In the past week, the cryptocurrency market has experienced a remarkable surge, with Bitcoin (BTC) breaking through $120,000, setting a new historical high, and Ethereum (ETH) strongly reclaiming the $3,000 mark, leading altcoins to rebound, even approaching historical highs.

This wave of increase is clearly not just a natural fluctuation of the market. The resonance of multiple favorable macro policies is injecting strong momentum into the cryptocurrency market: impending cryptocurrency legislation, the Nasdaq reaching new highs, the continuous growth of M2 money supply, expectations of interest rate cuts from the Federal Reserve, and strong pushes from Trump. These multiple factors are working together to reignite optimistic sentiment in the cryptocurrency market after nearly half a year of consolidation.

As the regulatory framework gradually becomes clearer, market liquidity has significantly increased, and several macro favorable factors are at play, the cryptocurrency market seems to be welcoming an unprecedented growth inflection point.

"Cryptocurrency Legislation Week" Begins, Institutional Funds Inject New Capital

This week, as the long-awaited "Cryptocurrency Legislation Week," several bills will be voted on in the House of Representatives. The "Digital Asset Market Structure Clarity Act" (Clarity Act) has already passed the House Financial Services Committee and the Agriculture Committee on July 2, 2025.

Meanwhile, the "Guiding and Establishing U.S. Stablecoin Innovation Act" (Genius Act) has also entered the House review stage and was passed by the Senate on June 17, 2025.

Both bills have bipartisan support, and if passed, will clearly pave the way for the legalization of crypto assets and stablecoins. A clear regulatory and compliance framework will attract more traditional financial institutions and investors into the market.

Among them, the Clarity Act brings a clear legal framework to the digital asset market, defining which assets should be regulated by the Commodity Futures Trading Commission (CFTC), such as Bitcoin (BTC) and Ethereum (ETH), and which should be regulated by the Securities and Exchange Commission (SEC).

The passage of this bill will resolve the long-standing regulatory gray area, ending the previous era of strict SEC regulation of cryptocurrencies and DeFi. Especially for institutional investors, clear regulations will provide a more defined path for entering the cryptocurrency market. This will further promote crypto assets to become part of the strategic reserves of U.S. companies, leading more legitimate enterprises to engage in the application and development of blockchain technology.

The Genius Act focuses on the legal protection of stablecoins, allowing banks and non-bank entities to issue stablecoins, regulated by the Federal Reserve (Fed) and the Office of the Comptroller of the Currency (OCC). The implementation of this policy framework will eliminate uncertainties in stablecoin regulation and attract traditional financial giants like JPMorgan, Citigroup, and Bank of America into the stablecoin market.

The bill requires stablecoin issuers to provide 1:1 reserves in U.S. dollars or short-term government bonds, which means that the demand for dollar stablecoins will significantly increase. It is expected that within the next two years, the stablecoin market size will surge from $200 billion to $400 billion to $500 billion.

As the core platform for decentralized finance (DeFi) and stablecoin issuance, Ethereum, with its smart contract and decentralized advantages, may become the preferred infrastructure for institutional investors. Data shows that stablecoin trading accounts for 60% of the transaction volume on the Ethereum network, and this proportion is expected to continue to rise with the increase in stablecoin issuance.

According to a report by Chainalysis, the demand for Ethereum from Wall Street financial institutions is also continuously growing, especially in the development of complex financial instruments such as cross-chain payments and asset management. All these factors will jointly drive the further development of the Ethereum ecosystem.

Powell Resignation Rumors Trigger Interest Rate Cut Expectations

Recently, rumors about Federal Reserve Chairman Jerome Powell possibly resigning due to pressure from Trump have attracted widespread attention in the market. Since June 30, 2025, Trump has publicly criticized Powell, claiming he has "cost the country hundreds of billions of dollars," and has repeatedly called for the Fed to cut interest rates immediately.

On July 1, Powell responded at the European Central Bank forum, stating that without Trump's tariff policies, the Fed might have already taken measures to cut interest rates. The market widely speculates that Trump may nominate a new Fed chairman, such as Kevin Hassett.

