For many years, the cryptocurrency industry has been growing wildly in a state of "no rules." This week, the U.S. Congress welcomed a crucial "Crypto Legislative Week," where the GENIUS Act, CLARITY Act, and Anti-CBDC Act collectively created the most comprehensive regulatory framework in the history of U.S. cryptocurrency, setting clear compliance paths while preventing government-issued digital currencies. If these three landmark bills are passed, they could fundamentally reshape the $2.8 trillion cryptocurrency market.

The voting process in the House of Representatives surrounding the three important crypto bills was equally dramatic, with several Republican members unexpectedly flipping during the first vote, and President Trump calling in 12 "core members" who could lead to the bill's failure for discussions. In the second vote, after nearly ten hours of back-and-forth, lawmakers ultimately passed a procedural vote (to determine whether the bill could be voted on), marking the longest vote in congressional history. This outcome paved the way for substantive discussions on the "Guidance and Establishment of a National Innovation Act for Stablecoins" (GENIUS Act), the "Digital Asset Market Clarity Act" (CLARITY Act), and the "Anti-CBDC Surveillance State Act."

Republicans "resisting" Trump, the longest legislative vote in history

The most closely watched is the GENIUS Act, which will establish a federal regulatory framework for stablecoins; the CLARITY Act aims to define when crypto assets are considered commodities or securities, clarifying the regulatory boundaries of the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC); another bill aims to prohibit the issuance of central bank digital currencies (CBDCs) in the U.S. to protect the financial privacy of Americans. If these bills are passed, the industry will transition from a "let's see" approach of gray innovation to a new era of "rules to follow."

Congressional Process and Initial "Failure"

The GENIUS Act was passed in the Senate on June 17, 2025, with a bipartisan vote of 68-30, becoming the most advanced comprehensive crypto legislation to date. However, House Republicans, led by Freedom Caucus Chairman Andy Harris (R-MD), demanded stronger anti-CBDC provisions before advancing the bill. On July 15, 2025, 12 House Republicans defied Trump's explicit instructions, voting 196-223 against the procedural rules for the GENIUS Act. This rare division within the Republican Party focused on a key issue: the lack of explicit provisions prohibiting central bank digital currencies (CBDCs).

The 12 Republican dissenters included notable figures like Marjorie Taylor Greene (R-GA), who stated she voted against it "because the bill does not include a ban on central bank digital currencies," and Anna Paulina Luna (R-FL), who warned it could create a "backdoor for central bank digital currencies." Their concerns reflect a deeper ideological opposition to the inherent government surveillance capabilities of CBDCs.

Without CBDC restrictions, the Federal Reserve could create an unprecedented digital surveillance state in U.S. history. CBDCs would enable the government to monitor all financial transactions in real-time, effectively eliminating the privacy protections of physical cash. The economic implications are equally significant, as CBDCs could trigger massive bank runs, with citizens transferring deposits to direct accounts at the Federal Reserve, potentially undermining the stability of the $18 trillion banking system.

Currently, 137 countries representing 98% of global GDP are exploring CBDCs, with China's digital yuan already in widespread use. Republican opponents argue that without a clear ban, the U.S. could unwittingly fall into a "money surveillance tool," fundamentally altering the relationship between citizens and the government.

The "Opposition" Called to the Oval Office by Trump

Trump's intervention on the evening of July 15 broke the deadlock. After meeting with 11 of the 12 dissenters in the Oval Office, Trump secured a commitment for a vote the next day through a carefully crafted compromise. The resolution included attaching the "Anti-CBDC Surveillance State Act" to the "Defense Authorization Act" and adding "clear and strong anti-central bank digital currency provisions" to the CLARITY legislation.

Trump's post on Truth Social stated, "After a brief discussion, they all agreed to vote in favor of the rule tomorrow morning." This personal intervention demonstrated Trump's continued influence over Republican meetings, even in the face of ideological opposition from the most conservative members of his party.

