Author: Andrew Fenton

Source: Cointelegraph

Translation: Shaw Golden Finance

Since two weeks ago, when Robinhood co-founder Vlad Tenev appeared on stage in Cannes wearing a white suit and bow tie, mimicking old-school movie star David Niven, everyone has been talking about tokenized stocks.

This is undoubtedly significant for the mainstream application of cryptocurrency. Robinhood is a traditional financial stock trading platform with 26 million retail customers, and it is tokenizing stocks on Arbitrum, providing services to EU users through its user-friendly application interface.

No cryptocurrency wallet or mnemonic phrase is required—Tenev stated that this is a test for broader integration of cryptocurrency, showcasing "the true face of Robinhood itself, fully based on blockchain technology."

In the same week, Gemini launched its own tokenized stocks on Arbitrum, while Backed's 60 types of xStocks went live on Solana, supported by Kraken, Bybit, Bitrue, and Gate.io.

With dShares issuer Dinari obtaining a broker-dealer license and Ondo Finance acquiring Oasis Pro to leverage its license, tokenized stocks could potentially launch in the U.S. within just a few months.

Since 2018, Coinbase has been hoping to launch tokenized stocks in the U.S., and reports indicate that the company is seeking permission from the U.S. Securities and Exchange Commission (SEC) to ultimately achieve this goal. Chief Legal Officer Paul Grewal described tokenized stocks as "the future of finance and a top priority for the company."

However, this is not the first attempt at tokenized stocks; there have been numerous failed cases from issuers in the previous cycle.

Despite the many advantages of tokenization, the models used by Robinhood and Kraken for stock tokenization also have significant drawbacks. Here is an analysis of the pros and cons of tokenized stocks in 2025.

Opposition: Tokenized Stocks Are Not Real Stocks

Critics argue that xStocks and the tokenized stocks offered by Robinhood are merely synthetic representations of stocks held in a vault, lacking any shareholder rights and protections associated with actual ownership.

For Robinhood, even though its model uses a licensed U.S. broker-dealer to issue tokenized stocks and safeguard the related assets, these tokenized stocks are still considered derivatives under EU regulations. Tenev referred to them as "derivatives backed by real stocks."

Backed's xStocks tokens are also supported 1:1 by a special purpose vehicle (SPV) located in Liechtenstein. Theoretically, even if Kraken or Bybit were to collapse, the underlying assets would still be secure. The token can be redeemed at over-the-counter prices when the market opens.

Alan Keegan, DeFi portfolio manager at M31 Capital, stated that half of the goal has already been achieved. "We have solved the problem of issuing certificates for off-chain assets on-chain through tokenization," but he added that there is still a long way to go.

"In order for on-chain trading of securities to truly represent the transfer of that security, regulatory issues need to be resolved and legal infrastructure established," he said.

"Building the infrastructure to solve this problem requires a considerable degree of legal knowledge, traditional financial expertise, proficiency in blockchain technology, and, frankly, financial investment."

The closest example to date is Securitize's Exodus token on Algorand, which represents direct legal ownership of securities on the Securitize shareholder register.

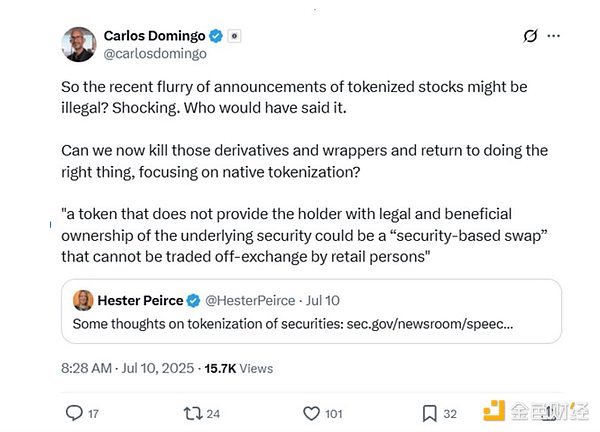

Securitize CEO Carlos Domingo stated, "It takes time, but native tokenization is a necessary first step."

Unless stocks are presented on-chain in a compliant and legal manner, decentralized ownership of stocks cannot be achieved. Securitize is currently one of the few platforms in the U.S. capable of doing this.

Neutral Opinion: Tokenized Stocks Are in a Legal Gray Area

Tokenized stocks exist in a legal gray area, and the practices of Robinhood and xStocks are reminiscent of Uber's approach with its ride-hailing app a few years ago, testing the boundaries of the law.

