Capital efficiency determines survival.

Written by: Sumanth Neppalli, Joel John

Translated by: Luffy, Foresight News

Do you remember Sam Bankman-Fried? He used to work at Jane Street and later became known for his "effective altruism" experiments and misappropriation of funds. Over the past month, Jane Street has made headlines for two reasons:

First, for allegedly assisting in a coup; second, for conducting arbitrage trading experiments in the Indian options market (also allegedly, after all, I can't afford lawyers who can beat them in court).

Some of these trades were so large that the Indian government decided to completely ban Jane Street from operating in the country and seized their funds. Matt Levine provided a brilliant summary of this in his Bloomberg column. In short, this is how the "arbitrage" works:

Sell put options in a liquid market (like a $100 million scale);

Gradually go long on the underlying asset in a thinly traded market (like a daily trading volume of $10 million).

In markets like India, the options trading volume is often several times that of the underlying stocks. This is a market characteristic, not a loophole. Even if the underlying asset is insufficient, the market can always find liquidity. For example, the total amount of gold ETFs far exceeds the actual gold reserves; another example is the surge in GameStop's stock price in 2022, partly because the size of its short positions exceeded the number of shares outstanding. Back to the case of Jane Street.

When you "buy" a put option, you are betting that the price will fall, or in other words, you are buying the right to sell the asset at a predetermined price (the strike price). Buying a call option is the opposite: you are buying the right to buy the asset at a preset price. Let me explain using the upcoming PUMP token as an example.

Suppose I bet that the fully diluted valuation (FDV) of the PUMP token at launch will be below $4 billion (perhaps out of disdain for venture capital and the meme market), I would buy put options. The venture capitalists selling me the options might hold a quota of PUMP tokens, believing that the price will be higher at launch.

The venture capital firm selling the put options would receive a premium. Suppose I pay a premium of $0.10, if the token launches at $3.10 and my strike price is $4, then exercising the put option would yield a profit of $0.90, resulting in a net profit of $0.80 after deducting the premium. Meanwhile, the venture capitalists would be forced to sell the tokens at a price lower than expected ($3.10), effectively incurring a loss of $0.90.

Why would I do this? Because the leverage is extremely high: I invest $0.10 to short an asset worth $4. Why can I achieve such high leverage? Because the option sellers (the venture capitalists) believe the price will not fall below $4. Worse, the venture capitalists (and their network) might buy PUMP at the $4 level, ensuring that the price remains at $4.5 when exercising the option. This is precisely what the Indian government accused Jane Street of doing.

Source: Bloomberg

However, in Jane Street's case, they were not trading PUMP tokens. They were trading Indian stocks, specifically the NIFTY Bank Index. Due to the high leverage offered in this market, retail investors often trade options. They only need to do this: buy some underlying stocks that make up the index, which are relatively illiquid.

Then, as spot buying pushes up the index price, they sell index call options at a higher premium; simultaneously, they buy index put options; finally, they sell stocks to pull down the index. The profit comes from the premiums of the call options and the proceeds from the put options, and while there may be slight losses from the spot trades, the put option proceeds usually cover these losses.

The above diagram explains how this trade works: the red line is the index trading price, and the blue line is the options trading price. In reality, they sell options (driving down the price, collecting premiums) and buy the underlying assets (pushing up the price, without having to pay for the options) — it’s all arbitrage.

What does this have to do with today's topic?

Nothing at all. I just wanted to clarify the concepts of put options, call options, and strike prices for those who are new to these terms.

