Original Title: "The Win-Win Situation of Hyperliquid and Phantom: One Hits New Highs, the Other Profits from the Ground Up"

Original Author: Azuma, Odaily Planet Daily

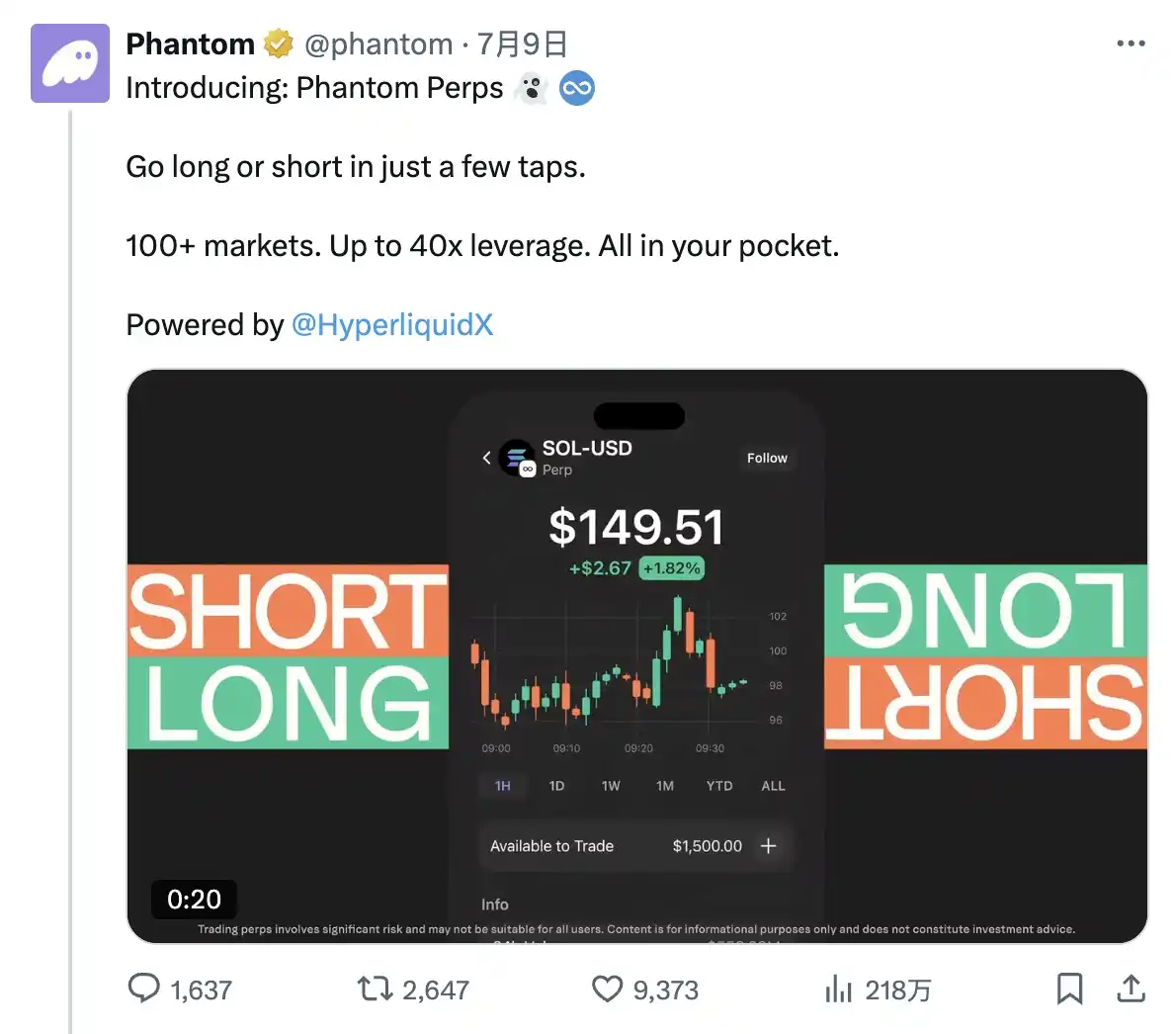

On July 9, the mainstream wallet application Phantom in the Solana ecosystem announced a partnership with the decentralized exchange Hyperliquid, which will leverage Hyperliquid's backend support to allow Phantom users to trade perpetual contracts directly within the wallet, with up to 40 times leverage on more than 100 tokens supported by Hyperliquid.

Although only 5 days have passed since the partnership was established, it is almost certain that this collaboration is a victory for both Phantom and Hyperliquid.

Hyperliquid: Reaching the Solana Ecosystem, Token Price Hits New High

From Hyperliquid's perspective, as the most dynamic decentralized contract exchange at present, Hyperliquid's main territory was previously in the EVM ecosystem. Although there were some sporadic Solana DeFi projects (like Ranger) attempting to connect both services, the overall reach to Solana users was not ideal. With the completion of the partnership, Hyperliquid will use Phantom, the most mainstream wallet application in the Solana ecosystem, to reach Solana ecosystem users in the most direct and efficient way.

