I. Introduction

On July 14, the price of Bitcoin broke through $120,000, setting a new historical high. At the same time, altcoins also experienced a long-awaited wave of growth. This market change quickly sparked discussions among investors about the "altcoin season." With rising expectations for interest rate cuts from the Federal Reserve, a shift towards loose macro policies, and continuous inflows of institutional capital into Bitcoin and Ethereum, market risk appetite has clearly increased. However, Bitcoin's dominance remains high, the ETH/BTC ratio has not broken through key resistance, and capital flows show selective diffusion characteristics. Is the current rise in altcoins a true signal of the start of an "altcoin season," or is it merely a short-term frenzy driven by capital?

This article will conduct a comprehensive in-depth analysis from multiple dimensions, including macro background and institutional capital layout, capital flow and index analysis, on-chain activity and ecological recovery, as well as changes in market sentiment and heat. Through rigorous data interpretation, we aim to help investors clarify the current complex market situation and review and analyze popular and potential sectors, hoping to assist investors in discerning the essence and seizing opportunities and risks in a chaotic market environment.

II. Macroeconomic Analysis

1. Macroeconomic Environment Tending Towards Loosening

Recently, the global macroeconomic environment has continued to tilt towards loosening, with favorable factors emerging. First, the Federal Reserve's monetary policy has shifted to a more moderate stance: the minutes from the July meeting revealed increasing hawkish-dovish divisions within the Fed, with Waller proposing a rate cut in July and Bowman supporting an earlier cut, but most officials still leaning towards maintaining a wait-and-see approach. Federal funds futures indicate a roughly 65% probability of a rate cut in September, a significant increase from previous expectations, while the Fed's own economic forecasts have also shown a rare hawkish-dovish standoff: 12 officials support a cumulative rate cut of 50 basis points by 2025, while 7 support a cut of 100 basis points. On one hand, the loose funding environment has driven up the valuations of Bitcoin and crypto assets; on the other hand, persistently high interest rates have made the market more sensitive to the timing of rate cuts. Once the central bank announces dovish signals, the upward momentum of Bitcoin may sharply amplify.

The recent easing of global trade frictions has also provided a relatively friendly macro backdrop for the crypto market. Additionally, geopolitical risks have somewhat eased, and market sensitivity to geopolitical risks is declining. Recently, U.S. regulatory bodies have also released supportive signals: changes in SEC leadership, the advancement of the stablecoin bill (GENIUS Act), the establishment of Bitcoin strategic reserves, and the White House's release of a digital asset policy blueprint have all reduced regulatory uncertainty and boosted investor confidence.

