Author: jawor, Crypto KOL

Translation by: Felix, PANews

"Human brains are naturally good at storytelling. And the economy is built on human decisions." — Robert J. Shiller (American economist, Nobel Prize winner)

1. Narrative as the Market Engine

In December 2017, something strange happened. Friends who had never cared about the crypto market began asking how to buy Bitcoin. Not because they had read the white paper or even understood what blockchain was. They had simply heard a story: someone they knew made life-changing money.

That was enough.

In what Nobel laureate Robert J. Shiller calls narrative economics, cryptocurrencies are the most fertile ground: the infectious narratives that influence market behavior are no less, and often more, impactful than traditional macro factors like interest rates or GDP.

Retail investors changed the rules of the game. In traditional finance, capital typically flows through structured channels: fund managers, analysts, investor reports. Now, capital flows through memes, viral posts, and high-quality Telegram groups. Narrative has become the new fundamental. And this is most evident in the cryptocurrency space.

When the market heats up, narrative becomes a crucial factor in capital allocation. Not the white paper, not the balance sheet, but belief.

The core argument is that the volatility of the crypto market does not depend on technology, user growth, or revenue (at least not initially). It depends on belief, which is built on compelling stories.

2. How Narrative Works: Capital-Infused Virality

Robert Shiller believes that the spread of economic narratives is like a virus. The most powerful narratives are not necessarily true — they are simply infectious. They appeal to emotions, identity, and FOMO psychology. In the cryptocurrency space, this spread is instantaneous, global, and algorithmically amplified.

A typical narrative usually starts with a seed idea: Bitcoin is digital gold. Ethereum is a world computer. DeFi is the new banking system. These ideas are simple, intuitive, and emotionally appealing. Once such a narrative gains popularity, it begins to reshape people's values.

The lifecycle of a powerful crypto narrative typically follows this trajectory:

- A narrative is born: someone writes a blog post, a key opinion leader hints at a trend, or a charismatic founder articulates a vision.

- The narrative spreads through social platforms, YouTube channels, and Discord.

- As the narrative gains influence, it changes the way people think. Even if there are no changes on-chain, the related assets feel more valuable.

- Capital flows in, chasing the narrative.

People often talk about network effects in a technical context. But narratives themselves also have network effects. The more people believe in a story, the more real it becomes: socially, economically, and ultimately financially.

Two key elements can make a narrative more infectious:

- A familiar face: a person who can represent the narrative. Think of Satoshi's mystery, Vitalik's wisdom, or Anatoly's product power. People are drawn to faces.

- A familiar plot: great narratives often resonate with well-known storylines. For example, the underdog, the rebel, the revolution. Cryptocurrencies fit these themes perfectly. They are anti-bank, anti-establishment, and support freedom.

Ultimately, in the crypto space, narrative is not an additional layer on top of the product. Narrative is the product itself.

3. Case Studies: Narratives Create Markets

Bitcoin: Digital Gold

In 2020, Bitcoin itself did not change. What changed was people's perception of it. The mainstream narrative shifted from "peer-to-peer cash" to "digital gold." Suddenly, Bitcoin was positioned as a hedge against inflation, a safe haven in an era of money printing. It was not Bitcoin's technology that attracted MicroStrategy or Tesla, but this idea.

The mysterious legend of Satoshi also played a role. This vanished founder made the story more compelling. It was not just code — it was a movement.

Ethereum: The World Computer

When Ethereum launched, there were almost no usable dApps. But its concept — a decentralized platform where anyone can build unstoppable applications — was highly appealing. The phrase "code is law" resonated deeply. The market was not buying actual usage, but potential.

Ethereum became valuable not because of its current state, but because of its promise.

DeFi Summer of 2020

During the DeFi summer, yields were absurdly high. But the core driver was not the annual percentage rate (APR), but the narrative: permissionless finance, being your own bank, financial primitives unbound by banks or borders. This idea spread rapidly. Most protocols had almost no revenue, few users, and flawed tokenomics — but that didn't matter. The narrative itself was enough to transcend reality.

NFTs as Cultural Ownership

Why are some people willing to spend millions of dollars on a JPEG image? Because NFTs are not about the image itself — they are about identity. The narrative is simple and enticing: digital ownership will redefine art, music, and status. Owning a "Bored Ape" is not about aesthetics, but about showcasing identity.

The narrative itself is more important than the product. That is why it succeeds.

AI Tokens of 2023 - 2024

Some projects with lacking product features and zero revenue skyrocketed simply because of the phrase "AI + cryptocurrency = the future." The AI concept, which has long been hot in traditional finance (TradFi), has now spread to the cryptocurrency space, bringing in a flood of speculative capital. Practicality does not matter; narrative is key.

Meme tokens with "agent" in their names surged tenfold. Founders rushed to add "AI" to their roadmaps. Investors are optimistic about their potential, even if it is just talk for now.

4. Why the Crypto Market is Particularly Susceptible to Narrative Influence

Cryptocurrencies lack traditional valuation benchmarks: no balance sheets, no price-to-earnings ratios, and no regulatory filings. This makes the space particularly susceptible to narrative rather than fundamentals.

Additionally:

- It is a retail-driven market that thrives on speculation.

- Meme culture spreads rapidly through social media.

- The liquidity of tokens and the ability to list without permission.

These factors create a perfect breeding ground for narrative-driven price behavior. In other markets, narratives are merely accompanying phenomena. In the cryptocurrency space, they are the driving force.

The price of cryptocurrencies is not based on the present state, but on possible futures.

5. Advantage: Trading Narratives

In a narrative-driven market, the advantage comes from early recognition.