According to official data disclosed by Phantom in January this year, the wallet currently has 15 million monthly active addresses, which means that even if only 1% of the addresses are converted, it will bring 150,000 new users to Hyperliquid—based on Hyperliquid's current total user count of about 540,000, this represents nearly a 30% increase in users.

In addition, Phantom also disclosed that in 2024, its built-in exchange service facilitated a total of 850 million transactions, with a trading volume of up to 20 billion dollars. Currently, the ratio of spot trading volume to contract trading volume in mainstream centralized exchanges is about 15% - 30%—even taking the more conservative figure of 30% for assessment, this corresponds to an expected contract trading volume of about 66.6 billion dollars.

On the morning of July 13, Phantom officially announced that its contract trading volume had surpassed 120 million dollars, just 4 days after launching the contract trading feature, which is already quite impressive.

Due to the growth expectations brought about by this collaboration, Hyperliquid's token HYPE has also been continuously hitting new highs, reporting 49.13 dollars as of July 14 at 15:45, with just one final push remaining to break the 50 dollar mark.

Phantom: "Commission" Profits

For Phantom, this collaboration is also of great significance. On one hand, introducing contract trading enriches Phantom's product functionality, providing users with more diverse service content; on the other hand, with the help of Hyperliquid's Builder Codes feature, Phantom is also expected to gain a considerable new source of income.

The so-called Builder Codes allow third-party Builders (in this context, Phantom) to earn transaction fees through trades sent on behalf of users, which can be simply understood as a kind of "commission" mechanism.

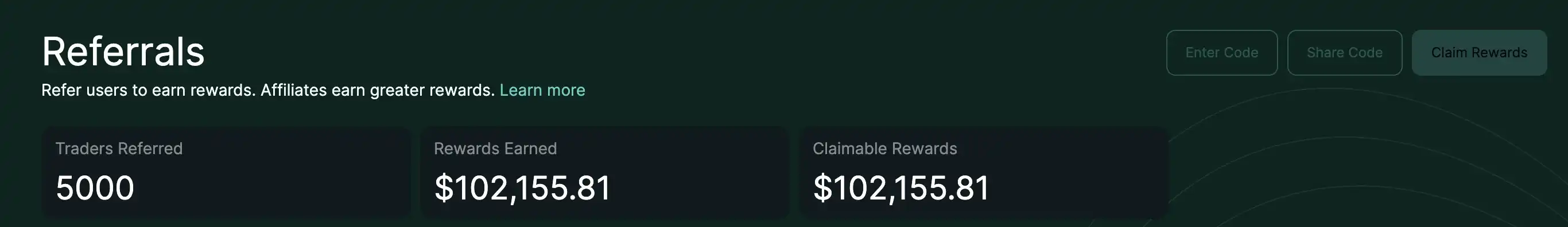

Hyperformance data shows that just 5 days after launching the contract trading service, Phantom's "commission" corresponding address (0xb84168cf3be63c6b8dad05ff5d755e97432ff80b) has earned 102,155 dollars in Builder Codes revenue.

Even based on the static calculation of the above data, this corresponds to an annual income of about 7.45 million dollars, and considering the expected growth in users and trading volume, this figure may continue to multiply several times.

User Side: Better Liquidity, Lower Fees

From the perspective of users in the Solana ecosystem, the collaboration between Phantom and Hyperliquid is clearly a boon. On one hand, Hyperliquid has a significant advantage in liquidity compared to current contract exchanges in the Solana ecosystem, which will provide Solana ecosystem users with better trade execution prices; more importantly, Phantom and Hyperliquid offer users highly attractive fee conditions.

GLC Research pointed out in its latest study that the median transaction fee provided by Phantom and Hyperliquid is 0.095%, compared to a fee of 0.3% for Jupiter's contract trading, showing a clear advantage for the former.

Overseas KOL JJ (@hyperliquidbull) further added that Phantom and Hyperliquid provide users with nearly institutional-level fee pricing, which is almost equivalent to Binance's VIP-1 pricing, typically requiring over 15 million dollars in monthly trading volume.

Conclusion: The Future of Chain Abstraction

Looking closely at the collaboration between Phantom and Hyperliquid, the most interesting point is that, as a key player in the Solana ecosystem, Phantom did not choose decentralized contract exchanges like Jupiter or Drift within the Solana ecosystem, but instead opted for Hyperliquid across ecosystems, with all integration work completed on the backend, leaving front-end users completely unaware.

This is almost the future of chain abstraction that we have envisioned—products will no longer be limited by their native stacks, complex technologies and concepts will be hidden behind the scenes, and users will directly enjoy convenient services in an unobtrusive manner.

As two leading players in different tracks, Phantom and Hyperliquid provide a great example through their collaboration, which may offer some insights for future collaborative innovations in the industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。