Author: RootData Research

Key Points

- In the first half of 2025, the total amount of financing in the crypto primary market reached $7.75 billion, a year-on-year increase of 40.17% and a quarter-on-quarter increase of 77.75%. There were a total of 547 financing events, averaging 91 per month, with a continuous decline in quantity, showing a trend of large financing concentration, active mergers and acquisitions, a shift in track preference towards CeFi, and capital flowing to the secondary market. The market capitalization of stablecoins surpassed $240 billion, with a correlated rise with BTC providing liquidity support for primary financing, especially driving large transactions in the CeFi sector.

- The crypto primary market exhibits characteristics of capital centralization and track diversification, with CeFi dominating market trends due to liquidity support and compliance advantages, while DeFi and tool tracks continue to gain favor due to technological innovation. From the 399 disclosed financing amounts, the number of financings below $10 million sharply decreased by over 45% year-on-year, nearly halving; the number of financings above $50 million surged by 146.7%, mainly concentrated in CeFi, mining companies, and asset management companies.

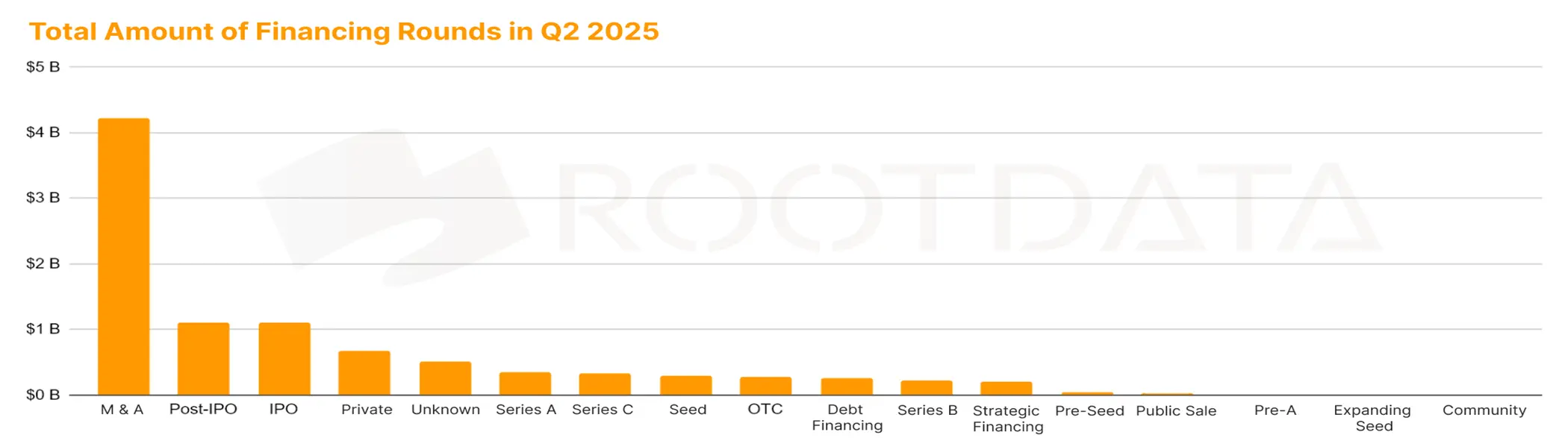

- Market hot money is gravitating towards U.S. stock concepts, with the highest financing rounds in the first half of the year being dominated by institutional activities (mergers/acquisitions/Pre-IPO/IPO/private placements), significantly surpassing the previously favored seed to A-round financing in DeFi and infrastructure sectors.

- Ethereum's total financing reached $1.63 billion, firmly maintaining its position as the leading public chain, but emerging public chains have significantly outpaced Ethereum in application growth rates. Monthly active developers fell to about 21,800 in January, marking a nearly four-year low, but rebounded to a high of 29,700 by mid-year, with community-driven technological innovation filling the financing gap.

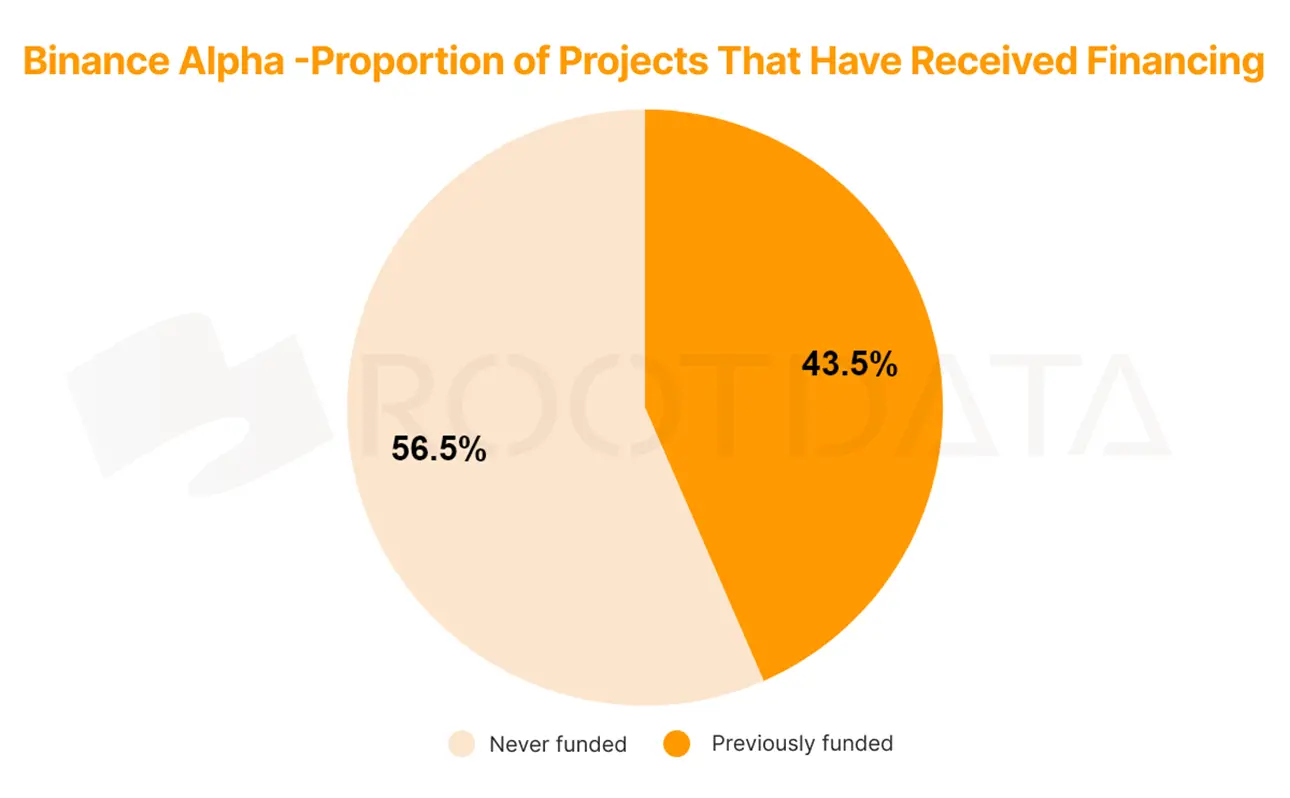

- Binance Alpha has transformed the BNB Chain into a CEX-DEX testing ground, with its DEX trading volume rising from 12% to 49% of the total network. The Alpha points system establishes different scores and tiered thresholds as a governance weight distribution mechanism for the Binance and BNB ecosystem, successfully exploring new paths for Binance listings and VC exits. Unannounced financing projects in Binance Alpha account for 56.5%, with a total market capitalization of unfinanced projects reaching $8.69 billion, while the total market capitalization of financed projects is only $6.23 billion, with less than 25% of projects having a history of financing and excellent performance.

