Author: Tuo Luo Finance

In the past week, the market's most关注的 TGE is none other than Pump.fun. This major token issuance event began in June and has been brewing amid anticipation and criticism, until July 12, when the token was finally launched. Despite ongoing doubts about its $4 billion valuation, data shows that investors made their preferences clear, as the public offering was sold out in just 12 minutes, with some investors even venting their frustrations on social media for missing out.

As of now, Pump.fun has delivered a relatively satisfactory performance. After its launch, the price has steadily increased, and today, Pump.fun also conducted its first token buyback using transaction fees. But can the token price really be maintained? This question remains uncertain in the minds of many.

Speaking of the king of applications in this bull market, Pump.fun may not be in first place, but it is certainly among the top contenders. It is no exaggeration to say that the emergence of Pump.fun has successfully elevated MEME to new heights. Its concept of fair launch and convenient operation has completely broken the high barriers of traditional issuance models, making it tempting to create a token for just $3. Even as MEME faces a downturn today, it still holds significant appeal.

From a mechanism perspective, there are no pre-sales or private placements, with pricing determined entirely by smart contracts. It even has a graduation mechanism that automatically creates a liquidity pool on DEX once the market cap reaches $69,000, resembling a fully automated token listing process that is well-received in the market, making Pump.fun the strongest money printer in this market cycle.

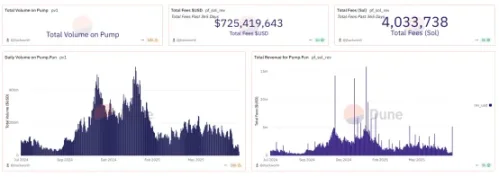

Since its launch in January 2024, Pump.fun has issued a total of 11.44 million tokens, with over 22 million active addresses, achieving cumulative revenue of nearly $720 million. The highest single-day transaction fee even reached $5.43 million, with a peak daily revenue astonishingly hitting $15.88 million. It can be said that the market dividends of this MEME cycle have all been captured by Pump.fun, further driving the development of the Solana ecosystem.

As a project that started with MEME, the sudden token issuance has sparked widespread discussion in the market. Rumors of Pump.fun's token issuance began in February this year, when Wu revealed that Pump.fun planned to issue tokens on centralized exchanges and had even prepared complete issuance documents. However, this was later abandoned due to liquidity depletion caused by frequent MEME from the Trump family. In June, rumors of token issuance resurfaced, with Blockworks citing multiple insiders reporting that Pump.fun planned to raise $1 billion through token sales, with a valuation of $4 billion, and the tokens would be sold to both public and private investors.

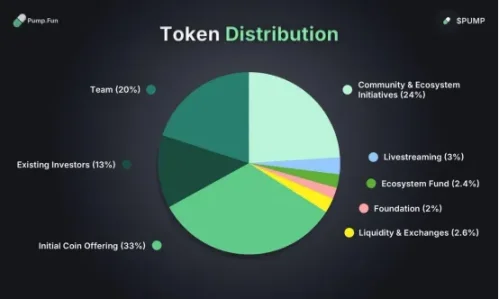

On July 10, Pump.fun finally released the news, announcing that it would officially launch its native token PUMP for public sale on July 12, 2025, at 22:00, with an airdrop coming soon. A total of 150 billion tokens will be sold at a price of $0.004 USDT, accounting for 15% of the total supply (1 trillion tokens). At a $4 billion valuation, it aims to raise $600 million. Due to compliance reasons, participants from the UK and the US are not allowed to participate in this sale. In the PUMP token economics, 33% is allocated for public sale, 24% for community and ecosystem incentives, 20% for the team, 2.4% for the ecosystem fund, 2% for the foundation, 13% for existing investors, 3% for live streaming-related activities, and 2.6% for liquidity and exchanges.

