The essence of institutional-level capital inflow and outflow is not merely a simple exchange of funds and crypto assets, but a complex operational capability that spans across chains, borders, and financial systems.

The on/off ramp business in the crypto industry has always been an inconspicuous yet crucial entry-level business. More importantly, because it connects fiat currency and crypto assets, it faces extremely complex and stringent compliance requirements. Any compliance lapse in the entire chain could lead to consequences ranging from card freezing to legal violations.

From a business model perspective, it may seem like a low-threshold business focused purely on exchanges and earning fees, but looking at future compliance trends, it is actually a critical infrastructure with a very high threshold and significant business potential.

1. Why is the inflow and outflow business so critical?

First, the first step for all fiat currency entry is to choose an inflow and outflow channel, especially for large institutions and high-net-worth individuals. Due to various privacy and confidentiality needs, compliant channels are crucial for large amounts of capital entering the crypto world. Secondly, cross-border and large-scale fiat currency clearing requires extremely high compliance and auditing standards. If trust is lost at the entry point, the entire crypto world’s business will face certain restrictions.

In fact, from a liquidity perspective, inflow and outflow is not just about buying and selling exchanges; it is also a key hub for aggregating off-chain funds and distributing on-chain asset liquidity.

For any institution engaged in inflow and outflow business, the challenges lie not only in the transactions themselves but also in the comprehensive management of cross-border clearing, banking channels, regulatory compliance, and on-chain risks.

