On the occasion of the launch of the StakeStone USD1 liquidity distribution product, a conversation with Charles to understand the new variables and bonus window in the 2025 Alpha stablecoin market.

Written by: Web3 Farmer Frank

What is the core competitiveness of the stablecoin business?

"Credit."

StakeStone founder Charles's response is straightforward and bare, and in the stablecoin battlefield, the typical embodiment of "credit" is the credit endorsement from the Trump family, as seen with USD1. In less than 100 days since its inception, USD1 has achieved a phenomenal "from 0 to 1" growth and full coverage on top exchanges:

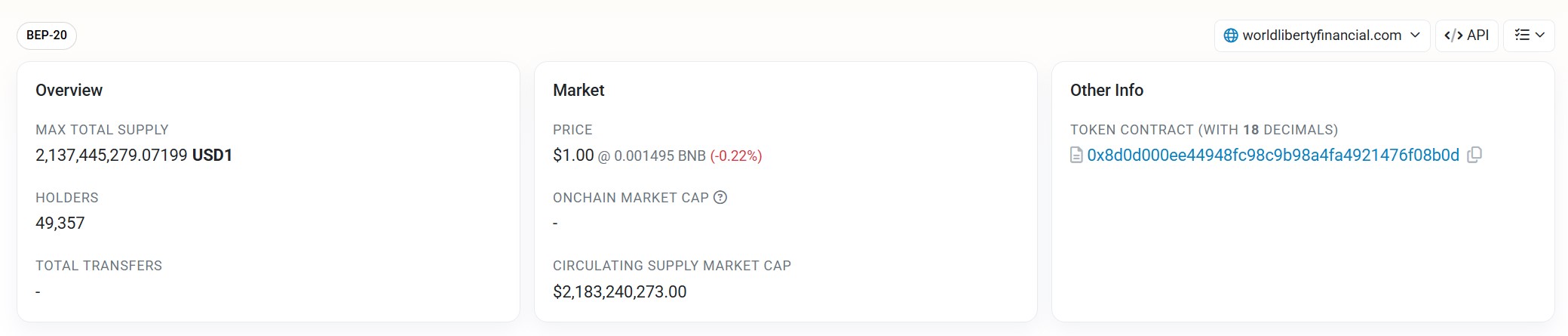

Since March, the issuance has skyrocketed to $2.1 billion, surpassing FDUSD and PYUSD to become the fifth largest stablecoin globally (CoinMarketCap data), and has fully landed on leading CEXs such as HTX, Bitget, and Binance. In contrast, PYUSD, backed by PayPal for two years, is still struggling to gain traction.

In Charles's view, "the essence of currency issuance is credit," and stronger credit will lead to faster adoption. Therefore, he is confident that USD1 will be the most growth-potential stablecoin in 2025.

So, why did StakeStone secure this first ticket?

"The development logic of USD1 is vastly different from USDT/USDC," the unique credit endorsement of USD1 allows for more cross-domain adoption and resource integration in its promotion in the real world compared to traditional stablecoins.

Thus, the greatest growth potential of USD1 does not lie within the Web3 circle, just as the larger proportion of today's USDT and USDC applications are in traditional finance, including but not limited to: large financial institutions, cross-border trade companies, small and medium enterprises, individual entrepreneurs (such as freelancers and content creators), and regions with underdeveloped financial services. These areas will greatly benefit from the proliferation of this round of digital stablecoins.

The widespread adoption of USD1 on-chain must be achieved through a full-chain liquidity hub. Therefore, Charles revealed that as early as the second half of 2024, StakeStone began discussions with World Liberty Finance (WLFI), the issuer behind USD1, regarding cooperation on full-chain liquidity.

The key factor that prompted WLFI to choose StakeStone was StakeStone's demonstrated multi-chain operational capabilities in previous products like Berachain, especially its functional performance in the ongoing construction of "full-chain liquidity distribution." Thus, in the ecological landscape of USD1, StakeStone actually plays a dual role: as the official minting channel and the full-chain liquidity hub, providing USD1 with a one-stop portal from minting to full-chain and full-scenario coverage.

From this perspective, StakeStone taking the lead with USD1 can be seen as a tacit agreement between WLFI and USD1. This interview aims to understand the cooperation logic between WLFI/USD1 and StakeStone through Charles's perspective, and to reveal the fundamental changes occurring in the stablecoin landscape, thus uncovering the key pieces of this new narrative in stablecoins.

