I. Outlook

1. Macroeconomic Summary and Future Predictions

The three major U.S. stock indices reached new historical highs last week, with the S&P 500 index peaking at 6279 points, and the Nasdaq also setting new records, particularly driven by the technology sector (especially companies in AI and semiconductors). Leading companies like Nvidia and Tesla led the charge, boosting market enthusiasm. Overall, U.S. economic data remained robust last week, with the stock market experiencing high-level fluctuations, while trade tensions and tariff escalations emerged as major risk points. The Federal Reserve maintained a wait-and-see attitude, with future economic growth expected to slow and inflation to moderately rise, potentially increasing market volatility, necessitating attention to trade negotiations and policy changes.

2. Market Changes and Warnings in the Crypto Industry

Bitcoin continued its strong upward trend, breaking through $120,000. If Bitcoin can stabilize around the $120,000 mark with increased trading volume, it may signal the start of a new bull market phase, laying the groundwork for the third quarter's market performance. The overall performance of the crypto market was strong last week, with Bitcoin leading and nearing historical highs, while most cryptocurrencies rose; however, low trading volumes and significant corrections in some cryptocurrencies indicate that risks still exist. Policy uncertainty remains a primary warning factor, and investors should remain cautious, paying attention to market fluctuations and policy changes.

3. Industry and Track Hotspots

TAC, which raised $5 million led by HackVC, aims to enhance compatibility with the Ethereum Virtual Machine (EVM) by connecting EVM dApps with the TON and Telegram's billion-user ecosystem. Ubyx, which raised $10 million with Galaxy leading and Coinbase participating, aims to create a global stablecoin clearing platform for cross-chain multi-currency face value settlement.

II. Market Hotspot Tracks and Potential Projects of the Week

1. Overview of Potential Projects

1.1. Analysis of TAC, which raised $5 million led by HackVC, connecting EVM dApps with the TON and Telegram's billion-user ecosystem

Introduction

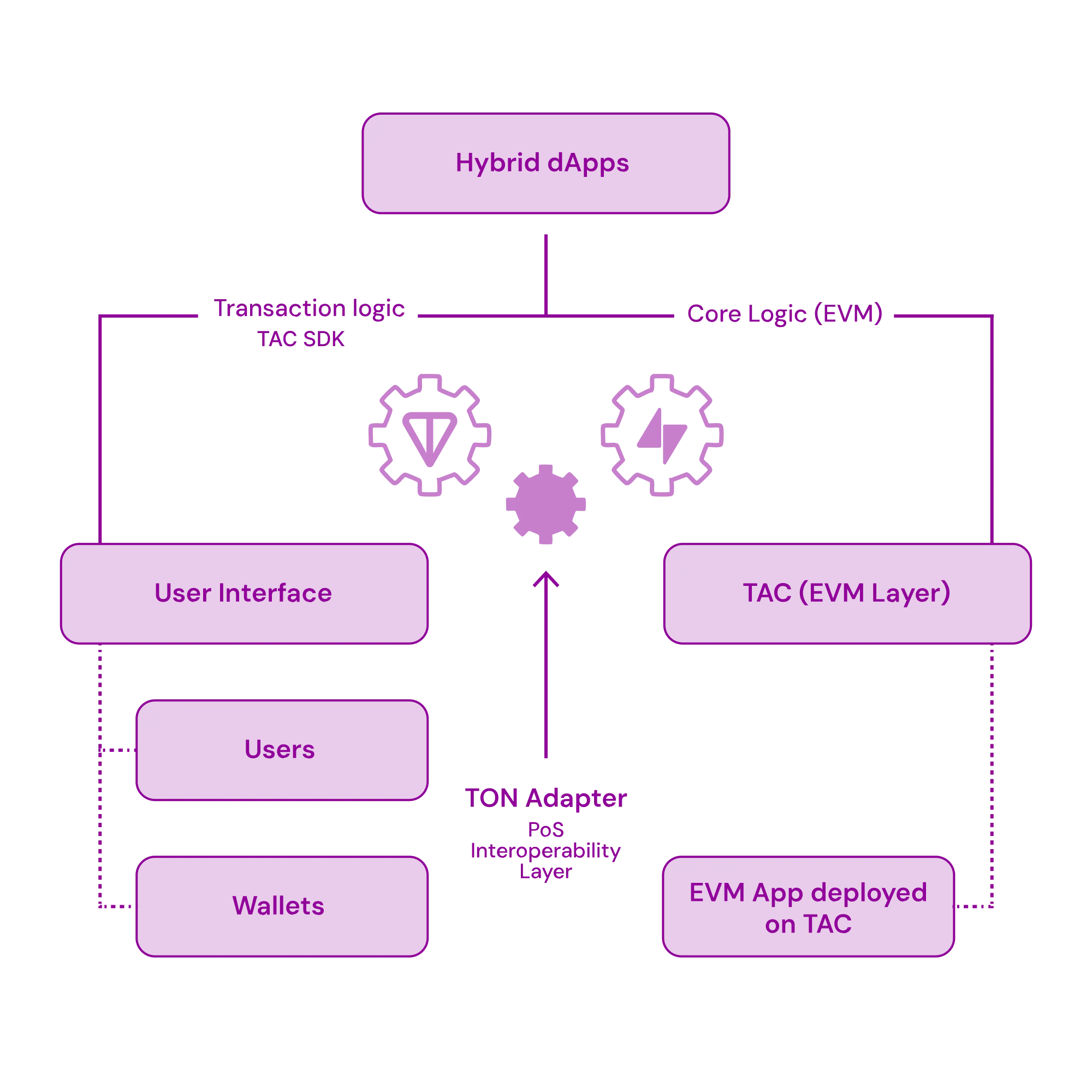

TAC is a network expansion of TON, designed to enhance its compatibility with the Ethereum Virtual Machine (EVM). It allows users to access EVM applications directly through the TON wallet without managing multiple wallets or using traditional cross-chain bridges.

1. System Overview TAC consists of three main components:

- TAC EVM: A dPoS Layer1 EVM chain built on CosmosSDK and Ethermint, reinforced by the Babylon Bitcoin staking mechanism for enhanced security.

- TON Adapter: A decentralized messaging routing layer operating on both TON and EVM sides, secured by a group of sequencers and proof-of-stake-based TON LST (liquid staking tokens).

- Proxy Applications: A set of smart contracts (including contracts on TON and TAC EVM) that support direct interaction with applications.

2. Overview of the TAC EVM Layer

The TAC EVM layer is a dPoS EVM Layer1 based on CosmosSDK and Ethermint (built on Tendermint-Core).

This EVM execution environment is fully compatible with the EVM specifications of the Ethereum mainnet, running a modified version of Geth 1.10, which includes new opcodes (such as Push0) and EIP-1559 for standard gas fee management, as well as support for services like the debug_trace() API.

This solution offers high compatibility and reusability of existing tools and middleware. Developers can easily connect their EVM wallets or integrated development environments (IDEs) directly to the TAC EVM layer, deploying Solidity code without the need for re-auditing.

3. EVM Security Model

The TAC EVM layer primarily ensures security through a dPoS (Delegated Proof of Stake) mechanism based on Tendermint-Core consensus, achieving a good balance between network decentralization and throughput.

Before the mainnet launch, the number of permissionless validators will be determined, allowing users to delegate TAC tokens to existing validators to participate in network security.

Ethermint provides the same block finality based on Tendermint, with a block time of 3 seconds for the TAC EVM layer.

In addition to network security provided by dPoS consensus in the next block, the TAC EVM layer also introduces an additional security layer provided by Babylon Bitcoin (re)staking: Bitcoin holders can stake BTC in a self-custodial manner on the Bitcoin blockchain and delegate Babylon validators to verify and sign TAC EVM blocks. If Babylon validators engage in double-signing behavior, the Babylon protocol will penalize their staked BTC, thereby enhancing economic security and preventing double-spending risks on the TAC EVM layer. This mechanism may slightly delay block finality but provides stronger guarantees and rewards through TAC token inflation.

Since the TAC EVM layer is built on Tendermint-Core, block reorganization (re-org) is not allowed.