The vote on July 16 became the longest procedural vote in House history, lasting over 10 hours, as the divided Republican leadership worked behind the scenes to reconcile differences among factions. Late Wednesday night, Speaker Mike Johnson facilitated final negotiations, and the dissenting voices among conservative lawmakers gradually diminished, ultimately passing with a vote of 215 to 211.

After the vote passed, the legislative process will enter the final voting stage, with the GENIUS Act, CLARITY Act, and Anti-CBDC Act all on the agenda. Among them, the GENIUS Act is expected to become the first significant piece of legislation in the crypto space signed by a U.S. president, as it has garnered bipartisan support in both chambers, aiming to establish federal-level rules for stablecoins.

Details of the new legislation indicate that regulatory standards for stablecoins will be stricter: issuers will need to back their reserves 1:1 with liquid assets such as U.S. dollars and short-term government bonds, and publicly disclose reserve composition monthly. This move aims to instill greater confidence among banks, merchants, and ordinary consumers regarding the legitimacy of using stablecoins. Additionally, the CLARITY Act seeks to clarify when crypto tokens are classified as commodities or securities, thereby expanding the CFTC's regulatory scope over the digital asset industry and alleviating enforcement pressure on the SEC. These measures indicate that the U.S. is establishing rules for the long-ignored cryptocurrency market through legislation.

The resolution set the debate rules for the three crypto bills, clearing the way for comprehensive crypto regulation while maintaining Republican unity on a broader legislative agenda.

Regulation is not the end, but the starting point for the industry's "second life"

For the past decade, cryptocurrencies have been in a "lawless experiment" phase. Bitcoin emerged as a rebellious digital currency experiment, Ethereum brought technological paradigm breakthroughs, and new concepts like DeFi, NFTs, GameFi, and tokenization of physical assets have all flourished in a legal gray area. However, since the FTX collapse in 2022, the "self-narrative" of the crypto space has been severely damaged, with markets and regulators calling for rule-making.

This round of legislation in the U.S. Congress is responding to three major questions: Which stablecoins can legally exist? Which crypto assets are considered commodities, and which are securities? Who will regulate this emerging financial ecosystem? Answers are about to be provided at the federal legal level. Once these three points are clarified, the industry can transition from a trial-and-error approach to a development path that follows fixed guidelines.

As Bitfinex's derivatives head Jag Kooner stated, as long as the legislative framework gradually takes shape, institutional investors will re-enter the market. These three bills create different regulatory pathways that will fundamentally reshape the crypto market, with clear winners and losers emerging across different sectors and projects.