2. Continuous Inflows of Institutional Capital

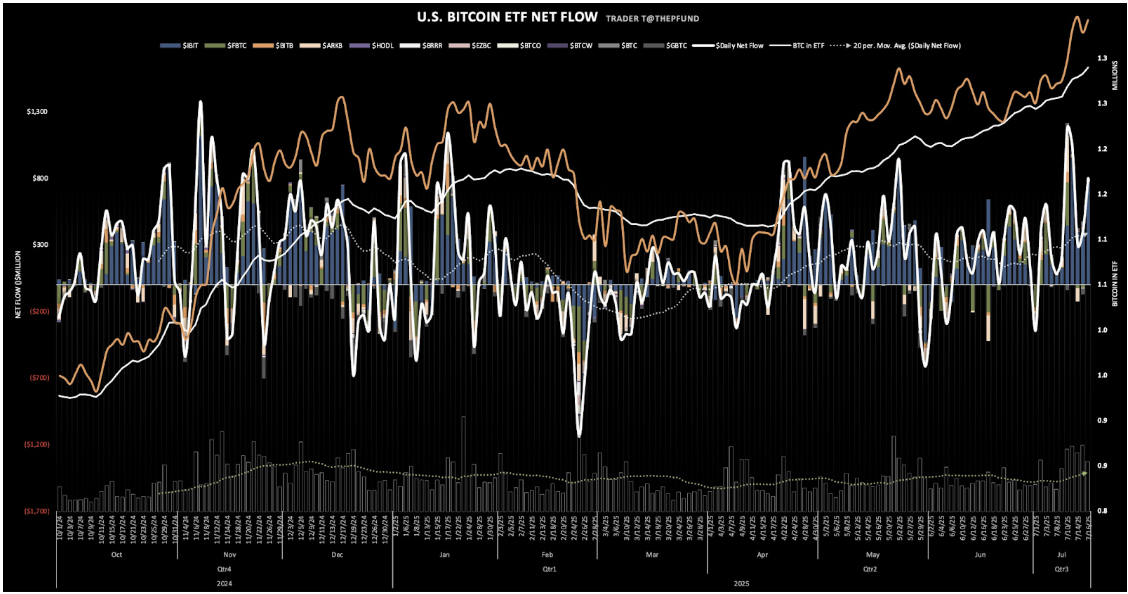

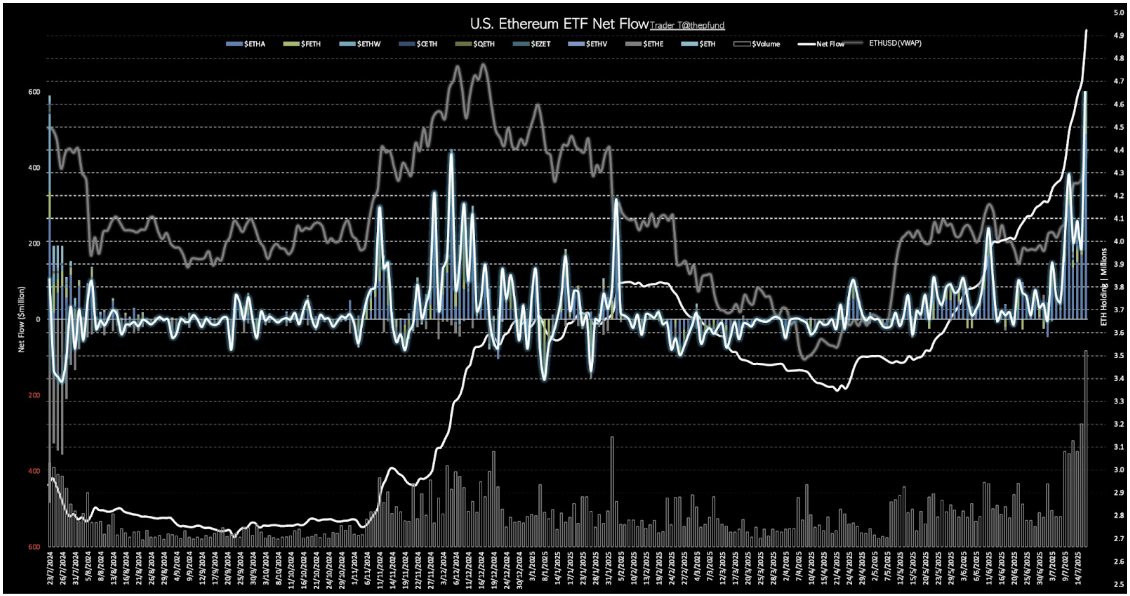

The continuous influx of institutional capital is a significant driver of market prosperity. Overall, institutional investment is gradually expanding from a focus on Bitcoin and Ethereum to other public chain assets. On July 16, Bitcoin spot ETFs saw a net inflow of $799.5 million, bringing the asset size to $148.84 billion, marking the 10th consecutive day of net inflows; Ethereum spot ETFs had a net inflow of $716.63 million, with an asset size of $13.25 billion, marking the 9th consecutive day of net inflows. Although Ethereum's spot price increase since 2025 has lagged behind Bitcoin, institutional funds are accelerating their entry through ETFs. As ETH returns above $3,000, the ETF's water storage effect becomes more apparent, further boosting the market sentiment for Ethereum and altcoins.

Source: https://x.com/thepfund

In addition to BTC and ETH, institutional funds are also gradually laying out beyond Ethereum into other public chain sectors. Currently, companies like VanEck and Bitwise have submitted applications for Solana spot ETFs to the SEC. Grayscale, the largest crypto asset management firm, has established a trust product that includes a basket of altcoins. On July 15, U.S. asset management company ProShares launched a 2x long Solana futures ETF (ticker: SLON) and a 2x long XRP futures ETF (UXRP), which are now officially listed on NYSE Arca. This reflects that mainstream altcoin assets are gaining more attention and allocation from mainstream investors.

Some listed companies have begun to include crypto assets other than Bitcoin on their balance sheets. On July 15, SharpLink Gaming (NASDAQ: SBET) held 296,508 ETH, valued at approximately $999.7 million, surpassing the Ethereum Foundation to become the company with the largest ETH holdings globally, earning the title of "MicroStrategy of Ethereum." The number of institutions holding over 100,000 ETH has increased to 7, including: SharpLink Gaming (280,600), Ethereum Foundation (241,500), PulseChain Sac (166,300), Bitmine Immersion (163,100), Coinbase (137,300), Golem Foundation (101,200), and Bit Digital (100,600).