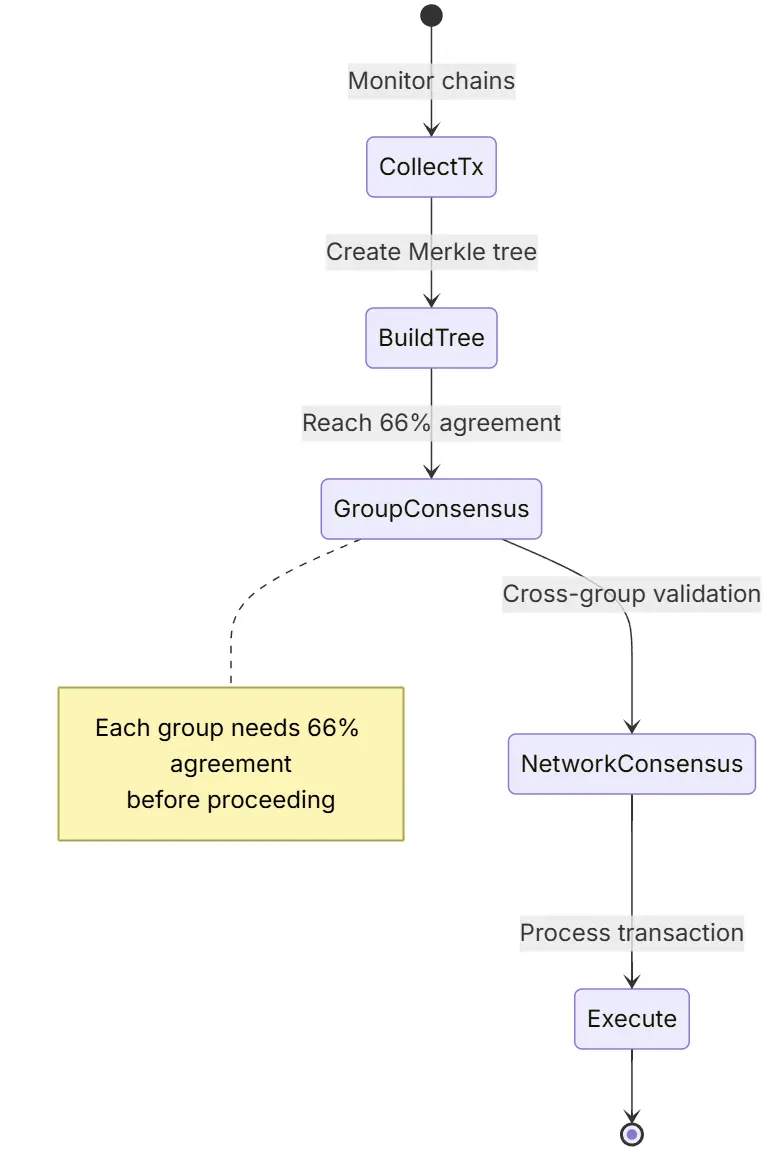

4. Security Model The sequencer network is an off-chain system based on Proof of Stake (PoS) that connects the TON chain and the EVM chain. The sequencers form several groups, each responsible for transaction validation and consensus management.

Bridging Sequencer Groups

The sequencer groups enhance security through decentralization. Each group:

- Contains multiple sequencer nodes

- Independently builds transaction trees

- Must achieve 66% internal consensus

- Must stake collateral as a security guarantee

The group's collateral must remain above the minimum threshold set by DAO voting. Although the amount staked does not affect voting weight, it does impact profitability, incentivizing groups to stake more to enhance security.

Group Election and Monitoring

Groups are elected through DAO voting or multi-signature processes. The system includes:

- Regular elections every N hours (parameters configurable by DAO)

- Performance monitoring and rating systems

- Penalty mechanisms for erroneous operations

- Security management of staked collateral

Consensus Threshold

- Groups must achieve 66% internal agreement

- Cross-group consensus is used for network validation

- Relevant parameters can be configured through DAO voting

Penalty Mechanism

- Groups can submit penalty requests

- A network-wide vote determines the penalty outcome

- Violations will result in the forfeiture of staked collateral

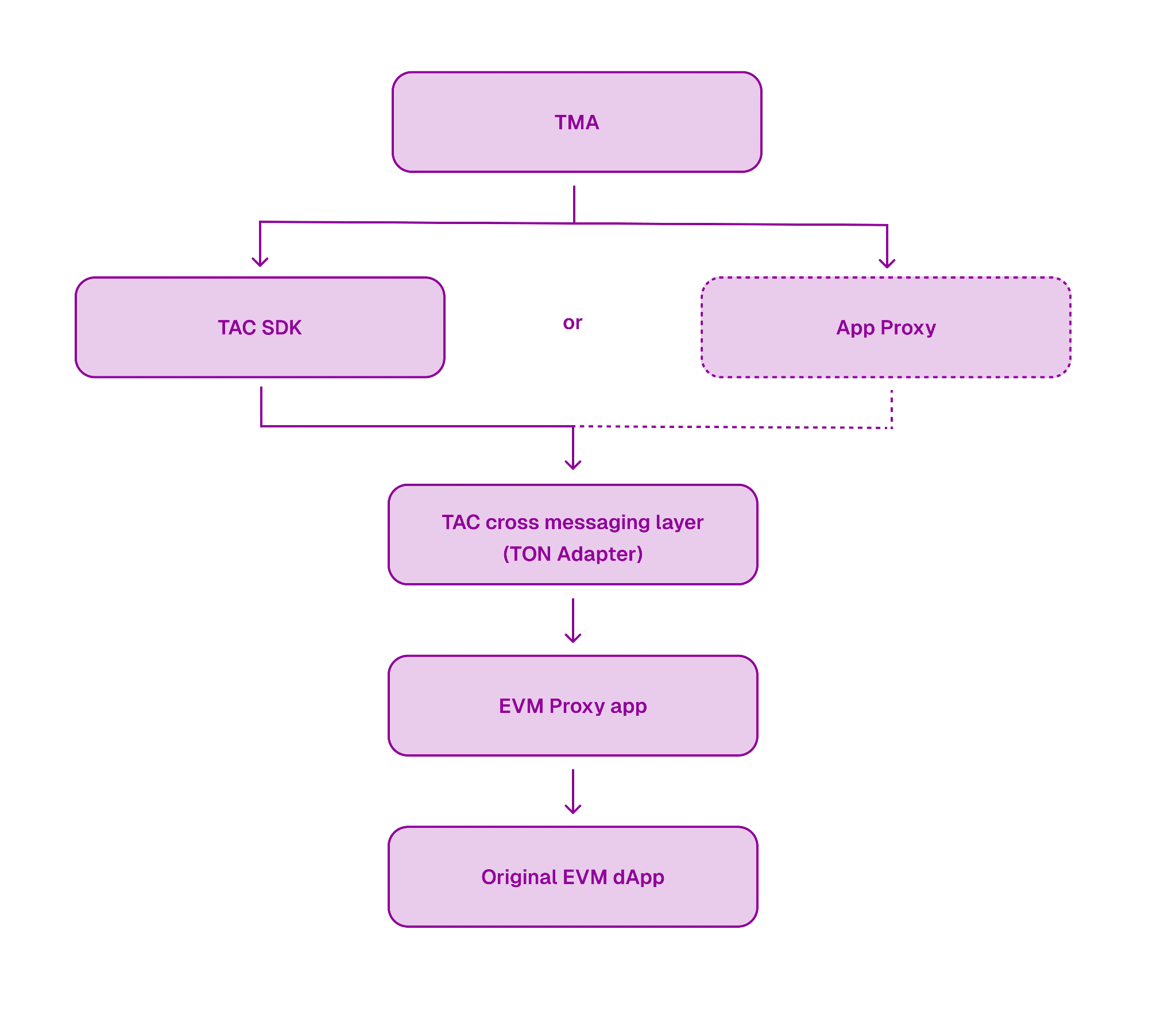

Proxy Applications

For each application on the TON and EVM chains, the system automatically generates DApp proxies. These proxies support:

- Direct interaction from the TON wallet

- Formatting messages for the TON adapter

- Asset management

- Interaction with EVM applications

5. Transaction Lifecycle

Each transaction in TAC goes through the following stages:

- Initialization The user initiates a transaction through the TON wallet, and the DApp proxy generates a message sent to the TON adapter, locking the TON assets.