Robinhood's tokenized stocks are currently only available in the EU market, but since Robinhood is a publicly traded company and collaborates with a U.S.-listed broker-dealer to issue U.S. securities, U.S. regulators may decide to shut it down.

The Securities Industry and Financial Markets Association (SIFMA) has urged the SEC to reject trading models that do not comply with the National Market System Regulation (NFM).

However, new SEC Chairman Paul Atkins has expressed support in principle. "Tokenization is an innovation. The SEC should focus on how to promote market innovation," Atkins said in an interview with CNBC.

OpenAI has also highlighted the legal issues surrounding Robinhood's sale of tokens linked to its private stock, noting that Robinhood needs to approve any token transfers, which the company has not yet done. The Bank of Lithuania subsequently launched an investigation.

Rob Hadick, a general partner at Dragonfly, stated on X that the risk faced by token holders is that private companies may ultimately "directly cancel the equity sale to shareholders who violate shareholder agreements."

But Tenev stated that while SpaceX or OpenAI may not be keen on tokenizing their private shares, more companies see it as a huge opportunity.

"Many private companies have been reaching out to me, asking… when can we tokenize our private stock?" he recently said. The larger legal issue of publicly selling tokenized private stock is that it essentially circumvents the disclosure and transparency rules for publicly traded companies.

If businesses can sell private stock to raise funds without incurring the costs and compliance requirements of an IPO, why would anyone go public?

Advantages: 24/7 Trading of Tokenized Stocks and Their Application in DeFi

Traditional markets are closed approximately 81% of the time each year, meaning that tokenized stocks available for 24/7 trading would have a significant advantage.

xStocks and Robinhood's tokenized stocks were initially available five days a week, 24 hours a day, but Tenev stated that this situation will soon change.

"The real interesting part comes when we connect it to Bitstamp, at which point 24/7 trading will become possible. By then, the performance of stock tokens will be similar to that of other cryptocurrencies like Bitcoin and Ethereum," Tenev said. The next phase will be integrating these assets into decentralized finance (DeFi).

"So you can imagine combining collateralized lending with true self-custody; I think this would be very powerful for stocks because it allows your stock tokens to break free from the constraints of any specific broker or cryptocurrency provider."

Keegan agrees that the ability to operate around the clock, lower costs, more reliable execution, and faster settlement are all significant advantages, along with the potential for composability within the DeFi ecosystem.

Blockchain Platforms May Outperform Traditional Financial Platforms in Competition

Galaxy Digital's analysis suggests that 24/7 trading of tokenized stocks on Bitstamp poses a significant threat to traditional markets like the New York Stock Exchange:

"This directly challenges the advantages of liquidity concentration and trading activity that traditional financial exchanges (like the New York Stock Exchange) possess… More brokers adopting blockchain-based trading strategies could put tremendous pressure on traditional exchanges."

However, Domingo of Securitize believes there is still a long way to go. Domingo stated, "To reach the level where the entire market operates around the clock on a cryptocurrency track, we need three things: clear regulation that allows on-chain trading venues to exist under a modified framework; liquidity and infrastructure—market makers, secondary markets, and settlement systems—that can reliably operate outside traditional trading hours; and institutional trust and adoption."

Traditional finance will not quietly exit the stage; traditional markets already offer pre-market and after-hours trading, which helps cover about 16 hours of the day.

The electronic trading platform Arca, owned by the New York Stock Exchange, was also approved in February to provide trading services five days a week, 22 hours a day, with extended trading hours expected to launch this year.

Opposition: After-Hours Volatility of Tokenized Stocks

Rob Hadick of Dragonfly pointed out that after-hours trading could raise numerous issues.

He used xStocks as an example, stating that when investors purchase tokens after hours, the special purpose vehicle (SPV) must buy the stock at market open, which exposes market makers to price risk.

This means that spreads may widen, and market makers could ultimately withdraw liquidity entirely when the market is under pressure. "If these factors seep into the DeFi lending and derivatives space, it could create significant chain liquidation risks," he said.

He also pointed out that tokens only grant holders the right to enjoy off-chain prices, meaning that when the market opens, stocks may quickly revert to that price.

"This means that when people buy during low liquidity periods on weekends or after hours, but the stock market opening price is lower than the expectations of token buyers, you will see rapid losses at the opening, primarily borne by retail investors," Hadick said.