Smart traders and funds do not just analyze charts or read code. They pay attention to the social aspect: who is tweeting, the density of memes, whether there is emotional interaction, and whether the narrative is moving from niche to mainstream?

Here are some popular narratives:

- Modular blockchains: "a new design space"

- Solana as the new Ethereum: "fast, cheap, and clean"

- RWA: "balancing yield and compliance"

- Agent-based decentralized finance: "AI protocols that think for you"

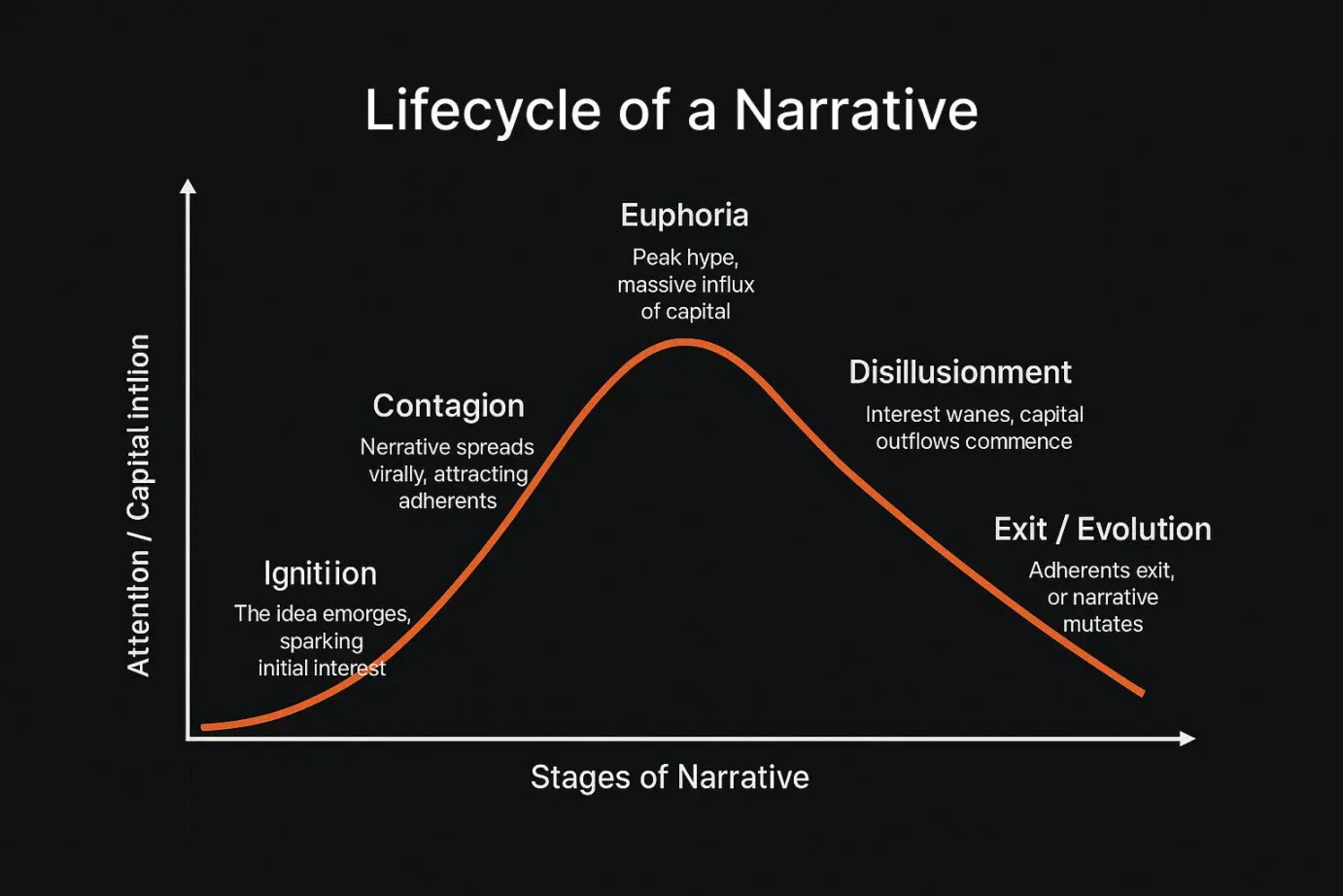

Each narrative follows the same lifecycle:

- Spark: the idea appears in alpha chats and early discussions.

- Spread: influential people amplify it.

- Frenzy: everyone gets involved, and tokens surge.

- Disillusionment: products fail to deliver, interest wanes.

- Exit or evolve: the narrative either dies or transforms.

Timing is crucial. If you enter in the second phase and exit before the fourth phase, you are riding the wave. If you miss the cycle, you can only bear the "burden" of the narrative.

6. Can You Invest in Narratives?

Absolutely. In fact, in early cryptocurrency investments, narrative is one of the few reasonable frameworks.

Robert Shiller makes a compelling point: ignoring narratives is ignoring macro forces. In the cryptocurrency space, this is amplified. Narratives not only reflect the market but also create it.

As cryptocurrencies gradually approach traditional finance, some noise may diminish. But this space will always attract speculators, dreamers, and builders who value vision over metrics.

In the crypto realm, the most successful individuals are not always the best engineers, but those who are best at interpreting market sentiment.

So, keep a long-term focus on narratives, pay attention to community dynamics (CT), and stay updated on the latest trends. Narratives may not be coded but are written.

If cryptocurrency is a grand narrative, perhaps the best traders are those who read a few chapters ahead.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。