GENIUS Act Changes the Stablecoin Landscape

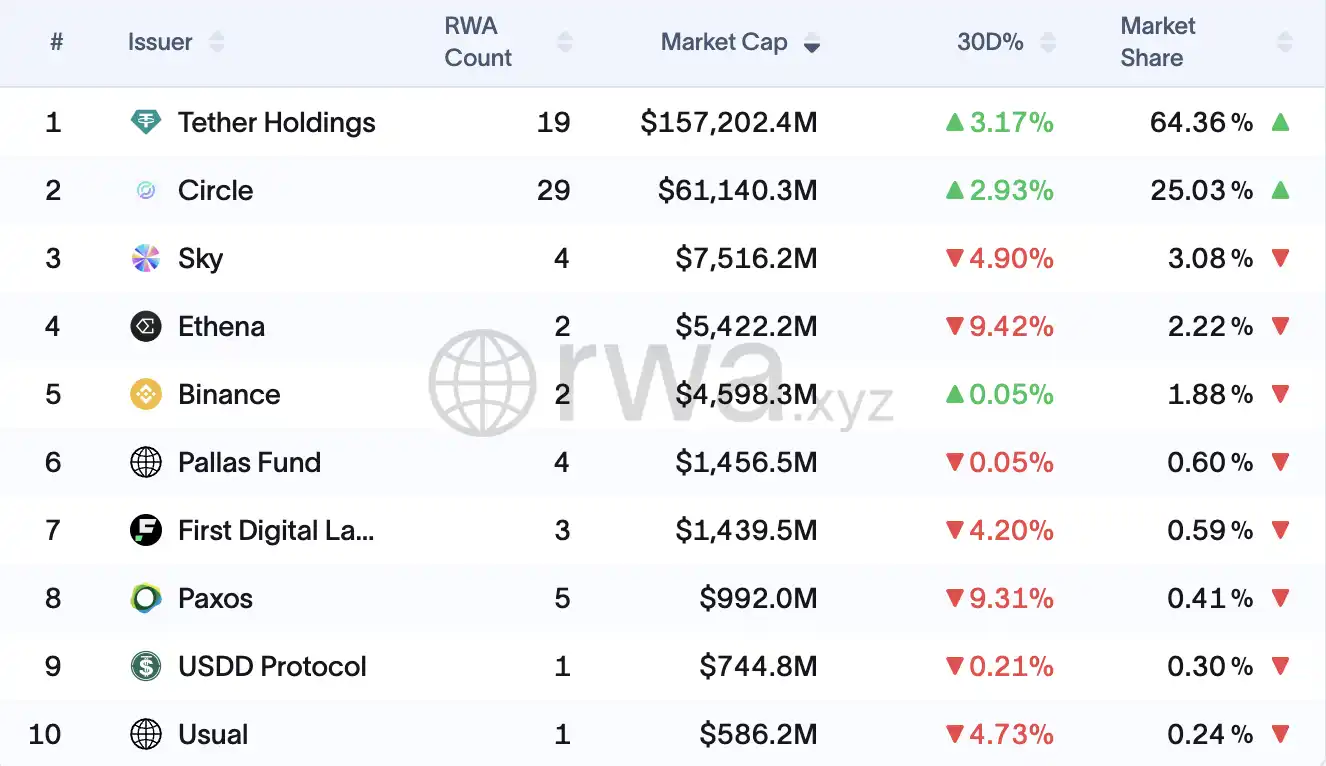

The stablecoin industry, currently valued at over $190 billion, faces the most direct transformation. Circle's USDC emerges as a clear winner, with 80% of its reserves in U.S. Treasury bonds and established banking relationships, already meeting most compliance requirements. The company's listing on the New York Stock Exchange and its partnership with BlackRock position it perfectly for institutional adoption under the new framework.

In contrast, Tether faces greater survival challenges, controlling over 60% of the stablecoin market with a circulation of $155 billion, but its historical lack of proper audits and regulatory compliance poses significant obstacles under the strict requirements of the GENIUS Act. The company must choose between expensive U.S. compliance (estimated at $2-5 million annually) or a potential market exit, focusing instead on its Salvadoran headquarters and unregulated markets.

Decentralized stablecoins like DAI must undergo complex restructuring. With 80% of DAI backed by centralized stablecoins (primarily USDC), MakerDAO faces dependency issues and may need to increase its U.S. Treasury bond reserves from 10% to over 50% to meet new requirements. The DAO governance structure of the protocol may need to be modified to meet centralized decision-making requirements.

New market entrants face initial setup costs of $1-3 million and ongoing compliance costs of $2-10 million annually, creating significant barriers for startups while opening opportunities for traditional finance. Major banks, payment processors like Visa and Mastercard, and fintech companies are preparing for stablecoin issuance, with expectations that this will become a $2 trillion market by 2030.

CLARITY Act Creates Regulatory Certainty but Increases Compliance Costs

The CLARITY Act's approach to delineating jurisdiction between the SEC and CFTC creates the first clear regulatory framework for digital assets but has significant compliance implications for different sectors.

DeFi protocols face the greatest uncertainty, as Uniswap and other decentralized exchanges must implement listing processes similar to centralized platforms, and front-end interfaces may require broker registration. Compound and similar lending protocols are adopting foundation structures for regulatory clarity while demonstrating sufficient decentralization to receive lighter regulation.

Smaller DeFi startups face potential prohibitive compliance costs of $500,000 to $1 million annually, creating advantages for established players. Industry leaders warn that this could force "DeFi developers to move overseas," as protocols require more centralized operational structures to meet regulatory demands. Token projects must navigate the reclassification process when transitioning from "investment contract assets" under SEC jurisdiction to "digital commodities" under CFTC oversight. This may cause short-term price volatility but brings long-term regulatory certainty for compliant projects. Licensed, audited, and registered trading platforms with the SEC or CFTC will attract funding and users, while projects with ambiguous attributes, operating cross-border, or relying on regulatory arbitrage will be marginalized.

