This article explores Bitcoin Improvement Proposal BIP-119 and its core feature "Covenants," along with its potential and controversies.

Written by: Oliver, Mars Finance

In the crypto world, Ethereum and its ecosystem always resemble a teenager eager to "stir things up," constantly attracting market attention with novel DeFi Lego and NFT artworks. In contrast, Bitcoin is more like a silent, deep-sea elder. It rarely changes, but every small movement is enough to trigger a profound earthquake across the industry. Since the significant upgrade named "Taproot" in 2021, this elder has enjoyed years of tranquility. However, beneath the calm surface, an undercurrent regarding its future is surging, stirred by a technical proposal numbered BIP-119.

At the core of this proposal is an ancient and powerful magic known as "Covenants." It is expected to reach consensus by the end of the year, but the debates surrounding it have long transcended the code itself, evolving into a philosophical debate about the soul and future of Bitcoin. This is not just a technical route dispute; it feels more like a collective interrogation of Bitcoin's identity: should it remain a timeless digital gold, or evolve into a financial operating system that can keep pace with the times?

A "Smart Will" from the Future

To understand the magic of BIP-119, let’s first imagine a scenario. Suppose you are a forward-thinking Bitcoin whale who wishes to pass on your assets to future generations but worries that they may squander them recklessly. In today’s Bitcoin world, you are powerless. Once the private key is handed over, control of the assets is completely transferred. But if BIP-119 is activated, you can establish a "smart will" for your Bitcoin UTXO (which can be understood as your "digital check") from the future.

The core of this "will" is OP_CHECKTEMPLATEVERIFY (abbreviated as CTV). It allows you to specify that this money can only be spent in a certain way in the future. For example, you could set a template stating, "These 1000 Bitcoins can only be transferred to my son's designated address for living and learning, starting from 2040, at a rate of 10 per year." Any transaction attempt that does not conform to this "template" will be ruthlessly rejected by the entire Bitcoin network. It’s like placing a time lock and rule lock on your assets, forged by global consensus; the private key is no longer the sole scepter.

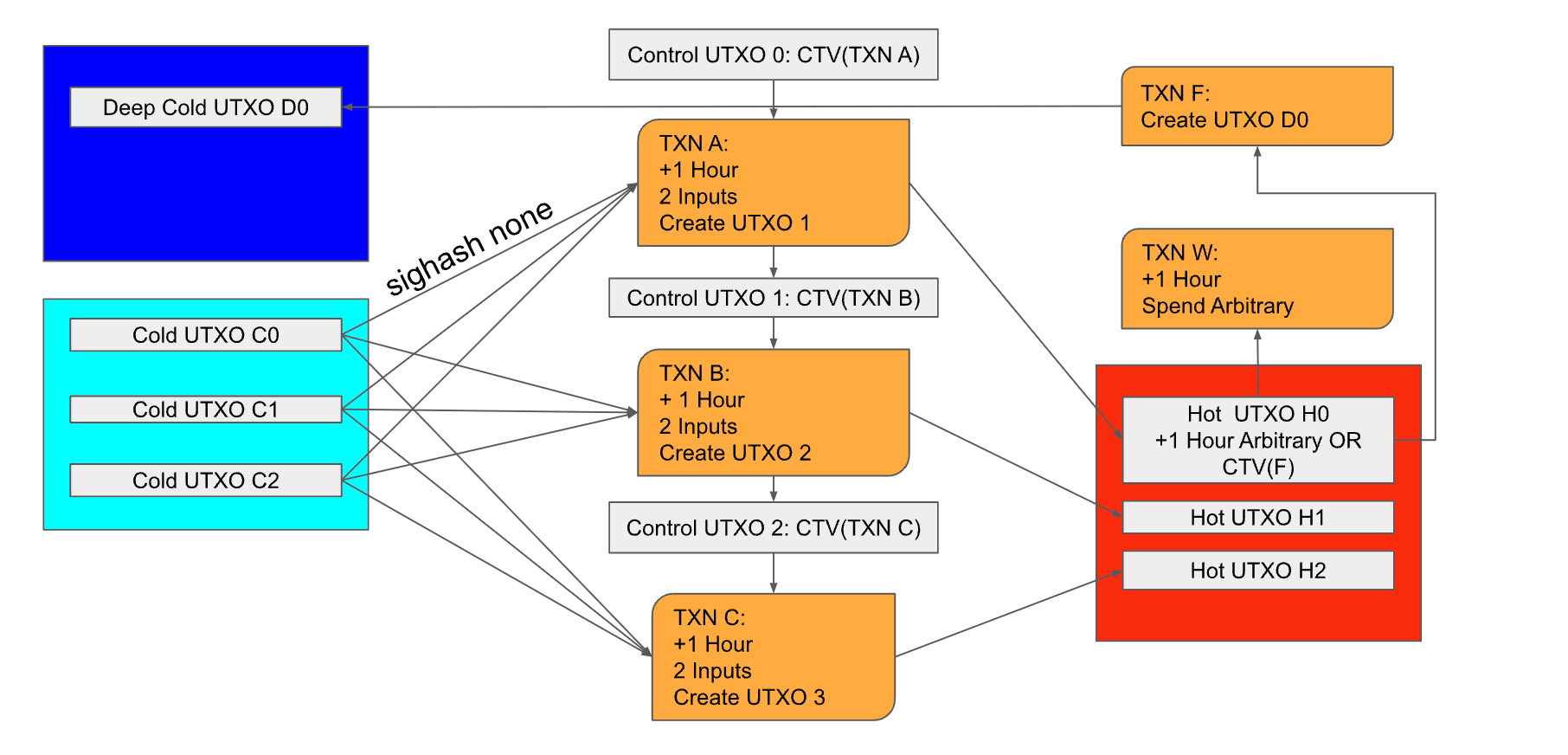

The most intuitive application of this feature is the personal vaults known as "Smart Vaults." Currently, if your private key is stolen, it is akin to a disaster. But in the world of CTV, even if a hacker obtains your private key, they cannot abscond with all your wealth at once. They can only transfer funds according to your pre-set, extremely slow withdrawal plan (for example, 0.1 BTC per week), like a disciplined "good child." This undoubtedly buys you valuable time to discover the theft and take remedial measures. As Jameson Lopp, co-founder of security company Casa and an industry veteran, stated, this mechanism will "greatly enhance the ability to build better and safer custody methods," which is undoubtedly a huge boon for institutions and long-term holders who view asset security as vital.

