Bitcoin BTC cooled off during U.S. trading hours Monday after nearly topping $123,000 earlier in the session, but market top calls are premature, analysts said.

BTC slipped below $120,000 late in the U.S. day, shedding most of its overnight advance, but holding on to a modest 0.6% gain over the past 24 hours. Ethereum's ether ETH slid back below $3,000, while dogecoin DOGE, Cardano's ADA ADA and Stellar's XLM XLM declined around 2%-3% on the day.

Among majors, XRP XRP, SUI SUI and Uniswap's UNI UNI outperformed with 2.5%, 10% and 6% gains, respectively.

Crypto-linked stocks also retraced some of their morning gains, with Strategy (MSTR) and Galaxy (GLXY) still higher 3%-4%, while Coinbase (COIN) gained 1.5%

After BTC surged over 10% in less than a week and some altcoins advancing much more, prices may consolidate as some traders digest the move and realize profits.

Still, this leg of the crypto rally is more likely in the early phases than towards the end, said Jeff Dorman, CIO of digital asset investment firm Arca.

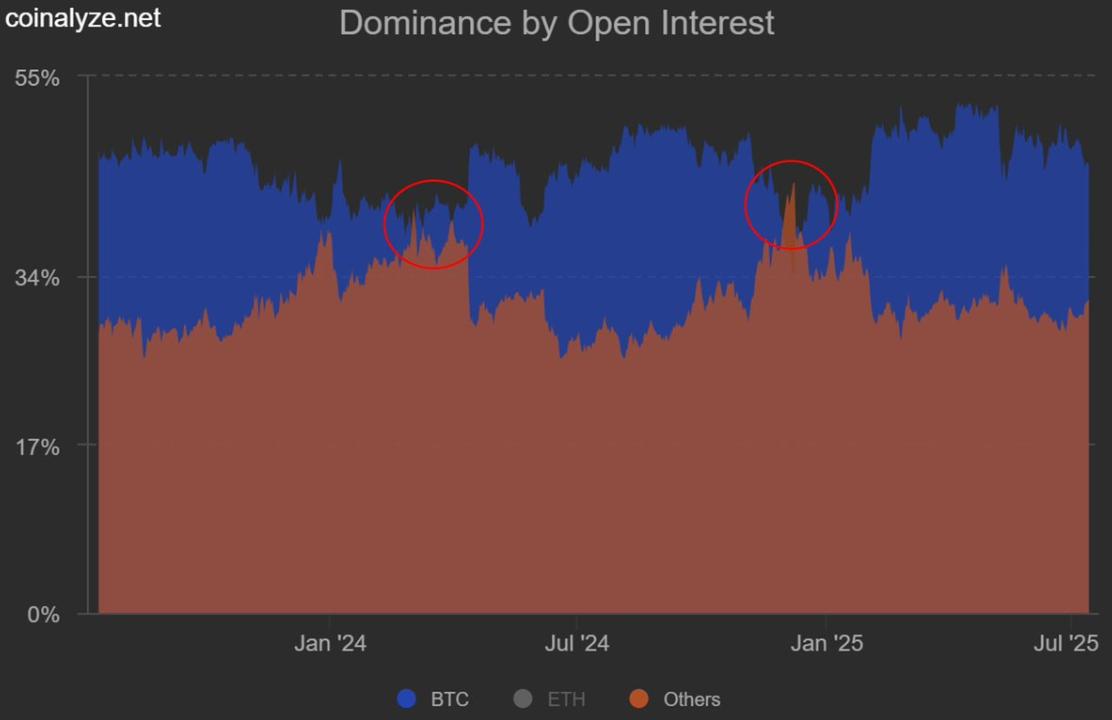

In a Monday investor note, he cited crypto analyst Will Clemente's observation about previous major tops like March 2024's spot bitcoin ETF-related peak and the Dec 2024/Jan 2025 frenzy surrounding the Trump election/inauguration, when open interest in altcoin derivatives flipped that of BTC

"The current rally is nowhere near that," Dorman said.

Volumes on both centralized and decentralized exchanges rose 23% week-over-week, but still aren’t near to the levels during other broad-market rallies in the past, Dorman added.

Looking at the big picture, bitcoin is being propelled higher by excessive sovereign debt and investors seeking refuge from monetary inflation, said Eric Demuth, CEO of Europe-based crypto exchange Bitpanda.

He said BTC rising to €200,000 ($233,000), is "certainly a possibility," but the underlying adoption of the asset carries more importance than price targets.

"What happens when Bitcoin becomes permanently embedded in the portfolios of major investors, in the reserves of sovereign states, and in the infrastructure of global banks?," he said. "Because that’s exactly what’s happening right now."

In the next years, Dermuth expect bitcoin's market capitalization to gradually converge to gold's, currently sitting at over $22 trillion, nine times larger than BTC.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。