Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

Letsbonk.fun has recently completed a comeback against the "big brother" of the track, Pump.fun, in terms of data.

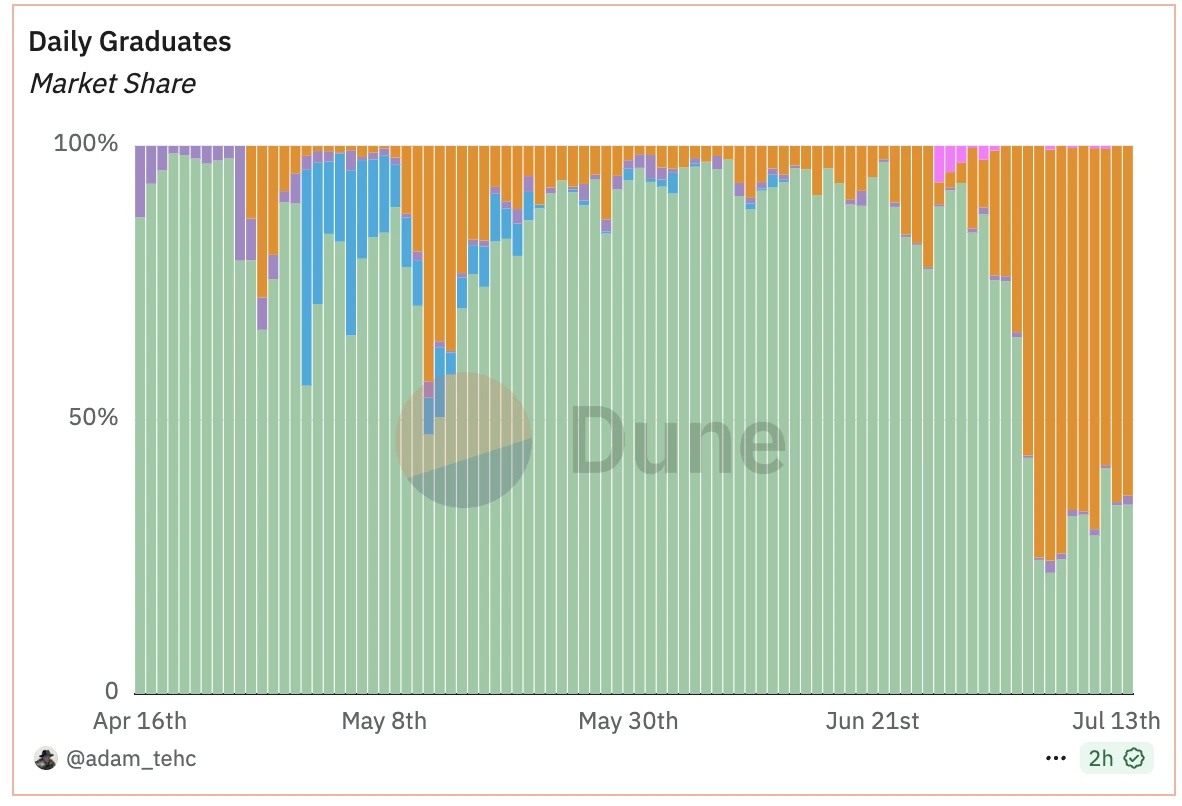

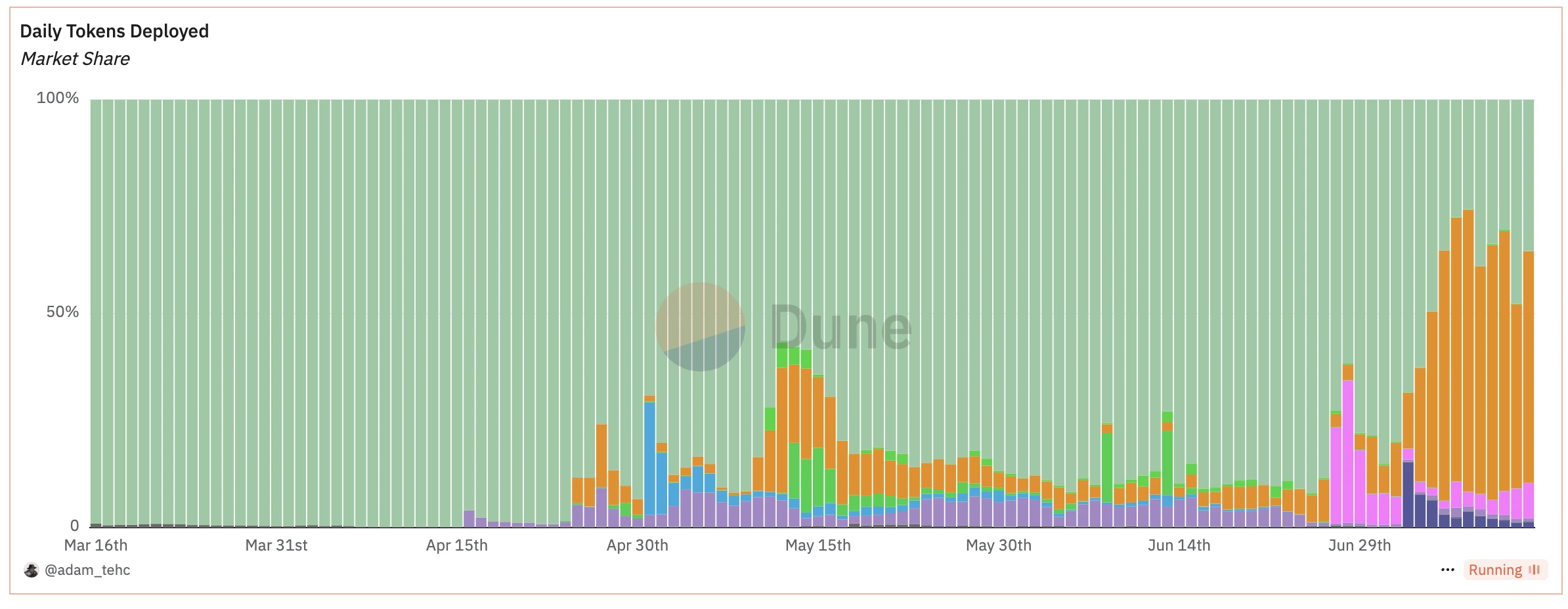

On-chain analyst Adam's data dashboard on Dune shows that recently, Letsbonk.fun (the orange part in the image below) has surpassed Pump.fun (the green part in the image below) in both daily deployed tokens and daily graduated tokens, becoming the most popular Meme token launch platform in the current market.

With the strong rise of Letsbonk.fun, more and more people have begun to try to find potential wealth codes on this platform, but many have overlooked another major winner after the data surge of Letsbonk.fun — Raydium.

Why does the rise of Letsbonk.fun benefit Raydium? The story begins with the feud between Pump.fun and Raydium.

The Betrayal of Pump.fun and the Counterattack of Raydium

We have previously published several articles following up on these stories, for details refer to “Data Analysis: How Much Does Raydium Depend on Pump.fun?”, “Raydium Strikes Back at Pump.fun, Who Will Laugh Last in the Meme Comeback Season?”, “Pump.fun's Dominance Shaken for the First Time, Raydium's 'Pack of Wolves' Strategy Works”.

To summarize briefly, in the early design of Pump.fun, token issuance had to go through two stages: "internal market" and "external market" — after the token issuance, it would first enter the "internal market" trading phase, relying on the bonding curve of the Pump.fun protocol for matching. Once the trading volume reached $69,000, it would enter the "external market" trading phase, at which point liquidity would migrate to Raydium, where a pool would be created on this DEX and trading would continue.

However, on March 21, Pump.fun announced the launch of its own AMM DEX product, PumpSwap. Since then, the liquidity of Pump.fun tokens entering the "external market" would no longer migrate to Raydium but would be directed to PumpSwap — this move directly cut off the flow path from Pump.fun to Raydium, thereby reducing the trading volume and fee income of the latter.

In response, Raydium announced on April 16 that it had officially launched the token issuance platform LaunchLab, allowing users to quickly issue tokens through this platform, and once the token liquidity reached a certain scale (85 SOL), it would automatically migrate to Raydium AMM. Clearly, this was Raydium's direct counterattack against the aggressive Pump.fun.

So what does this have to do with Letsbonk.fun?

Value Flow: Letsbonk.fun ➡️ LaunchLab ➡️ Raydium

Although LaunchLab's token issuance function is quite similar to Pump.fun, its biggest feature lies not in the issuance process itself — the architecture of LaunchLab supports third-party integration, allowing external teams and platforms to create and manage their own launch environments within the LaunchLab ecosystem. In other words, third parties can rely on the underlying technology of LaunchLab and Raydium's liquidity pools to launch independent token launch frontends.

The protagonist of this article, Letsbonk.fun, is a third-party launch platform developed by the BONK team based on the LaunchLab architecture.