NFT markets like OpenSea gain regulatory clarity through potential exemptions from securities exchange classifications, although they must separate customer and company funds. This legislation creates market segmentation between "digital commodities," "investment contract assets," and "non-commodity collectibles," each with different regulatory treatments.

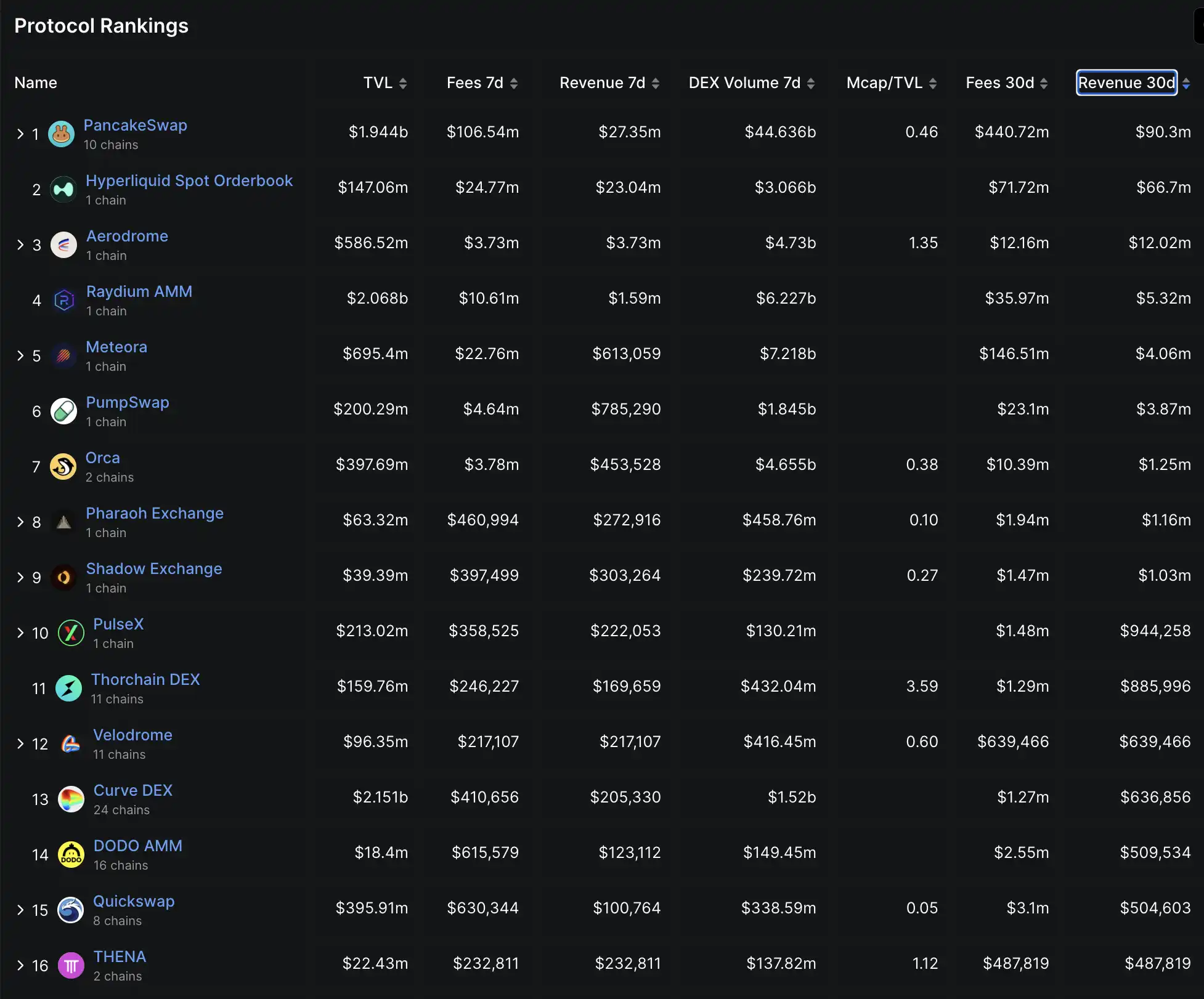

Fewer than 30 DeFi protocols have monthly revenues exceeding $100,000, source: Defillama

