Bitcoin Lifts Broader Market Back to $3.46 Trillion in Q2 2025 Crypto Review

Following Q1’s market correction, Q2 2025 brought renewed confidence in crypto, with total market capitalization climbing 28.2% to around $3.46 trillion. This upswing came largely from exchange-traded fund (ETF) inflows and an impressive bitcoin rally.

According to Token Insight’s Q2 2025 crypto exchanges report, supportive U.S. labor data and Fed rate-cut expectations aided sentiment, but global growth headwinds and geopolitical issues capped full-scale resurgence.

Top-tier centralized exchanges recorded $21.6 trillion in volume, a 6.2% drop from Q1, even as bitcoin soared from $83K to a $111.9K peak, ending near $106K. Spot trading volumes dropped more sharply: Q2 spot volumes averaged $40 billion daily, down from $51 billion in Q1, totaling $3.63 trillion (–21.7%).

In contrast, derivatives remained dominant, with $20.2 trillion in Q2 volume, a modest 3.6% decline, and average daily volume around $226 billion. Traders favored derivatives to hedge amid uncertainty.

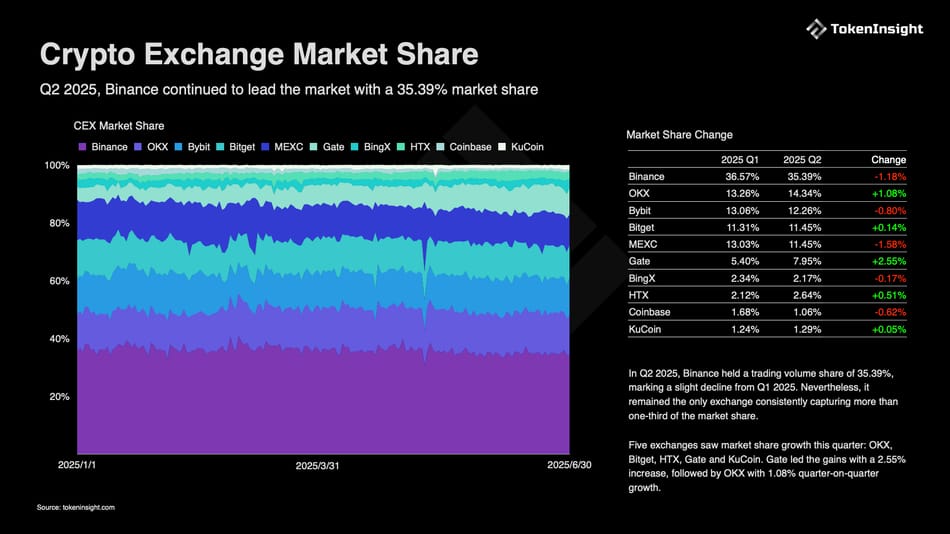

Looking at crypto exchange performance, Binance led with 35.4% of total trade volume, a slight dip from Q1, while OKX, Bitget, HTX, Gate, and Kucoin expanded their shares, with Gate gaining the most (+2.55%).

In derivatives open interest, Binance also led at 23.8%, followed by increasing shares at HTX, Bitget, and OKX. Exchange tokens trailed BTC’s 31.6% Q2 gains: BNB rose 8.9%, OKB, BGB, and KCS saw minor upticks, but most others declined, reflecting slumping altcoin activity.

Despite bitcoin’s strong performance, volume concentration persists. With macro uncertainty still a backdrop, Q3 may see spot trading remain flat or dip further ($3–3.5 trillion projected), even as derivatives retain dominance. Exchange token performance is expected to diverge further, echoing capital flow patterns across assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。