Author: Thejaswini

Source: TokenDispatch

Translation: Shaw Jinse Finance

When former South Korean President Yoon Suk-yeol declared martial law on that strange night in December 2024, dispatching troops into the National Assembly and attempting to go to war with North Korea, he likely did not anticipate that his political suicide act would trigger one of the most radical cryptocurrency policy agendas in the world.

But that is exactly what happened.

The coup, which lasted two hours, ultimately ended in impeachment, and the resulting power vacuum was filled by the current President Lee Jae-myung. With a unified government and a clear mandate, the Lee Jae-myung administration introduced the "Digital Asset Basic Law" within days of taking office and began to dismantle an eight-year-long corporate cryptocurrency ban.

Before we delve deeper

Before we delve deeper

First, you need to understand a bit about South Korea. South Korea is a technologically advanced economy with a high level of public awareness regarding cryptocurrencies, yet it still faces traditional economic challenges that have not been addressed through conventional monetary policy. Cryptocurrencies provide solutions to current economic pressures and lay the groundwork for long-term competitive advantages.

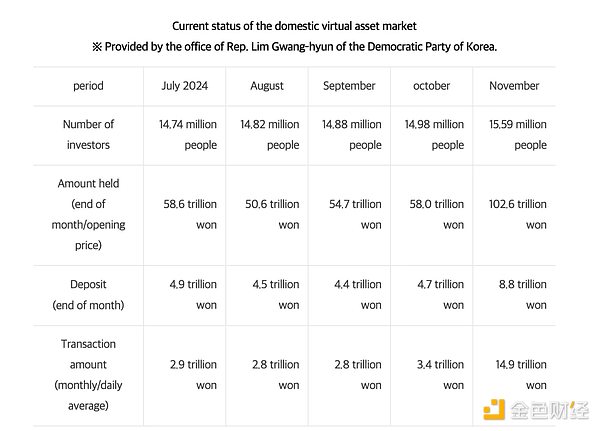

Currently, South Korea has over 16 million cryptocurrency account holders, surpassing the 14.1 million stock investors in the country. In terms of retail participation, digital assets have historically outpaced traditional stocks in South Korea for the first time.

Nearly one-third of South Korea's population engages in cryptocurrency trading. Among adults under 60, this figure rises to over half. Currently, 20% of government officials have disclosed a total of approximately $9.8 million in cryptocurrency holdings. According to a report by Hana Financial Research Institute, 27% of South Koreans aged 20 to 50 own cryptocurrencies, with digital assets accounting for 14% of their total assets.

This is the result of years of increasing acceptance of cryptocurrencies, driven by economic pressures, technological familiarity, and a political system that ultimately chose to embrace rather than resist this shift.

Economic Fundamentals

South Korea's enthusiasm for cryptocurrencies stems from the reality of economic pressures that traditional policy tools have failed to address effectively. The country is projected to have a GDP growth rate of 0.8% in 2025. Such figures are typically only seen during major financial crises. In March, South Korea's youth unemployment rate rose to 7.5%, the highest level for the same period since 2021.

The national debt-to-GDP ratio in South Korea is approaching 47-48%, having risen post-pandemic and currently stabilizing. By the end of 2024, household debt is expected to account for 90% to 94% of GDP, ranking among the highest globally and leading among major developed economies and Asian countries. This contrasts sharply with other major economies like the U.S. and Japan, where government debt far exceeds household debt. In the U.S., household debt accounts for 69.2% of GDP, while government debt reaches 128%; Japan's government debt is as high as 248%, with household debt at only 65.1%. This inverted debt structure in South Korea creates unique economic pressures, with personal financial stress rather than sovereign fiscal issues driving policy decisions.

When interest rates rise and economic growth stagnates, this debt burden suppresses consumer spending, and monetary policy alone cannot resolve the issue.

