A month ago, we organized the "token airdrop" projects on Binance Alpha, attempting to analyze the market's preference for different conceptual tokens based on the price performance after these projects' "token airdrops."

(Related reading: Which conceptual projects on Binance Alpha can help retail investors make money?)

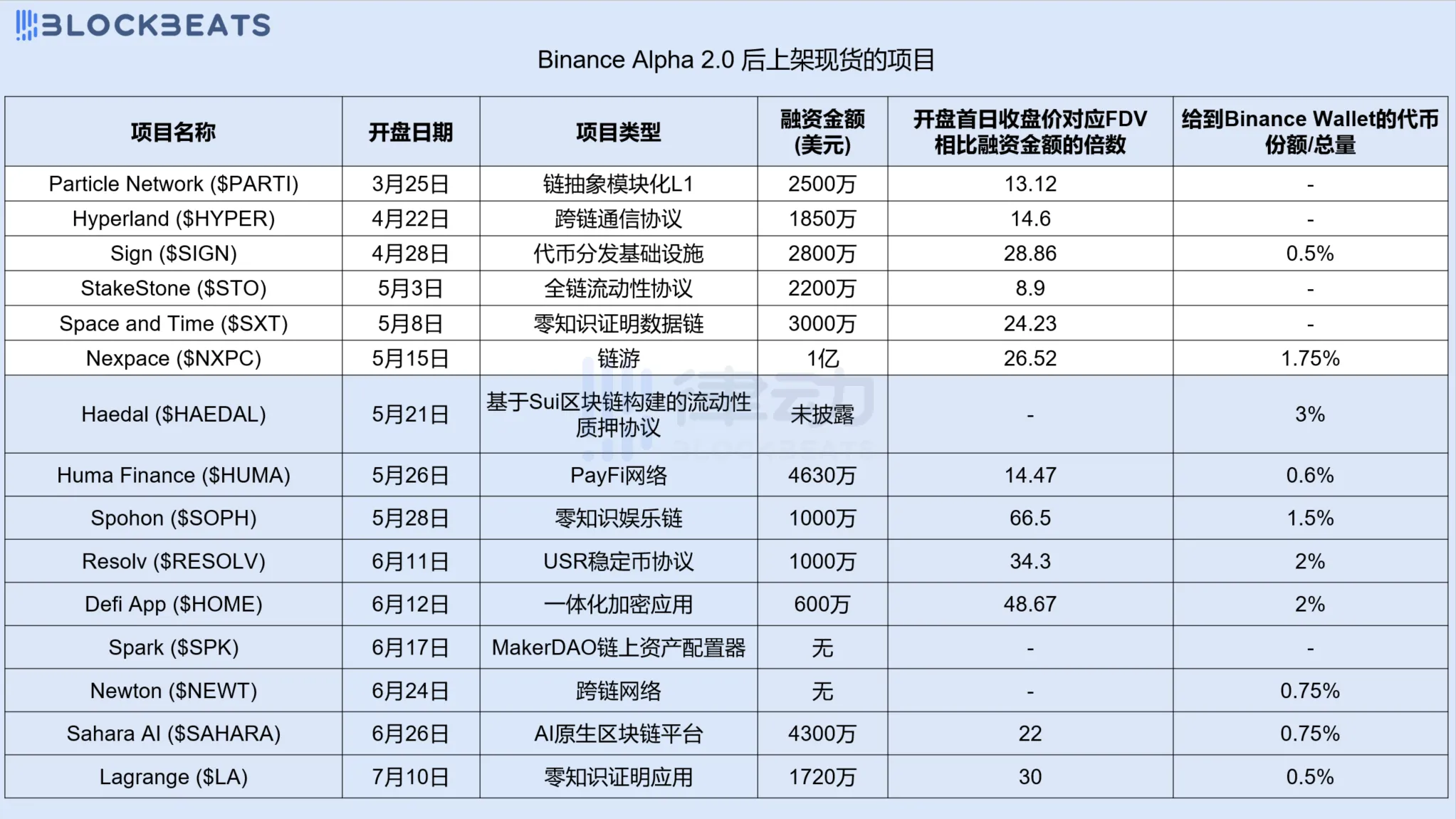

This time, we switched to a new perspective—projects listed on Binance Alpha that have been launched on Binance spot. What effective information and interesting conclusions can we draw from observing these projects from multiple data angles?