2. Why does institutional-level OTC inflow and outflow business seem simple, yet have underlying complexities?

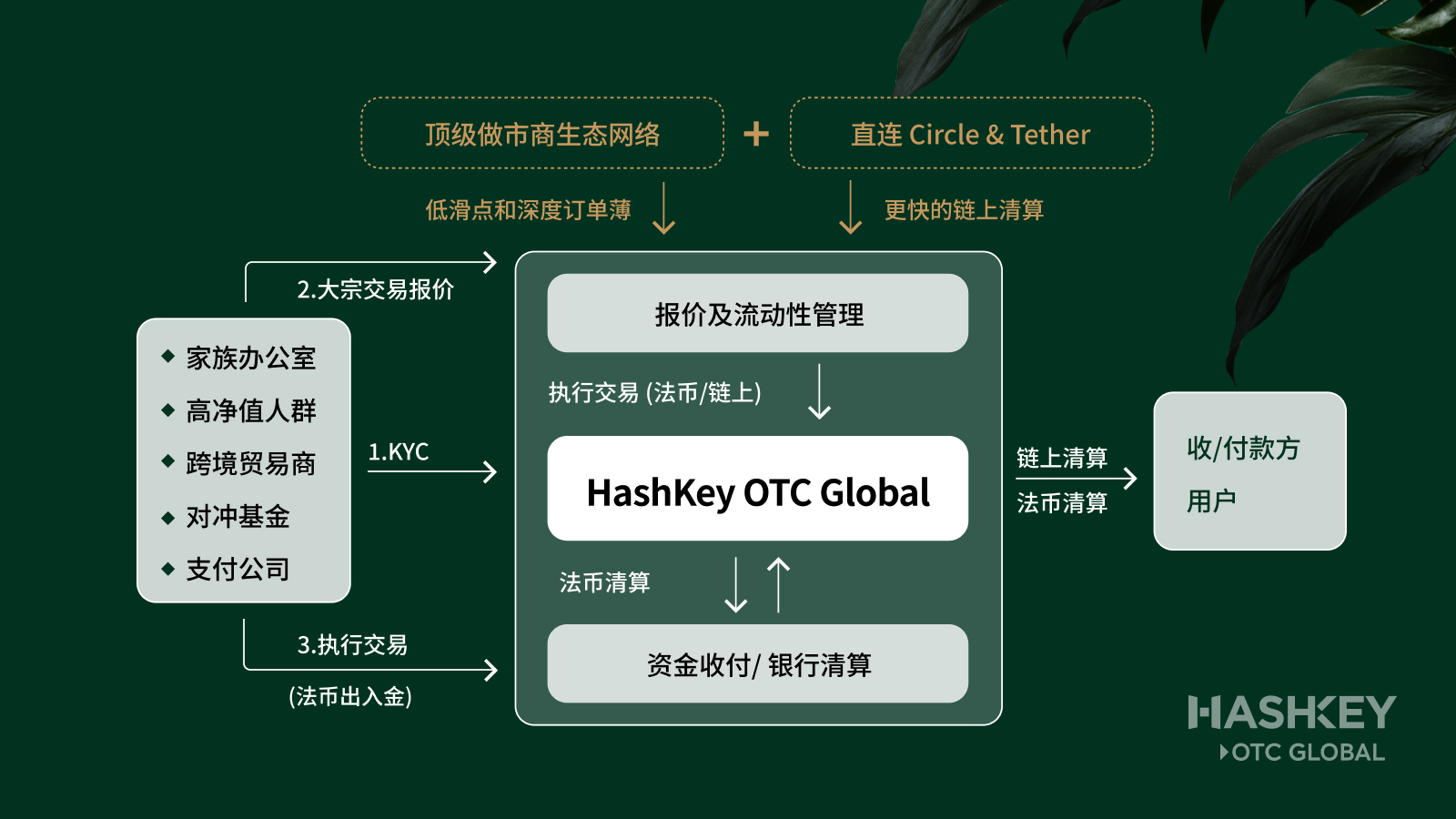

Traditionally, OTC is perceived as direct exchange and instant settlement, but achieving this is not easy. The actual process is far more complex than imagined, mainly involving several key stages, each of which tests comprehensive capabilities. Taking Hashkey OTC Global as an example, the specific process is summarized as follows.

The above business process is not simpler than any trading system; in fact, due to the involvement of traditional banks, on-chain elements, exchange rates, regulatory requirements, and other factors, its complexity and the difficulty of the entire chain are even higher (brief chain link shown below).

First, regarding institutions and global cross-border clearing and exchange rate risks, different regions have completely different regulatory, banking channel, and capital entry and exit requirements, making the process extremely complex.

Secondly, there are multi-layered compliance regulations. The entire business must not only meet local regulations but also comply with the regulations of the counterparty's country. Any mistake in any link could lead to fund freezing.

Finally, liquidity preparation and hedging are required to quickly hedge risks and allocate multi-chain assets in extreme market conditions, testing both technology and global market-making network resources.

Therefore, institutional-level inflow and outflow is essentially not a simple exchange of funds and crypto assets, but a complex operational capability that spans across chains, borders, and financial systems, placing extremely high demands on resource reserves and operational coordination capabilities.

3. What are the main advantages and barriers of HashKey OTC Global?

In the current global crypto market, HashKey OTC Global's layout and capabilities are not only present but may also be unique. Let’s briefly analyze its advantages and barriers:

1. Direct connection to stablecoin sources, primary minting rights

HashKey OTC Global is one of the few global first-level agents with native minting/redemption rights for Circle USDC, bypassing all intermediaries and directly accessing core liquidity. It has also established a strategic partnership with Tether, allowing access to the largest USDT network globally, supporting multi-chain instant clearing.

As the largest compliant stablecoin, Circle has extremely strict review processes for partners, typically granting rights only to the most compliant, high-volume, and strong risk control top institutions globally. Native minting means the lowest capital cost, fastest speed, and most stable liquidity, making it almost irreplaceable by traditional secondary OTC or exchange intermediaries. More importantly, with Circle's listing on the US stock market, the requirements for partner institutions will only increase, further highlighting this scarcity.

2. Exclusive bank-named accounts

HashKey OTC Global is the only institutional OTC service provider that can simultaneously offer named account services from Standard Chartered Bank and DBS Bank, ensuring zero intermediary layer settlement. This truly achieves T+0, with minute-level fund clearing, which is highly attractive for the time value of money.