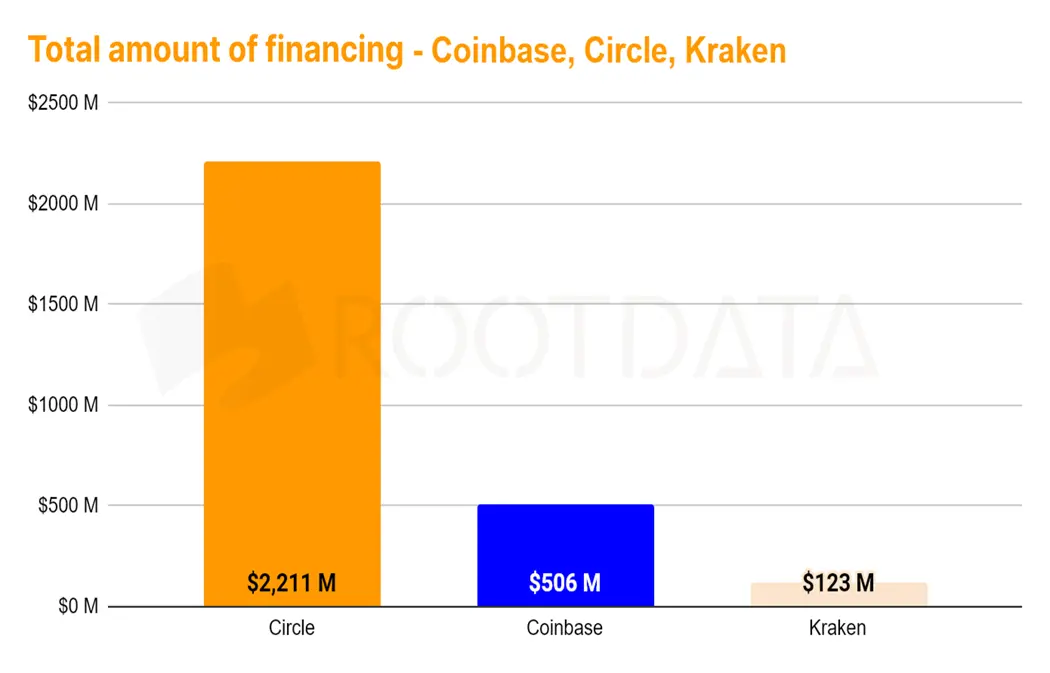

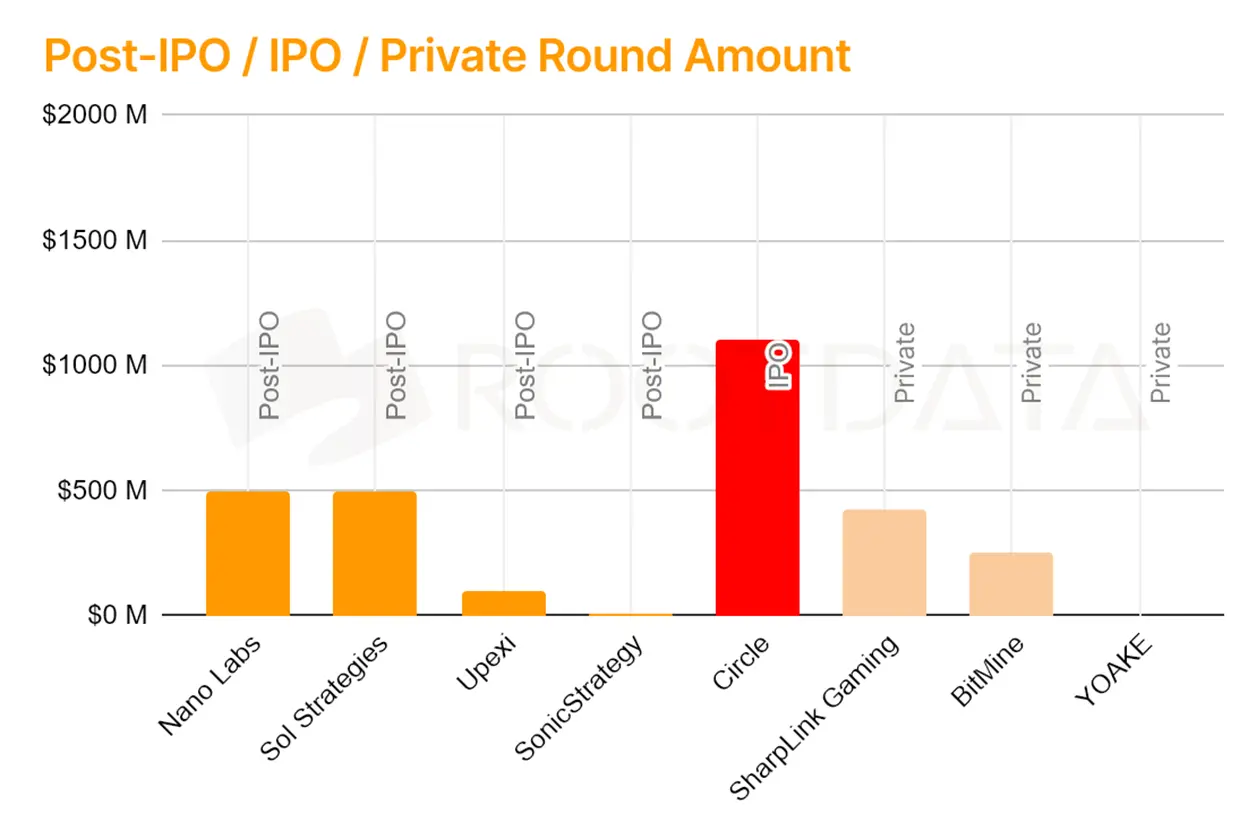

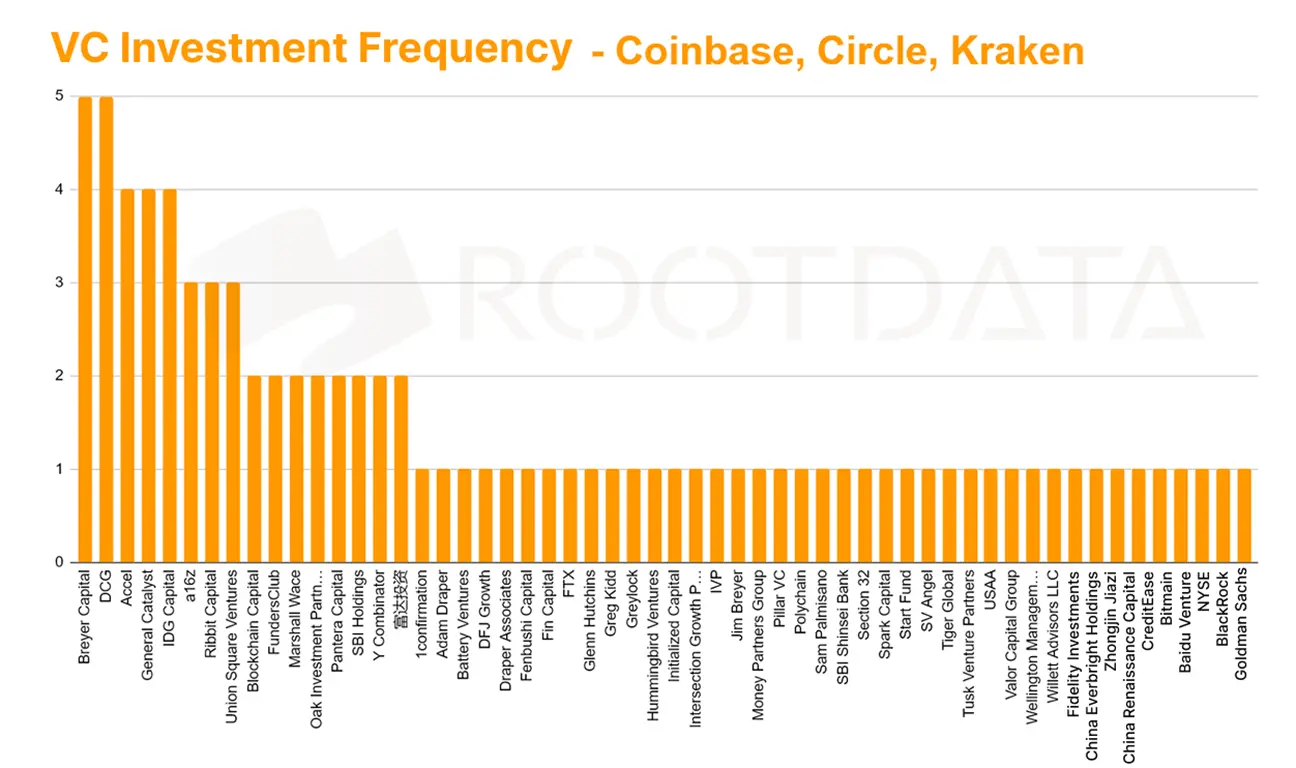

- Wall Street's capital-raising beast Circle became the project with the highest IPO financing amount at $2.2 billion, with Circle SPV previously selling OTC at $36 per share (an $8.2 billion valuation) before the IPO. In contrast, Coinbase and Kraken only raised $500 million and $120 million, respectively, with their large U.S. stock financing occurring approximately every 1-2 years. The stablecoin and RWA sectors have gained recognition from Wall Street, injecting strong momentum into the mainstreaming process of the entire industry.

A total of 547 financing events were recorded in the crypto primary market in the first half of 2025, with a total amount of $7.75 billion

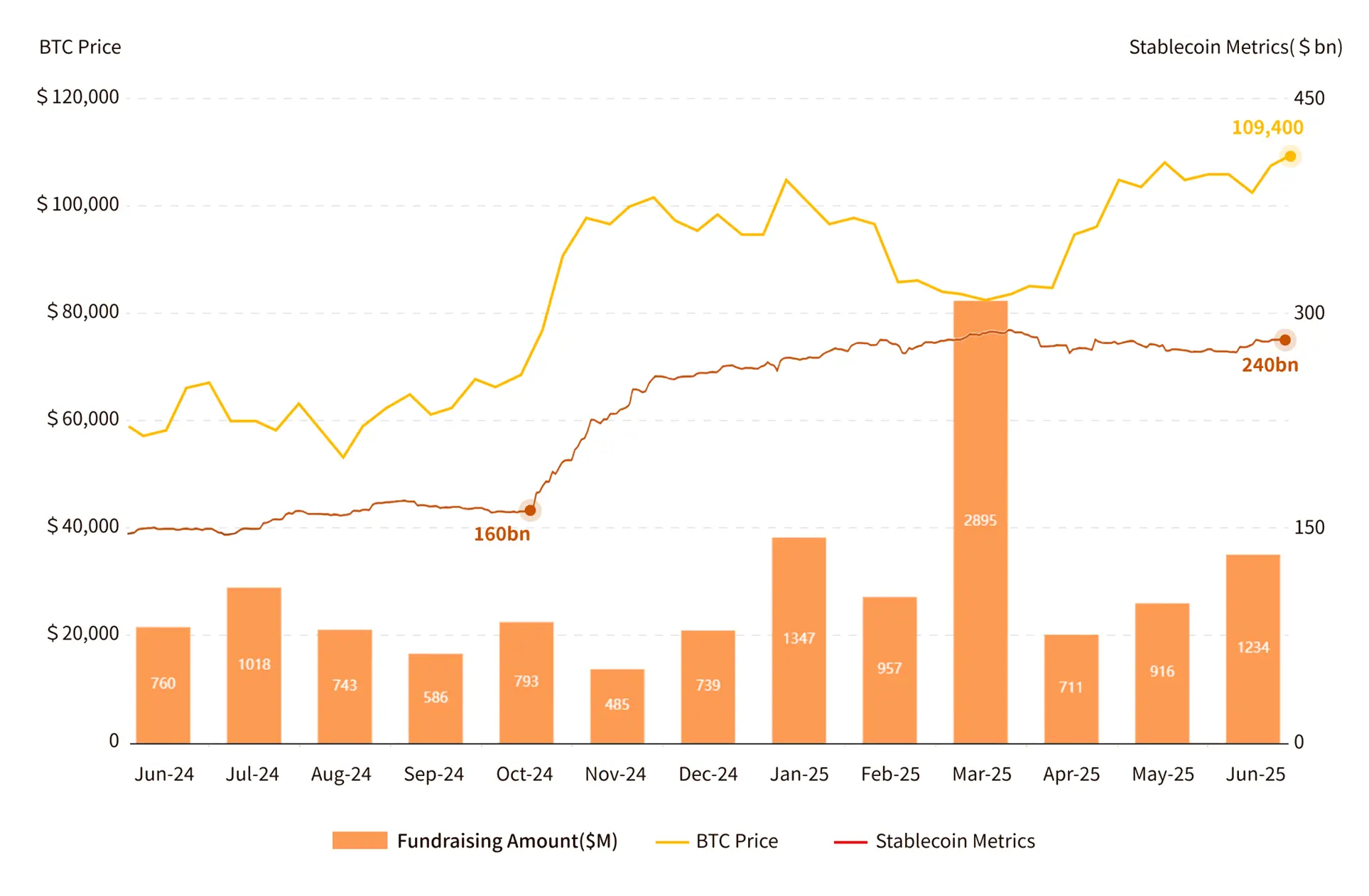

Correlation between Web3 primary market financing, BTC price, and stablecoins

In the first half of 2025, the amount of financing in the crypto primary market reached $7.75 billion, a year-on-year increase of 40.17% and a quarter-on-quarter increase of 77.75%. In March, financing amounted to $2.895 billion, of which Binance accounted for $2 billion. Excluding this financing, the average monthly financing was about $950 million, with an average financing amount of $12.419 million and a median of $5.425 million.

