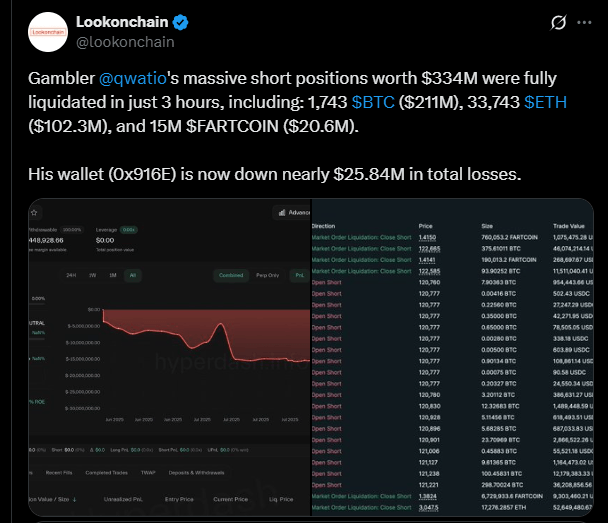

A high-risk trader known as Falllling had massive short bets worth $334 million liquidated in just three hours. According to the crypto analytics firm Lookonchain, the liquidated digital assets included 1,743 Bitcoin valued at $211 million at the time, 33,743 Ether valued at $102.3 million, and 15 million FARTCOIN valued at $20.6 million.

The liquidations caused the trader’s total losses to mount to $25.84 million, a figure that has sparked widespread discussion on social media platforms. Some observers have questioned Falllling’s insistence on shorting BTC despite the powerful bullish sentiment and upward momentum that have taken hold of the market.

The high-risk strategy is also drawing comparisons to that of another prominent trader, James Wynn, who similarly saw his funds liquidated in a recent, high-profile trading setback. Wynn reportedly suffered losses of over $100 million in May 2025 when a $100 million long- BTC position was liquidated after the price fell below $105,000.

Wynn, who gained notoriety for using up to 40x leverage, had previously acknowledged his high-risk approach was akin to gambling. However, after attempts to recover ultimately failed, Wynn, who had boasted about his high-risk approach on social media, reportedly deactivated his X account.

Meanwhile, BTC’s rally in the early hours of July 14 culminated in a massive wave of short liquidations as the top cryptocurrency breached the key psychological barrier of $120,000. The surge propelled BTC to a new all-time high of $122,604, marking the climax of a powerful bull run.

The cryptocurrency’s latest explosive run came after a prolonged period of consolidation, where it had spent several weeks testing the $110,000 level as a critical support zone. The breakout, which began on July 10, saw BTC’s price surge by more than 10% inside four days, suggesting that bullish momentum has finally overcome a period of market indecision.

Overall, BTC and the cryptocurrency market’s rally triggered a cascade of liquidations, with a wave of more than 124,000 traders being wiped out in the last 24 hours alone. At 1:20 a.m. EST on July 14, the total liquidations in that period had soared to $702.56 million, a figure largely driven by the BTC surge. The imbalance in the market was particularly stark: short positions, or bets against the price, accounted for a staggering $590.72 million of the total, while long positions contributed just $111.84 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。