- Event Detection The sequencer monitors new events, stores them in a local database, and collects TON logs.

- Root Hash Generation The sequencer periodically builds a Merkle tree of transactions, with the root hash used for consensus.

- Consensus Process Each group forms and verifies the Merkle tree, submitting consistent results to achieve network-level consensus.

- Transaction Execution Verified transactions are executed on the TAC EVM layer, calling contract methods and verifying the executed Merkle proof.

- Completion/Rollback Successful transactions update the status and feedback to TON, with corresponding changes in the user's wallet assets; failed transactions are rolled back, and fees are allocated to the sequencers.

Commentary

TAC effectively connects the TON and Ethereum ecosystems by building a Layer1 network compatible with EVM and utilizing the TON wallet and proxy contracts for seamless interaction. It boasts strong compatibility, a simple user experience, no need for bridging, and enhanced security through Bitcoin re-staking. Additionally, the combination of sequencer groups, DAO governance, and penalty mechanisms ensures system decentralization and operational stability. However, its complex system design relies on the coordination of multiple off-chain and on-chain components, placing high demands on sequencer performance, consensus efficiency, and DAO governance, which may pose certain technical barriers and governance challenges in the early stages.

1.2. Interpretation of Ubyx, which raised $10 million with Galaxy leading and Coinbase participating: Creating a global stablecoin clearing platform for cross-chain multi-currency face value settlement

Introduction

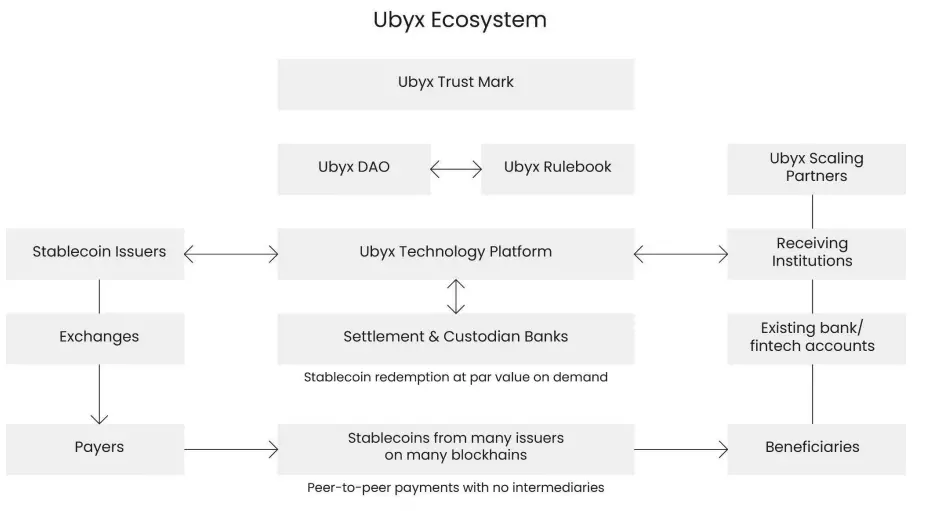

Ubyx is a global clearing and settlement platform designed to enable stablecoins to operate like universal digital cash. It allows banks, fintech companies, issuers, and merchants to accept, deposit, and redeem stablecoins at face value across multiple currencies and blockchains using existing financial infrastructure. The protocol ensures stablecoins are redeemed at face value through a shared rulebook and pre-funded settlement accounts, making them compliant with cash equivalents (IAS7) standards in accounting, while also supporting peer-to-peer payments without intermediaries.

Architecture Overview

1. Ubyx Protocol Components

Ubyx consists of core components and advanced components, where the core components are the minimum necessary conditions for real-time transactions in a many-to-many clearing system. The advanced components are necessary for achieving a gradual decentralization process and realizing the vision of widespread stablecoin application.

Core Components

- Ubyx Clearing Platform: A secure and scalable technological infrastructure that connects all network participants and transmits transaction instructions among regulated participants.

- Ubyx Token: A governance token used to drive community participation and ecosystem incentive mechanisms.

- Ubyx Foundation and DAO: A community-driven protocol evolution towards decentralized governance.

- Ubyx Rulebook: A complete governance framework defining access standards, operational norms, etc.

Advanced Components

- Custodial Receiving Institution Wallet: A technical tool provided by Ubyx's extended partners to help financial institutions access the network, including multi-chain custodial wallets, on-chain data analysis, etc.

- Ubyx Minting Gateway: Enables reverse flow, allowing users to obtain stablecoins from partner issuers through their financial institutions.

- Ubyx Lending Facility: A cross-issuer mechanism that provides liquidity support to issuers during operational interruptions.

- Ubyx Labs: A collaborative R&D platform dedicated to meeting the additional technical and regulatory requirements necessary for the widespread adoption of stablecoins.

2. How Ubyx Works

Ubyx is a straightforward system that makes redeeming stablecoins as simple as depositing a check. Its operation is as follows:

- Network Membership: Issuers and receiving institutions must agree to the Ubyx Rulebook to join the network and connect to the Ubyx platform via standard APIs. Eligibility for membership is defined by the rulebook and is limited to regulated entities. High-risk jurisdictions are not covered by the system.

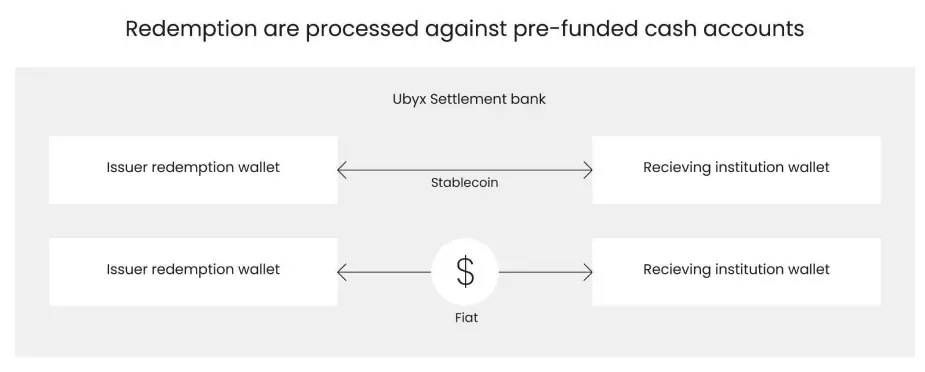

- Settlement Bank Setup: Each issuer and receiving institution holds a digital wallet and cash account at a Ubyx-designated settlement bank or custodial institution to support various currency operations.

- Client Configuration: Banks and fintech companies provide custodial digital wallets for their clients, which support all participating stablecoins and their respective blockchain networks. Technical support is typically provided by Ubyx's extended partners.

- User Experience: Clients receive blockchain addresses for receiving stablecoins from different networks and can easily convert stablecoins into funds in their bank or fintech accounts.

- Pre-Funded Cash Accounts: Stablecoin issuers hold dedicated cash reserves in designated settlement banks to ensure they can fulfill all redemption requests. This portion of funds comes from the issuer's existing reserves, not additional capital buffers. The pre-funding amount is determined by the Ubyx community through the rulebook, typically calculated based on average net redemption days.

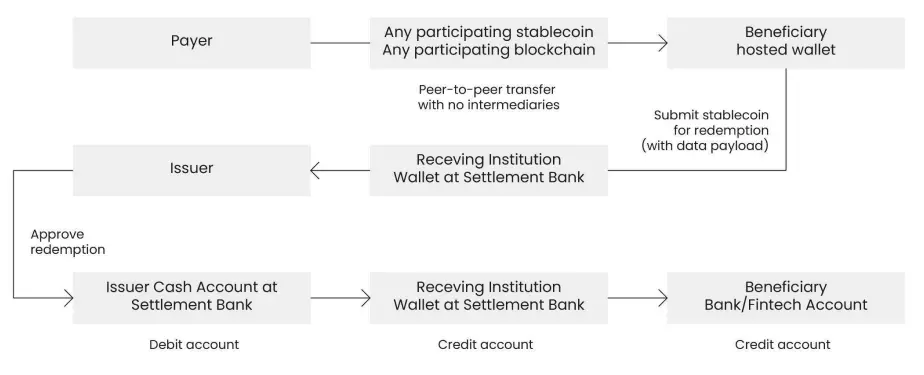

- Redemption Process:

a. When a client deposits stablecoins, their associated institution first conducts a financial crime check, then forwards it to the issuer for verification.

b. After passing further compliance checks, the issuer transfers equivalent funds from its pre-funded account to the receiving institution's cash account.

c. The client's bank account will be credited in full with the selected currency, equivalent to the value of their stablecoins. - Compliance Checks: The receiving institution, settlement bank, and issuer all conduct multiple layers of compliance checks to ensure the transaction is legal and compliant.

