一、引言:ETH低迷时代的突围信号?

2024年以来,ETH价格增长明显滞后于BTC和SOL的表现,与此前市场的预期存在较大落差。比特币在本周期表现强势,而以太坊则面临Solana、Sui等新兴Layer1网络和Base、Arbitrum等Layer2的竞争和市场争夺,导致ETH价格难以同步上涨。另一方面,主网因使用率下降导致的收入缩水,使得ETH的销毁效应减弱,进一步压制了价格表现。此外,这背后也与以太坊现货ETF表现欠佳、机构采用和储备较低等因素有关。在这种“BTC独秀而ETH乏力”的市场环境下,不少人认为传统体制已无法有效提振以太坊价值得到保护和增长。以太坊生态内部也出现了对现状的不满情绪。一些社区成员将价格低迷归咎于以太坊基金会(EF)的战略失误和治理问题,包括“软弱不作为、治理集中、透明度低、组织臃肿、缺乏战略远见”等。尽管EF在2025年6月宣布了战略重组,但仍未能完全消除外界质疑。

在上述背景下,以太坊核心开发者Zak Cole于2025年7月在法国戛纳举办的第八届以太坊社区大会(EthCC 8)上宣布成立以太坊社区基金会(Ethereum Community Foundation, ECF),并喊出“ETH 涨到1万美元不是笑话,而是一项必然要求!”的口号。他指出,ECF将“说以太坊基金会不敢说的话,做以太坊基金会不愿做的事”,并明确表示ECF的核心使命就是以资产的形式支持以太坊生态,将ETH推升至1万美元。这一宣言既映射了社区对以往治理方式的失望,也激起了人们对是否能借此撬动以太坊市场的广泛讨论。

本文将围绕以太坊社区基金会的成立背景展开,分析ETH在本周期价格低迷的根本原因,并对ECF的使命和战略进行深度剖析,并对比ECF与以太坊基金会(EF)的差异与冲突,探讨ECF的成立将对以太坊生态及ETH币价产生怎样的实际影响。最后,结合市场反应与未来可能的路径,展望以太坊生态的发展趋势。

二、ETH为何落后?——价格低迷的五重原因剖析

来源:https://www.tradingview.com/symbols/ETHBTC/

今年以来ETH/BTC价格比率持续走低,并在5月25日触及0.01867的短期低点。根据7月10日最新数据,当前ETH/BTC价格比率为0.02493,和去年同期相比下降了52.8%。以太坊在本周期表现疲软的原因是多方面的,大致可概括为以下五点:

1. 以太坊经济模型与升级影响

从技术路线看,2024年3月的Dencun升级显著改变了以太坊的经济模型。该升级引入了Blob交易大幅降低了Layer-2的费用,用户纷纷转向Polygon、Optimism等Layer-2解决方案,这些网络分散了主网流动性和交易需求,导致以太坊主网手续费收入锐减,主网收入几乎断崖式下跌99%,同时因为低费而燃烧较少ETH,导致网络从通缩转为通胀,长期来看降低了价值支撑。此外,主网活跃度也出现下降趋势,一些数据显示Dencun后交易量回落到数年低点,这增加了市场对升级效果落空的担忧。

2025年上线的Pectra升级计划重点改善质押效率、合约性能和扩展性,但目前来看,这一升级尚未大规模改善市场预期。关键升级完成后带来的负面影响(低燃烧、高供给)比预期更大,对价格构成压力。

2.市场避险情绪和现货ETF资金流向

2024年下半年以来,多种宏观事件引发市场大幅波动,引发全球避险情绪上升。历史数据显示,在币价下跌中,以太坊往往跌幅更大。Grayscale指出,以太坊在近期几轮下跌中平均跌幅约为比特币的1.2倍,而本轮更是接近1.8倍。