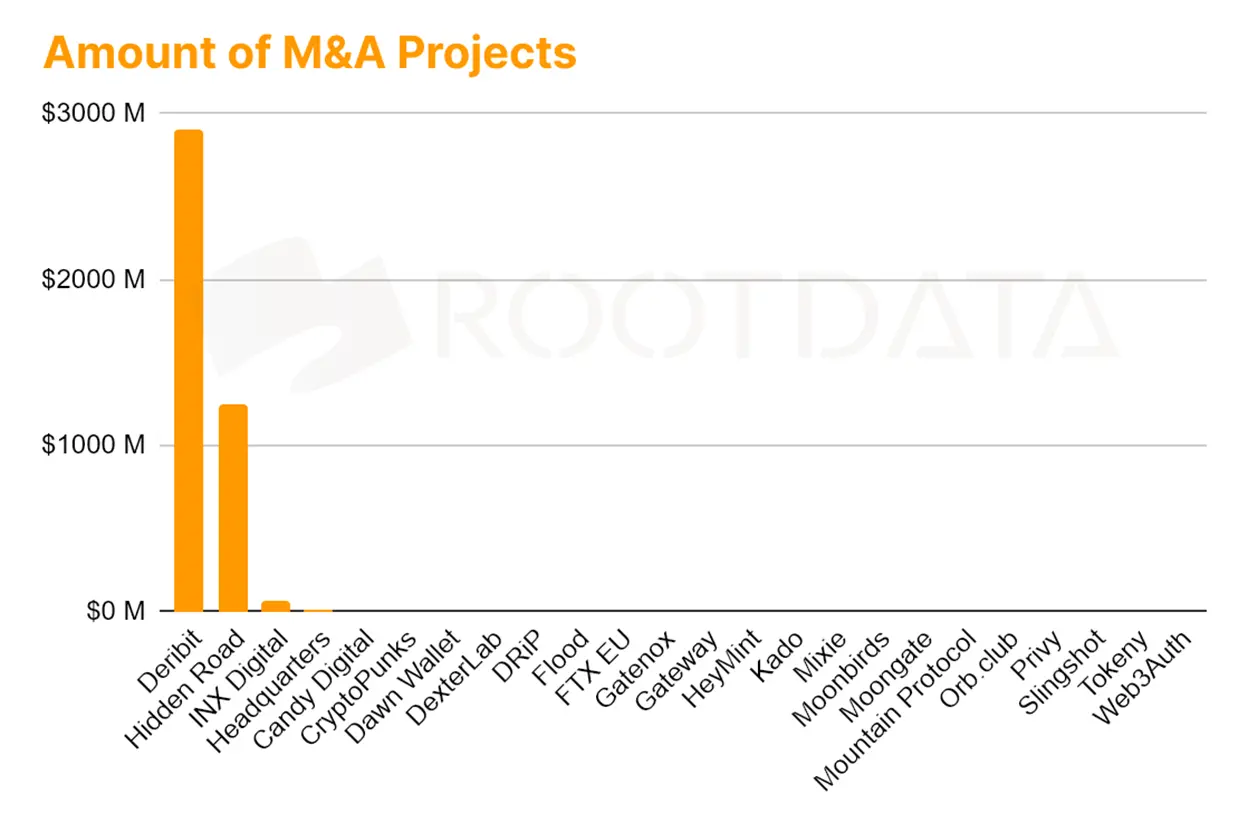

There were a total of 547 financing events, averaging 91 per month, with first-time project financing accounting for 57.7% (316 events). In terms of track distribution, CeFi led with a financing amount of $2.719 billion, surpassing the infrastructure track ($1.87 billion). M&A activities significantly increased to 66, up 60.9% from 41 in the second half of 2024. Crypto-related listed companies (such as Circle, Sol Strategies) raised $2.233 billion, setting a historical high.

The stablecoin market has significantly expanded since the end of October 2024, with total market capitalization rapidly increasing from $160 billion to $240 billion, a growth of 50%. During the same period, the BTC price rose from a low of $68,000 to $105,000, and has not returned to the range prior to the stablecoin surge within the year. The correlated rise of stablecoins and BTC has provided liquidity support for primary financing, especially driving large transactions in the CeFi sector.

Overall, the amount of financing in the crypto primary market in the first half of 2025 has significantly increased, but the number of events continues to decline, showing a trend of large financing concentration, active mergers and acquisitions, a shift in track preference towards CeFi, and capital flowing to the secondary market.

Investment hotspots are trending towards compliance, diversification, and scaling

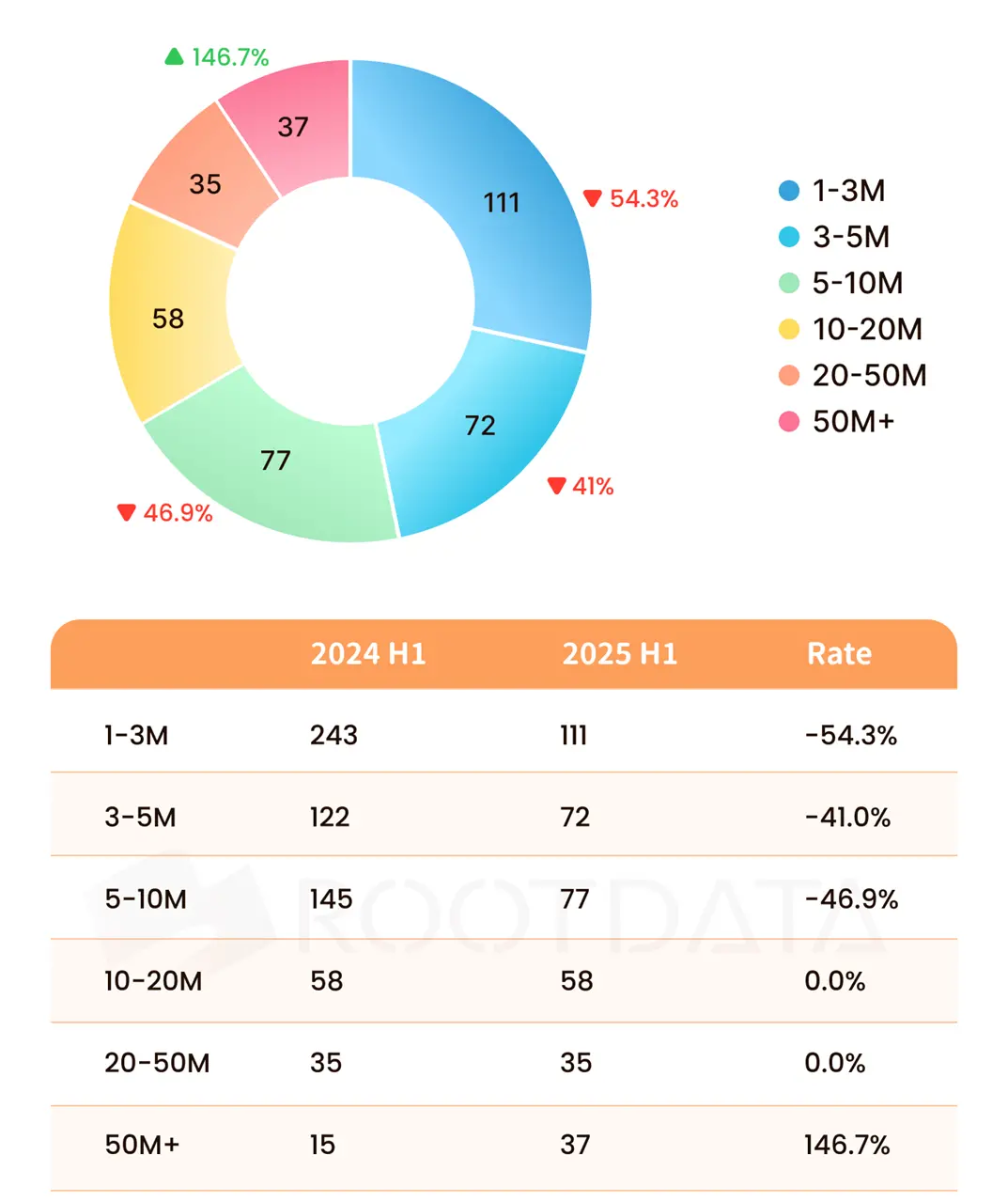

Overview of financing amount distribution in the first half of 2025

From the 399 disclosed financing amounts, it shows that the number of financings below $10 million sharply decreased by over 45% year-on-year, nearly halving; the number in the $10 million to $50 million range remained stable; the number of financings above $50 million surged by 146.7%, mainly concentrated in CeFi, mining companies, and asset management companies, indicating a capital preference for large investments and a reduction in small-scale layouts.

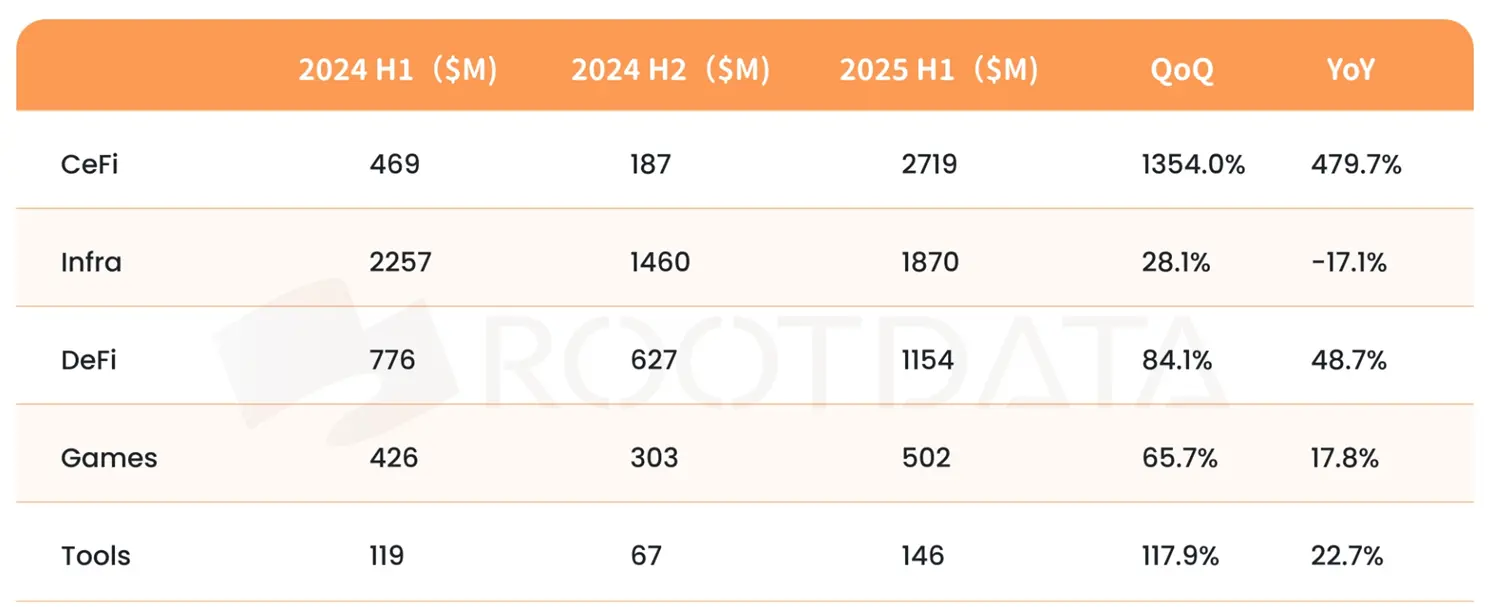

Track performance is distinctly differentiated, with investment hotspots trending towards compliance and diversification. CeFi led with a financing amount of $2.719 billion, a year-on-year increase of 479.7% and a quarter-on-quarter increase of 1354%, regaining its leading position. The infrastructure track raised $1.87 billion, down 17.1% quarter-on-quarter. DeFi and tool tracks saw year-on-year increases in fundraising of 84.1% and 117.9%, respectively.