For millions of young South Koreans, cryptocurrencies represent what researcher Eli Ilha Yune describes as "financial despair"—not an ideological support for blockchain technology, but a practical response to the current economic situation where wealth creation avenues are scarce. Traditional investments like stocks yield very low returns, real estate prices are prohibitively high, and concerns about the long-term sustainability of the national pension system persist.

This context explains why cryptocurrency adoption in South Korea differs from other markets. Western investors typically view cryptocurrencies as a diversification option for their portfolios or as speculative technology, while South Korean investors see them as essential financial infrastructure. The South Korean government's cryptocurrency policy is a response to the adoption that has already occurred.

The cryptocurrency agenda set by the South Korean government aims to prevent the outflow of South Korean wealth through dollar-denominated digital assets. Currently, when South Korean investors purchase stablecoins, they primarily buy USDT or USDC, effectively exporting capital to U.S.-controlled financial infrastructure.

In the first quarter of 2025, South Korean cryptocurrency exchanges transferred approximately 56.8 trillion won (about $40.6 billion) in digital assets overseas. Among these, stablecoins accounted for 26.87 trillion won (about $19.1 billion), nearly half (47.3%) of all digital assets transferred abroad.

Interestingly, despite the relatively strong won, this capital outflow persists. In 2025, the won to dollar exchange rate has risen by about 6.5%, and as of July, the exchange rate was approximately 1393 to 1396 won per dollar. This indicates that South Korean investors' preference for dollar-denominated stablecoins is not due to a weak won, but rather a lack of alternatives priced in won and the dominance of dollar-based crypto infrastructure globally.

The "Digital Asset Basic Law" establishes a regulatory framework for South Korean companies to issue won-backed stablecoins. The capital requirement is set at 500 million won (about $370,000) to allow companies to enter the stablecoin market. This lower threshold aims to encourage domestic competition while maintaining minimum standards.

Can the won-backed stablecoin strategy truly prevent capital flight? If South Koreans want exposure to dollars, they can still exchange won for USDC. Therefore, the goal is not to stop capital outflow but to reduce the demand for foreign stablecoins by providing similar benefits (programmability, access to decentralized finance, 24/7 trading) without the need for currency exchange. More importantly, it keeps financial infrastructure domestic—fees, custody, and related services flow to South Korean institutions rather than to Circle or Tether. This is a behavioral nudge rather than capital control, making won-denominated options more convenient while placing the financial system under South Korean regulation.

Eight major banks in South Korea have collaborated on a won-pegged stablecoin, planning to launch it by the end of 2025 or early 2026. This alliance includes KB Kookmin Bank, Shinhan Bank, Woori Bank, NongHyup Bank, Korea Development Bank, Hana Bank, K Bank, and IM Bank. Their goal is not only to compete with USDT and USDC but also to build financial infrastructure that incorporates South Korea's economic activities into its own system.

The stablecoin strategy reflects widespread concerns about the dollar's dominance in the digital finance space. Currently, 99% of stablecoins globally are pegged to the dollar, giving U.S. financial institutions and regulators disproportionate influence over digital asset infrastructure.

The Bank of Korea has expressed reservations about privately issued stablecoins, warning that they could "seriously undermine the effectiveness of monetary policy and pose systemic risks." This divergence led to the suspension of the Bank of Korea's central bank digital currency (CBDC) project in June, as officials questioned the necessity of a state-operated CBDC when private alternatives might perform similar functions more efficiently.

Institutional Transformation

In 2017, due to concerns about speculation and money laundering, South Korea restricted corporate and financial institutions from opening cryptocurrency trading accounts, allowing only individuals to trade cryptocurrencies using real-name verified accounts. Institutional and corporate accounts were frozen, and banks faced strict compliance obligations. The South Korean government has initiated a phased process to lift these restrictions.

In the initial phase (mid-2025): Non-profit organizations and certain public institutions are now allowed to liquidate cryptocurrencies received through donations or seizures, provided they comply with strict compliance measures, such as verified real-name won trading accounts and internal review committees.