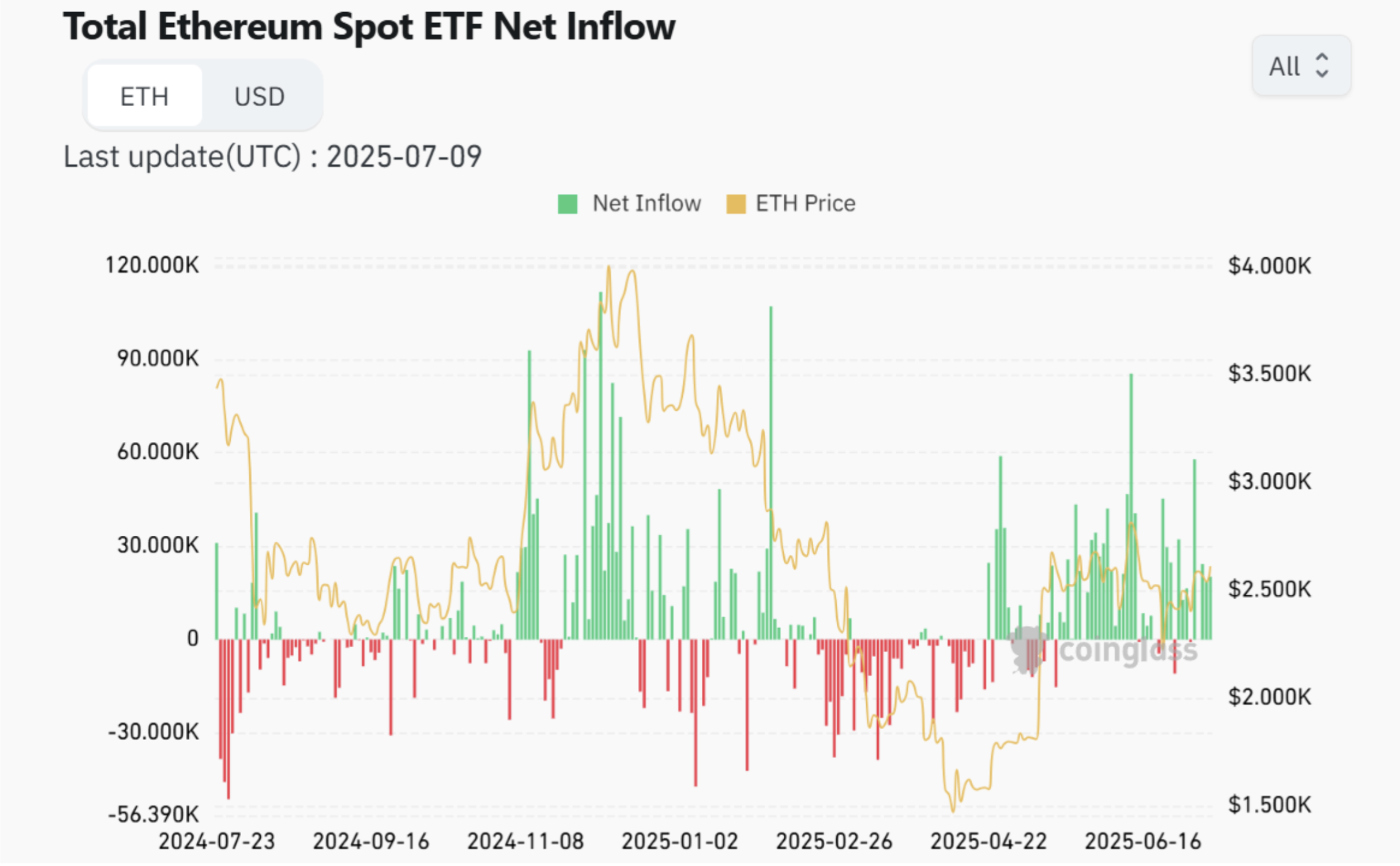

以太坊现货ETF上市初期吸引了一波资金,但2025年伊始这种热度逐渐衰减。比特币继续获资本青睐,而ETH则表现平淡。这种情况虽然在4月底开始得到改善,但和比特币的表现相比仍然不尽人意。截至2025年7月10日,美国比特币现货ETF资产约1375亿美元,而以太坊现货ETF资产规模仅约114亿美元,市场规模与比特币相差甚远,表明机构买盘疲软。