In the first half of 2025, the crypto primary market exhibited characteristics of capital centralization and track diversification, with CeFi dominating market trends due to liquidity support and compliance advantages. Public companies are following the crypto reserve strategy of Strategy, leveraging the liquidity and appreciation potential of BTC and stablecoins to reshape valuation logic; DeFi and tool tracks continue to gain favor due to technological innovation, moving the market towards a more efficient investment pattern.

Top 5 tracks in financing in the first half of 2025

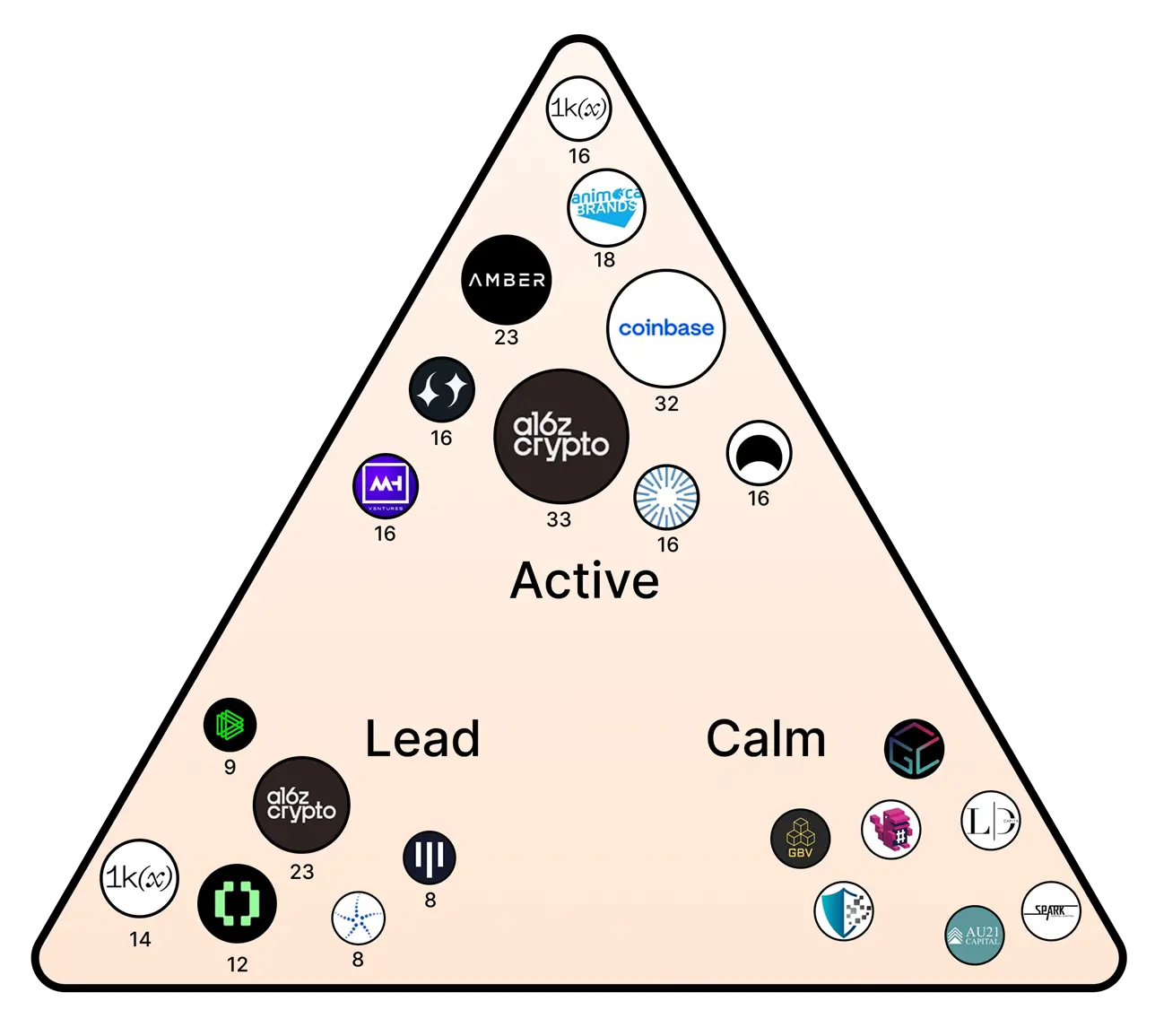

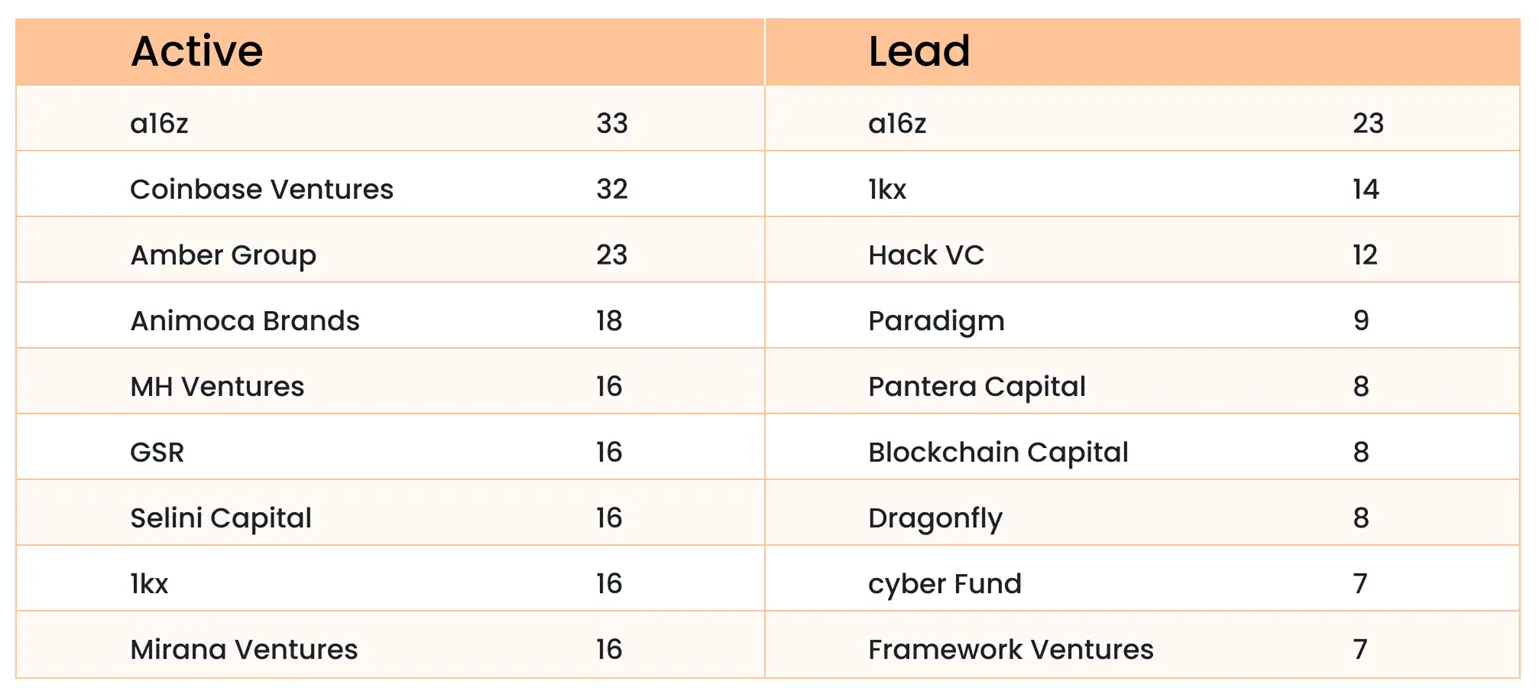

In the first half of 2025, a16z and Coinbase Ventures led crypto investments

Performance of crypto-native institutions in H1 2025

a16z and Coinbase Ventures led crypto investments in the first half of 2025, with a16z making 33 moves, leading 23 times, focusing on the intersection of AI and blockchain, demonstrating precise layout. Coinbase Ventures followed closely with 32 investments but only led 2 times, adopting a broad diversification strategy. 1kx, Hack VC, and Paradigm maintained leadership in leading investments, each with their own characteristics.

Crypto-native funds have become more conservative, with 700 institutions having invested at least once (including institutions like LD Capital and AU21 Capital that have made over 200 moves cumulatively) not making any moves in the first half of the year, accounting for about 67%, reflecting a cautious market sentiment. Inspired by public companies' strategies, some crypto VCs have shifted towards investing in blockchain concept stocks, promoting further integration of crypto assets with traditional finance, reflecting the diversification and maturation of crypto investment strategies.