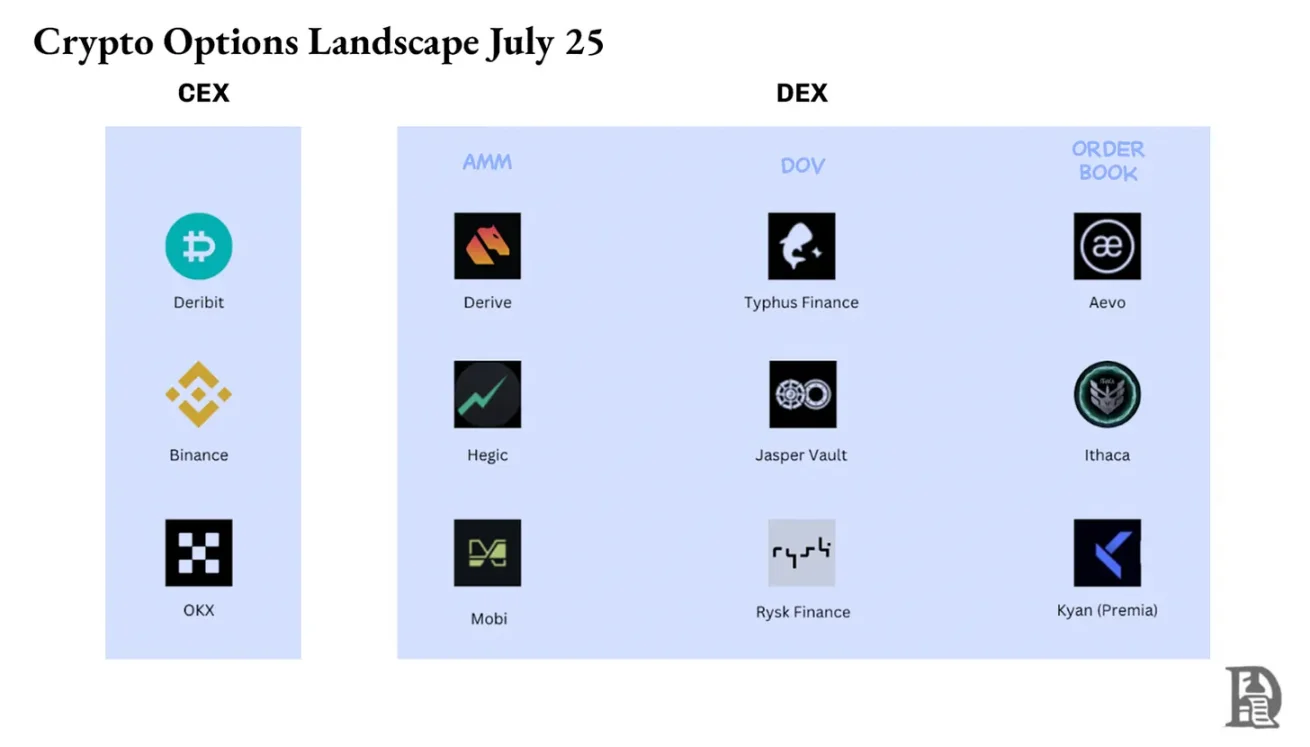

In this issue, Sumanth and I explore a simple question: Why hasn't the cryptocurrency options market exploded? With Hyperliquid leading the narrative, on-chain perpetual contracts are once again hot, and stock perpetual contracts are about to launch, but what about options? Like most things, we start with the historical context, then analyze the operational details of these markets, and finally look to the future. Our hypothesis is: if perpetual contracts can establish a foothold, the options market will develop accordingly.

The question is: which teams are developing options products? What mechanisms will they adopt to avoid repeating the mistakes of the 2021 DeFi Summer?

We do not have clear answers yet, but we can provide some clues.

The Puzzle of Perpetual Contracts

Do you remember that pandemic? That time when we sat at home, guessing how long this large-scale social isolation experiment would last? It was during that time that we saw the limitations of the perpetual contract market. Like many commodities, oil has a futures market where traders can bet on its price. But like all commodities, oil only has value when there is demand. The restrictions imposed by the pandemic led to a sharp decline in demand for oil and related products.

When you buy a physically settled futures contract (non-cash settlement), you gain the right to receive the underlying asset at a predetermined price in the future. So, if I go long on oil, I will "receive" oil when the contract expires. Most traders do not actually hold the commodity but sell it to factories or counterparties that have logistics capabilities (like tankers).