来源:https://www.coinglass.com/eth-etf

3. 市场竞争加剧与热点分流

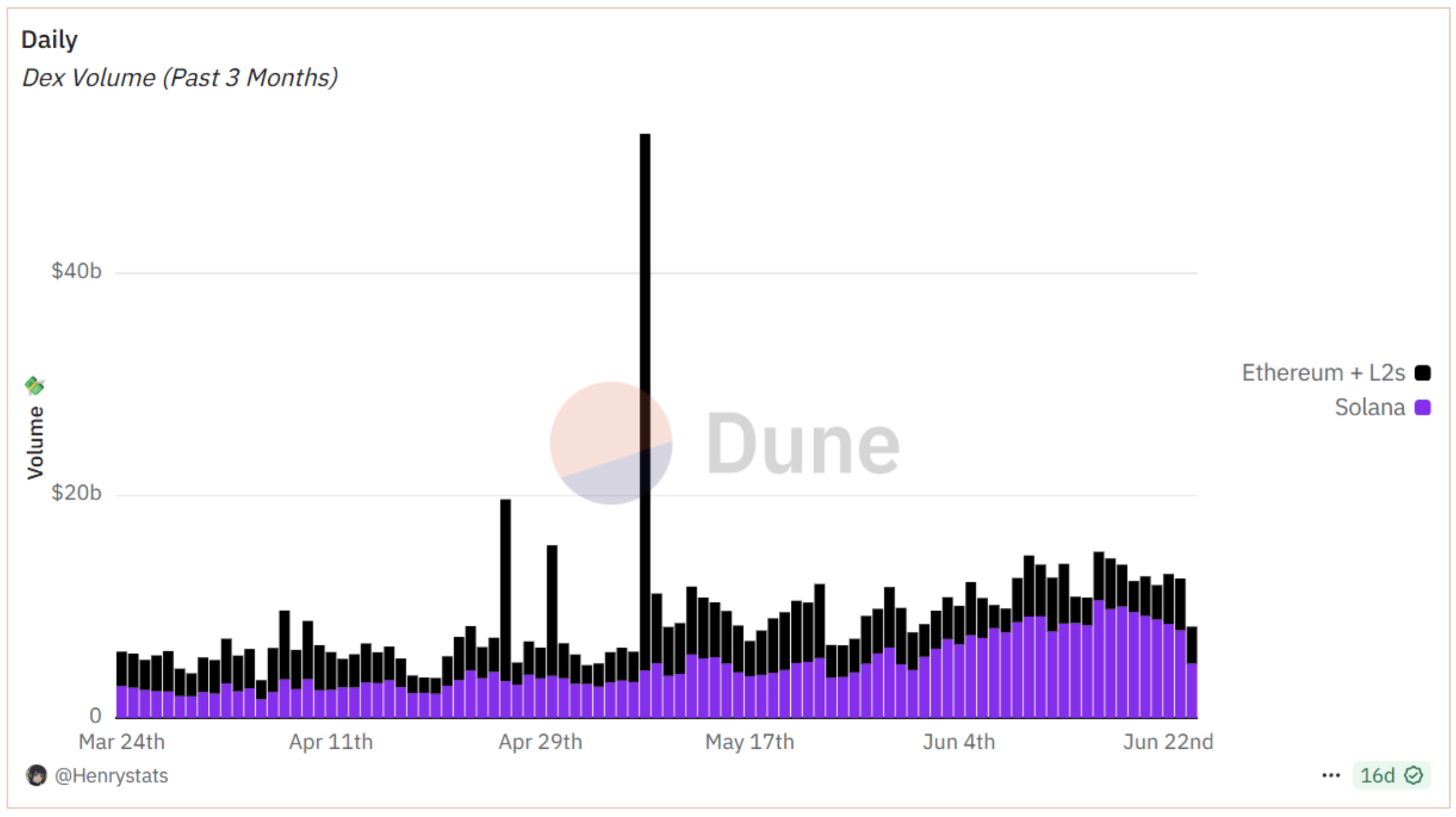

近期市场热点多元化导致投资者关注分散。一方面,美国拟建立比特币战略储备,多州政府公开支持BTC,这些消息吸引了大量投资者的关注和资金流入。另一方面,Solana(SOL)、币安链(BNB)等竞争性公链借助Meme热潮带动自身生态快速扩张,相关资产价格显著上涨。此外,以Base链、Sui链和Tron链为代表的其他区块链网络也曾短暂吸引大量投机资金,这种短期的资金流动一定程度上削弱了以太坊的市场注意力。

相较而言,以太坊近期缺乏引发广泛市场共识的爆款应用或创新概念,特别是DeFi领域的创新速度显著放缓,导致以太坊生态在热点竞争中被边缘化。同时,以太坊Layer-2网络(如Arbitrum、Optimism等)的快速崛起虽然有效解决了扩容难题,但也在客观上分散了生态资源,使主网的交易活跃度降低,进一步导致市场关注度下降。

来源:https://dune.com/Henrystats/ethereum-vs-solana

4. 机构需求与兴趣仍偏低

机构资本的投入仍然高度集中于比特币,市场对以太坊的需求和关注显著偏低。目前,大多数国家或机构的战略储备仍以BTC为主,极少将ETH纳入长期资产配置。尽管2025年7月纽约上市公司Bit Digital宣布全面放弃比特币,将公司资产几乎完全转入ETH,并计划成为全球最大的上市ETH持有公司之一,但此类行动在机构市场仍属个别案例。此外,BTCS、Sharplink Gaming等一些老牌区块链公司也开始布局以太坊质押业务,但这些公司规模相对较小,对整体市场情绪的带动作用十分有限。