Fragmentation of public chain ecosystems intensifies, weakening the driving force of crypto funds on public chains and applications

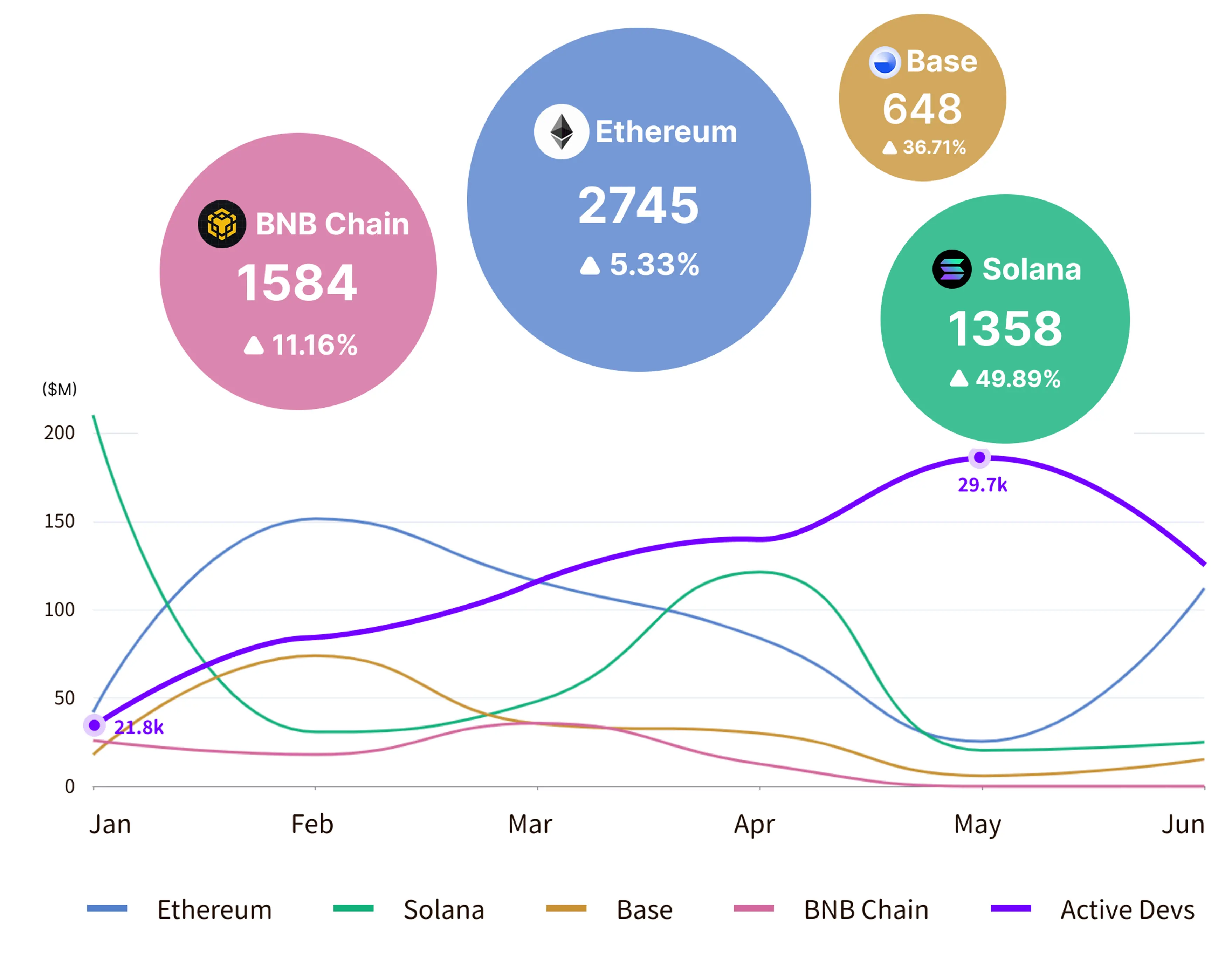

Mainstream public chain ecosystems and financing performance in H1 2025

Ethereum, with over 2,700 quality applications (excluding unknown meme projects), firmly maintains its position as the leading public chain, with a total financing amount of $1.63 billion, far exceeding other ecosystems and consolidating its market dominance.

However, emerging public chains are optimizing specific dimensions of the "impossible triangle" to meet diverse user needs. Emerging public chains have significantly outpaced Ethereum in application growth rates, rapidly capturing niche markets and challenging its dominant position. This ultimately leads to increased fragmentation of the public chain ecosystem.

For example, Solana has become a breeding ground for meme coins and DeFi applications due to its high throughput, attracting high-frequency trading users. Base focuses on compliant assets and AI-driven on-chain applications, optimizing low-cost Layer 2 solutions to meet the needs of institutions and developers.

The driving force of crypto funds on public chains and applications has weakened, with financing amounts significantly diverging from application ecosystem growth. In the first half of the year, primary market funds concentrated on the CeFi track, with mainstream public chain financing amounts generally sluggish and showing a downward trend, but application development has not been significantly hindered. According to developer report data, the number of monthly active developers fell to about 21,800 in January, marking a nearly four-year low, but rebounded to a high of 29,700 by mid-year, with community-driven technological innovation filling the financing gap.

Binance Alpha transforms BNB Chain into a CEX-DEX testing ground

The most notable phenomenon in Q2 2025 is undoubtedly the $1.7 million Binance Alpha project launched by Binance in May. Compared to the BTC Renaissance CEX-DEX trading experience launched by OKX, and the controversial Binance listing and VC exit paths, or the lucrative profits of DEX and All-in-one (AIO) on-chain trading platforms.

The Binance Alpha project aims to provide liquidity for project parties while creating an on-chain prosperous interactive scene for the BNB Chain, guiding and incentivizing users to migrate liquidity from CEX to its own ecosystem.

Market data validates the effectiveness of this strategy: From April to July, the daily trading volume of BNB Chain's DEX surged from $1 billion to a peak of $7 billion, with its share of total network trading volume rising from 12% to 49%, while Ethereum and Solana's shares fell from 25% and 22% to 15% and 11%, respectively.

Subsequently, other T2 exchanges also launched distinctive centralized DEX trading experience services. Binance's move not only incentivizes users but also marks 2025 as the experimental year for centralized exchanges to transition and compromise towards the crypto native ecosystem. The Alpha points system aims to strengthen user and community engagement by setting different scores and tiered thresholds, serving as a governance weight distribution mechanism for the Binance and BNB ecosystem.

Institutional Endorsements in Dilemma, New Listing Logic Driven by Community

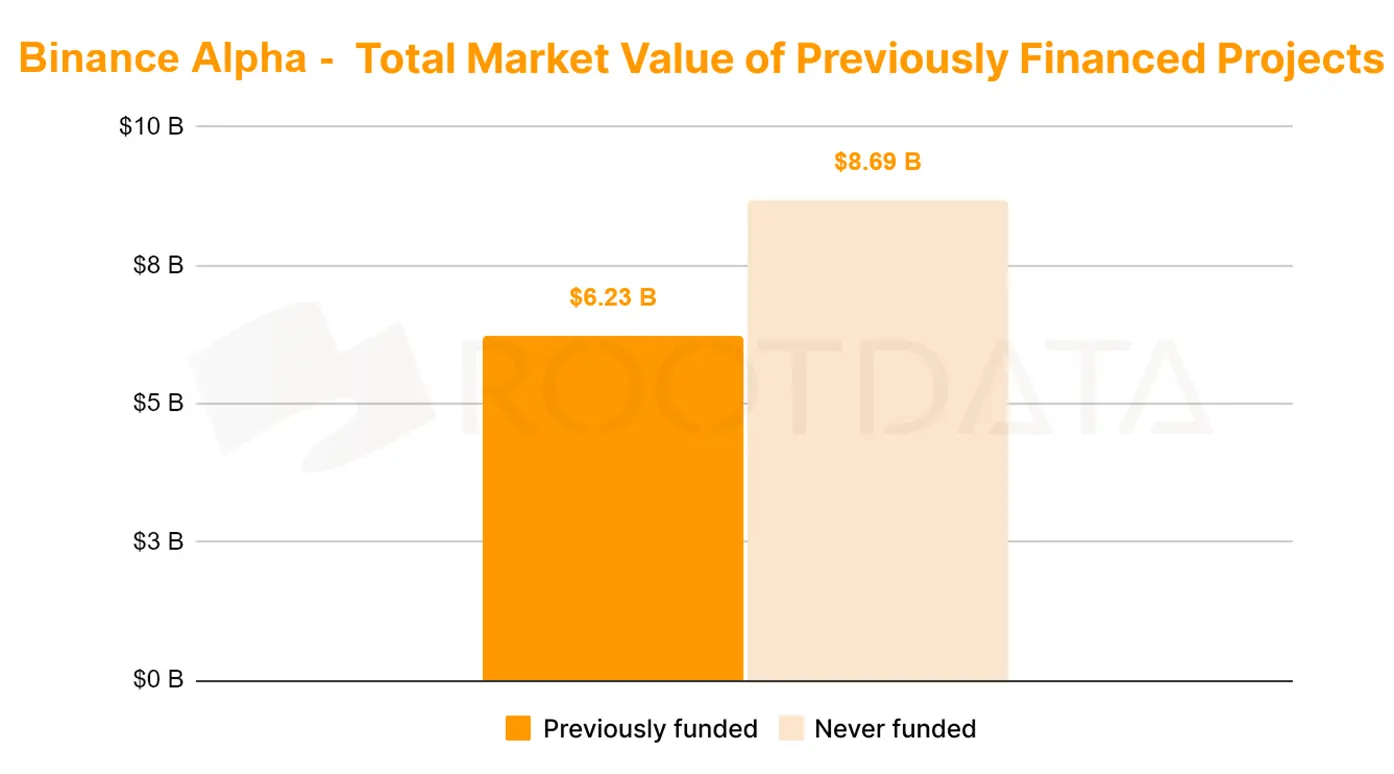

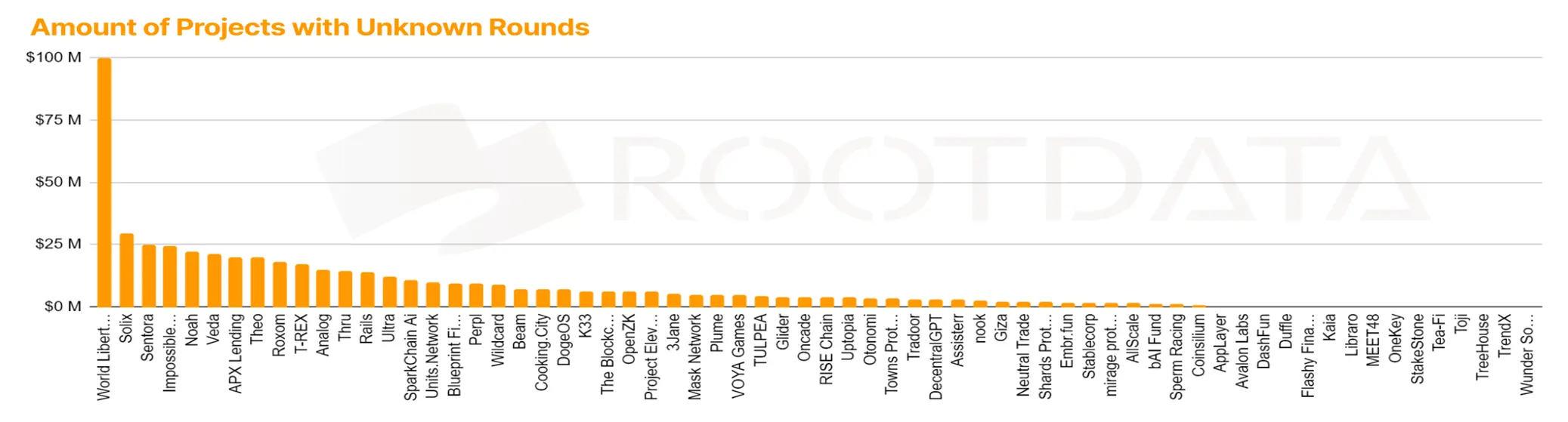

According to Rootdata financing data:

Among the tokens launched on Binance Alpha, projects that have not disclosed financing account for 56.5%, with the total market capitalization of unfinanced projects reaching $8.69 billion, while the total market capitalization of financed projects is only $6.23 billion.

