoin ETF trading volume hit $4.62 billion, and net assets stood firm at $152.40 billion.

As ether ETFs keep stealing the spotlight from bitcoin, the data shows a broader trend that institutions are no longer looking at crypto as just bitcoin. Ether is earning its seat at the institutional table.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。