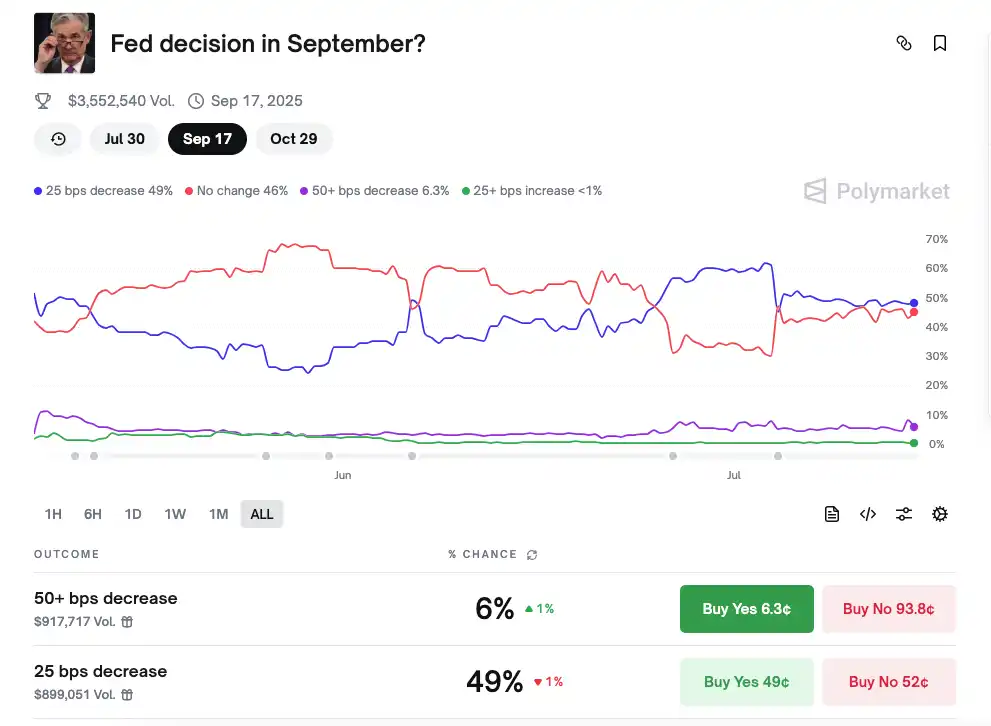

According to the current predictions from CME FedWatch, the probability of the Fed cutting interest rates in September is 63%. According to the latest predictions from Polymarket, the probability of a Fed rate cut in September is 49%, and the future low-interest-rate environment will release more liquidity, benefiting risk assets such as cryptocurrencies.

If the new chairman supports interest rate cuts, the cryptocurrency market may welcome more long-term benefits. Former Trump economic advisor Stephen Moore stated that Trump might appoint a "market-friendly" Fed chairman, paving the way for the approval of the BTC strategic reserve proposal.

Nasdaq Hits New High, U.S. Stock Funds Flow into Cryptocurrency Market

In the past week, the Nasdaq Composite Index reached a new historical high, driven by the strong performance of tech giants like Nvidia. As of the close on July 9, the Nasdaq Composite Index stood at 20,611.34 points, with an increase of nearly 0.95%, successfully surpassing a total market capitalization of $40 trillion. The continuous rise in stock prices of tech giants like Nvidia indicates a significant recovery in investor confidence towards risk assets.

The Nasdaq futures index is currently still hovering at high levels, and market sentiment is showing positive changes. The recovery of the financial market is not only reflected in the rebound of tech stocks but also signifies the revival of other high-risk assets, providing a favorable opportunity for capital to flow into the cryptocurrency market.

In recent years, the correlation between crypto assets and the U.S. stock market has been increasing, especially during periods of rising risk appetite, this correlation has become more pronounced. In previous cycles, when risk markets warmed up, U.S. stock investors often flowed into the more volatile cryptocurrency market in pursuit of higher returns.

M2 Growth Reopens Liquidity Tap

According to the latest data from the Federal Reserve, the U.S. M2 money supply has grown by approximately 5.2% year-on-year, significantly accelerating from 3.8% at the end of 2024. This growth is primarily driven by increased government bond issuance due to the OBBBA debt ceiling increase and fiscal stimulus measures. The growth of M2 complements fiscal expansion, and the market generally interprets this as a signal of government support for economic growth, further enhancing the attractiveness of risk assets and significantly improving current market liquidity.

Federal Reserve officials recently indicated that M2 growth could reach 6% in the third quarter of 2025, further expanding liquidity.