Laying the "Entrance Ramp" for "Lightning Fast"

However, if the smart vaults are merely an appetizer for CTV, its empowerment of the Bitcoin Layer 2 ecosystem, represented by the Lightning Network, is the main course that could truly change the game. The Lightning Network greatly enhances Bitcoin's payment efficiency, but it has always faced an "entry" bottleneck: everyone wanting to hop on must first make a transaction on the congested main road (the Bitcoin main chain) to buy a "ticket" (create a channel). When thousands of people want to board at the same time, this main road naturally becomes clogged.

CTV cleverly addresses this issue through a mechanism called "Channel Factories." It allows multiple users to "carpool" on the road. They can pool funds through a single on-chain transaction to create a shared UTXO, and then establish countless Lightning channels among themselves off-chain based on this shared foundation. According to its designer Jeremy Rubin, this can reduce the on-chain cost for users entering the Lightning Network by an order of magnitude. It’s like everyone used to have to drive their own car onto the highway, but now they can take a bus and share an entrance ramp, vastly improving efficiency. Essentially, this expands the distribution efficiency of Bitcoin's "property rights," marking a key step toward large-scale application.

Interestingly, this mechanism also enables "non-interactive" channel creation. Imagine that Coinbase could directly open a Lightning Network channel for you and deposit some Bitcoin, all without you needing to be online, and when you log in next time, you find yourself already on the "Lightning Fast" highway. This seamless user experience was previously unimaginable.

The Risks of Opening Pandora's Box?

It sounds so wonderful; why has the path to activating BIP-119 been so rocky, even sparking a fierce civil war in the community in 2022? The voices of opposition are equally deafening, and their concerns revolve around the fear that this "Covenant" could become the key to opening Pandora's box.

The loudest alarm bells come from worries about Bitcoin's core values—censorship resistance and homogeneity. Opponents paint a chilling scenario: a heavily regulated centralized exchange could be forced by the government to require all user withdrawals to go into a CTV "covenant address." The funds in this address could then be mandated to flow only to other KYC (Know Your Customer) "whitelisted" addresses. In this way, the Bitcoin world would be invisibly divided into "clean" and "contaminated" parallel universes, eroding its foundation as a global neutral currency. This concern of "slippery slope fallacy" is less about the technology itself and more about a deep-seated anxiety regarding Bitcoin's ability to withstand future state-level infiltration.

Another faction of opponents consists of technical "perfectionists." They argue that while CTV is useful, it is "not general enough." They advocate for spending more time developing a more flexible and powerful "Swiss Army knife" (such as another much-discussed proposal OP_CAT) rather than activating a functionally limited "specialized wrench" (CTV). They worry that hastily launching a "half-baked" feature today could lead to it becoming "zombie code" in the future, leaving permanent technical debt for a Bitcoin protocol that values simplicity and elegance. This reflects a profound divide in Bitcoin's development philosophy between "incrementalism" and "holism."

Of course, there are also the staunch "Bitcoin fundamentalists." In their eyes, Bitcoin's value lies precisely in its simplicity and immutability. As one community member stated, "What Bitcoin 'cannot do' is more important than what it 'can do'." They view any attempt to increase protocol complexity as heretical, believing it would expand the potential attack surface. In 2022, when the proponents of BIP-119 attempted to force activation through a "fast-tracking" mechanism, they faced strong opposition from many, including Bitcoin evangelist Andreas Antonopoulos. Antonopoulos clearly stated that his opposition was not to the technology itself but to the arrogant process that "disrespected community consensus."

A Political Game of Governance

This turmoil ultimately ended with the failure of the activation attempt in 2022, but it also taught the community a valuable lesson: in the world of Bitcoin, while the quality of code is certainly important, the process of reaching consensus is the key to survival.

Fast forward to 2025, the proponents of BIP-119 have clearly learned their lesson; they are making a comeback, but with a more humble posture and a more mature strategy. In June of this year, an open letter signed by 66 prominent developers and institutional representatives (including the aforementioned Jameson Lopp and custody giant Anchorage) called for the community to re-examine BIP-119. This time, they are no longer going it alone but have formed a "Builders Alliance." More cleverly, they have bundled BIP-119 with another less controversial, complementary proposal BIP-348. This is undoubtedly a clever political maneuver, forcing opponents to weigh the pros and cons: does rejecting BIP-119 also mean giving up another beneficial upgrade?

Regardless of the ultimate fate of BIP-119, the lengthy debate surrounding it is highly valuable. It serves as a mirror, clearly reflecting the complexity, challenges, and evolution of Bitcoin's decentralized governance. It compels every participant to ponder where the sacred balance lies between efficiency and security, evolution and stability, pragmatism and idealism.

Ultimately, the future of Bitcoin may not depend on the activation of a specific opcode but on whether this community, composed of millions of "invisible hands" worldwide, can find the right course to the stars and the sea through repeated intense collisions and difficult compromises. This soul-searching inquiry about "Covenants" continues, and each of us is a witness to this grand social experiment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。