Current interest rate markets expect only a 43 basis point cut by the end of the year, a significant drop from the 67 basis points anticipated in June.

Written by: Long Yue, Wall Street Insights

Despite the growing rumors of Trump firing Federal Reserve Chairman Powell, the two major "barometers" of the financial market are sending completely different signals.

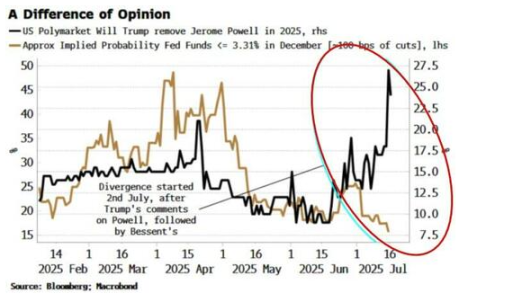

Data shows a clear divergence between the prediction market and the interest rate market regarding Powell's future. The latest development is that Wall Street Insights reported Powell will be interviewed on July 16 (Wednesday), and Trump has drafted a termination letter. This news has once again pushed up the betting odds on the prediction market platform Polymarket regarding "Powell being dismissed in 2025."

However, the interest rate market shows a significantly lower level of concern about Powell's premature departure compared to the probabilities indicated on the Polymarket betting platform. The interest rate market refers to the interest rate derivatives market, particularly the federal funds futures market, which reflects expectations for future Federal Reserve rates through trading prices.

Specifically, after the release of stronger-than-expected employment data in the U.S., the interest rate market actually reduced bets on rate cuts. Currently, the interest rate market expects the Federal Reserve to cut rates by 43 basis points by the end of the year, down from the 67 basis points expected at the end of June. More critically, U.S. Treasury Secretary Basant previously revealed in an interview that he does not fully support President Trump's sharp comments on the Federal Reserve, and his more moderate stance provides a stabilizing anchor for the interest rate market.

As a result, participants in the prediction market continue to reinforce Trump's "firing remarks," while traders in the interest rate market choose to believe Basant's cautious position and economic data indicating ongoing inflationary risks.

The chart shows the divergence between the interest rate market and the prediction market.

Market Divergence Widens

In fact, the prediction market and the interest rate market have been diverging since early July.

Before early July, the implied probability of rate cuts in the interest rate futures market was largely consistent with the betting odds on Polymarket regarding Powell's dismissal. However, this correlation was broken on July 2.

On July 2, Trump publicly demanded Powell's resignation, and the relevant betting odds on Polymarket rose accordingly. However, at the same time, the short-term interest rate market was largely unaffected. Additionally, the employment data released on July 3 was stronger than expected, leading to a sell-off in the interest rate market as traders began to lower their expectations for rate cuts. On the same day, Treasury Secretary Basant, in an interview, refused to fully endorse Trump's comments about the Federal Reserve. His statement further reinforced the market's cautious sentiment. Since then, the two curves have moved in different directions.

According to Bloomberg macro strategist Simon White, the prediction market typically uses political rhetoric as a weather vane, while the interest rate market focuses more on economic fundamentals and policy signals.

Interest Rate Market Pricing Logic: Data and Signals First

The performance of the interest rate market clearly indicates that traders tend to filter out political "noise" and focus on economic "signals." Recent employment data in the U.S. suggests that economic resilience remains, and inflation faces upward risks, which directly weakens the rationale for significant rate cuts by the Federal Reserve in the short term.

Data shows that the interest rate market currently expects the Federal Reserve to cut rates by 43 basis points by the end of the year, which is far lower than the 67 basis points predicted at the end of June.

The core driving force behind this change, aside from economic data, is Treasury Secretary Basant's position. As a key figure connecting the White House and financial markets, his more moderate remarks are interpreted by the market as an important signal of policy continuity, softening Trump's harsh rhetoric.

However, strategist Simon White points out that if any market participants believe Trump's political will will ultimately prevail and successfully install a more "dovish" Federal Reserve chairman, then the odds on Polymarket may be closer to the truth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。