Centralized exchanges benefit the most from regulatory clarity, although they face dual SEC/CFTC registration compliance costs ranging from $10 million to $50 million annually. Regulated platforms like Coinbase gain a competitive advantage over unregulated competitors while entering institutional markets that were previously inaccessible due to regulatory uncertainty.

Anti-CBDC Act Protects Private Sector Dominance

The Anti-CBDC Act creates the most significant long-term market protection for private digital payment systems. By prohibiting the Federal Reserve from issuing central bank digital currencies, this legislation eliminates government competition in retail digital payments, benefiting the entire private crypto ecosystem.

Stablecoin issuers gain permanent market protection from government competition, ensuring that private stablecoins remain the dominant digital payment mechanism. This ban drives innovation incentives for private digital payment solutions while protecting traditional payment processors like Visa and Mastercard from CBDC competition. Community banks emerge as significant winners, maintaining their deposit bases and lending capabilities without facing government competition for retail deposits. The ban prevents the Federal Reserve from becoming a competitor to retail banks, preserving the role of traditional banks in credit creation.

This presents new opportunities for traditional financial institutions along with stricter requirements, as banks must invest between $5 million and $20 million for stablecoin issuance and compliance, while payment processors need $2 million to $10 million for enhanced anti-money laundering/know your customer requirements. The regulatory framework allows pension funds and asset management companies to enter the crypto market for the first time, with crypto exchanges categorized as winners and losers based on regulatory compliance. Compliant U.S. exchanges gain market share, while foreign platforms face higher operational costs, creating a competitive advantage for regulated platforms seeking to engage institutional investors.

The era of the SEC's "arbitrary enforcement" may soon end, with the Commodity Futures Trading Commission expected to become one of the core regulatory bodies for digital assets. Blockchain projects developed in the U.S., compliant custody services, and legally recognized stablecoins will be revalued. In other words, the once "disorderly and borderless" crypto industry is about to enter a new phase characterized by clear rules, compliant operations, and higher entry barriers.

How Does the Crypto Industry View Wall Street?

Industry insiders generally hold an optimistic view of this round of legislation. Steven Goldfeder, CEO of Offchain Labs (the developer of Arbitrum), points out that the biggest uncertainty in the crypto space is regulatory risk, stating, "The legislative framework ultimately signals to the market that this technology will continue to exist; it needs a real governance structure, and participation can occur within a trusted system." Similarly, Jag Kooner from Bitfinex believes that even if the final legislation is difficult to pass, the mere signs of "legislative intervention" are enough to boost market confidence.

At the same time, traditional financial giants are also actively positioning themselves. Bank of America CEO Brian Moynihan revealed that the bank is planning to issue a stablecoin, although a timeline has not yet been determined. He believes that as regulatory clarity increases, the banking industry will naturally roll out stablecoin services, similar to the adoption of digital payment platforms like Zelle and Venmo. JPMorgan CEO Jamie Dimon also acknowledged that "stablecoins are real" and stated that banks will participate in the development of the stablecoin sector. These signs indicate that both crypto-native teams and Wall Street giants are seizing the opportunities presented by this "anchoring moment," preparing for cryptocurrencies to further align with mainstream finance.

Since the birth of Bitcoin, the crypto industry has been destined to engage in a tug-of-war with regulatory forces. Now, this action by the U.S. Congress is expected to provide a systematic response that is "neither stifling nor permissive" for the first time. This is not an end but a new beginning, a transformative moment for crypto assets from self-governance to institutional logic, signifying that this once-experimental space is maturing into an essential part of the global financial infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。