可见,大型机构、上市公司及政府战略储备对ETH的持仓力度远低于BTC,机构资本的明显偏好导致以太坊的估值上升空间受限。当前市场环境下,ETH仍未形成足够强大的机构认可度和资金吸引力。

5. 大户抛售与流动性不确定性

近期市场出现了以Jump Crypto、Paradigm和Golem Network等为代表的大型持仓实体减持以太坊的现象,这些机构此前合计持仓规模高达15亿美元ETH。其中部分资产被转移至交易所并出售,加剧了市场的抛售压力。

同时,以太坊网络质押奖励率的变化及活跃验证者数量的波动,也暗示着ETH流通供应正处于动态调整中。这些供给端的不确定因素不仅增加了ETH市场的波动性,也在短期内形成额外的价格下行压力,使市场情绪受到明显负面影响。

综上所述,技术经济模型的变化、宏观与杠杆风险、竞争态势、机构偏好和流动性结构这五重因素,共同造成了以太坊近期相对滞涨的局面。

三、ECF的使命及其与EF的对比

ECF以“市场思维”切入,试图通过资金和政策工具提升ETH作为核心资产的地位。以太坊社区基金会(ECF)宣称要“为ETH持有者服务,说EF不愿说的事,做EF不愿做的事”。他们将以太坊的“北极星”对准$10,000的价格目标,认为只有当币价与网络安全性同步提高,才能保证ETH的长期价值。

1.以太坊社区基金会(ECF)的使命与定位

ECF声称已经从匿名ETH持有者和社区捐赠者处筹集了数百万美元等值的ETH,将依据“促销毁、无代币、不可变” 三大原则资助那些不发行自有代币、部署在以太坊主网并直接推动ETH燃烧的项目。ECF披露的策略包括:

