These blockchain-based tokens, designed to maintain a stable value, offer a glimpse into a future where governments could leverage their infrastructure to introduce a state-controlled digital dollar. As the U.S. grapples with the implications of a CBDC, stablecoins like Tether’s USDT and Circle’s USDC, which have thrived with fairly minimal government interference, raise questions about whether they are inadvertent prototypes for a broader, more centralized financial transformation.

Stablecoins operate on a simple premise: they are cryptocurrencies tied to a fiat currency, typically the U.S. dollar, to avoid the volatility plaguing assets like bitcoin or ethereum. Issued by private companies, they are backed by reserves of cash, bonds, or other assets, ensuring a 1:1 peg with the dollar. Tether’s USDT, the largest stablecoin, and USDC, issued by Circle, dominate the market, facilitating billions in daily transactions across decentralized finance (DeFi) platforms, remittances, and global trade.

Their utility lies in their ability to merge the speed and transparency of blockchain with the stability of traditional currency, making them a darling of crypto enthusiasts and a potential blueprint for central banks eyeing digital currencies. The U.S. government has long signaled interest in a CBDC, a digital version of the dollar issued and controlled by the Federal Reserve. Unlike stablecoins, a CBDC would be a direct liability of the central bank, offering unparalleled control over monetary policy, transaction tracking, and financial oversight.

Proponents argue it could streamline payments, reduce costs, and enhance financial inclusion. Critics, however, warn of privacy erosion, surveillance risks, and the potential for governments to exert unprecedented control over individual spending. The Biden administration’s 2022 executive order on digital assets tasked agencies with exploring CBDC feasibility, and the Federal Reserve has been studying its implications through initiatives like Project Hamilton. Yet, deploying a CBDC from scratch is a monumental task—unless the infrastructure already exists.

A few years after BTC was introduced, stablecoins became a prominent fixture. Yet in 2011, before stablecoins, Bernard von NotHaus, creator of the Liberty Dollar, was convicted on counterfeiting charges for making and distributing silver coins that resembled U.S. currency and for conspiracy against the United States.

Enter stablecoins, which have quietly built the scaffolding for a digital dollar. Their blockchain networks, wallet systems, and integration with global exchanges provide a ready-made ecosystem. Tether and USDC, for instance, operate on public blockchains like Ethereum, enabling seamless, near-instantaneous transactions across borders. They’ve also navigated regulatory gray zones since their inception. This resilience suggests a tacit acceptance by regulators, who could be observing how these coins function under real-world conditions—potentially as a dry run for a CBDC.

The parallels between stablecoins and a potential CBDC are striking. Both rely on digital ledgers to track transactions, both aim for dollar parity, and both require trust in the issuer’s backing. A CBDC could theoretically adopt a stablecoin’s architecture, swapping private issuers for the Federal Reserve. This transition would be a backdoor approach, bypassing the need to build a CBDC from the ground up. By leveraging existing stablecoin frameworks, the Fed could deploy a digital dollar with minimal disruption, using familiar technology to ease public and institutional adoption. The question is whether this is already happening in plain sight.

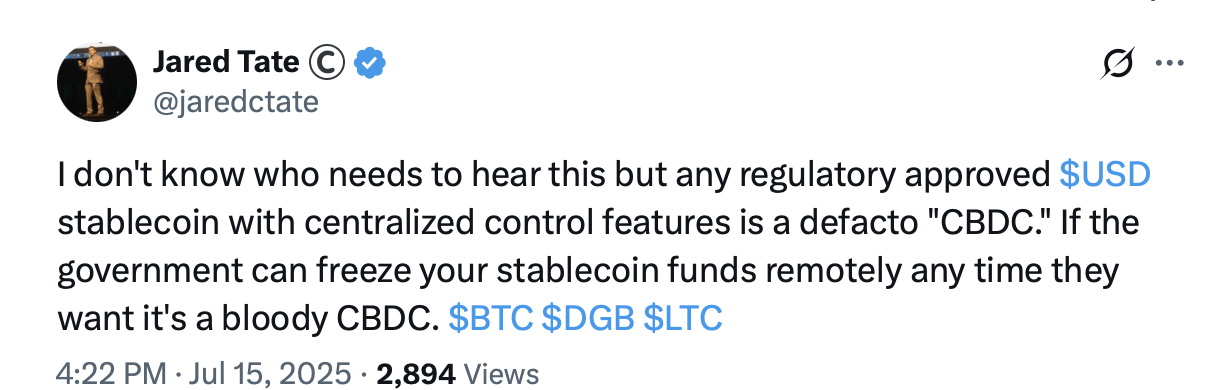

Some critics believe the GENIUS Act serves as a backdoor for a CBDC because it creates a framework for banks to issue dollar-pegged stablecoins that could function similarly to a state-controlled digital dollar, potentially enabling government oversight and control without direct Federal Reserve issuance. By allowing federally chartered banks to issue stablecoins under strict regulatory supervision, the Act could establish an interoperable network of private digital currencies that mirror CBDC capabilities.

