Earlier today, Bitcoin.com News reported on the whale who shuffled 80,000 BTC on July 4, 2025—exactly 10 days ago. At the time, the stash was split into eight separate wallets, each loaded with 10,000 BTC, with one wallet holding an extra 9 coins. This morning, the entity consolidated two of the eight wallets into a single address now holding 20,000 BTC.

Now, that same entity is back in action, shifting 20,000 BTC—roughly $2.4 billion—and making another move at block 905531 using two more of the remaining wallets. The two wallets dispatched three transactions: one for 1 BTC, another for 9,999 BTC, and a final 10,000 BTC move at block height 905535.

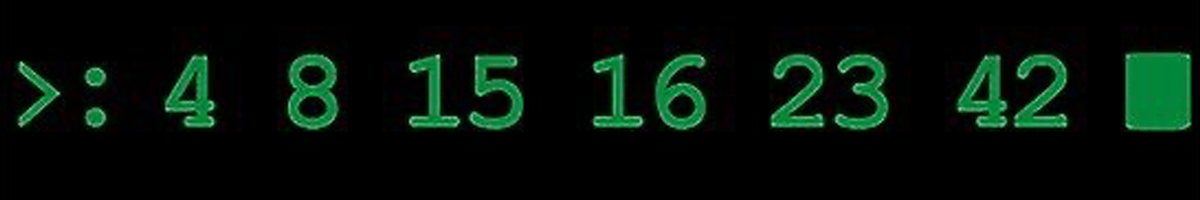

The newly created P2WPKH address, “bc1qq8q,” is now sitting on the full 20,000 BTC. As of 7 a.m. Eastern on Tuesday, wallets – 1, 2, 3, 4 – each still hold 10,000 BTC. The new wallet, bc1qq8q, also received a tiny dust transfer of 0.00025076 BTC, which included an OP_RETURN message containing a curious string of numbers: “4 8 15 16 23 42.”

The numbers 4, 8, 15, 16, 23, 42 are famously known from the TV series “Lost,” where they form a recurring sequence tied to the show’s mythology. In the context of Lost, these numbers are associated with a mysterious curse or cosmic significance, appearing in various forms (e.g., lottery numbers, a computer code, and character backstories).

“Lost” series numbers.

The numerals are often interpreted as “cursed” numbers that bring bad luck to those connected to them. Interestingly, other new wallets tied to last week’s 80,000 BTC move were also hit with cryptic messages referencing the series “Lost,” adding another layer of mystery to the massive transfer.

However, it’s not unusual for whale wallets—and even dormant addresses like Satoshi’s—to receive strange OP_RETURN messages. These odd transmissions are often cryptic or symbolic, but typically hold meaning only for the sender and have no real significance beyond that.

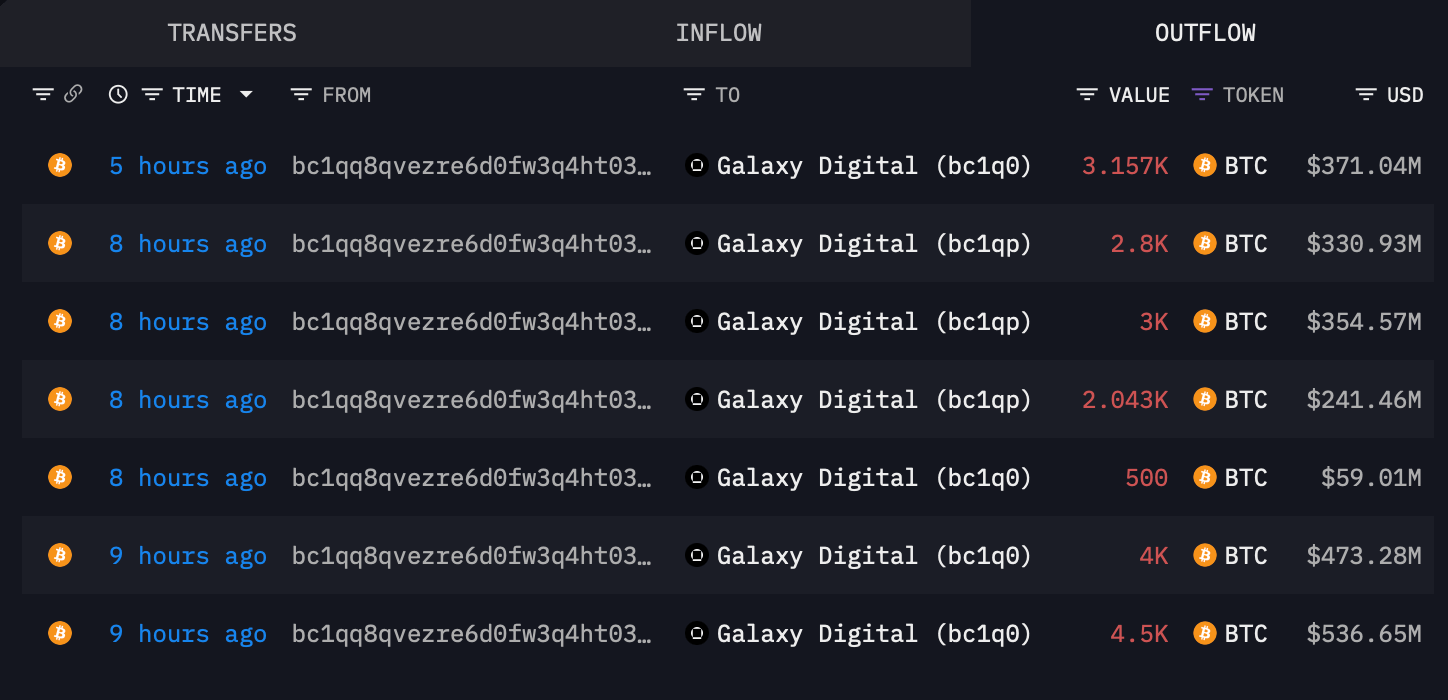

What is significant is what came next—as the ancient 2011 whale once again shifted the 40,000 BTC that was consolidated into two new addresses and sent the funds to Galaxy Digital. For the first wallet labeled “bc1qq8q,” the outflow took place over seven transactions, beginning with two massive transfers of 4,000 BTC and 4,500 BTC (worth $473.28M and $536.65M respectively).

Source: Arkham Intelligence

The pace didn’t slow down. Over the next few hours, the wallet bc1qq8q sent an additional five transactions ranging from 500 BTC ($59.01M) to a whopping 3,157 BTC ($371.04M), each one landing in addresses linked to Galaxy. The final tally? Every satoshi accounted for, all 20,000 BTC from that wallet is now in Galaxy’s custody.

Another hefty chunk of BTC—this time from wallet “bc1qmux…”—was funneled into Galaxy Digital over 17 transactions totaling roughly 20,000 BTC. It still holds 0.348 BTC worth around $40,000. The flurry included transfers as high as 2,100 BTC ($245.74M) and as low as 120 BTC ($14.01M), all executed within the last five hours.

With this second wave, Galaxy Digital’s coffers got a serious bitcoin boost. With the latest activity, consolidation no longer appears to be the motive. Instead, the flow suggests these coins were likely lent out, handed over for custody, or potentially sold off—marking a clear shift in intent behind the whale’s moves. The remaining 40,000 BTC, spread across four separate wallets, continues to sit untouched in those addresses as of press time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。