Additionally, the "SOL version of MicroStrategy," DeFi Development Corp, has held 640,585 SOL and equivalent assets, totaling a value of $98.1 million. Starting July 17, SRM Entertainment officially changed its name to Tron Inc, altering its stock ticker from "SRM" to "TRON." Tron previously announced it would go public through a reverse merger and initiate a TRX strategic reserve, with SRM having staked all its TRX to earn staking rewards.

III. Capital Flow and Index Analysis

1. Bitcoin Dominance

Bitcoin dominance (BTC Dominance) is an indicator that measures the proportion of Bitcoin's market capitalization relative to the entire crypto market. A peak and subsequent decline in Bitcoin's share is one of the typical signals for the start of an "altcoin season." On July 14, when Bitcoin's price broke through the new high of $120,000, Bitcoin dominance (BTC Dominance) showed a downward trend, currently at 62.88%, but still at historically high levels. The sustained high level of Bitcoin dominance indicates that Bitcoin has absorbed a large amount of new capital, while altcoins have not yet received widespread attention. Only when this ratio significantly declines, and capital shifts from Bitcoin to smaller assets, can clear signs of an altcoin season emerge.

Source: https://www.tradingview.com/symbols/BTC.D

2. ETH/BTC Ratio

The ETH/BTC ratio reflects Ethereum's relative performance against Bitcoin and is seen as a leading indicator of capital flow into altcoins. An increase in the ETH/BTC ratio often signals that capital inflows into altcoins may be starting. If this ratio continues to rise, it indicates that more capital is flowing from Bitcoin to Ethereum and other altcoins, providing strong support for an altcoin bull market. Currently, the ETH/BTC ratio is on an upward trend, indicating accelerated capital inflows into Ethereum. The ETH/BTC ratio has rebounded from a low of 0.017 in Q1 to 0.029. Technically, some analysts point out that if the ETH/BTC ratio can effectively break through 0.03, it would signify a shift in market risk appetite from Bitcoin to Ethereum and altcoins, potentially triggering a new round of altcoin activity and fully reviving the altcoin market.