But in 2020, things went out of control. No one wanted that much oil, and traders who bought futures contracts had to bear the storage responsibility. Imagine this: I’m a 27-year-old analyst at an investment bank, and I have to receive 1 million gallons of oil; the compliance officer in their 40s would definitely make me sell it all first. And that’s exactly what happened.

In 2020, oil prices briefly fell below zero. This vividly demonstrated the limitations of physical futures: you have to receive the goods, and receiving goods incurs costs. If I’m just a trader betting on the prices of oil, chicken, or coffee beans, why would I want to receive the physical goods? How do I transport the goods from the production site to the port of Dubai? This is precisely the structural difference between cryptocurrency futures and traditional futures.

In the cryptocurrency space, receiving the underlying asset is almost costless: you just need to transfer it to a wallet.

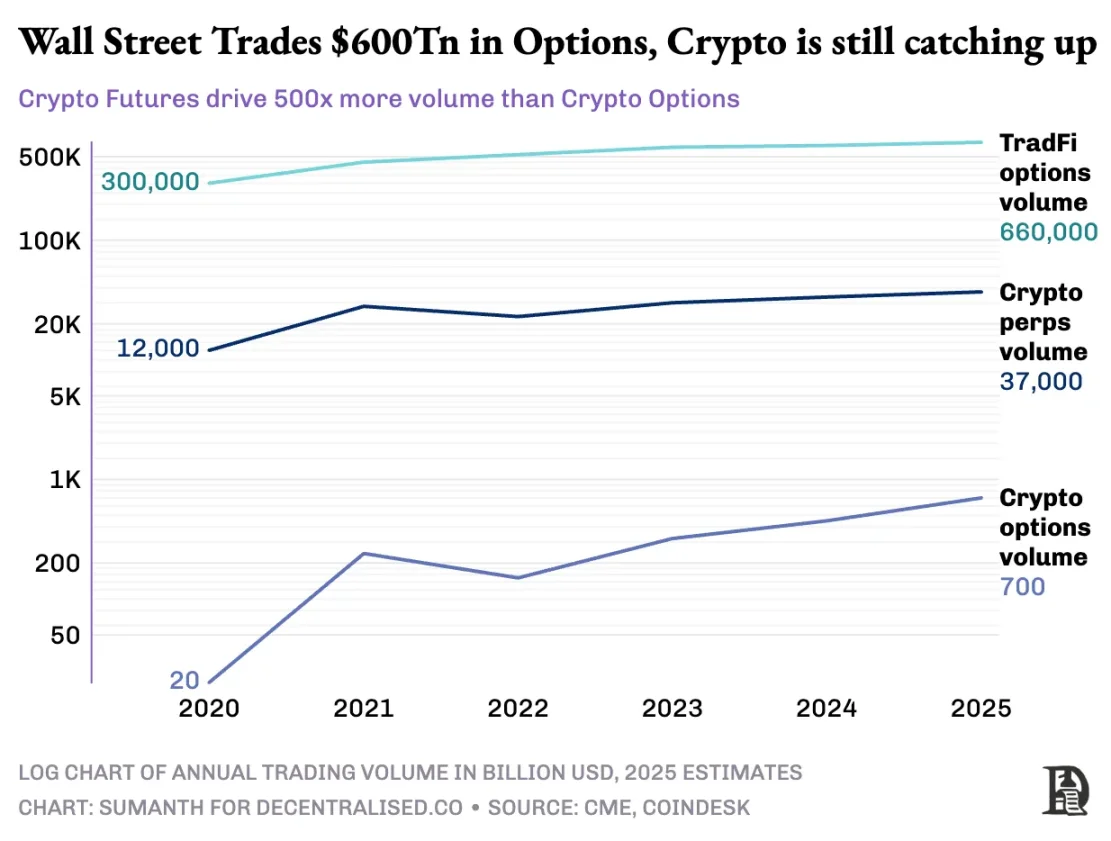

However, the cryptocurrency options market has never truly exploded. In 2020, the U.S. options market had a trading volume of about 7 billion contracts; today, that number is close to 12 billion, with a notional value of about $45 trillion. The U.S. options market is about 7 times the size of the futures market, with nearly half of the trades coming from retail investors who are keen on short-term options that expire the same day or over the weekend. Robinhood's business model is based on this: providing a fast, convenient, and free options trading channel and profiting through the "payment for order flow" model (paid by market makers like Citadel).