- Exception Handling:

a. If the stablecoin fails to pass compliance checks from any regulatory participant, it will be intercepted for processing.

b. If the issuer's pre-funded cash account lacks sufficient funds, the redemption cannot be completed, and the stablecoins will be returned to the client, who can attempt other withdrawal channels.

3. Ubyx Platform

The Ubyx technology platform coordinates all interactions between stablecoin issuers, financial institutions, and settlement banks. The platform connects all network participants through standardized APIs to orchestrate the entire redemption process:

- Custodial Wallet Reception (in the name of the payee): The sender obtains the payee's address on the selected blockchain and sends the chosen stablecoin. Both parties can see the Ubyx trust mark, confirming that the payment will be accepted.

- Redemption Routing: When a client deposits stablecoins at their financial institution, the platform routes these tokens to the corresponding issuer. This process is completed by transferring the client's stablecoins into the institutional wallet held by the receiving institution at the Ubyx settlement bank.

- Verification Process: The stablecoins, along with a data package that meets the Travel Rule and other regulatory requirements, are submitted to the issuer. The issuer verifies the stablecoins and authorizes the redemption.

- Settlement Coordination: The platform is responsible for coordinating the transfer of funds from the issuer's pre-funded account to the receiving institution's account, a process that occurs in the Ubyx settlement bank's ledger, operating 24/7, while maintaining transaction independence from Ubyx.

- Settlement Model: Initially, a gross settlement model will be used, with the potential to introduce other models (such as deferred net settlement) as the system matures. The Ubyx clearing mechanism will optimize liquidity efficiency and other metrics in the future, but the initial focus is on establishing ecosystem trust through a simple standardized solution.

- Transaction Records: The platform provides detailed redemption information to the receiving institution based on the ISO20022 data model for client account bookkeeping.

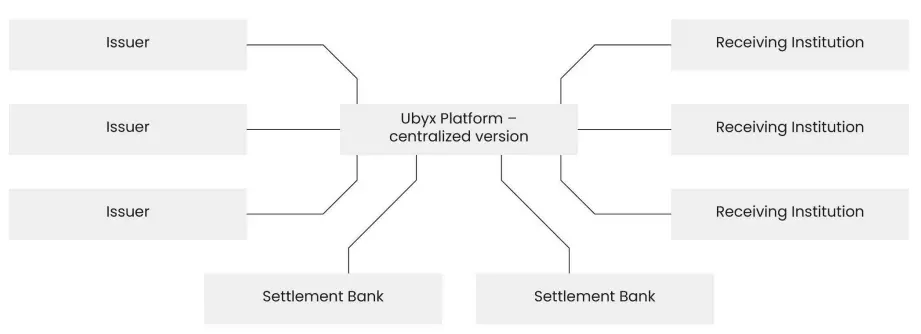

Pragmatic Strategy for Technical Implementation of Ubyx:

- Initial Phase: The platform will operate as a centralized system similar to traditional clearing infrastructure to gain the trust of regulatory bodies and traditional financial institutions.

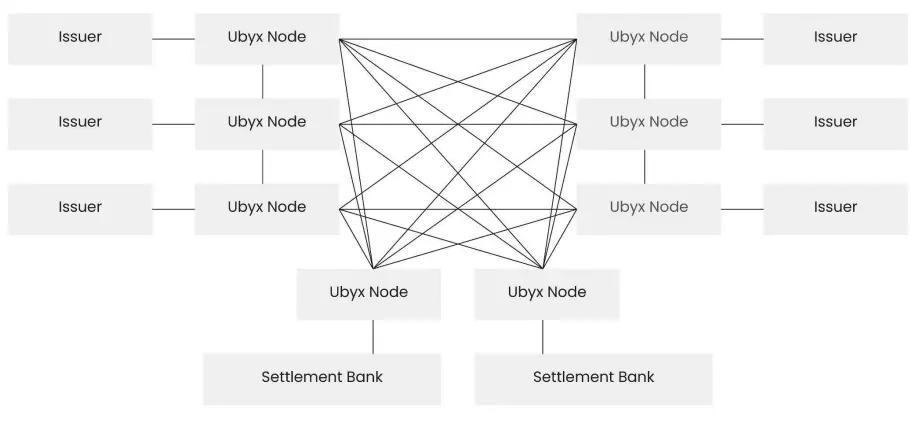

- Gradual Decentralization: Over time, the Ubyx platform will transition to a more decentralized architecture, potentially evolving into an independent Layer 1 or Layer 2 blockchain network. Its core functions will remain unchanged, still coordinating the flow of stablecoins, cash, and data among participants.

The Ubyx platform starts with mature technology and traditional models, gradually moving towards a higher degree of decentralization, fostering innovation while building trust, effectively bridging the gap between traditional finance and a decentralized future.

Summary

Ubyx combines traditional financial compliance systems with blockchain technology to create a secure, scalable stablecoin clearing and settlement platform, featuring multi-chain and multi-currency support, strong compliance guarantees (such as multi-layer KYC/AML checks), 24/7 fund flow, and a gradual decentralization technical roadmap, which helps enhance the usability and trustworthiness of stablecoins. However, its initial reliance on a centralized architecture, limitations imposed by regulatory bodies and compliance requirements, and participation restricted to compliant entities may slow its expansion in terms of openness and global applicability.

2. Key Project Details of the Week

2.1. Detailed Explanation of EigenCloud, a Developer Infrastructure Platform Integrating DA, Computing, and Dispute Resolution Launched by Eigen Labs with $70 Million in Funding Solely from a16z

Introduction

EigenCloud is the unified platform vision for the development direction of EigenLayer—an integrated platform aimed at supporting the next generation of programmable, verifiable applications and agents. EigenCloud marks a shift from fragmented infrastructure components to a developer-centric experience, with a core focus on programmable verifiability, cloud-level collaboration capabilities, and a trust mechanism based on cryptoeconomics.

EigenCloud reimagines the developer experience around EigenLayer, packaging a series of officially verifiable services such as EigenDA, EigenCompute, and EigenVerify with a new suite of powerful development tools. This includes a new command-line tool DevKit designed for AVS and application developers, composable middleware and orchestration tools, a unified billing and incentive mechanism, and industry-leading onboarding and monitoring capabilities.

These features enable developers to move from idea to deployment in days without needing to deeply understand the underlying details of EigenLayer, thus driving the large-scale adoption of verifiable infrastructure.

Building EigenCloud is intended to serve developers of "verifiable applications." Each service or feature within the platform directly addresses real user pain points, aiming to reduce development friction, increase adoption rates, and unlock new value. As official and partner services continue to expand, EigenCloud will integrate them into a ready-to-use, unified developer solution.

Feature Analysis

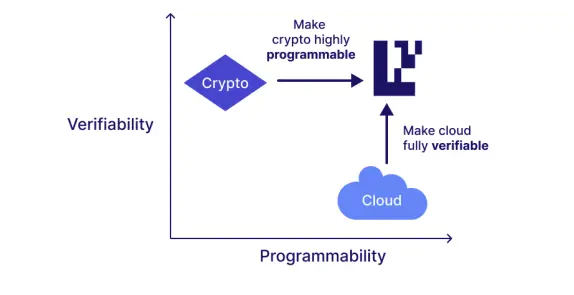

EigenCloud aims to provide developers with a platform that combines "cloud-level programmability" with "cryptographic-level verifiability" (see below). EigenCloud allows developers to migrate complex application logic into verifiable off-chain containers, retaining only the most basic logic that requires consensus enforcement on-chain, while non-verifiable infrastructure (such as front-end) can continue to be deployed on existing public clouds.