"Functionally, this means they are not good products at all […] they cannot serve the complex, real, and global stock market. Moreover, they may not even meet the needs of professional cryptocurrency traders, as these traders know they can get better prices and lower risks elsewhere."

Disadvantages: Tokenization of Stocks Accompanies Liquidity Fragmentation

Tokenizing stocks by multiple issuers can also lead to liquidity fragmentation. As Mike Dudas of cryptocurrency VX jokingly put it, imagine a future where you have to choose between "rTSLA, cTSLA, sTSLA, xyzTSLA, ethTSLA, solTSLA, or hyperTSLA."

Robinhood's cryptocurrency head Johann Kerbrat acknowledged that this would be a problem. "I hate the idea of having both Tesla-Kraken tokens and Tesla-Robinhood tokens at the same time," he said. "We haven't really moved forward and created a better financial system; instead, we are splitting liquidity."

Domingo sarcastically asked on X, "Isn't this exactly what Robinhood is doing?" Having multiple tokenized stock issuers also significantly increases the likelihood that one of the issuers could go bankrupt in some way, leading to substantial losses for token holders.

Tokenized Stocks Failed in 2021

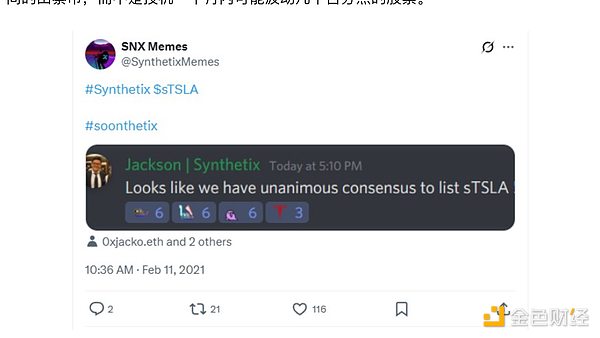

In the previous cycle, Synthetix launched synthetic tokens that provided exposure to stock prices like Tesla in 2021. sTSLA had only 798 transactions before it was gradually phased out that year.

Lack of liquidity was one reason, but it is also possible that DeFi investors preferred to speculate on altcoins with 10x potential upside rather than on stocks that might fluctuate a few percentage points within a month.

Mirror also offered synthetic stocks but collapsed along with Terra. Binance also provided stock tokens for a few months in 2021 but delisted them under pressure from regulators in the UK and Germany.

The "most successful" issuer of the last cycle was FTX, which issued tokenized stocks backed 1:1 through CM Equity. Its trading volume peaked at nearly $1 billion in October 2021. However, after FTX collapsed the following year, reports indicated that CM Equity had exited the agreement in December 2021, raising questions about the support for tokenized stocks. When FTX collapsed, holders of tokenized stocks lost their funds.

However, during those dark days, one company survived. Securitize tokenized the stock of wallet provider Exodus in 2021, achieving a market cap of $294.7 million, which alone accounted for 78% of the entire tokenized stock market today.

Domingo pointed out that it is no longer 2021; the regulatory environment is favorable, and asset management companies like BlackRock, Apollo, and Hamilton Lane are also getting involved. "The credibility provided by top asset issuers is now expanding from tokenized bonds and private credit to other assets like tokenized stocks," he said.

How Will Tokenized Stocks Affect Cryptocurrency Prices?

As the blockchain with the most stablecoins and real-world assets (RWA), Ethereum is expected to benefit from the broader adoption of tokenized stocks. Robinhood's choice of Ethereum L2 Arbitrum is seen as a significant vote of confidence in its ecosystem and L2 roadmap.

Keegan stated that financial institutions can customize L2 to meet KYC and privacy requirements and support trade rollbacks. "The most exciting feature of L2 scaling infrastructure is that L2 can inherit Ethereum's decentralization and reliable neutrality guarantees while being built according to the needs of specific use cases, including regulatory compliance."

Since the announcement, Ethereum's price has risen by a quarter. Solana has also proven to be very popular among retail investors over the past two years, so it will also benefit from the widespread adoption of xStocks.

Some believe that tokenized stocks will compete for funds currently spread across various altcoins. However, Domingo believes that a halo effect is more likely to occur.

"We do not think that tokenized stocks and altcoins are necessarily competing for funds. Instead, we see traditional financial institutions embracing blockchain infrastructure, leveraging the same underlying technology as DeFi. This is undoubtedly beneficial for the resilience and expansion of the entire cryptocurrency ecosystem."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。