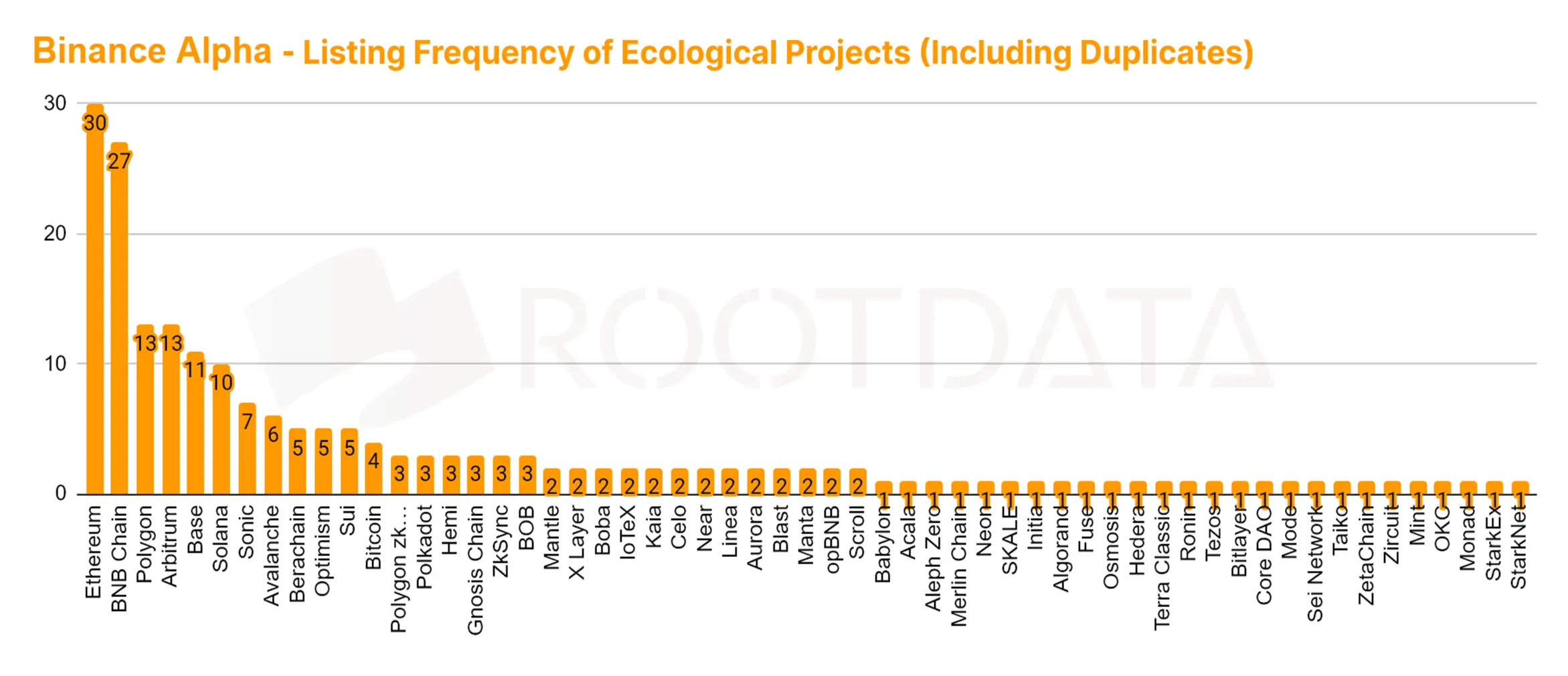

Among all projects, 30 support the Ethereum network, and 27 support the BSC network, followed closely by Polygon, Arbitrum, Base, and Solana.

This means that founders should prioritize supporting mainstream networks like Ethereum and BSC to improve their chances of being selected by Binance Alpha, in addition to obtaining exit strategies through formal listings on Binance.

More importantly, the market strategy of the projects should prioritize gaining support from Binance users and the community, which may indicate that the necessity of obtaining endorsements from reputable institutions has gradually become a thing of the past for listing on Binance.

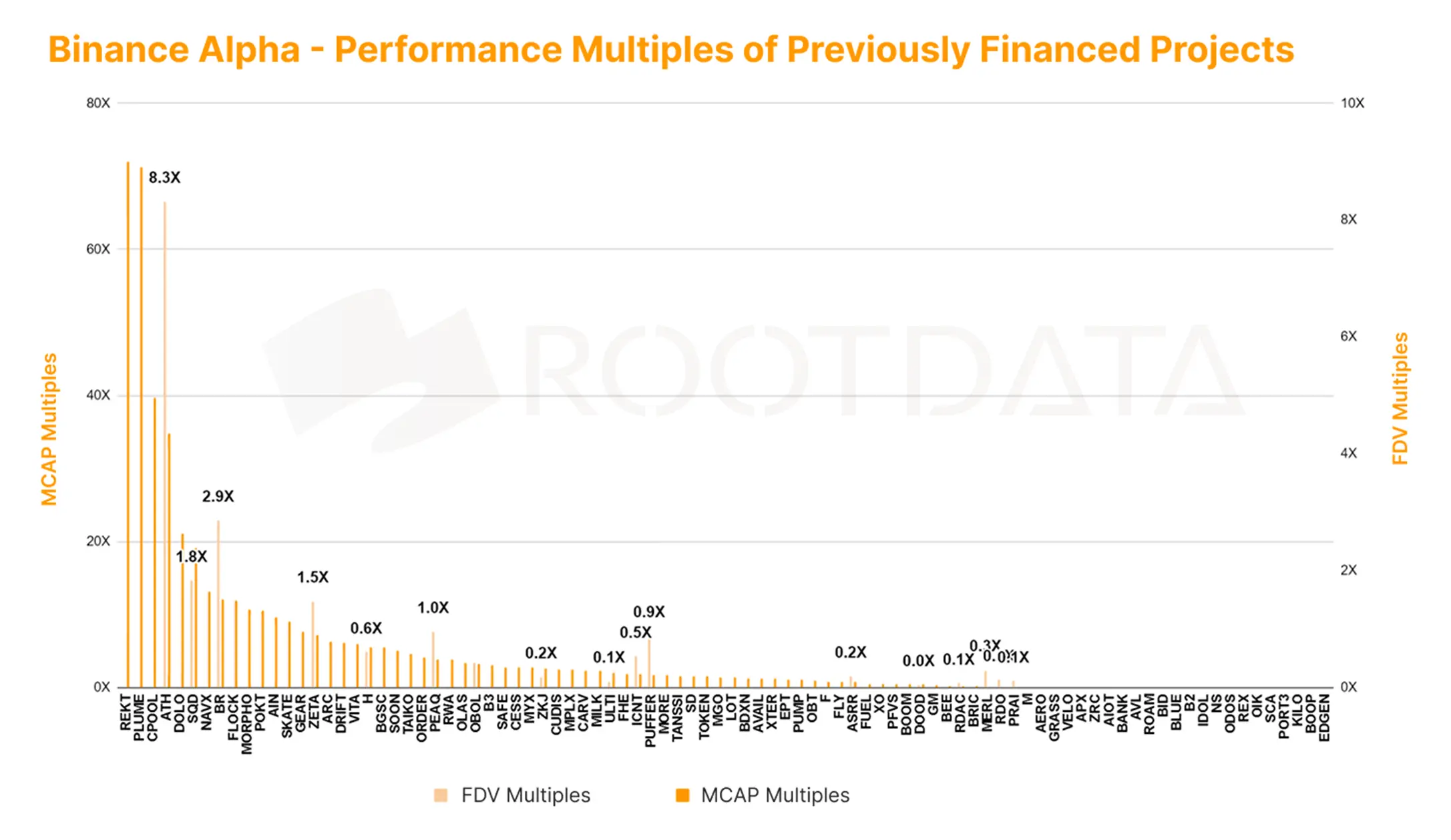

The "VC Coin Curse" Still Effective, Less Than 25% of Projects with Financing Valuation History Perform Well

The "VC Coin Curse" remains effective due to several reasons:

- Insufficient external liquidity in the crypto industry

- Weak purchasing desire among retail investors

- Institutional investment misalignment with overvalued projects

- The crypto industry has entered a phase of maturity characterized by technological bottlenecks

Insufficient innovation and the inability to organically integrate with the thriving AI industry have led to a failure to attract external overflow liquidity.

- MCAP multiple: Calculated by dividing financing valuation by current market capitalization, there are no projects with a financing history that can maintain a multiple above 10, and based on current performance, institutions find it difficult to recover costs.

- FDV multiple: Calculated by dividing financing valuation by current FDV valuation, less than 25% of projects with financing valuation history perform well, with a failure rate as high as 75%.