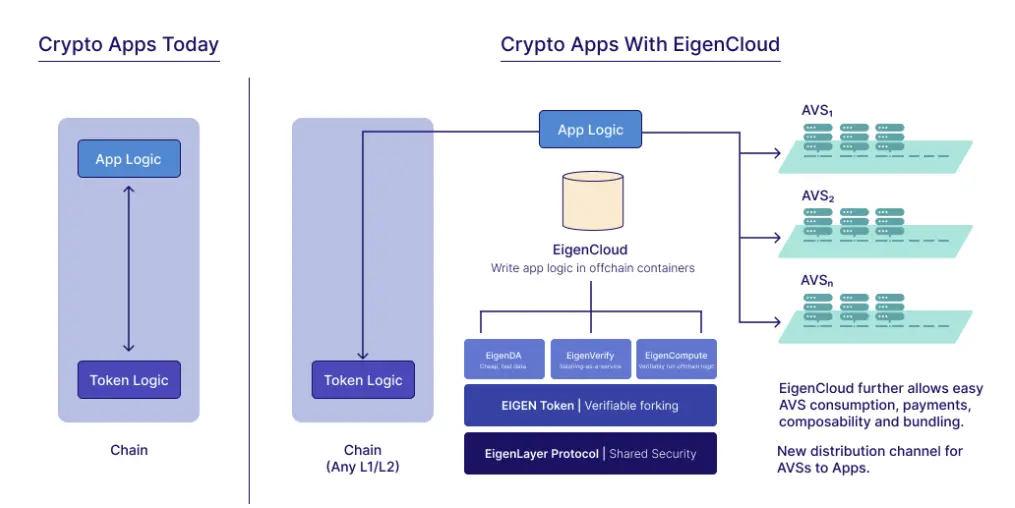

Eigen Labs proposes a new application architecture that combines the programmability of the cloud with the verifiability of blockchain, achieving this goal by migrating application logic from smart contracts to EigenCloud. The application architecture is divided into two parts:

- Token Logic: Blockchains are well-suited for handling token-related logic, such as token storage, custody, and ownership transfers based on various programmatic conditions.

- Application Logic: Application logic encapsulates business logic to determine under what conditions related token-layer operations are executed.

The Eigen team proposes migrating application logic out of the on-chain virtual machine into a fully programmable off-chain container. In this container, developers can write programs in familiar programming languages, calling the necessary software libraries and off-chain tools and APIs (see below). The container provides economic security through staking EIGEN tokens on EigenLayer: if the execution results of the container are tampered with, the staked tokens will be penalized and redistributed to application users.

Developers can also combine custom logic with existing autonomous verifiable services (AVS) and manage them through EigenCloud. Additionally, developers can customize trust models beyond the economic security mechanism, such as adopting optimistic rollup-level security, zero-knowledge proofs (ZK), honest-majority assumptions, and trusted execution environments (TEE) to protect the execution process of these verifiable containers.

By migrating application logic to a verifiable cloud, developers can freely build more powerful and complex applications that would be nearly impossible to achieve if fully deployed on-chain, and which also cannot achieve verifiability in traditional public clouds. EigenCloud greatly expands the design space for applications, giving rise to a new class of verifiable software services whose logical richness far exceeds the capabilities provided by traditional on-chain virtual machines.

Just as cloud computing has numerous official and third-party infrastructure services (IaaS), platform services (PaaS), and software services (SaaS), EigenCloud is also establishing an ever-expanding library of first-party and third-party verifiable services (AVS). These AVS, like public cloud services, provide developers with verifiable computing and staking capabilities, allowing them to focus on creating unique value for their applications without the need to repeatedly build generic infrastructure.

1. EigenCloud Provides a Combination of Cloud-Level Programmability and Cryptographic-Level Verifiability.

EigenCloud is a set of tools and services aimed at helping developers quickly build, deploy, and scale highly expressive applications that can interact verifiably with any blockchain. The core idea of EigenCloud is to enhance the application logic in smart contracts through off-chain computation and services, ensuring that the execution process of these containers is verifiable.

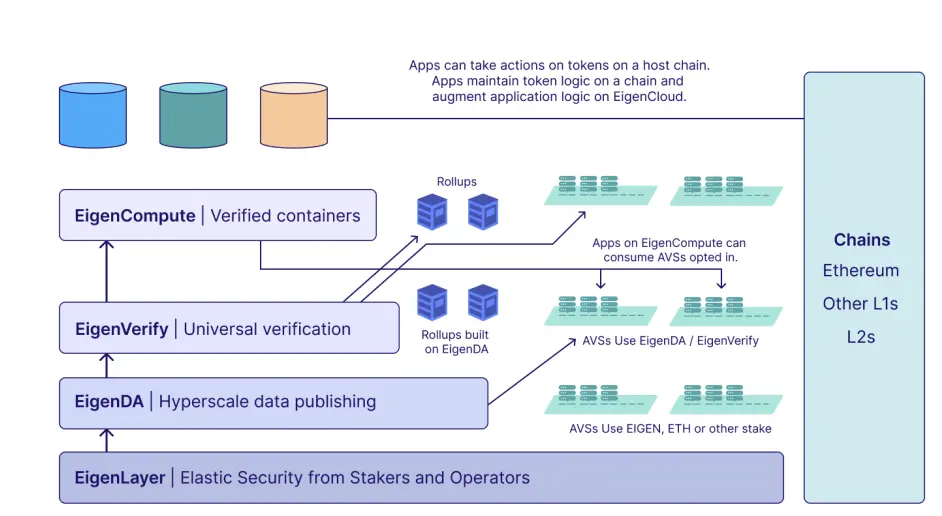

2. EigenLayer is the Foundation of EigenCloud

EigenLayer enables developers to build verifiable off-chain services, thus achieving a combination of "cloud-level programmability" and "cryptographic-level verifiability." In proof-of-stake (PoS) blockchain networks, verifiability comes from cryptoeconomic security—validators must stake tokens and run nodes to verify network activity, facing penalties for misconduct (such as slashing their stake) and earning rewards for beneficial work.

Through EigenLayer, the cost of initiating economic security has been significantly reduced, allowing for the construction of various services. We refer to these services as AVS (Autonomous Verifiable Services)—"autonomous" means anyone can stake and continuously run these services (similar to Ethereum), while "verifiable" means the correct operation of these services is enforced by on-chain penalty contracts.

3. Eigen Primitives Extend Programmability and Verifiability.

While it is simpler than launching a Layer 1 chain, building autonomous verifiable services (AVS) is still complex, meaning that only teams capable of constructing generic infrastructure primitives can develop AVS. EigenCloud is dedicated to enabling application developers to easily build cloud-scale applications with cryptographic-level verifiability.

However, building AVS must contend with throughput limitations, the high costs of data publishing on Ethereum, the necessity of writing on-chain penalty logic, and the overall complexity of development on top of EigenLayer. If similar services already exist, applications can choose to directly use existing AVS.

However, using existing AVS in the EigenLayer ecosystem presents friction such as difficulty in discovery, lack of standardization (including payment, trust models, and supported chains), and composability issues (when applications require multiple AVS). To address these issues, Eigen has proposed three key primitives: EigenDA, EigenVerify, and EigenCompute.

EigenDA is the foundational component of EigenCloud, as it provides a massively scalable, economically secure data availability layer necessary for verifying off-chain computations. Without EigenDA, verifiable containers and fraud proofs cannot reliably publish their inputs and outputs for independent verification. EigenDA ensures the integrity of the entire trust model of EigenCloud by providing guaranteed, transparent, and low-cost cryptographic proofs and off-chain data storage, allowing complex applications to inherit blockchain-level trust while maintaining cloud flexibility.