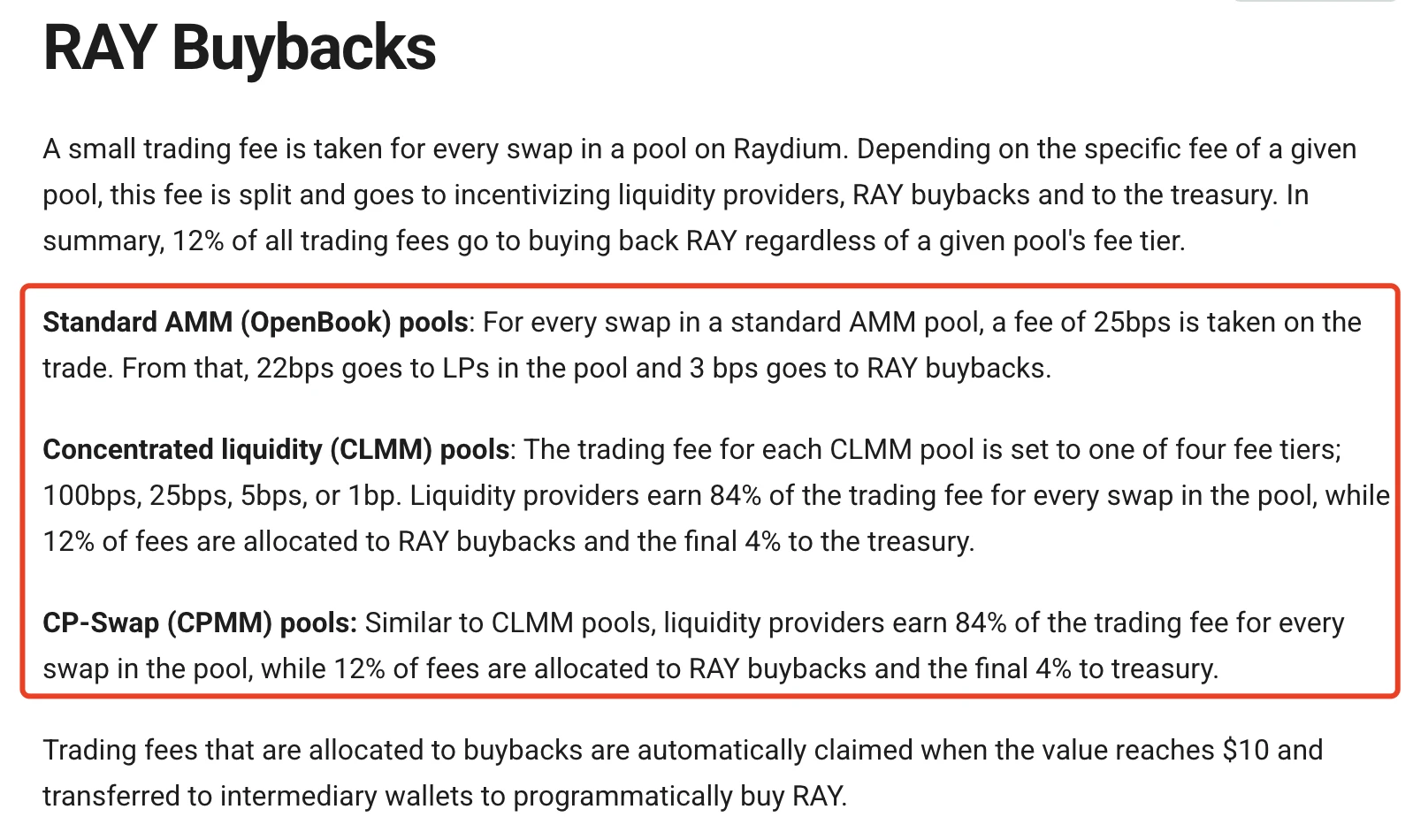

As a third-party platform developed based on LaunchLab, Letsbonk.fun adopts the fee mechanism of LaunchLab. For all Meme tokens issued based on Letsbonk.fun, LaunchLab will charge a 1% joint curve issuance fee, of which 25% will be directly used for RAY repurchase; additionally, after the tokens exit the "internal market," Raydium will also charge based on the fee rules of the liquidity pool, with part of the fees going towards RAY repurchase.

Odaily: The fee repurchase ratio of different types of liquidity pools on Raydium.