Why did WLFI choose StakeStone at the end of last year?

When asked why StakeStone became the first DeFi minting service provider for USD1, Charles first broke down USD1's issuance mechanism:

After institutional users complete KYC certification and other compliance processes, they need to deposit US dollars into a designated custodial bank account. Once WLFI verifies the funds have arrived, institutions can mint USD1 in minimum units of $100—however, the USD1 balance during this process remains within the account system and has not yet gone on-chain; it must be "withdrawn" to enter the public chain world, and currently, USD1 officially only supports Ethereum and BNB Chain (with the latter accounting for over 98% of total issuance).

In other words, in the current on-chain environment, USD1 has not achieved native multi-chain deployment. To realize the circulation and use of USD1 on other chains, there are currently only two methods. One is to rely on the official cross-chain bridge, but this is far from sufficient; it can only solve the "cross-chain existence" of assets but cannot build a complete application scenario. The other is to build an independent full-chain distribution system through partners.

StakeStone is stepping in at this critical juncture, leveraging its multi-chain distribution and scenario operation capabilities to distribute USD1 across more than 20 chains, achieving native landing and application in multi-chain DeFi scenarios.

According to Charles, StakeStone and the WLFI team began multiple rounds of discussions starting at the end of 2024. The decision to cooperate was closely tied to the asset distribution system that StakeStone had already established in the multi-chain ecosystem, as well as its rich experience in integrating blue-chip asset yields, which can quickly bring USD1 into real DeFi application scenarios. This also means that from the very beginning of USD1's inception, StakeStone has not just been a "minting party," but more like a strategic partner for its entry into the multi-chain ecosystem—not only to serve as a core hub for full-chain distribution of USD1 but also to be responsible for building yield products across DeFi chains, providing yield certificates, and creating the on-chain usage soil for USD1, ultimately achieving an integrated connection of "fiat deposit → minting → multi-chain distribution → on-chain and off-chain scenario docking," thus building a truly one-stop liquidity closed-loop service for USD1.

Here are the related interview questions:

Frank: We see that StakeStone is the "official full-chain liquidity support partner for USD1 stablecoin." Can you introduce the specific content of the cooperation with WLFI? What core support and services will StakeStone provide for USD1?

Charles: Currently, we are both the minting service provider for USD1 and deeply involved in its governance ecosystem, undertaking the construction of full-chain liquidity. Future cooperation plans include:

Payment Products: Launching a payment tool based on USD1, allowing global businesses to directly receive USD1 through Visa/Mastercard, and integrating into traditional banking systems as stablecoins become legal;

Full-Chain DeFi Yield Products: Launching a one-stop full-chain yield product, USD1 LiquidityPad Vault, on-chain;

CeDeFi Products: Simultaneously building USD1 CeDeFi products that combine traditional financial institution dollar wealth management products and quantitative trading yields;

Compliance Channel Construction: Applying for payment licenses in multiple countries to create a one-stop exchange path from fiat to USD1, gradually replacing OTC channels;

Frank: Currently, USD1 has high qualification requirements for mint service providers. Why did WLFI choose StakeStone as the first DeFi protocol minting service provider? What opportunity led to this cooperation?

Charles: Our cooperation with the USD1 team began during its private placement phase at the end of last year (Q4 2024). We participated early in its technical path planning, and based on our successful liquidity distribution experience in multiple projects, the USD1 team recognized our capabilities in building a multi-chain ecosystem, leading to a strategic partnership.

Frank: Previously, StakeStone had not launched any business or products directly related to stablecoins. Does this deep cooperation with USD1 mark StakeStone's official entry into the compliant stablecoin field?

Charles: We indeed did not have stablecoin products before; this cooperation is our first step into the stablecoin infrastructure. In the future, we will definitely develop a complete set of products around USD1, including the LiquidityPad full-chain liquidity distribution vault for USD1, minting, and stable yield products, etc.

These are actually things that StakeStone is already good at; we just primarily served blue-chip assets or public chain assets before. Now we will provide a complete "stablecoin as a service" solution for USD1.

Frank: As the "first DeFi protocol minting service provider for USD1," will ordinary users be able to mint or cross-chain exchange USD1 directly through StakeStone in the future?