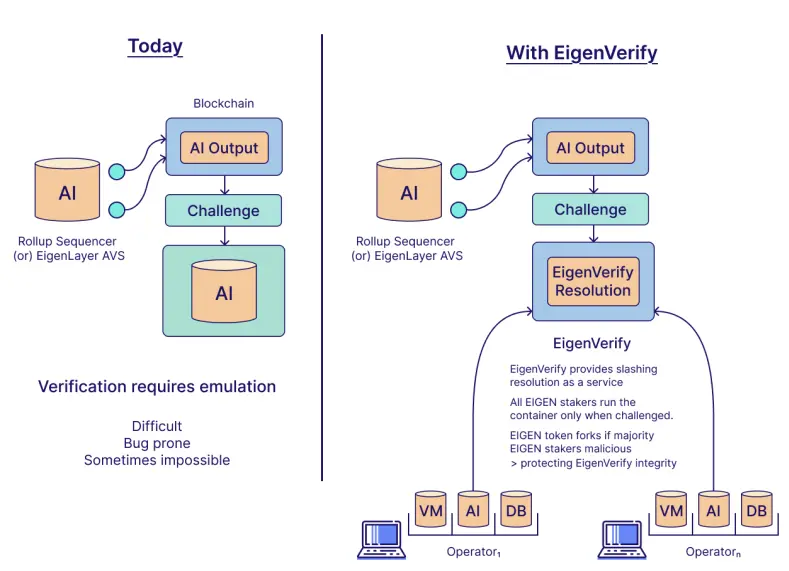

EigenVerify is a set of plug-and-play services used to verify whether AVS or Rollup operators have correctly executed computations. In the past, building robust and customized fraud proofs was both complex and resource-intensive for AVS developers. Currently, only limited forms of dispute resolution (such as double-signing violations or simple zero-knowledge proof verification services) are feasible. Developing expressive on-chain fraud proof contracts for complex workloads (such as AI inference, large-scale database computations, or custom Rollup virtual machines) is extremely challenging and requires significant time and budget. Additionally, certain types of errors, such as oracle disputes and liveness failures, cannot be objectively verified on-chain, making adjudication difficult.

EigenVerify addresses these challenges by providing ready-made verification primitives to verify whether AVS has correctly executed computations. When suspicious errors are detected in AVS or Rollup execution, anyone can invoke EigenVerify to resolve disputes. EigenVerify supports two verification modes with strong security guarantees:

- Objective verification of whether AVS operators have correctly executed deterministic code through local re-execution or zero-knowledge proofs.

- Subjective verification, meaning any task where two users can reach a consensus result can be verified (e.g., the adjudication of prediction markets—who won the election).

EigenVerify consists of a group of operators who stake EIGEN tokens on EigenVerify and EigenDA, and must reach a majority consensus to respond to verification requests. If a majority-weighted EigenVerify operator colludes to make an erroneous ruling, EIGEN tokens will be "forked" to punish malicious stakers and operators, ensuring the reliability of EigenVerify services. The EIGEN token forking mechanism serves as a deterrent to most stakers, imposing "nuclear" penalties—burning all their EIGEN tokens and appropriately rewarding the party initiating the fork. For details, please refer to the explanation of the EIGEN token forking mechanism.

EigenCompute provides application developers with an abstraction layer that allows them to easily build applications based on off-chain verifiable computation and autonomous verifiable services (AVSs). EigenCompute leverages EigenLayer, EigenDA, and EigenVerify at its core to achieve this goal. It primarily accomplishes two tasks: off-chain verifiable computation and AVS composition.

4. EigenCloud Flywheel Effect and EIGEN Value Accumulation

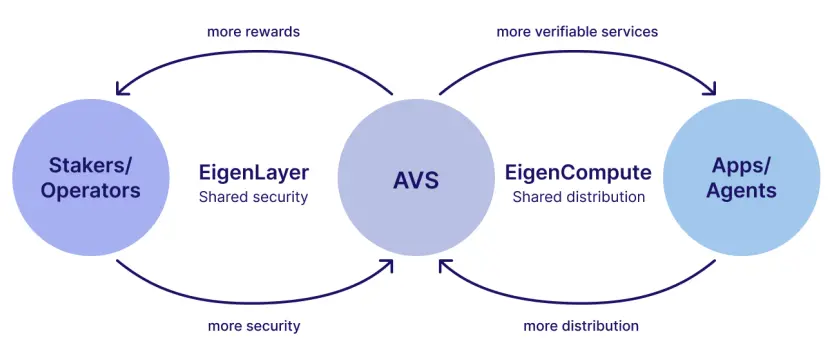

EigenLayer expands the boundaries of traditional proof-of-stake (PoS) systems through the foundation of open-source cryptoeconomic security. Since its inception, EigenLayer has served as a coordination layer, connecting stakers (or their designated operators) with protocols and applications that require cryptoeconomic security guarantees. Applications are built on top of autonomous verifiable services (AVS) deployed on EigenLayer, and these AVS reward stakers and operators who choose to participate and take on the computational tasks required to secure the protocols and applications.

With EigenCloud, this flywheel effect is further strengthened:

a) It expands the types of applications that can be secured by blockchain (through EigenVerify);

b) It simplifies the process of directly utilizing security mechanisms and leveraging security through AVS (through EigenCompute).

Combined with these new primitives, the EIGEN token ensures that any two rational users can ultimately verify the execution results of tasks they agree upon. As more powerful AVS are built, novel applications can develop based on them; simultaneously, as new applications are conceived and born, innovative AVS will compete for the business of these applications.