Source: https://www.tradingview.com/symbols/ETHBTC/

3. Altcoin Season Index

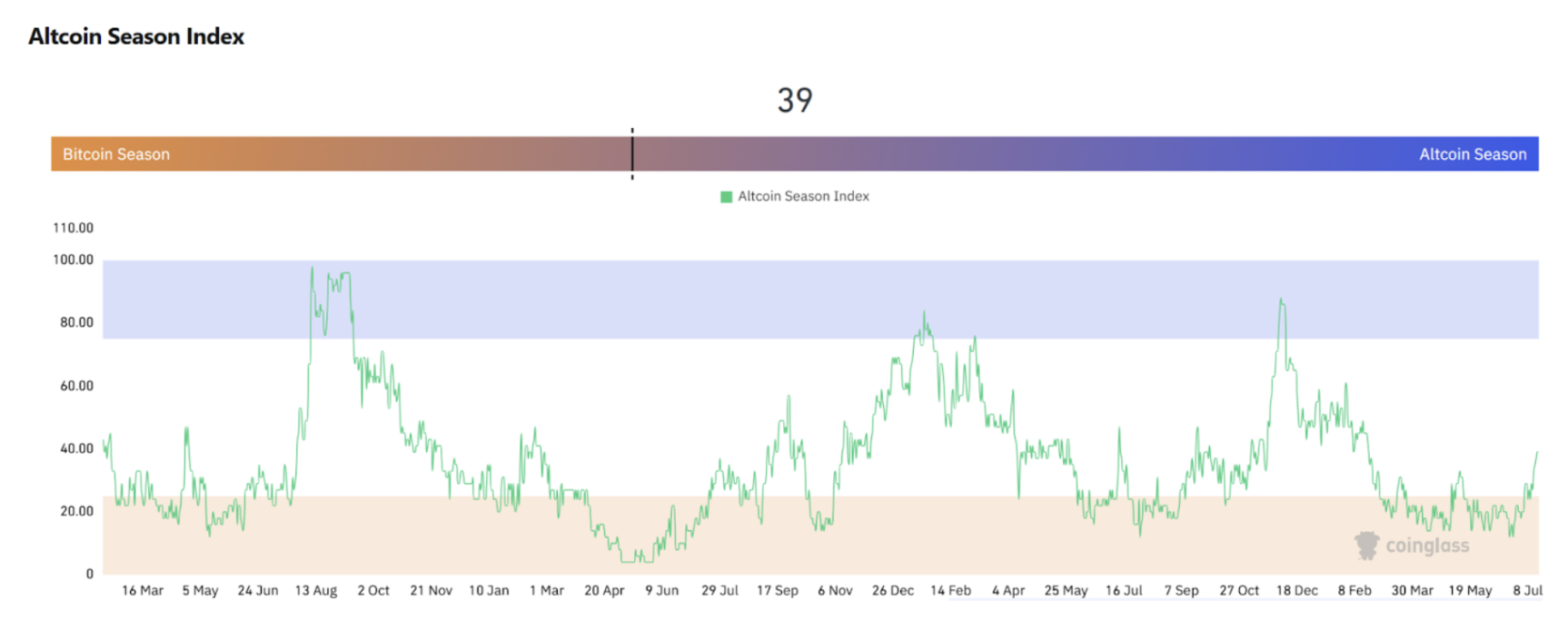

The Altcoin Season Index is used to measure whether non-Bitcoin assets (altcoins) have overall outperformed Bitcoin over the past 90 days. According to CoinMarketCap's algorithm, when at least 75% of the top 100 cryptocurrencies (excluding stablecoins) outperform Bitcoin, it is recognized as an altcoin season; conversely, if only 25% or fewer altcoins outperform Bitcoin, it is considered a Bitcoin season. The altcoin season index has recently warmed up again: it had previously dropped to around 15 in mid-June but began to rebound rapidly in July, reaching 39 this week. This index is based on the number of altcoins that have outperformed Bitcoin over the past 90 days, and currently, about 40% of mainstream coins are performing better than BTC, indicating that altcoins are becoming more active in the current market.