However, compared to the previous anticipation for the token issuance, when it actually happened, the market collectively sang its praises. The controversy centered around the $4 billion valuation. It is worth noting that the last stablecoin to ring the bell in New York, Circle, had a valuation of only $7 billion. If a legitimate company is valued like this, how can an on-chain casino claim a $4 billion valuation, even surpassing most DeFi blue-chip protocols today, leading the market to say it is overextending liquidity?

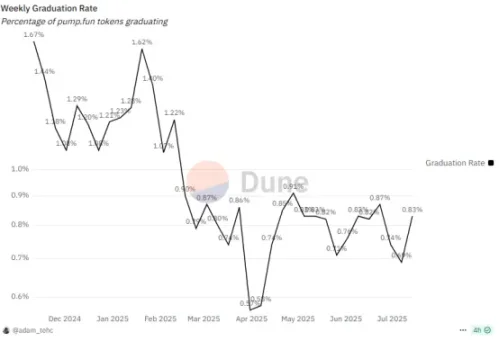

More critically, times have changed. Looking at the current market, aside from a recent surge, most altcoins and MEME coins are experiencing a downturn. This can be seen from the trading volume; according to Dune's data, after reaching a peak trading volume of $5.44 million on January 23, 2025, Pump.fun's trading volume has shown a cliff-like decline, with recent daily trading volumes stabilizing below $700,000, a drop of 87.2% from its peak. Furthermore, the daily token creation has plummeted from a peak of 70,000 to 30,000, nearly halving. The graduation rate is astonishingly low; in 2024, it was 1.6%, but now it has dropped to below 1%. This indicates that the beneficial effects are diminishing, the MEME market is becoming "cold," and user enthusiasm is rapidly waning. However, no matter how powerful Pump.fun is, it is merely a tool that needs to rely on the heat of the MEME market, which raises doubts about its valuation.

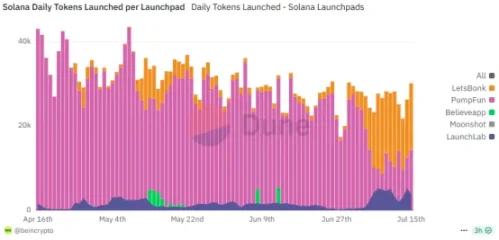

On the other hand, while the market is shrinking, competitors are rising. Once invincible in the market, Pump.fun is now facing pressure. Recently, competitors like letsbonk.fun, centered around BONK, have rapidly developed, often ranking first in token issuance numbers, surpassing Pump.fun to take the top market share. Although Pump.fun has quickly retaliated, the competition between the two remains intense, and it must be acknowledged that Pump.fun's leading position is under threat.

For various reasons, Pump.fun's $4 billion valuation has come under severe scrutiny. Following the rumors of token issuance in June, it triggered a risk-averse sentiment in the market, leading to a widespread correction of popular MEME coins in the Solana ecosystem and a rapid outflow of funds. IOSG Ventures partner Jocy even bluntly stated that this ICO seems more like a liquidity exit rather than a long-term development plan, while crypto researcher @rezxbt pointed out that Pump.fun is staging a complete "harvesting operation."

Interestingly, in March 2024, Pump.fun co-founder Alon stated on social media that every pre-sale is a scam. Ironically, Pump.fun is now issuing tokens in the form of a pre-sale, a live demonstration of face-slapping. The total supply of tokens issued is 33%, with 18% allocated for institutional private placements and 15% for public offerings, with all tokens fully unlocked on the first day of listing.

From the final results, although industry insiders are not optimistic, supporters and institutions clearly do not share this view. In terms of public offerings, the PUMP token completed a public offering of $500 million in just 12 minutes, with six major exchanges, including Kraken, Bitget, and Bybit, participating in the PUMP public offering. According to Dune's panel data, the number of wallet addresses that participated in the Pump.fun official pre-sale and completed KYC was 23,959, with 10,145 wallet addresses successfully purchasing, averaging a subscription amount of $44,209. A staggering 89.7% of the PUMP token pre-sale was completed through the official website, while the total sales from various CEXs accounted for only 10.3%. Among the pre-sale addresses on the official website, small users are the main group, with 5,758 users subscribing for PUMP under $1,000, while the number of addresses with subscriptions exceeding $1 million was 202, indicating a preference for institutional enthusiasm.