From a banking cooperation perspective, whether with Standard Chartered or DBS, both globally and in Asia, there are extremely high compliance thresholds for partners. HashKey OTC Global's ability to collaborate with these top banks effectively addresses institutional clients' biggest concerns regarding fund freezing, intermediary risks, and approval delays. This is especially important for high-frequency capital flow scenarios such as arbitrage, hedging, and cross-border trade.

3. Global compliance layout

With multiple licenses in Singapore (MAS), Japan (JFSA), and Dubai (VARA), HashKey OTC Global has formed a global multi-hub compliance network. It collaborates with Moody's for KYC-related processes and services, and Chainalysis for on-chain auditing and tracking services, meeting the auditing requirements of large institutions, family offices, and funds.

In terms of license layout, compliance licenses typically take years to apply for and require strict processes. Even if competitors are willing to invest in the short term, it is difficult to obtain core licenses simultaneously in multiple countries, creating a first-mover advantage that perfectly fits the compliance requirements of top institutions such as global family offices, listed companies, and sovereign funds.

4. Deep liquidity network

HashKey OTC Global's own liquidity and market-making network not only provides extremely deep liquidity but also supports large transaction dark pool execution, ensuring low slippage for large transactions without affecting the market.

Under these four advantages, HashKey OTC Global is not just an enhancement at the trading end but an integrated strategy from the source of funds (banking, compliance) to on-chain issuance and then to scenario circulation.

From the perspective of strategic barriers, native minting rights cannot be temporarily applied for, forming an irreplaceable core node in the stablecoin supply chain; the named accounts with top banks require years of cooperation accumulation and compliance endorsement, also possessing strong exclusivity; and in terms of licenses, the regulatory moat is clear, while in core liquidity and pricing aspects, large-scale market makers and on-chain pools, the deeply accumulated network is difficult to catch up with in a short time.

Overall, at least in the OTC business for institutional funds, there are very few comparable competitors globally, making it highly likely to become the core hub for the future stablecoin ecosystem and large-scale institutional capital entry.

4. More than just OTC, why is HashKey OTC Global a key hub?

With the introduction of stablecoin regulatory frameworks in core Asian markets like Hong Kong and Singapore, the future demand for fast, safe, and low-slippage stablecoin exchanges will surge. HashKey OTC Global is already one of the few service providers with energy-level minting and rapid bank clearing, destined to become the preferred entry and exit point for global stablecoins.

1. Key support for cross-border payments

Additionally, from the broader application scenario of stablecoins in cross-border payments, the global cross-border payment market is approximately $150 trillion, with traditional banking channels facing high costs and slow reviews, which have become industry pain points. HashKey OTC Global's compliant channels, T+0 settlement, and direct fiat connection capabilities are key supports for revolutionizing cross-border payments.

2. Linkage stickiness for institutional large capital allocation

In the future, more family offices, sovereign funds, and listed companies will need compliant, audit-friendly, and rapidly liquid crypto asset allocation solutions. HashKey OTC Global provides a full-link solution from KYC/KYB to exit, locking in long-term stickiness with high-net-worth users and institutional funds.

3. Ecological closed loop with HashKey Group's businesses

As HashKey Exchange and HashKey Chain continue to improve and expand, OTC Global can feed liquidity back into exchanges, on-chain financial applications, and asset tokenization scenarios, achieving continuous integration of stablecoins, asset tokens, and real-world applications. It can also provide full-link inflow and outflow services for HashKey Capital, including VC investment fund inflow and investment return outflow. This not only fills a key link in the positive flywheel of the HashKey Group ecosystem but also allows this business capability to be directly replicated externally, truly becoming the hub of compliant finance in the Web3 world.

HashKey OTC Global is a seemingly simple yet extremely complex and strategically valuable global infrastructure. It is not only the first entry point for crypto capital but also the core channel connecting the TradFi and Web3 worlds.

In the future global digital asset maritime era, HashKey OTC Global will serve as a super engine for global stablecoin and large asset liquidity, carrying the complete value closed loop from fiat—on-chain—real applications, becoming an irreplaceable core hub.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。