Source: https://www.coinglass.com/pro/i/alt-coin-season

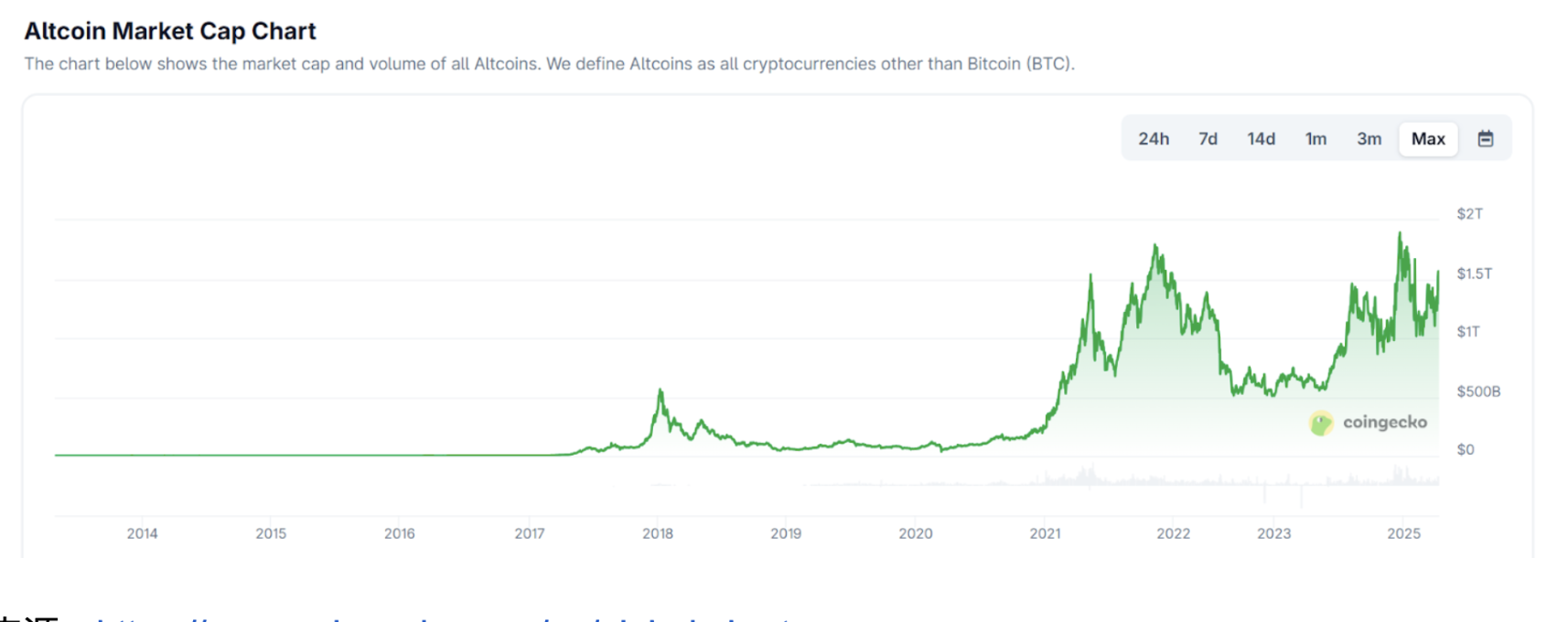

4. Altcoin Market Share and Trading Volume

According to CoinGecko data, the current overall trading volume in the crypto market is approximately $243.7 billion over 24 hours, with Bitcoin's trading volume accounting for about 21%, Ethereum's trading volume about 17.5%, and other tokens' trading volume approximately 61.5%, showing a significant increase in trading volume share. This is mainly due to Ethereum's substantial rebound, as mainstream altcoins have been at low levels after continuous declines, coupled with rising narratives, leading to signs of "bottom fishing" in the market. It is important to note that while the relative trading volume of altcoins has increased, it is not a comprehensive rise; rather, capital is selectively rotating among hot themes, with current capital flows showing characteristics of "actively seeking the next theme and blue-chip" rather than "fully embracing all altcoins."

Source: https://www.coingecko.com/en/global-charts

IV. On-Chain Activity and Ecological Recovery

1. On-Chain Activity

1. On-Chain Activity

On-chain activity indicators (such as daily active addresses, daily transaction counts, etc.) reflect network usage and user engagement. Data shows that on-chain activity has significantly rebounded recently. Ethereum's gas fee revenue regained the top position in June, while Solana continued to lead in activity rankings, with over 29.7 billion transactions in June (approximately 4.8 million daily active addresses), far surpassing Ethereum and Bitcoin.

As of July 17, 2025, the number of daily active ERC-20 addresses on Ethereum is approximately 510,000, representing a year-on-year increase of about 50.8%. This substantial growth reflects that more users and applications are utilizing the Ethereum network. On the other hand, the DApp ecosystem is also showing active performance, with the daily average active wallets (dUAW) rising to 25 million, an 8% month-on-month increase. DeFi total value locked (TVL) and NFT transaction volume surged by 25% and 40%, respectively, further indicating an overall increase in on-chain user activity. These data suggest that both capital and user engagement are heating up the entire on-chain ecosystem, providing a foundational environment for the rotation of the altcoin market.

2. DeFi Total Value Locked (TVL)

The total value locked (TVL) in DeFi has rebounded, with Ethereum's 40% surge driving many protocols' TVL to soar, with leading protocols like Aave seeing a month-on-month increase of about 20%. Although protocols like Lido and EigenLayer have experienced fluctuations, their overall locked assets remain substantial. In the Layer-2 space, Base has rapidly emerged, with a total of 292 million transactions in June and approximately 1.71 million daily active addresses. Arbitrum (ARB) and Optimism (OP), as leaders in Ethereum Layer-2, have also continued to maintain recent narrative momentum. Although ARB has not yet approached its highs from last year, it has received funding support to re-empower DeFi applications. Chainlink (LINK) has benefited from a resurgence in oracle demand, maintaining a strong position in the data market. The Aptos (APT) community has seen significant growth, with prices rising to about $5.90, indicating that the DeFi ecosystem is regaining vitality and attracting capital back in.