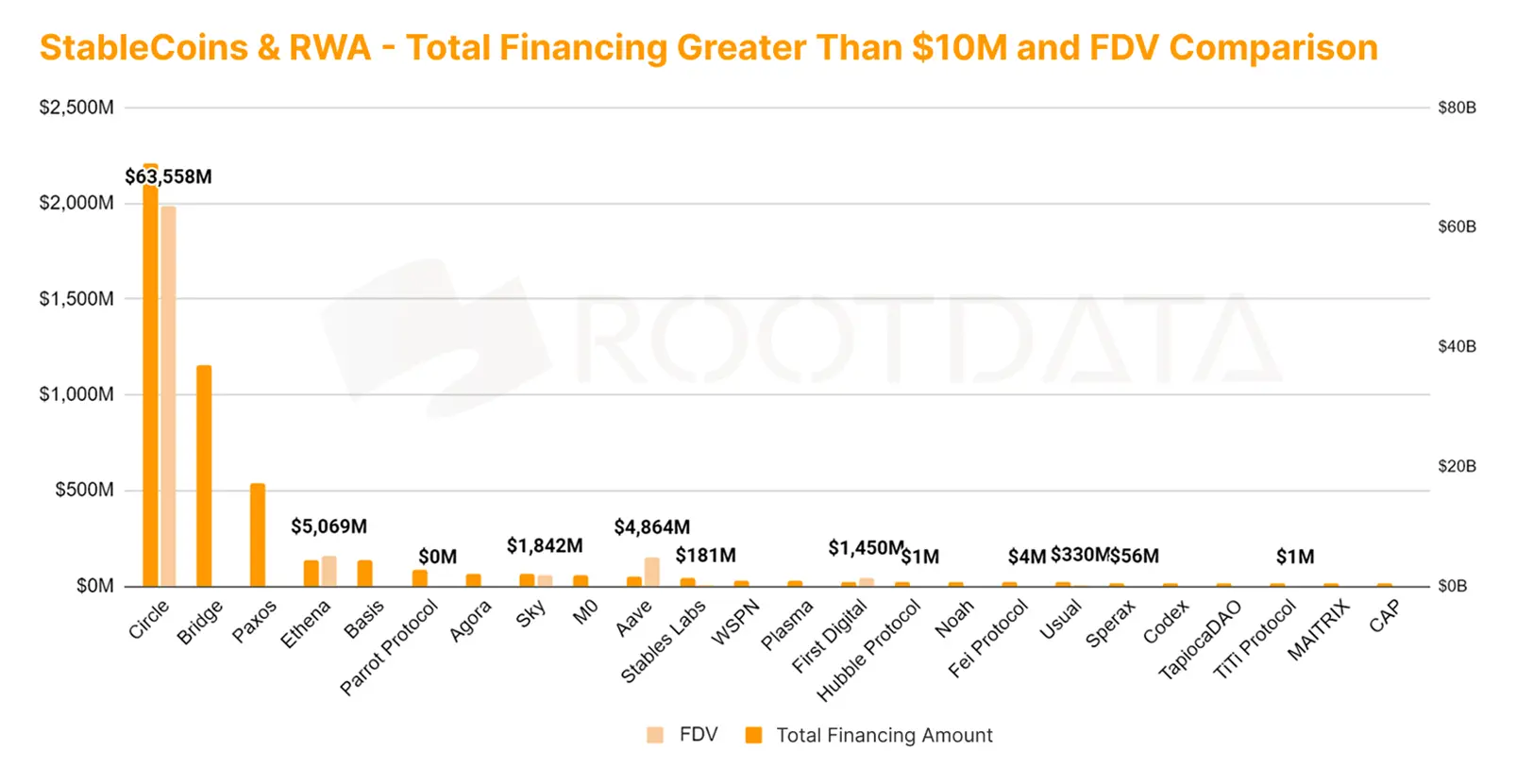

Stablecoins and RWA, A Ray of Hope from Wall Street

The market capitalization of stablecoins grew from $226 billion to $244 billion in Q2, with a quarterly growth rate of 7.9%. Benefiting from the signing of stablecoin regulatory bills and the "Too Big to Fail" act, mandatory holdings and national reserves will provide debt purchasing power for the dollar, and the market capitalization of stablecoins is expected to continue to grow. Therefore, the benefits of holding stablecoins and related RWA returns are also expected to receive national support and tax incentives in the future.

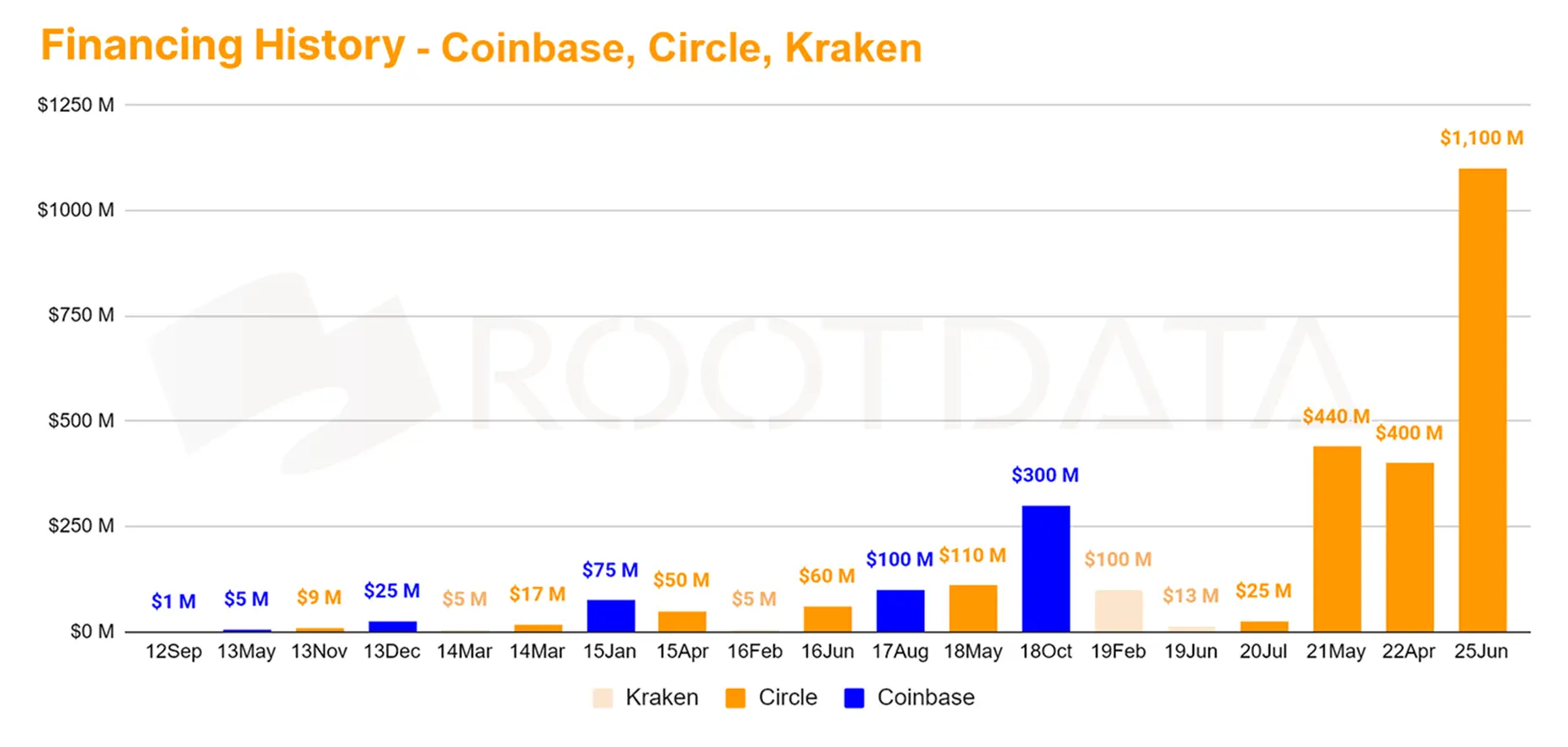

Thanks to these favorable factors, the USDC issuer Circle, which went public in Q2, became the first stablecoin concept stock in the Nasdaq cryptocurrency sector, aside from concepts like BTC mining, cryptocurrency holding, and exchanges, and became a capital-raising beast on Wall Street within a week of its listing.

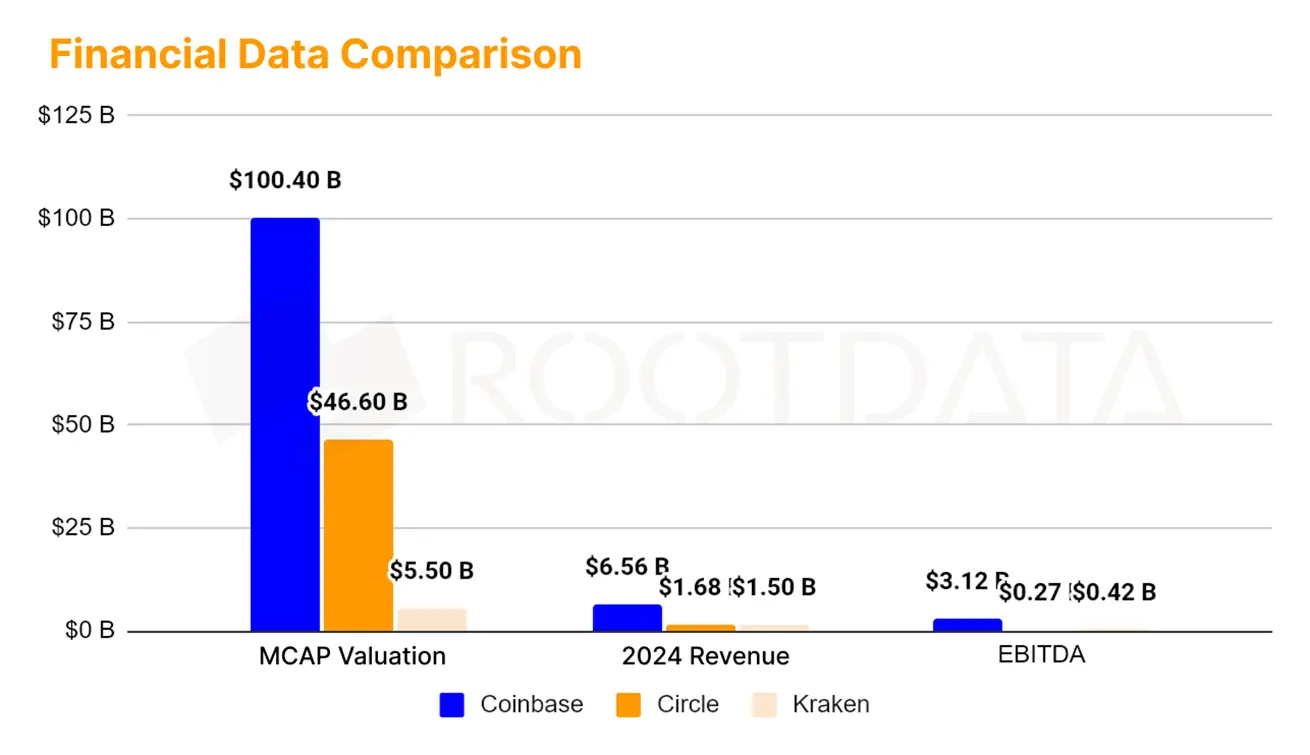

Circle's astonishing performance in valuation surge: According to Rootdata OTC data, Circle SPV was previously sold OTC at $36 per share (an $8.2 billion valuation) before the IPO, while the current CRCL is $204 per share, leading to a post-Nasdaq listing valuation increase to $46.6 billion, recording a 566.7% increase.