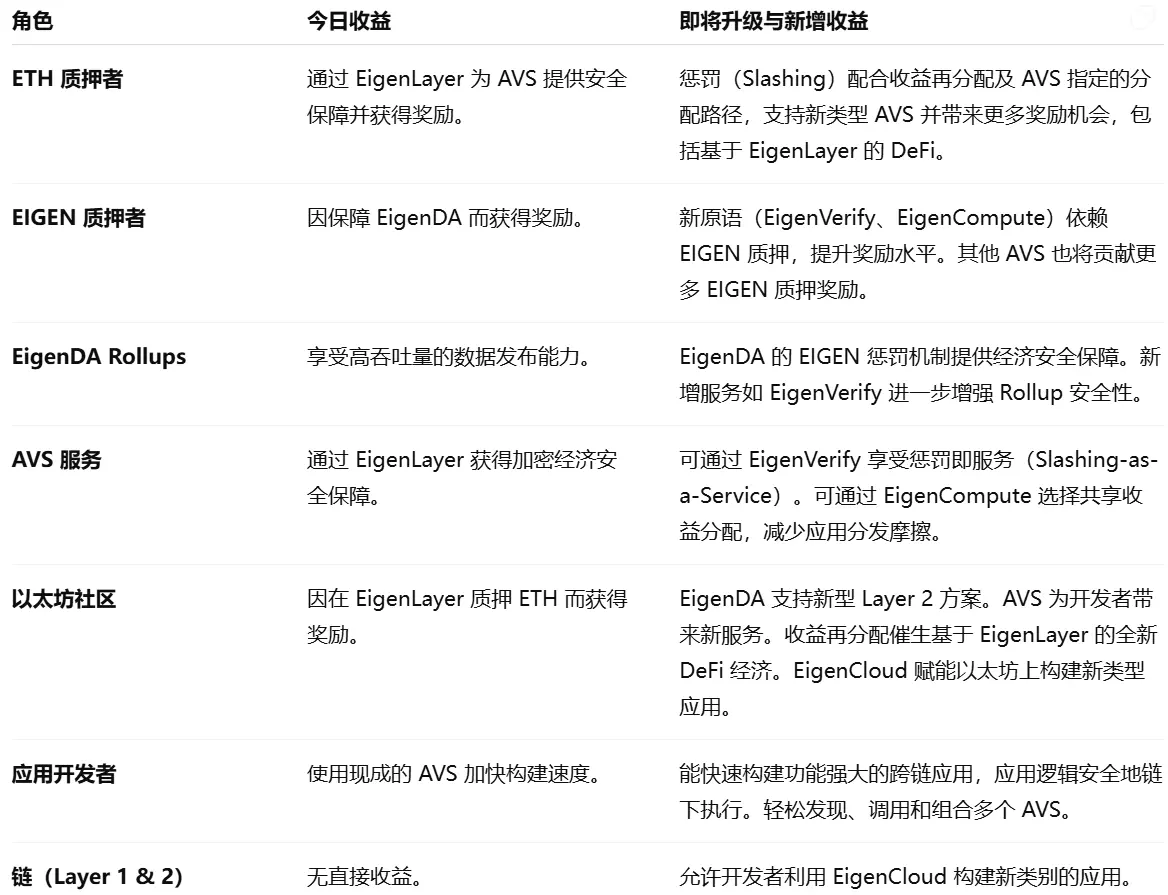

5. Functions of Ecosystem Participants

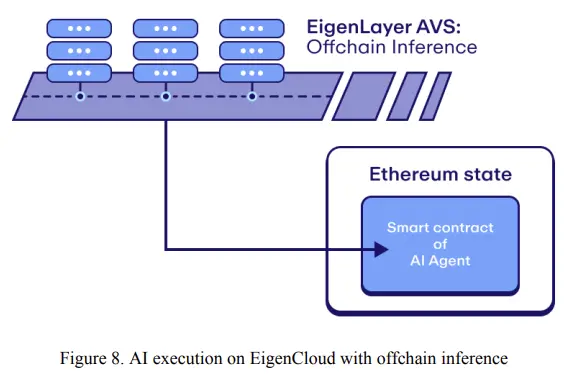

6. AI as Secure as Smart Contracts

A core limitation of existing blockchains is that any program executed on-chain must maintain determinism across different hardware. This poses a severe challenge for AI execution, as GPUs have various non-deterministic factors (such as scheduling, rounding, etc.), making it difficult to enforce cross-platform determinism without significantly degrading performance.

In contrast, on EigenCloud, any fact that two rational observers can reach consensus on can be correctly resolved. Therefore, for AI, it is sufficient to ensure platform-specific determinism; for example, if a piece of code can produce the same deterministic result on a widely available GPU target (such as H100), then such programs can achieve verifiable execution on EigenCloud.

A great example is AI-enhanced DeFi, which dynamically adjusts parameters, prices, and liquidity through AI, enhancing the intelligence of DeFi programs.

- AI Adjudication of Disputes and Automated Governance

In the final phase, we believe subjective verifiability will also become possible. Once AI reasoning and upgrade covenants are realized, we can build and maintain models for adjudication—any current version of the adjudication model is executed through verifiable AI reasoning, and any upgrades to the AI reasoning model must be conducted through pre-committed upgrade covenants, for example: the updated AI model is trained only on data inputs recognized by the community. Examples include:

- Protection for minority token holders

- AI-managed meme coins, allowing AI to mint new coins for qualified participants

- AI debate adjudication

- AI prediction market adjudication

Support for multiple trust models: cryptoeconomic, optimistic, zero-knowledge (ZK), and majority honest.

Any matters on which two rational parties can reach consensus can be secured through the EIGEN token forking mechanism. For such services, we can provide cryptoeconomic or optimistic guarantees based on usage patterns.

Some services require stronger guarantees than cryptoeconomic security and need to leverage zero-knowledge (ZK) proofs to ensure higher program integrity or privacy. These services will also be available on EigenCloud. EigenLayer already has multiple zero-knowledge proof networks that can be used for ZK proofs on EigenCloud.

However, some categories of services cannot be built on either ZK or cryptoeconomic trust and require a "majority honest" trust model. EigenCloud will provide a carefully selected cluster of high-quality decentralized operators for approved third parties to build and deploy services. Examples of such services include:

Secure Multi-Party Computation (Secure MPC), secret sharing, threshold fully homomorphic encryption (Threshold FHE), etc.

zkTLS notaries

Internet oracles

Location oracles

Threshold signers

Data storage

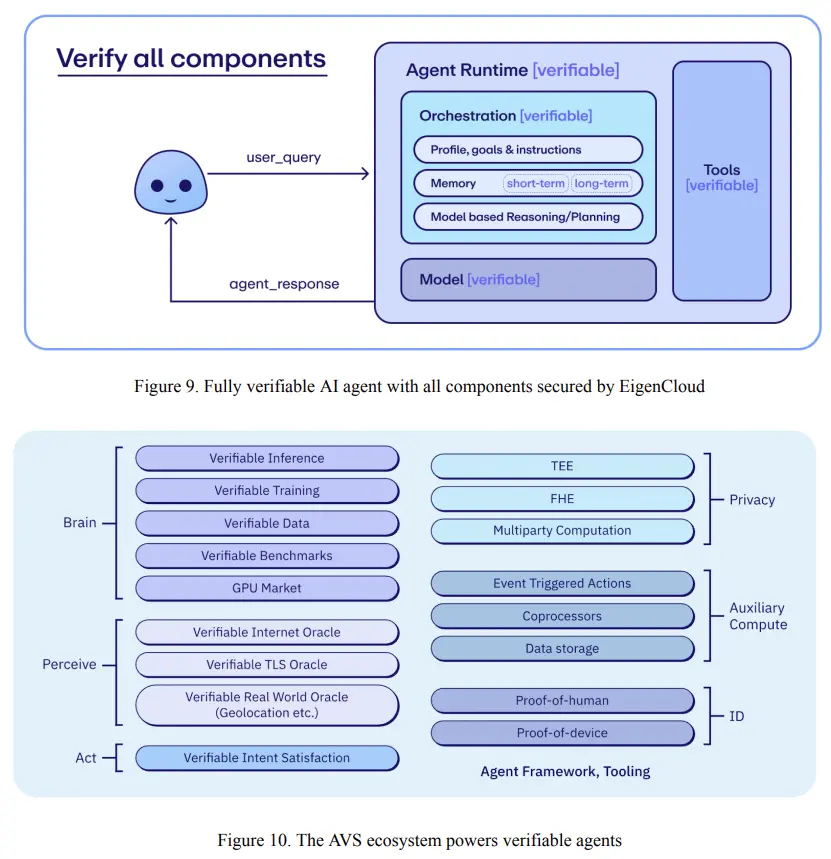

Fully verifiable AI agents.

A verifiable AI agent must not only verify its underlying model but also the entire supply chain, including all data inputs, agent runtime, internal storage, reasoning and planning, base model, and each tool invocation. The Eigen ecosystem has a rich and diverse set of verifiable services capable of building fully verifiable AI agents. Sovereign/verifiable AI agents may require substantial support from powerful services, as detailed in the table below.

Summary

The advantage of EigenCloud lies in its combination of the cryptoeconomic security of blockchain and the programmability of cloud computing, providing a highly verifiable and scalable off-chain computing and service platform that significantly reduces development complexity, supports diverse trust models, and offers a rich ecosystem of verifiable services, helping developers quickly build innovative and secure applications. However, its disadvantage is that the technical threshold remains high, some advanced features rely on complex economic incentives and governance mechanisms, and the ecosystem is still in its early stages, with application and user scale needing further expansion.

III. Industry Data Analysis

1. Overall Market Performance

As of November 1, Eastern Time, the total net outflow of Ethereum spot ETFs was $10.9256 million.

1.1. Spot BTC vs ETH Price Trends

BTC

Analysis

Key resistance level to watch this week: None (continuously reaching new highs, no effective resistance levels for reference)

Key support levels to watch this week: $118,400 first line support, $116,000 second line support

ETH

Analysis

Key resistance level to watch this week: $3,040~$3,220 resistance zone

Key support levels to watch this week: $2,900 first line support, $2,760 second line support

2. Public Chain Data

2.1. BTC Layer 2 Summary

Analysis

The mainnet launch of Botanix marks a significant step forward for Bitcoin Layer 2 in terms of speed and compatibility.

Bitcoin Hyper is rapidly raising funds in the presale phase, with its SVM architecture and DeFi capabilities expected to make Bitcoin Layer 2 a smart contract system.

Sidechain technology continues to attract attention from the research community, providing possibilities for more Bitcoin expansion features in the future.

2.2. EVM & Non-EVM Layer 1 Summary

Analysis

This week, EVM-compatible Layer 1s (including WOM, Injective, Cronos) have launched testnets or significant upgrades, driving improvements in underlying performance and ecosystem support.

The core Ethereum mainnet is accelerating its transition to zkEVM, which will greatly enhance main chain throughput and decentralized verification in future deployments.

In the non-EVM or multi-VM Layer 1 sector, projects like Kusama, COSMOS, Babylon Genesis, and MANTRA are advancing cross-chain compatibility and Bitcoin-native DeFi architectures.