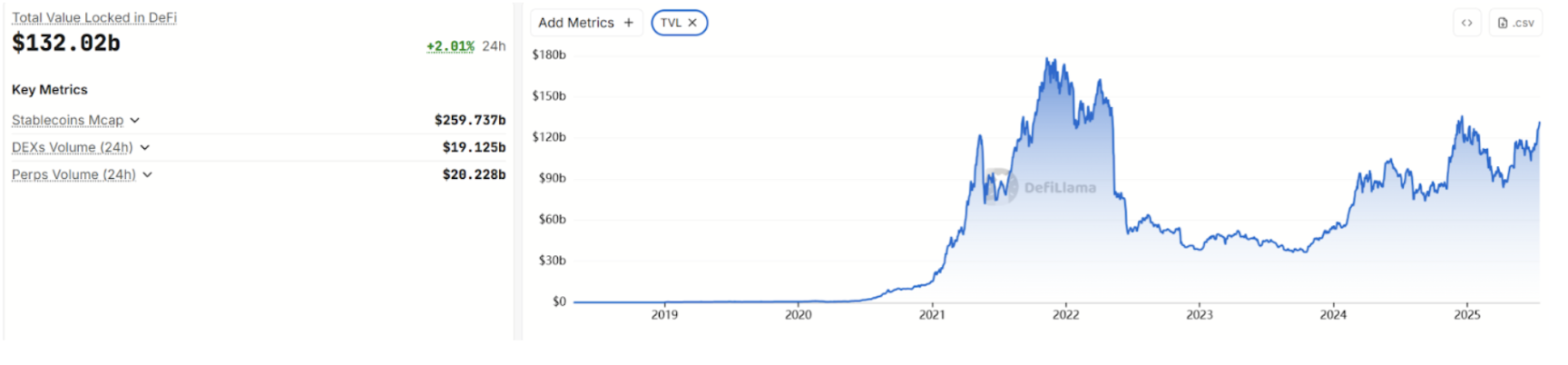

As of July 17, the total locked value (TVL) in the DeFi market has increased from $89 billion at the beginning of the year to approximately $132 billion in June, particularly as innovative projects and new financial protocols have garnered capital favor.

Source: https://www.coingecko.com/en/global-charts

V. Market Sentiment and Heat Indicators

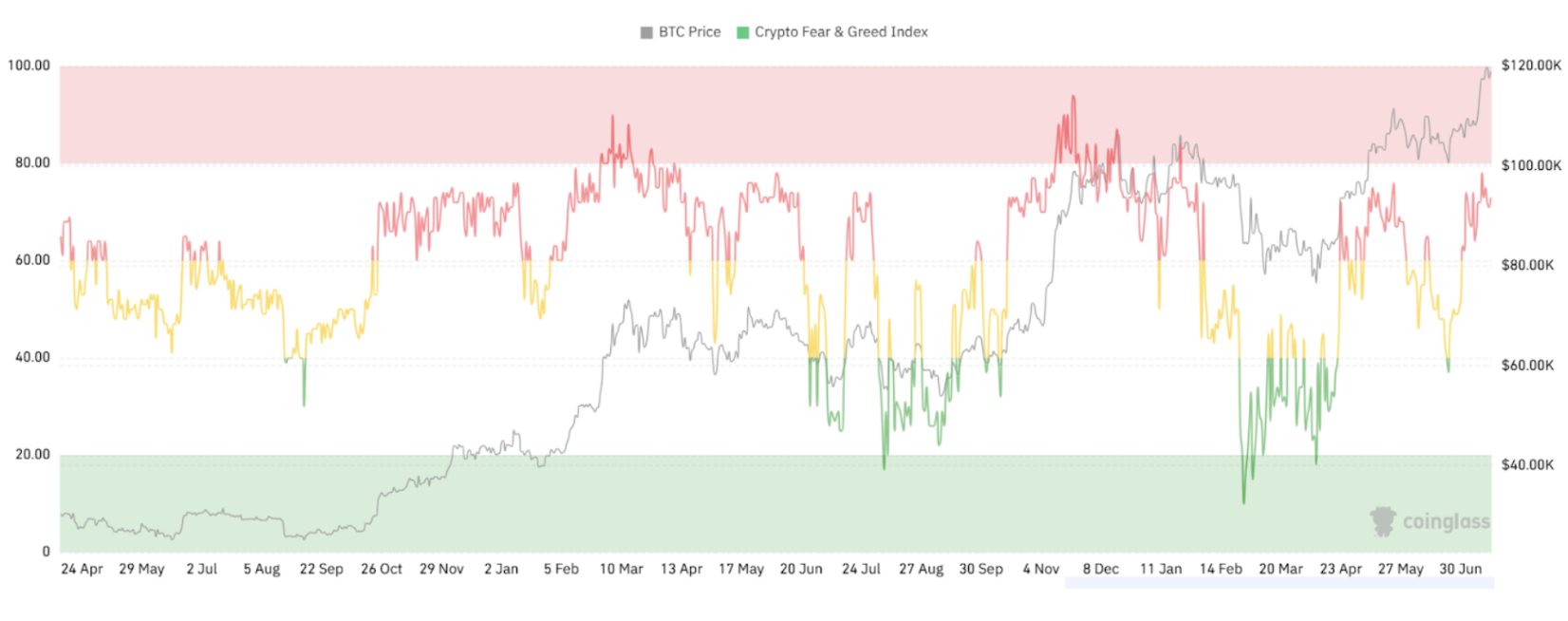

Market sentiment often indicates the rotation of capital inflows and outflows. The Fear & Greed Index is a commonly used indicator to measure overall market sentiment. As of mid-July, market sentiment is clearly optimistic, with investors' FOMO (Fear of Missing Out) emotions accumulating. Since July, the Fear & Greed Index (Crypto Fear & Greed) has continued to rise, climbing to above 70, indicating a "greed" level.