Is Binance Alpha still a "foothold" for Binance spot?

Initially, Binance Alpha served as a "foothold" for Binance spot, but after Binance announced the upgrade to Binance Alpha 2.0 in March this year, the correlation between projects listed on Binance Alpha and those launched on spot has weakened significantly.

After the Binance Alpha 2.0 update, there are a total of 88 projects listed, with 71 of them having undergone "token airdrops." Ultimately, only 15 projects have been launched on Binance spot, accounting for about 17% of all listed projects and about 21% of those that have undergone "token airdrops."

Are all the projects on spot "new regular troops"?

After the Binance Alpha 2.0 update, among the 15 projects launched on Binance spot, 13 have received financing. According to the disclosed data from various project parties, the highest financing amount was for the blockchain game "MapleStory Universe Adventure Island" $NXPC, which raised $100 million, while the lowest was for the DeFi app $HOME, which raised $6 million. Excluding the undisclosed financing amount for the project Haedal, the total financing amount for the remaining 12 projects reached $356 million.

As for the 2 exceptions without financing information, they are not insignificant. Spark $SPK comes from MakerDAO, and Newton $NEWT comes from Polygon Labs.

So does Binance have a "preference" for projects invested in by Binance Labs/Yzi Labs? Actually, no. Among these projects, only four—StakeStone, Sign, Sophon, and Sahara AI—received investments from Binance Labs/Yzi Labs.

In terms of project types, Binance does not show any particular "preference," covering a wide range of types. There are modular blockchains, chain abstraction, Payfi, blockchain games, full-chain liquidity protocols, zero-knowledge proofs, and more. These types generally require significant financing for research and development.

It can be said that in the era of Binance Alpha 2.0, the path to Binance spot is filled with "regular troops," and it is difficult to see projects like $AIXBT that come from the chain.

These projects are not only "regular troops," but also "new regular troops"—all are TGE, open airdrop claims, and then almost simultaneously launched on Binance spot. The exception is Lagrange, which was listed on Binance spot more than a month after its launch on Binance Alpha and TGE. From the perspective of the correlation between these projects and the Binance Alpha airdrop activities, 10 projects underwent "token airdrops." The token shares allocated to the Binance Wallet by these 10 projects vary, with Haedal providing the largest share at 3% of its total, while Sign and Lagrange provided the smallest share at 0.5% of their totals.

Compared to the financing amounts, can the performance of these new tokens be considered successful?

Taking the maximum diluted market cap corresponding to the closing price on the first day of trading, among the 12 projects that disclosed specific financing amounts, only 4 projects had a maximum diluted market cap that did not exceed 15 times their financing amount, with the lowest being StakeStone, which still had a multiple of about 8.9.

The remaining 8 projects had maximum diluted market caps corresponding to the closing price on the first day of trading that exceeded their financing amounts by 20 times. Among them, the highest multiple was for Sophon, reaching about 66.5 times, while the lowest was for Sahara AI, reaching about 22 times.

This does not have a direct correlation with project types; factors such as the market environment at the time, the project's own operations, and the market's understanding of the project all play a role. For example, although the blockchain gaming sector has not received much attention or optimism in the market, "MapleStory Universe Adventure Island" still achieved about 26.52 times, which is related to the project's strong game IP and high expectations in the blockchain gaming sector.

Conclusion

From an overall trend perspective, projects listed on Binance Alpha must undergo strict scrutiny from Binance to successfully advance to Binance spot. Having a narrative and financing has become the "standard," but project types are not limited to popular market concepts.

Among the projects we can statistically analyze, more than 75% had a maximum diluted market cap corresponding to the closing price on the first day of trading that exceeded their financing amounts by 20 times, which has, to some extent, become the "passing line" for new projects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。