Overall, the on-chain mainnet continues to move towards high performance, EVM compatibility, and multi-chain interoperability, while also focusing on the diversification of DeFi applications and cross-ecosystem collaboration.

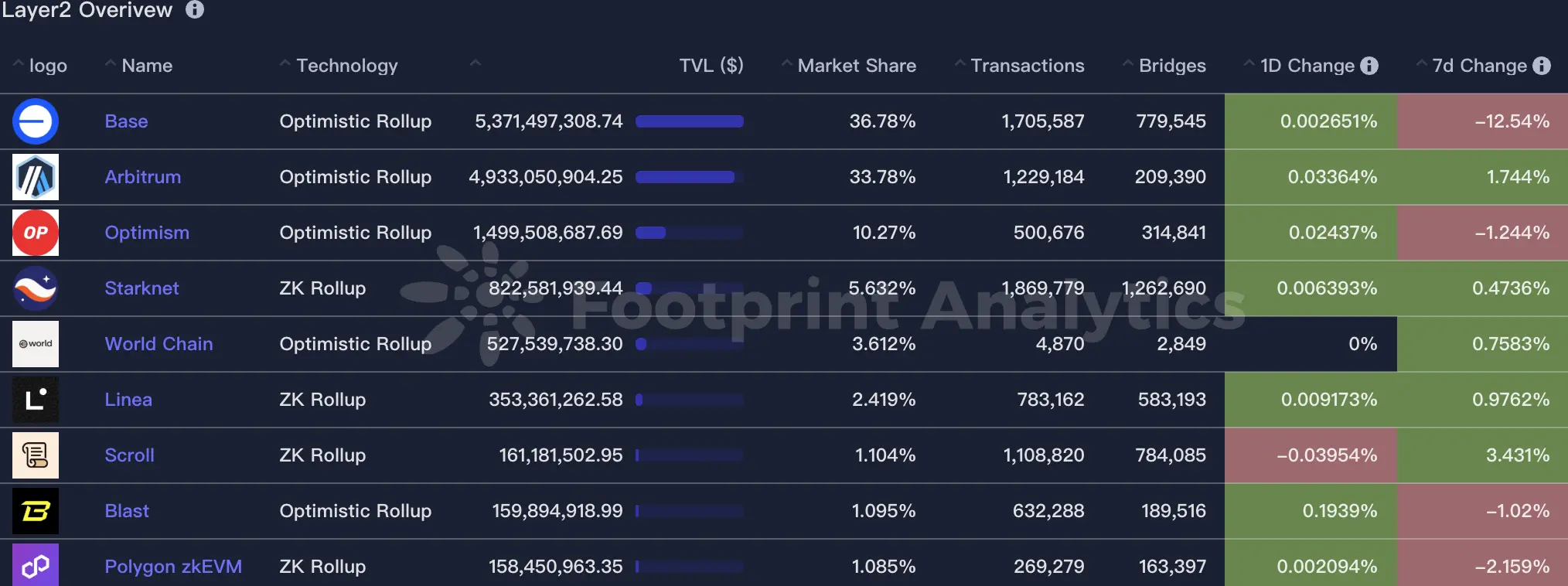

2.3. EVM Layer 2 Summary

Analysis

1. XRP Ledger Launches EVM Sidechain Mainnet

Ripple and Peersyst have jointly launched the EVM sidechain mainnet for XRPL, which is now active and open for developers to deploy Ethereum smart contracts. This sidechain supports interoperability with the XRP Ledger, connects via the Axelar bridge, and uses XRP as the gas token, allowing low-cost operation of dApps.

Within a week of launch, approximately 1,400 contracts have been deployed, mainly including DeFi and trading protocols (such as variants of Uniswap).

The number of daily users is relatively limited: about 1,211 new accounts, with 80% created in the first two days, and the number of active accounts remains below 150.

Network performance is good: processing over 1.12 million blocks, with an average block time of about 5.66 seconds, no backlog of transactions, and an average transaction fee of about 0.048 XRP (approximately $0.03).

2. EVM Layer 2 Projects on Bitcoin: Botanix and Protocol

Botanix has launched its mainnet, achieving EVM-equivalent functionality on the Bitcoin network: block generation cycles have been reduced from 10 minutes to 5 seconds, allowing developers to deploy Ethereum smart contracts on the BTC network.

Additionally, a project called Protocol is also building a similar Bitcoin EVM Layer 2, using BTC as collateral and achieving Ethereum smart contract compatibility without modifying the underlying Bitcoin code.

IV. Macroeconomic Data Review and Key Data Release Nodes for Next Week

Despite market expectations for interest rate cuts, strong employment data and inflationary pressures make it highly likely that the Federal Reserve will maintain interest rates unchanged in the July decision, with only a slight chance of a small rate cut before the end of the year. The U.S. has increased tariffs on multiple countries, raising the overall effective tariff rate to 17.6%, the highest in nearly 90 years. Trade negotiations are progressing slowly, and the market remains highly focused on trade prospects.

Key macroeconomic data nodes for this week (July 14-18) include:

- July 15: U.S. June unadjusted CPI year-on-year

- July 17: U.S. June retail sales month-on-month

- July 18: U.S. July Michigan University Consumer Confidence Index preliminary value

V. Regulatory Policies

United States — "Crypto Week" Launches with Impact

- The U.S. Congress has declared July 14-20 as "Crypto Week," during which it plans to vote on three key pieces of legislation: the GENIUS Act (stablecoin regulation), the CLARITY Act (digital asset market structure), and the Anti-CBDC Surveillance Act (prohibiting the issuance of central bank digital currencies).

- The GENIUS Act has been passed by the Senate and will be submitted to the President for signature if passed by the House, requiring stablecoins to be fully reserve-backed, registered, disclosed, and compliant with anti-money laundering regulations.

- The CLARITY Act advocates for the CFTC as the primary regulatory body, with the SEC only regulating securities-type digital assets, aiming to clarify regulatory boundaries.

- The Anti-CBDC Surveillance Act aims to prevent the Federal Reserve from issuing or managing CBDCs to protect financial privacy.

- There is intense discussion in both chambers regarding the allocation of regulatory powers over digital assets, emphasizing the need to balance regulatory clarity with financial innovation.

- During this time, Bitcoin's price broke through $118,000, with positive market expectations for the regulatory framework driving a general rise in mainstream cryptocurrencies.

European Union — Strengthening MiCA Implementation, Warning Member States of Regulatory Risks

- The European Securities and Markets Authority (ESMA) has pointed out that some crypto service providers are confusing whether their products are subject to MiCA regulation and has demanded an immediate halt to misleading advertising.

- ESMA has stated that regulatory personnel must possess professional qualifications and has warned that Malta has insufficiently reviewed business plans, conflicts of interest, and system security in the issuance of virtual asset licenses.

- The EU is accelerating efforts to ensure that all member states implement unified standards before the full effectiveness of MiCA in 2025.

Pakistan — CBDC Pilot Launch Imminent

- The State Bank of Pakistan has announced that it will soon launch a pilot project for the national digital currency (CBDC) and is finalizing the regulatory framework for virtual assets, including licensing systems, capital requirements, and risk management.

- The government also plans to utilize surplus electricity for Bitcoin mining and is involving international experts in policy formulation and technical construction.

China/Shanghai — Official Discussion on Stablecoin Development Strategies

- The Shanghai State-owned Assets Supervision and Administration Commission held an internal meeting this week to discuss policy paths to respond to the rapid development of stablecoins.

- Although China still prohibits digital asset trading, local governments have begun discussing how to explore the possibility of a digital stablecoin for the renminbi without violating national policies, marking a significant change in the official stance.

India — Preparing to Release Cryptocurrency Policy White Paper

- The Reserve Bank of India (RBI) has informed Parliament that it is closely monitoring global virtual asset trends, particularly the regulatory direction in the U.S., and plans to release a national policy white paper within this year as a basis for subsequent legislation.

Dubai — Comprehensive Regulation of the Crypto Industry Implemented

- The Dubai Virtual Assets Regulatory Authority (VARA) has released a complete set of regulatory rules covering advertising content, platform compliance standards, market manipulation prevention, and investor protection.

- The new rules are seen by the industry as providing a regulatory paradigm for the world, but the effectiveness of implementation remains to be observed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。