Source: https://www.coinglass.com/pro/i/FearGreedIndex

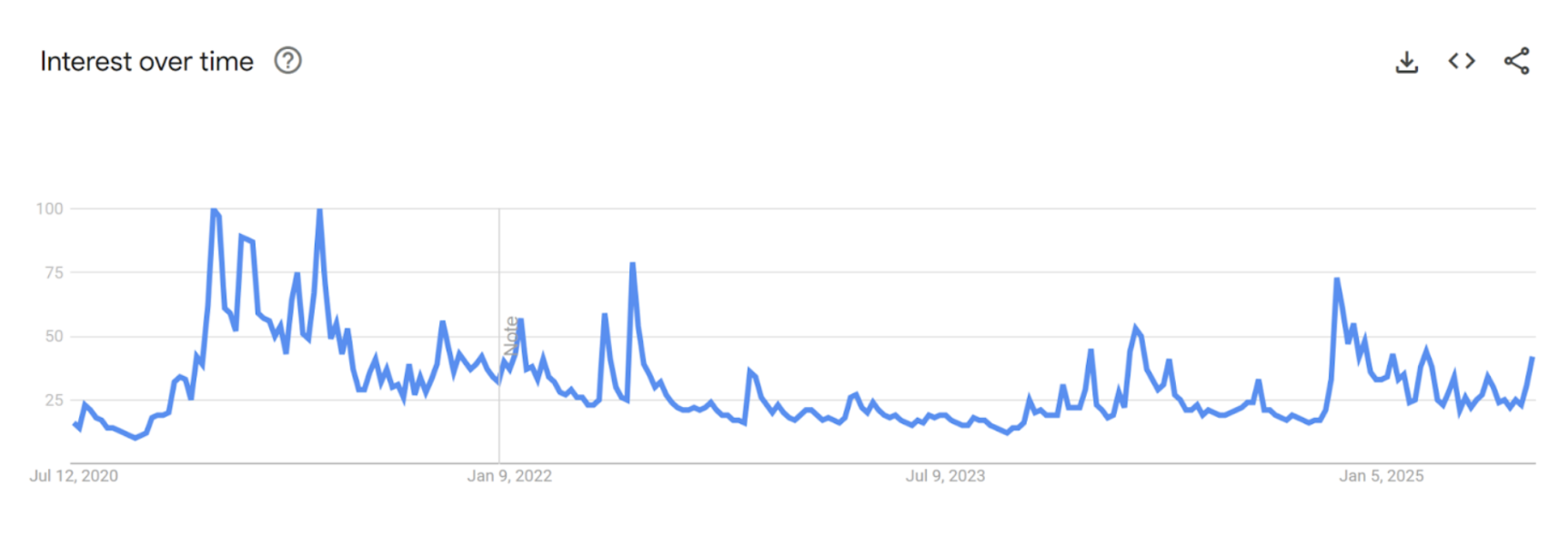

Compared to the price surge, public attention has not yet significantly increased. Google Trends shows that while Bitcoin's current price has reached a new high, its search popularity is far below the peaks seen during the bull markets of 2017 and 2021. This indicates that although capital is flooding in, retail investors and the general public's enthusiasm is still in the cultivation stage. Discussions about altcoins on social platforms like X are also relatively subdued, with no explosive topics emerging. Overall, the market exhibits a clear FOMO atmosphere while harboring a certain degree of caution. Although Google Trends indicates that the popularity of Bitcoin-related keywords has not reached previous highs, the search volume for altcoin-related terms has increased, suggesting that retail interest is partially shifting from Bitcoin to more altcoins.

Source: https://trends.google.com/trends/

VI. Review of Popular and Potential Altcoin Sectors

Meme: According to CoinGecko data, the total market capitalization of meme coins is approximately $78.9 billion, with an average increase of 25% over the past week. Leading projects include DOGE, SHIB, PEPE, BONK, TRUMP, PUMP, and PENGU. In terms of narrative, cat and dog-themed and frog-themed meme coins have a broad community base, while emerging memes like TRUMP, PENGU, and USELESS leverage celebrity, NFT/IP associations, and new ecosystem hype from Launchpad. Overall, the meme sector still has a "hype cycle," but with significant volatility.

Emerging Layer 1: The Layer 1 sector focuses on scalability upgrades, such as Solana, BNB, and Hyperliquid expansion plans. It also emphasizes ecosystem incentives for public chains, such as funding inflows from official incentives for Sui, Berachain, and Sonic, as well as progress in performance, security, and application ecosystems across major public chains. Overall, the Layer 1 sector's position is solid, leaning towards medium to long-term ecological accumulation.