Valuation Advantage of Stablecoin Concepts in the Nasdaq Market Compared to Other Cryptocurrency Concepts

According to Rootdata OTC statistics, the hottest IPO project currently is the Kraken exchange concept stock. Kraken's Pre-IPO valuation analysis shows:

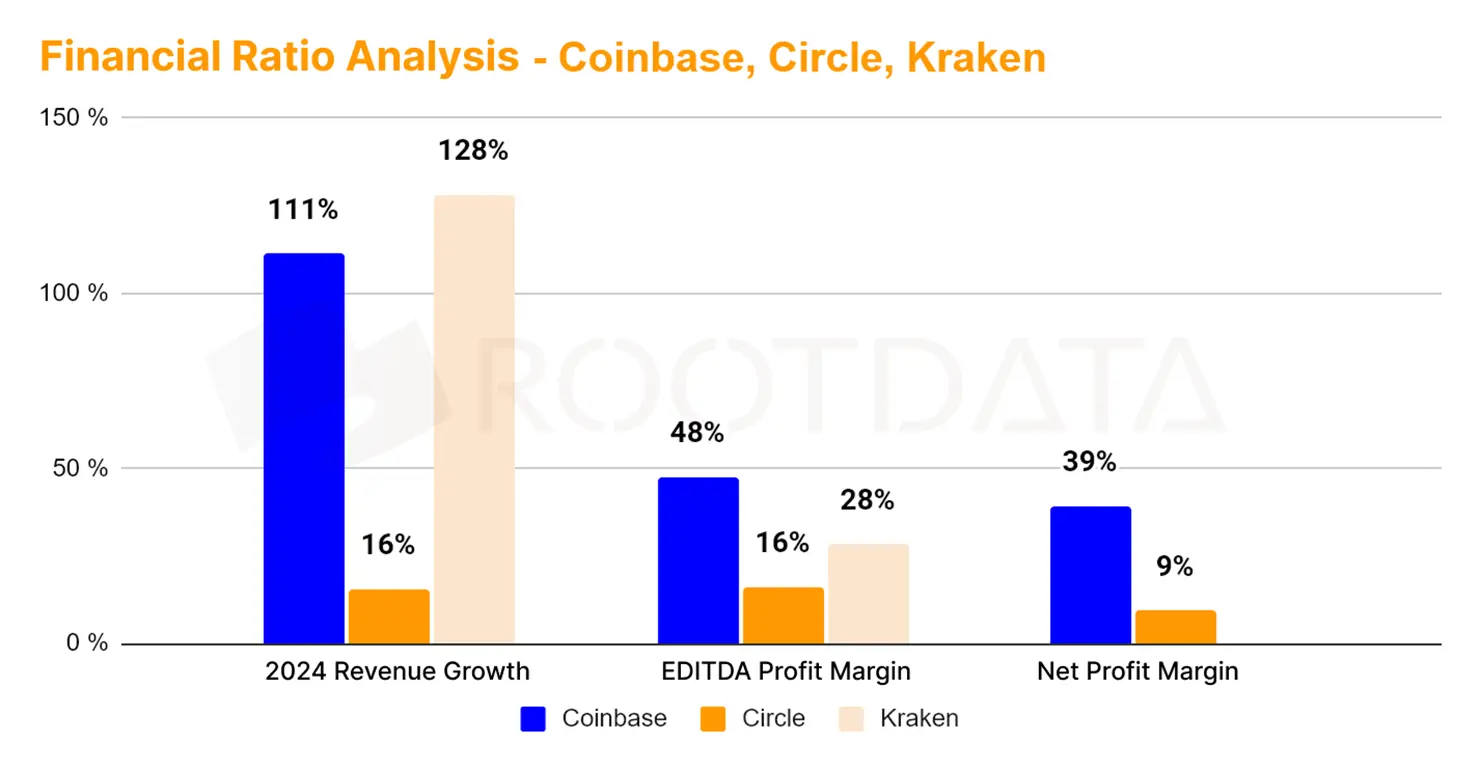

- Using the P/E method, there is a potential upside of 20 times for Coinbase and 8 times for Circle.

- Using the revenue method, there is a 4 times potential for Coinbase.

- Kraken's cost control, revenue growth, and profit margins are significantly higher than Circle's.

This indirectly reflects Wall Street's preference for stablecoins and RWA, confirming the valuation advantage of stablecoin concepts in the Nasdaq market compared to other cryptocurrency concepts.

Circle is the project with the highest financing amount in the IPO, reaching $2.2 billion, while Coinbase and Kraken only raised $500 million and $120 million, respectively, with their large U.S. stock financing occurring approximately every 1-2 years.

Mergers/Pre-IPO/IPO/Private Placements Occupy the Top Four Financing Rounds by Amount

Under the influence of Q2 trends, Rootdata shows that market hot money is gravitating towards U.S. stock concepts, with the highest financing rounds in the first half of the year being dominated by institutional activities (mergers/Pre-IPO/IPO/private placements), significantly surpassing the previously favored seed to A-round financing in DeFi and infrastructure sectors.

Integration of Upstream and Downstream Resources in the Industry, SPACs Draw Attention of Crypto Whales to Wall Street Funds

Notable key transactions include:

- Deribit, a leader in options trading, was acquired by Coinbase, which simultaneously launched perpetual contract trading in compliance with U.S. regulations.

- Nano Labs mining concept.

- The屯币 concept of Sol Strategies raising bonds issued by Solana and SharpLink raising bonds issued by ETH.

This trend of capital flow confirms the cyclical characteristics of the aforementioned technological bottlenecks and maturity curves—integration of upstream and downstream resources in the industry, while also blowing the wind of familiar SPAC reverse mergers from 2021, igniting the enthusiasm of crypto whales for Wall Street funds. As entrepreneurs consider how to increase cash flow, they should also think about how to "monetize" at the right time.

The Path for Crypto Grassroots: RWA or Algorithmic Stablecoins?

According to Rootdata statistics, the financing amounts comparable to Circle's stablecoin concept are Bridge, Paxos, and Ethena, among which DeFi applications like RWA and algorithmic stablecoins are severely undervalued compared to Circle, which has Wall Street funding support.

Through the analysis of the above chart, early investors and reinvestors in Circle, Coinbase, and Kraken include prominent VC firms such as Breyer, DCG, General Catalyst, IDG, a16z, and Rabbit Capital, which have become the biggest winners in this round of crypto U.S. stock concepts. This dispersed risk capital overflow is expected to mitigate investment risks to the aforementioned related crypto-native stablecoins & RWA concept coins.

View the PDF version of this report: Chinese | English

About RootData

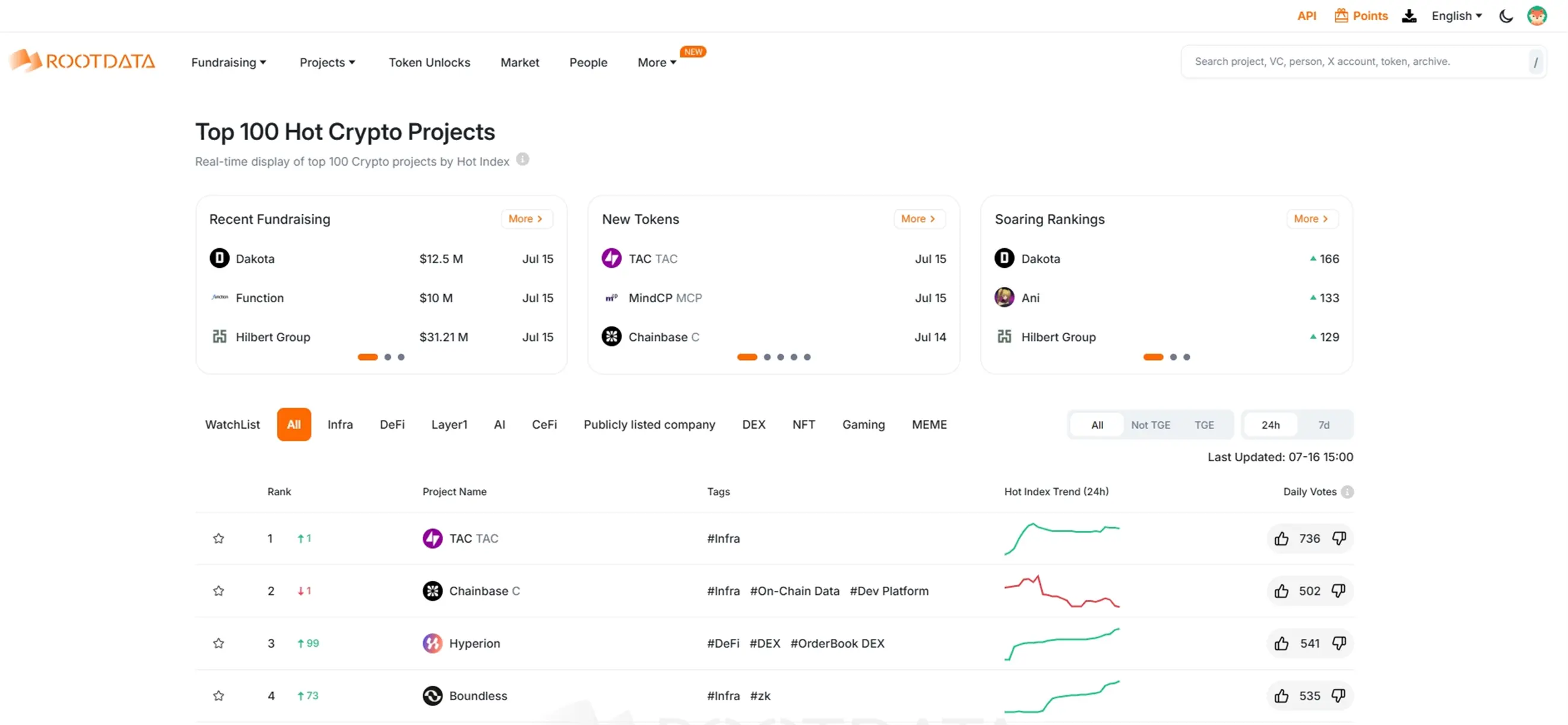

RootData is a Web3 asset data platform dedicated to making Web3 investment simpler, having recorded over 16,000 projects, 10,000 investors, 13,000 individuals, and 8,800 financing rounds, presenting data in a highly visual and structured manner, and has become an essential data platform for over 2 million Web3 users to discover early alpha projects and make investment decisions.

Disclaimer

This report is produced by RootData Research. The information or opinions expressed in this report do not constitute investment strategies or recommendations for anyone. The information, opinions, and speculations contained in this report only reflect the judgment of RootData Research on the day of the release of this report. Past performance should not be used as a basis for future performance. At different times, RootData Research may issue reports that are inconsistent with the information, opinions, and speculations contained in this report. RootData Research does not guarantee that the information contained in this report is kept up to date. Reliance on the information in this material is at the discretion of the reader. This material is for reference only.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。