Charles: We definitely hope to package this mechanism well, for example, users can bind their bank cards through the StakeStone front end, deposit fiat currency directly, and then the system backend will mint USD1 through our institutional account, and bridge it to the target chain selected by the user, thus achieving a one-stop experience from deposit, minting to distribution.

Currently, we are already laying out compliance licenses in this area, especially in regions like Singapore and Hong Kong where compliance licenses are clearer, to open up payment channels. In the future, users may be able to deposit and exchange USD1 through credit cards, SWIFT, wire transfers, etc.

"The larger application scenarios for USD1 are not in the crypto circle," a new growth paradigm of full-chain liquidity × global liquidity

"The larger application scenarios for USD1 are not in the crypto circle."

StakeStone is also preparing payment products based on USD1 to provide compliant and efficient global aggregation acquiring products for small and medium enterprises, digital nomads, and self-employed individuals.

He believes that the market pointed to by this direction is an unignorable larger second half of stablecoins. StakeStone not only aims to provide "stablecoin as a service" full-stack support for USD1 but also attempts to evolve it into an "on-chain dollar API" that serves real settlement and global circulation.

Here are the related interview questions:

Frank: The full-chain stablecoin distribution product may seem a bit abstract. Can you give an example of how ordinary users can use USD1 across the full chain through StakeStone, participate in different ecosystems, and earn yields?

Charles: It can be simply understood as "three steps." Users first deposit USD1 into StakeStone's liquidity vault, StakeStone issues yield-bearing stablecoin certificates, and users then participate in target chain blue-chip DeFi scenarios (such as Morpho, Pendle, etc.) to earn yields through the yield-bearing certificates they hold.

At the same time, StakeStone will distribute the underlying USD1 into the full-chain ecosystem, participating in the deployment of cross-chain multi-yield strategies.

Finally, users can effortlessly receive full-chain yields through the yield-bearing certificates they hold.

Frank: From the perspective of ecological cooperation, how do you assess the synergistic value of this StakeStone × USD1 collaboration? Does this mean that both parties will form a long-term alliance of stablecoin + liquidity protocol to jointly penetrate multi-chain and cross-regional markets?

Charles: In the future, we will be a one-stop portal for USD1 from minting to distribution.

In the crypto space, we have launched a dedicated LiquidityPad vault for USD1 to help expand its multi-chain DeFi scenarios. We will also release RWA + CeDeFi products based on USD1 to provide stable yield services. In the traditional finance sector, we are advancing the application and cooperation for payment licenses, aiming to create a compliant, low-friction path for users to mint USD1 directly from fiat, truly opening the gateway for off-chain funds.

For this closed loop to truly land and operate smoothly, it still relies on the promotion of three key variables: First is regulatory progress, such as whether policies like the U.S. "Stablecoin Act" can be successfully implemented, which will directly determine the legality of USD1's fiat channels; second is the ability to penetrate scenarios, meaning whether small and medium enterprises, cross-border freelancers, and global trade institutions will adopt USD1 on a large scale as a payment tool; finally, it is the ability to expand yield products, specifically whether the on-chain yields of USD1 can be further extended to RWA, government bonds, and other off-chain assets, as well as CeDeFi.

The biggest Alpha in 2025 is "legal stablecoins," and the true realization of the closed loop depends on the joint drive of regulation, scenarios, and products.

What's the next step?

"The stablecoin industry has entered the second half, and the focus of competition is shifting from scale and traffic to compliance capability and scenario penetration."

In addition to product cooperation, Charles also shared his understanding of the future landscape of the industry regarding stablecoins in this conversation. He believes that legal stablecoins represent a watershed moment for the crypto industry, specifically:

The emergence of legal stablecoins will gradually erode the market share of traditional fiat currencies in cross-border payments. It is evident that crypto stablecoins have lower ledger security maintenance costs and lower global access costs.

The emergence of legal stablecoins will end the existing P2P deposit and withdrawal structure, which will ultimately be replaced by licensed currency exchange enterprises in various countries.

The emergence of legal stablecoins will blur the business boundaries between traditional banks and Web3 stablecoin asset management projects. In the future, the only differences will be in the methods of ledger accounting (centralized database accounting vs. on-chain accounting) and regulatory requirements, with their business boundaries becoming increasingly similar.

Therefore, StakeStone will firmly embrace the stablecoin market in 2025, especially emerging stablecoins like USD1 that have the potential to become legal stablecoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。