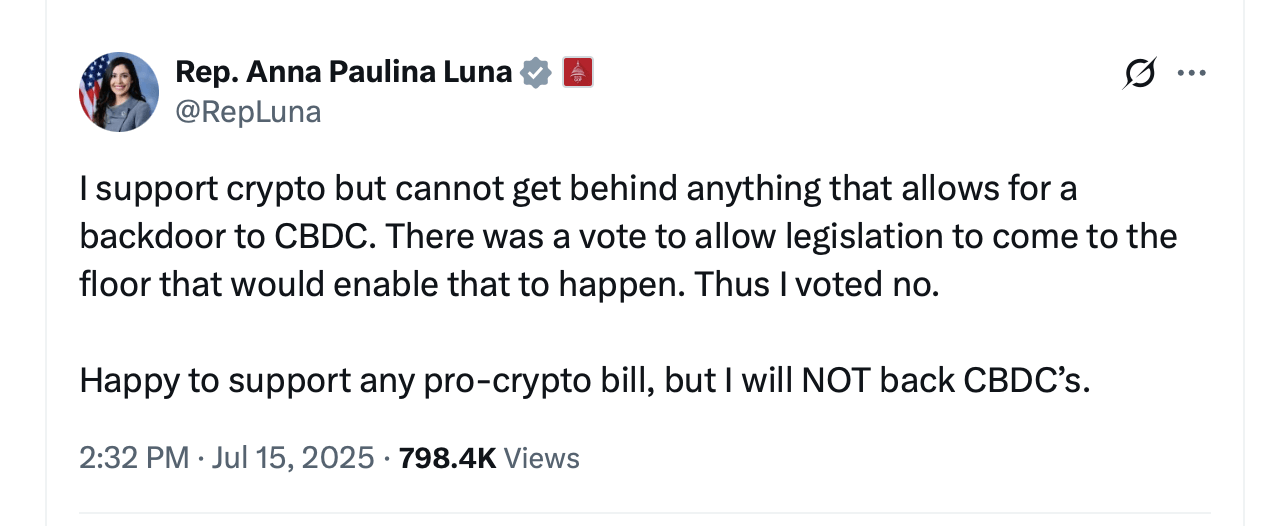

Rep. Marjorie Taylor Greene said she voted NO on the GENIUS Act because it left out one key piece: a ban prohibiting a CBDC. The implications of such a move could be profound. A CBDC built on stablecoin rails could give the Federal Reserve unprecedented visibility into transactions, potentially requiring digital wallets linked to verified identities. Unlike cash, which is anonymous, a CBDC could track every dollar’s movement, raising privacy concerns. Stablecoins already collect user data through exchanges and wallet providers, a practice that could scale under a CBDC.

Moreover, a central bank could program a CBDC to enforce policies—like negative interest rates or spending restrictions—directly affecting how individuals use money. Stablecoins’ smart contract capabilities, which allow programmable transactions, could serve as a template for such controls. Skeptics might argue that stablecoins are too decentralized to serve as CBDC prototypes. After all, their blockchains are often permissionless, meaning anyone can participate without gatekeepers.

But this overlooks the centralized choke points: issuers control reserve management, and exchanges enforce KYC (know-your-customer) rules. A CBDC could retain the blockchain’s efficiency while replacing private issuers with the Fed, centralizing control. The government could also mandate interoperability between stablecoins and a future CBDC, creating a hybrid system where private tokens pave the way for state dominance.

The global context adds urgency to this theory. China’s digital yuan is already in trials, and countries like the Bahamas and Nigeria have launched their own CBDCs. The U.S. risks falling behind in the race to define the future of money, especially as stablecoins like Tether dominate cross-border payments in regions with unstable currencies. If the U.S. were to integrate stablecoin infrastructure into a CBDC, it could maintain the dollar’s global dominance while countering foreign digital currencies.

This strategic advantage might explain why regulators have allowed stablecoins to flourish despite their risks. Public perception remains a hurdle. Stablecoins enjoy trust among crypto users, but a CBDC could face backlash over surveillance fears. The government could mitigate this by framing a CBDC as an evolution of stablecoins, emphasizing familiarity and stability. For instance, a popular dollar coin’s transparency and reserve backing could serve as a model to reassure users that a digital dollar is just as reliable.

Meanwhile, stablecoin issuers might welcome integration, as it could cement their role in a government-sanctioned system, shielding them from future regulatory crackdowns. The road to a CBDC is fraught with technical and political challenges, but stablecoins offer a compelling shortcut. Their widespread adoption, battle-tested infrastructure, and regulatory resilience over the last decade make them ideal candidates for a backdoor transition.

Whether intentional or not, the survival of Tether and USDC amid regulatory As the Federal Reserve inches closer to a CBDC, the line between private stablecoins and state-controlled currency blurs, raising a critical question: Are we already using the prototype for the future of money?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。