ETF Rally Continues: Bitcoin and Ether Funds Add Over Half a Billion in One Day

Momentum in crypto ETFs refuses to cool down as both bitcoin and ether ETFs posted another day of strong inflows, showcasing continued institutional appetite.

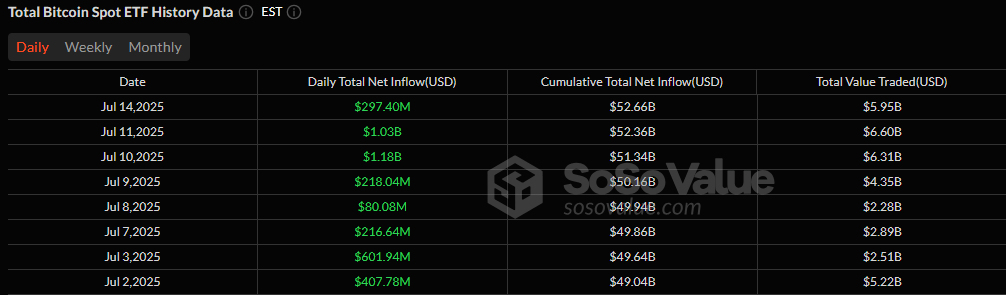

Bitcoin ETFs recorded $297.40 million in net inflows, marking the 8th consecutive day in the green. The charge was once again led by Blackrock’s IBIT, which soaked up $394.71 million, overshadowing moderate outflows elsewhere.

Grayscale’s Bitcoin Mini Trust brought in $12.75 million, while Vaneck’s HODL and Bitwise’s BITB added $8.47 million and $7.17 million, respectively. That said, ARK 21shares’ ARKB saw a $99.57 million outflow, and Fidelity’s FBTC posted a $26.13 million withdrawal, trimming the net total. Daily trading volume was robust at $5.95 billion, with total net assets reaching $153.29 billion.

Source: Sosovalue

Meanwhile, ether ETFs kept their inflow streak alive with $259.04 million in net gains. Blackrock’s ETHA again dominated, capturing $151.45 million, followed by Grayscale’s Ether Mini Trust ($43.79 million) and Fidelity’s FETH ($31.43 million).

Bitwise’s ETHW and Grayscale’s ETHE added $11.17 million and $8.94 million, respectively. Minor but steady inflows from VanEck’s ETHV ($6.58 million) and Franklin’s EZET ($5.69 million) helped round out the day. Trading volume surged to $1.26 billion, with net assets standing at $13.77 billion.

The ETF momentum rolling into mid-July is signaling something clear: the market is watching and buying institutionally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。