推动高销毁应用: 资助链上高交易量项目(如金融衍生品和RWA代币化),通过产生大量手续费来促进ETH销毁,压缩流通供应以提振币价。

加速机构采用: 为银行、企业提供以太坊一体化解决方案,将以太坊打造成全球清算层,引入传统金融资本。

社区治理赋权: 成立以太坊验证者协会(EVA),并引入基于代币的投票机制,让PoS验证者在协议升级和资金分配中拥有更大话语权。

透明化拨款: 所有资助决策通过社区代币投票决定,资金流向100%公开,力图避免EF过去被批评的“黑箱操作”。

ECF指出其关注的重点领域包括基础设施建设、ETH价值提升、ETH烧毁最大化、极端透明度、机构参与和政府合作等多个维度。ECF计划通过改进网络基础设施和数据可用性、与监管部门对接、优化“blob空间”定价等手段增强以太坊的基础层经济,ECF旨在构建一个以ETH增值为核心的生态模型。

2.与以太坊基金会(EF)的主要差异

ECF与现存以太坊基金会(EF)在愿景和运作上的显著差异主要包括:

目标导向: ECF明确把提高ETH价格作为首要目标,将“ETH价值飙升”视为验证网络安全性的关键;而EF传统上更强调长远生态与技术建设(如协议升级、零知识研究等),并未将币价作为直接追求目标。

资助原则: ECF坚持“无代币、促销毁、不可变”的资助条件:所有获批项目必须部署在以太坊主网、不得发行新代币、智能合约不可随意升级,以确保所有经济价值直接反哺ETH持有者。相比之下,EF资助过的生态项目(如Uniswap、ENS、Optimism等)最终都发行了自己的代币。ECF批评这种“创世项目发行代币”的做法是「经济封建主义」,而EF则更倾向于多元生态投入,不强求“胖协议”理论。

治理模式: ECF强调100%透明:所有资助方案和拨款流向都通过社区投票决定并公开披露。其目标是让持币者直接监督资金使用,并批判EF既有体系“决策集中、信息不透明”。而EF作为传统非营利组织,其资金来源主要来自历年销售ETH所得,内部决策由核心团队和委员会驱动,常被社区质疑缺乏实时监督和去中心化。

意识形态: ECF公开宣称自己代表“持币者利益”,其创始团队自诩走的是“以ETH为中心的资本主义”道路;EF则标榜“可信中立”和公共产品支持,更关注协议中立性和长期发展。例如,EF着力推进社区教育、共识层和执行层研究,并且通常避免直接针对价格作表态;ECF则毫不掩饰要将ETH视为资产类别,用价格目标来“校准”一切决策。

总体来看,ECF的出现既是对传统基金会模式的不满宣泄,也是以太坊社区对“生态建设”与“资产价值”两者平衡的一次探讨。未来,ECF能否兑现其宏大目标,提升ETH价值并维护网络安全;EF又能否改革其治理,以回应社区关切;这些都将影响以太坊生态的发展方向。不同理念和策略的碰撞,或许会为这一去中心化网络带来新的演进契机。

四、ECF对以太坊网络和ETH价格的影响分析

ECF的成立对Ethereum网络和ETH币价具有多方面的潜在影响,如果ECF能够按计划运作,对以太坊网络的潜在影响或是深远的。

1.对Ethereum网络生态的影响

基础设施与技术层面:ECF聚焦的公共产品项目(如改进blob数据定价)有望提升主网性能和Layer 2协作,增强以太坊整体技术生态。

链上活动与ETH销毁:ECF若成功推动现实资产上链等高交易量应用,将直接增加以太坊主网交易和Gas消耗,从而放大EIP-1559燃烧效应,提升ETH稀缺性。

验证者治理:ECF资助的以太坊验证者协会(EVA)赋予质押者在协议改进路线上的发声权,可能改变以太坊网络治理格局,使验证者在费用结构、提案优先级上有更大影响力。

与Layer 2的关系:通过鼓励使用以太坊blob空间而非第三方数据网络,ECF举措或能把更多Layer 2活动留在以太坊结算层,防止主网被边缘化。

长期生态影响:如果ECF引导更多开发者专注无代币的公用设施建设,可能重塑以太坊DApp生态的价值观,促使更多项目回归以太坊主网、以ETH为价值载体,巩固以太坊在公链竞争中的“可信中立”地位。