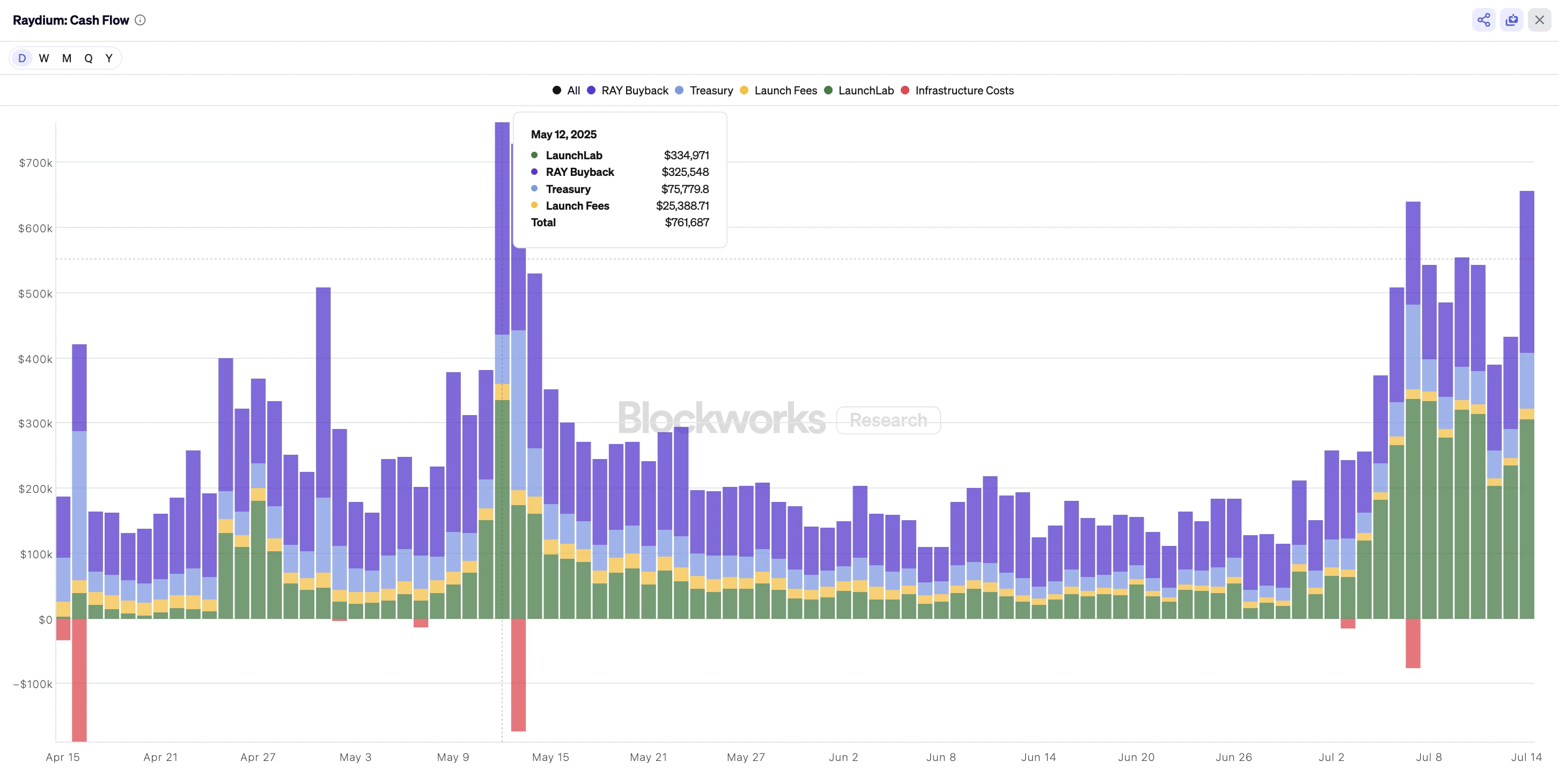

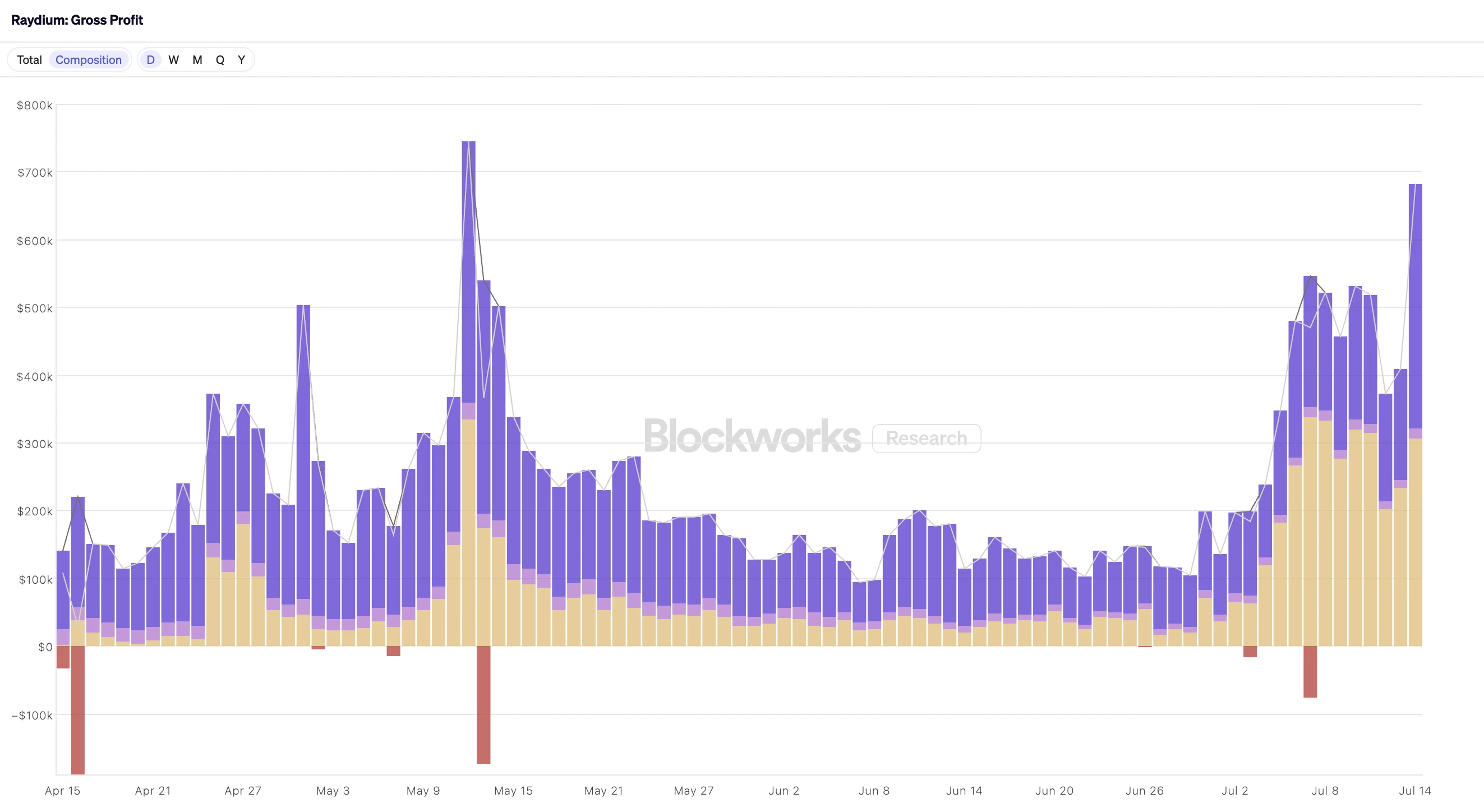

Data from Blockworks shows that since the launch of LaunchLab on April 16, Raydium's protocol revenue and RAY repurchase volume have both shown significant growth, and their growth trajectories highly overlap with the data fluctuations of the LaunchLab system — on May 13, the number of tokens graduating from the LaunchLab system surpassed Pump.fun for the first time, and that day Raydium recorded a recent repurchase peak of $325,000; additionally, with the recent explosion of Letsbonk.fun, Raydium's protocol revenue and RAY repurchase volume have again shown significant increases.

More notably, previously, Raydium's protocol revenue mainly came from the exchange fees of liquidity pools (the purple part in the image below), but recently, the revenue from LaunchLab's issuance fees (the yellow part in the image below) has gradually surpassed it, becoming Raydium's new main source of income, and 25% of these fees will be directly used for RAY repurchase.

Based on yesterday's repurchase data of $249,000, Raydium could invest approximately $90.88 million annually for RAY repurchase, while the current market cap of RAY is about $749 million, meaning that 12% of RAY's market cap will be repurchased each year, which will create a huge and sustained buying pressure.

Beyond Memes, There’s also US Stock Tokenization

In addition to the continuously growing LaunchLab fee income, the recently popular US stock tokenization is also expected to boost Raydium's protocol revenue.

Previously, Kraken's stock tokenization platform xStocks has officially launched and issued a series of popular US stock tokenized certificates on Solana, most of which have deployed liquidity pools on Raydium. Although the current trading volume is still limited and the fee contribution is not significant, considering the market trend of US stock tokenization, this sector also has strong revenue growth expectations.

Looking ahead, if Letsbonk.fun can continue to maintain its current market share (even without considering the growth of LaunchLab and other third-party platforms), Raydium is likely to maintain its current protocol revenue level and repurchase intensity. Coupled with the potential growth expectations of US stock trading, this data is expected to achieve further breakthroughs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。