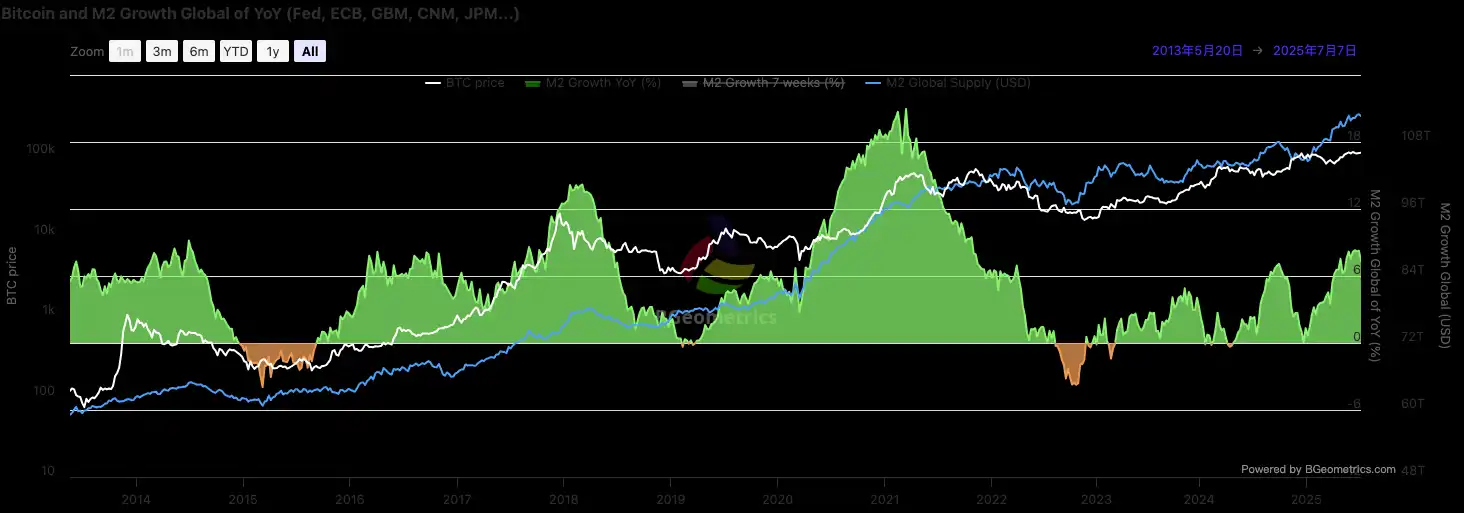

M2 includes cash, demand deposits, and short-term deposits, reflecting the broad money supply in the economy. The growth of M2 will inject substantial liquidity spillover effects into the cryptocurrency market. Historical data shows that during the significant M2 growth periods of 2017-2018 and 2020-2021, Bitcoin rose from several thousand dollars to $20,000 and $69,000, respectively.

The growth of M2 may also weaken the purchasing power of the dollar, prompting emerging markets to increase their holdings of Bitcoin to hedge against inflation risks. Currently, the inflation rate is about 3.5%, and the demand for Bitcoin as a store of value is continuously rising, with international companies like Metaplanet announcing increased holdings of Bitcoin as part of their strategic reserves.

However, if M2 growth prompts the Federal Reserve to adopt tightening policies (such as interest rate hikes), it may exert pressure on the cryptocurrency market in the short term, and investors should closely monitor the Federal Reserve meeting on July 29-30.

Tariff Turmoil Resurfaces, Safe-Haven Funds Drive Bitcoin Up

Recently, Trump announced a 35% tariff on Canada and a 30% tariff on Mexico and the European Union. Additionally, he plans to implement tariffs ranging from 25% to 50% on more countries starting August 1.

The global stock market has reacted relatively calmly to the tariff threats, but the holdings of Bitcoin have significantly increased. The global trade uncertainties triggered by tariffs may lead investors to turn to BTC and gold as safe-haven assets.

Historically, Bitcoin also rose from $6,000 to $13,000 during the global trade war in 2018.

Moreover, tariffs may increase import costs, weakening the dollar's competitiveness, and a depreciating dollar will drive up Bitcoin prices. The reallocation of global capital also plays a key role, especially as emerging markets may accelerate their accumulation of Bitcoin to hedge against risks due to tariff pressures.

However, if tariffs trigger a global economic recession, it may suppress the performance of risk assets in the short term, and investors should pay attention to the market reaction after the implementation of the tariff policy on August 1.

Conclusion

In summary, changes in the macroeconomic and policy environment are bringing unprecedented opportunities to the cryptocurrency market. From the promotion of cryptocurrency legislation to adjustments in Federal Reserve policies, and the positive performance of the Nasdaq and M2 money supply, all factors are jointly driving capital inflow into the cryptocurrency market.

As the demand for core assets like stablecoins and Ethereum increases, it is foreseeable that in the near future, with the continued fermentation of these macro favorable factors, the cryptocurrency market will continuously benefit and gradually move towards a broader application phase.

With technological innovation and the improvement of the regulatory framework, the role of crypto assets will become increasingly important, not only as investment tools but also deeply integrated into various fields such as daily financial services, cross-border payments, and corporate finance, truly realizing their extensive commercial value and global influence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。