2.对ETH价格的影响

供需基本面:ECF推动的ETH大量销毁和实际应用增加,将改善ETH的供需结构—供应通缩叠加需求提升,有望形成对币价的正向支撑。

市场信心与预期:ECF高调提出“ETH $10K”目标,在投资者心理层面树立新预期标杆。这种明确的价格导向可能吸引场内外关注,重聚市场对ETH的信心。

机构资金流入:ECF着力推动以太坊成为全球金融结算层,如果其与传统机构的合作拓展顺利,大型机构资金或通过企业链改、现货ETF等渠道进入ETH资产。这将为ETH提供潜在的新增买盘动力。

风险与不确定性:需要警惕的是,过度强调价格可能引发监管关注或市场质疑。若ECF短期内未能兑现业绩,反而可能令投资者失望。另一方面,ECF资助策略的集中性也带来由少数人影响市场的风险,被部分人视为投机噱头。此外,ECF核心发起人Zak Cole此前参与过多个项目,但部分项目在空投或交易后未实现理想价格表现,可能导致信任不确定性。

总的来说,ECF通过专注于公用基础设施、链上金融,以及治理透明化,可能为以太坊网络注入新的活力。这些措施若能成功执行,有助于提升网络的经济效率并助推ETH价格上涨。但其实际效果仍需后续项目落地和社区参与度来检验。即使有ECF这样的基金会加持,驱动价格上行的关键还是要看宏观经济、监管政策和技术升级是否到位。

五、结论与展望:社区觉醒,还是投机噱头?

以太坊社区基金会的出现,既体现了一部分群体对以太坊现状的不满,也引发了对其前景的分歧性解读。这既可能是一场社区的觉醒——草根力量对抗中心化、推动ETH价值最大化的胜利;也可能只是另一场投机噱头——“精心包装的财富密码”。ECF发布的高调口号和激进路线图,精准捕捉了社群对价格回升的渴望,但是否能兑现,则需市场的长期检验。

展望未来,以太坊网络和ETH价格的走向将受到多重因素综合作用。推动因素之一是机构投资者的持续流入,部分上市公司和大型机构开始将ETH作为长期资产进行定投,Pectra升级将进一步提高数据传输效率,为链上应用尤其是AI/Web3场景铺路,预计会提高网络利用率并带来更多ETH销毁。此外,ECF推动的链上资产发行和基础设施投资如果顺利实现,将为以太坊生态注入新动力,对ETH价值起到支持作用。

无论结果如何,ECF的出现已经反映出以太坊生态内部的分歧:一些人渴望快速回报和价格繁荣,一些人则更关注协议的技术进步和长期创新。未来的关键在于——ECF能否在其“透明化、无代币、促销毁”的框架下推动实质性项目落地,并让这些项目经得起市场考验。如果能做到这一点,ECF或许会成为带动ETH重拾增长动力的重要变量;否则,它就可能只是一场热闹过后归于沉寂的高调宣传。

关于我们

Hotcoin Research 作为 Hotcoin 生态的核心投研中枢,专注为全球加密资产投资者提供专业深度分析与前瞻洞察。我们构建"趋势研判+价值挖掘+实时追踪"三位一体的服务体系,通过加密货币行业趋势深度解析、潜力项目多维度评估、全天候市场波动监测,结合每周双更的《热币严选》策略直播与《区块链今日头条》每日要闻速递,为不同层级投资者提供精准市场解读与实战策略。依托前沿数据分析模型与行业资源网络,我们持续赋能新手投资者建立认知框架,助力专业机构捕捉阿尔法收益,共同把握Web3时代的价值增长机遇。

风险提示

加密货币市场的波动性较大,投资本身带有风险。我们强烈建议投资者在完全了解这些风险的基础上,并在严格的风险管理框架下进行投资,以确保资金安全。

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。