But the situation for cryptocurrency derivatives is entirely different: the monthly trading volume of perpetual contracts is about $2 trillion, which is 20 times that of options (about $100 billion per month). The cryptocurrency market did not inherit the existing models of traditional finance but built its own ecosystem from scratch.

The regulatory environment has shaped this difference. Traditional markets are constrained by the U.S. Commodity Futures Trading Commission (CFTC), which requires futures rollovers, leading to operational friction; U.S. regulations set the margin leverage limit for stocks at about 2 times and prohibit "20x perpetual contracts." Therefore, options became the only way for Robinhood users (like retail investors with only $500) to turn a 1% fluctuation in Apple stock into over 10% returns.

The unregulated environment of cryptocurrency has created space for innovation. It all started with BitMEX's perpetual futures: as the name suggests, these futures have no "delivery" date and are perpetual. You do not need to hold the underlying asset; you just need to trade repeatedly. Why do traders use perpetual contracts? Two reasons:

Lower fees compared to spot trading;

Higher leverage for perpetual contracts.

Most traders prefer the simplicity of perpetual contracts. In contrast, options trading requires understanding multiple variables simultaneously: strike price selection, underlying asset price, time decay, implied volatility, and Delta hedging. Most cryptocurrency traders transition directly from spot trading to perpetual contracts, completely skipping the learning curve for options.

In 2016, BitMEX launched perpetual contracts, instantly becoming the favorite leveraged tool for cryptocurrency traders. In the same year, a small team from the Netherlands launched Deribit, the first trading platform focused on cryptocurrency options. At that time, Bitcoin was priced below $1,000, and most traders thought options were too complex and unnecessary. Twelve months later, the tide turned: Bitcoin soared to $20,000, and miners holding large inventories began buying put options to lock in profits. By 2019, Ethereum options were launched; by January 2020, open interest in options first surpassed $1 billion.

Today, Deribit handles over 85% of cryptocurrency options trading volume, indicating that the market is still very concentrated. When institutions need to execute large trades, they do not choose the order book but instead contact a pricing service desk or communicate on Telegram, then settle through the Deribit interface. A quarter of Deribit's trading volume comes from these private channels, highlighting the dominance of institutions in this seemingly retail-driven market.

What makes Deribit unique is its allowance for cross-market collateralization. For example, if you go long on futures (Bitcoin at $100,000) while buying put options at $95,000, if the price of Bitcoin falls, the futures long position will incur losses, but the appreciation of the put options can prevent liquidation. Of course, there are many variables here, such as the expiration time of the options or the leverage of the futures, but Deribit's cross-market collateralization feature is a key reason for its dominance.