By the end of 2025, the government plans to expand the eligibility for cryptocurrency trading accounts to approximately 3,500 listed companies and professional institutional investors through a pilot program. These accounts must be real-name verified and comply with strict anti-money laundering (AML) and KYC protocols. Financial regulators have announced that listed companies will eventually be allowed to participate directly in cryptocurrency trading, enabling large-scale corporate adoption.

Major domestic exchanges in South Korea are launching or upgrading "institutional-grade" products, custody solutions, and support services to meet the growing demand from large enterprises and professional investors.

Currently, traditional financial institutions such as banks, asset management companies, and brokerage firms are still excluded from direct cryptocurrency trading. This arrangement ensures that the first wave of institutional cryptocurrency activity in South Korea will be led by non-financial enterprises, which may gain a competitive advantage as regulatory doors gradually open.

Political Endorsement

South Korean President Lee Jae-myung's cryptocurrency agenda has garnered broad political support, extending even beyond his Democratic Party. In recent electoral campaigns, both major parties have pledged to legalize cryptocurrency ETFs—a rare bipartisan consensus in South Korean politics. The Financial Services Commission (FSC), which previously opposed discussions on cryptocurrency ETFs, has now submitted a roadmap to approve Bitcoin and Ethereum spot ETFs by the end of 2025.

This political shift reflects the status of cryptocurrencies as a significant voter issue. With over 16 million cryptocurrency holders in South Korea, accounting for about one-third of the total population, digital asset policy has transitioned from a fringe technology policy to a mainstream political topic.

The government has also adopted a broader approach to support cryptocurrency businesses. The Ministry of SMEs and Startups announced plans to remove restrictions on cryptocurrency companies qualifying for venture capital, allowing them to enjoy significant tax benefits, including a 50% reduction in corporate income tax for five years and a 75% reduction in real estate acquisition tax.

South Korean investors have reacted enthusiastically to policy developments. Following the trademark application for stablecoins, bank stocks surged. Kakao Bank rose 19.3% the day after submitting its cryptocurrency-related trademark application, while KB Financial Group increased by 13.38% after submitting a similar application.

More notably, South Korean retail investors spent nearly $450 million in June to purchase Circle shares, making it the most bought overseas stock that month. Circle's stock price has risen over 500% since its June listing, with South Korean investors viewing it as a representative of the global adoption of stablecoins.

This investment pattern reflects that South Korean investors have a profound understanding of how South Korea's stablecoin policy could drive global stablecoin infrastructure. South Korean investors are positioning themselves to leverage South Korea's potential influence in the global digital asset market.

Lee Jae-myung's cryptocurrency strategy faces significant external pressures. U.S. President Trump has threatened to impose retaliatory tariffs of up to 50% on South Korea, which could severely impact the export-oriented economy. With exports accounting for 40% of South Korea's GDP, trade disruptions could trigger an economic recession, limiting the funds available for cryptocurrency investment, regardless of regulatory improvements.

The current timing creates a race between policy implementation and economic deterioration. South Korean authorities are eager to establish cryptocurrency infrastructure before potential trade conflicts make the economic environment too challenging for new investment initiatives.

Domestically, the central bank's opposition to private stablecoins may lead to ongoing regulatory tensions. Officials at the Bank of Korea prefer to place the issuance of stablecoins under bank regulation rather than allowing tech companies to enter the currency infrastructure space.

South Korea's tax policy is also yet to be determined. The government originally planned to impose a 20% capital gains tax on cryptocurrency earnings exceeding 2.5 million won per year, a plan that has been postponed multiple times but is still in the works. How this tax interacts with the new corporate cryptocurrency access rules will influence institutional adoption patterns.

The global impact of South Korea's approach to cryptocurrency policy is drawing international attention, seen as a potential model for other countries facing similar economic pressures and technology adoption patterns. The combination of clear regulation, institutional access, and domestic stablecoin infrastructure represents a comprehensive approach to digital asset integration.

If successful, South Korea's model could influence policy-making in other Asian economies and provide a reference for countries looking to embrace digital asset innovation while maintaining monetary sovereignty.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。