Layer 2 Ecosystem: Layer 2 focuses on Ethereum scalability, with leading projects including Mantle, Arbitrum, Polygon, Stacks, Optimism, Immutable X, Starknet, and zkSync. Layer 2 benefits from the scalability narrative, with high expectations for ecosystem testing and airdrops. Many projects are upgrading functionalities and cross-chain interoperability, such as Arbitrum expanding its ecosystem applications and Optimism launching new network plans. Overall, if the "cross-chain interoperability + airdrop" concept continues to gain traction, this sector will still attract attention in the second half of the year, but caution is needed regarding the risk of overall market saturation for Layer 2 demand.

LSD/Restaking: With the rebound in ETH prices, the staking and restaking sector continues to heat up. Tokens like LDO, EIGEN, BABY, and ETHFI have recently started to rebound. Protocols in the LSD space are continuously developing new products, with Pendle promoting V2 expansion and exploring traditional financial markets. Overall, LSD/Restaking fundamentally relies on PoS Ethereum, with a solid ecological foundation, and still holds capital attraction potential in the second half of the year.

RWA: RWA has recently gained institutional attention. Major projects include Ondo, Centrifuge (CFG), Goldfinch (GFI), TrueFi (TRU), Maker (MKR), and Reserve Rights (RSR). For example, Ondo focuses on the tokenization of government bonds and credit assets, with the total TVL of the U.S. government bond tokenization pool (OUSG/USDY) currently around $1.4 billion. Recently, it partnered with Pantera to launch a $250 million fund for RWA projects; Centrifuge is also laying out offline collateral assets. The RWA topic is gradually heating up on social media, with multiple institutions collaborating with project parties. On the fundamental side, regulatory compliance and off-chain asset yields are driving this sector, with MakerDAO actively introducing RWA collateral. Overall, the RWA sector is supported by real assets, offering stable returns and attracting capital; as compliance advances and the asset securitization process continues, it is expected to attract new funds in the second half of the year.

AI: The AI sector is active, relying on popular concepts like generative AI and smart contracts. Leading projects include ICP, FET, and VIRTUAL, which have recently seen technical rebounds. Additionally, the search term "AI Agents" has increased by 320% year-on-year in Google searches, enhancing the market topic for AI-related tokens. The global AI wave is driving interest in AI chain tokens, especially as mainstream tech giants lay out crypto AI projects, leading to capital inflows into related tokens. In summary, the AI sector is strongly driven by macro themes and is a hot investment direction. If AI applications continue to explode in the second half of the year, its representative projects may have significant upward momentum.

VII. Conclusion and Recommendations

In summary, the current crypto market is experiencing the early stages of a transition from Bitcoin dominance to altcoins within a bull market cycle. Loose liquidity, regulatory friendliness, and institutional buying provide solid support for the market; the Fear & Greed Index has reached extreme greed, indicating strong market optimism; the ETH/BTC ratio and ETH's price increase significantly lead Bitcoin; most mainstream altcoins have outperformed Bitcoin in the short term; and DeFi TVL, stablecoin supply, and on-chain activity are all on the rise. All these factors suggest that as market sentiment warms and the macro environment improves, the demand for altcoin allocation is building momentum.

However, Bitcoin's market share remains high, and the ETH/BTC ratio has not yet shown a significant technical breakthrough; capital rotation exhibits a selective "point-to-point" characteristic, lacking an atmosphere of all projects rising together. This means that the current market is more likely characterized by "partial altcoin rises" led by large-cap and popular themes, rather than forming a widespread speculative frenzy. Therefore, from a trend perspective, the current altcoin market is leaning towards the early stages of a substantive launch.

Looking ahead, if the loose cycle and institutional inflows continue, and the macro environment stabilizes and warms, the overall crypto market is still in an upward channel, and the bull market wave in the second half of the year is likely not over. Various signals across market dimensions are diverse and positive, indicating the initial signs of an "altcoin season." Investors may consider paying moderate attention to competitive altcoin assets while closely tracking market trends and key indicators, remaining vigilant against the risk of pullbacks under extreme sentiment. In this transitional period, where future trends are not yet fully clear, maintaining flexibility, cautious diversification, and dynamic position adjustments will help seize opportunities and control risks.

About Us

Hotcoin Research, as the core research and investment center of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global crypto asset investors. We have built a "trend judgment + value excavation + real-time tracking" integrated service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and all-day market volatility monitoring. Combined with our weekly live strategy sessions of "Hotcoin Selection" and daily news briefings of "Blockchain Today," we provide precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。