The entire process perfectly illustrates the unique phenomenon of the crypto space, where there is often a disconnect between complaints and reality. Due to some technical issues during the exchange's public sale, users found it difficult to complete their subscriptions, leading to multiple users expressing dissatisfaction on social media. At that time, there was significant controversy in the community regarding Pump's subsequent performance. On one side, there were concerns about the high valuation, predicting a collapse once the spotlight effect ended; on the other side, there were beliefs that Pump, as the most representative product of MEME, has a complete revenue logic and cognitive foundation, and would not easily falter.

From the current stage, the latter seems to have temporarily won. After the launch of GMGN on July 15, Pump briefly dropped from $0.0065 to $0.0042, but after some fluctuations, it began to rise, currently reported at $0.0066, a 55% increase from the fundraising price of $0.004, with the FDV price rising from $4 billion to $6.6 billion, bringing a certain wealth effect to the subscribers.

Of course, this part of the increase also has a performative aspect. According to on-chain analysis by @EmberCN, as of 8 AM this morning, pump.fun began using transaction fee income to buy back PUMP after the token issuance. In the past 7 hours, it transferred 187,770 SOL of transaction fee income to the address 3vkp…3WTi, purchased PUMP, and then transferred the acquired tokens to the address G8Cc…kqjm for storage. So far, it has used 111,953 SOL (approximately $1.83 million) to buy 3.04 billion PUMP, with an average price of $0.006. Buybacks can support the price, but they also raise suspicions of a left hand to right hand transfer. However, for holders, regardless of the purpose, as long as the price is driven up, it is ultimately a good thing.

Whether it is an exit of liquidity or simply building for the benefit, the valuation controversy surrounding Pump.fun reflects the current market situation. The MEME, once known for its liquidity, is collectively facing difficulties, and the once-booming attention economy seems to be gradually becoming a false proposition. At this point, even the most representative applications are taking the path of token issuance, subtly signaling the end of the narrative. Ultimately, where MEME will head is uncertain, but the token PUMP serves as a barometer, and the market's bets on it will be an effective observation of the value judgment of the attention economy. A rising token at least indicates market recognition of its pricing, while a falling token prompts the public to contemplate the true essence of the MEME market, which may lead to more selling sentiment. This may also be one of the reasons why Pump is opting for buybacks.

Returning to the question in the title, who really profited from Pump.fun's token issuance? Undoubtedly, the project team has made a profit, and participants in both the public and private offerings have also seen gains. Short-term investors who went long have made money as well, but how long this will last and to what extent the project team can maintain the token price remains a big question mark. Some large whales have already begun to cash out. According to Lookonchain's monitoring, a whale identified as 8a5nSU spent 5 million USDC through 5 wallets to participate in the PUMP public sale, purchasing 1.25 billion PUMP tokens. Today, they sold all of them at an average price of $0.0067, realizing a profit of $3.416 million.

On the other hand, returning to the current reality, the improvement in the macro market will also have some impact on MEME. With a strong narrative around Ethereum, mainstream tokens led by Ethereum continue to rise, resulting in a direct outcome where Ethereum blue-chip altcoins are surging. For example, ENS has risen over 18% today, reaching a new high since February of this year. In the long run, even though the current market uncertainty is somewhat strong, foreseeable interest rate cuts are already on the way, and the altcoin market may also be poised for a small surge. MEME, however, reflects a more polarized trend; high-quality MEME tokens are rising due to sector rotation, while the remaining MEME liquidity is being siphoned off, leading to a situation where most are left unattended.

If this path continues, MEME, which is similar in nature to the lipstick economy and lottery economy, will always exist, but it will be difficult to stir up the same waves of capital flow in the market as seen in 2024.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。