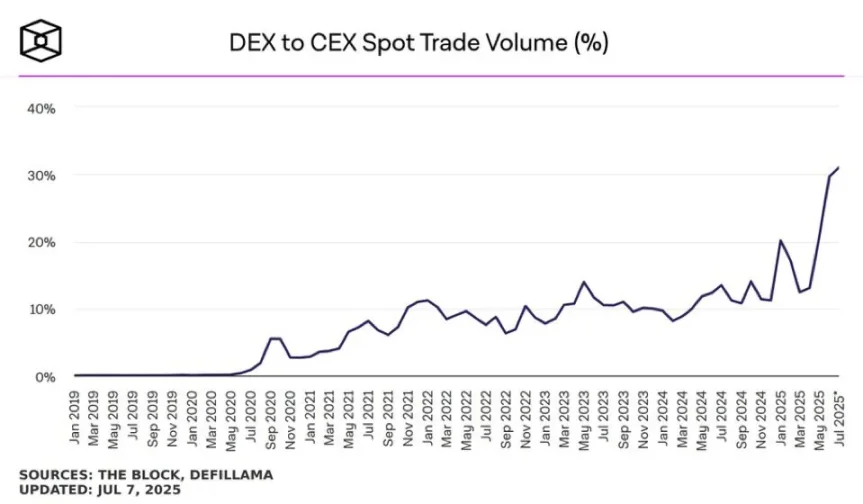

In theory, on-chain options could easily achieve this: smart contracts can track strike prices and expiration dates, custody collateral, and settle profits without intermediaries. However, after five years of experimentation, the total trading volume of decentralized options exchanges is still less than 1% of the options market, while decentralized exchanges for perpetual contracts account for about 10% of futures trading volume.

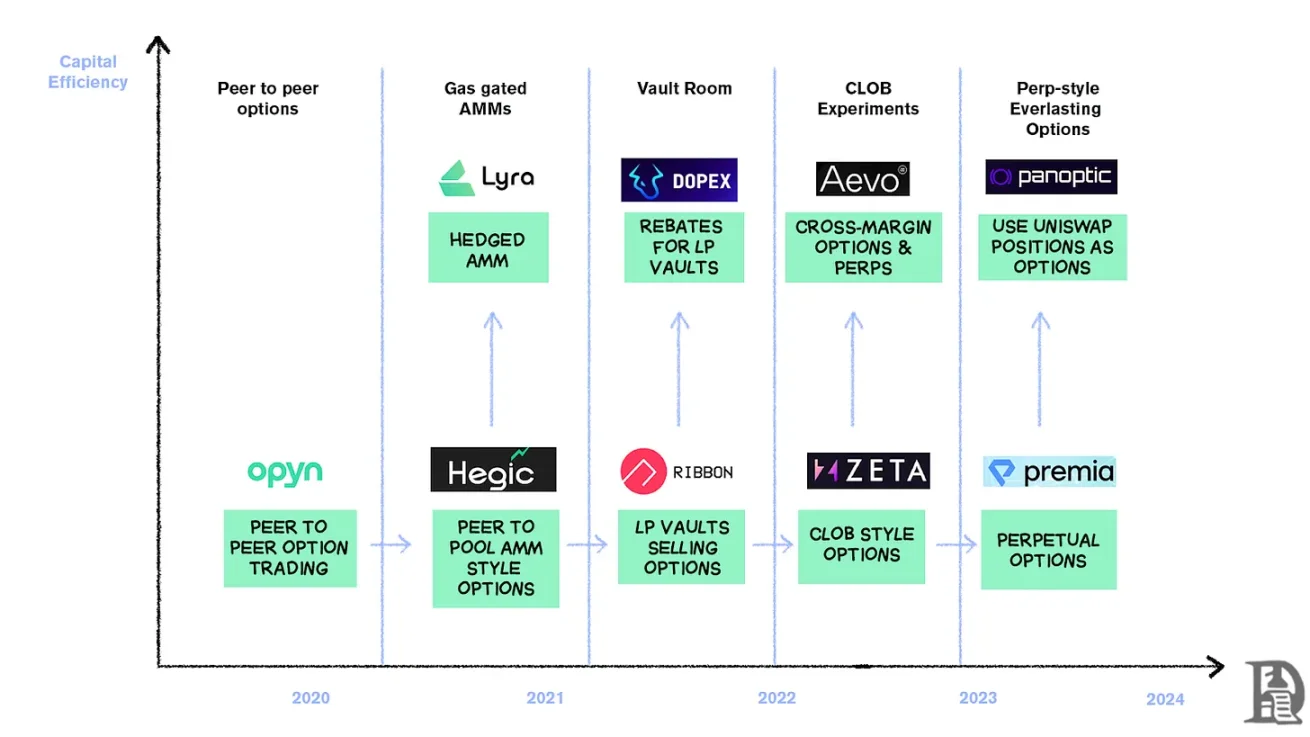

To understand the reasons, we need to review the three development stages of on-chain options.

The Stone Age of Options

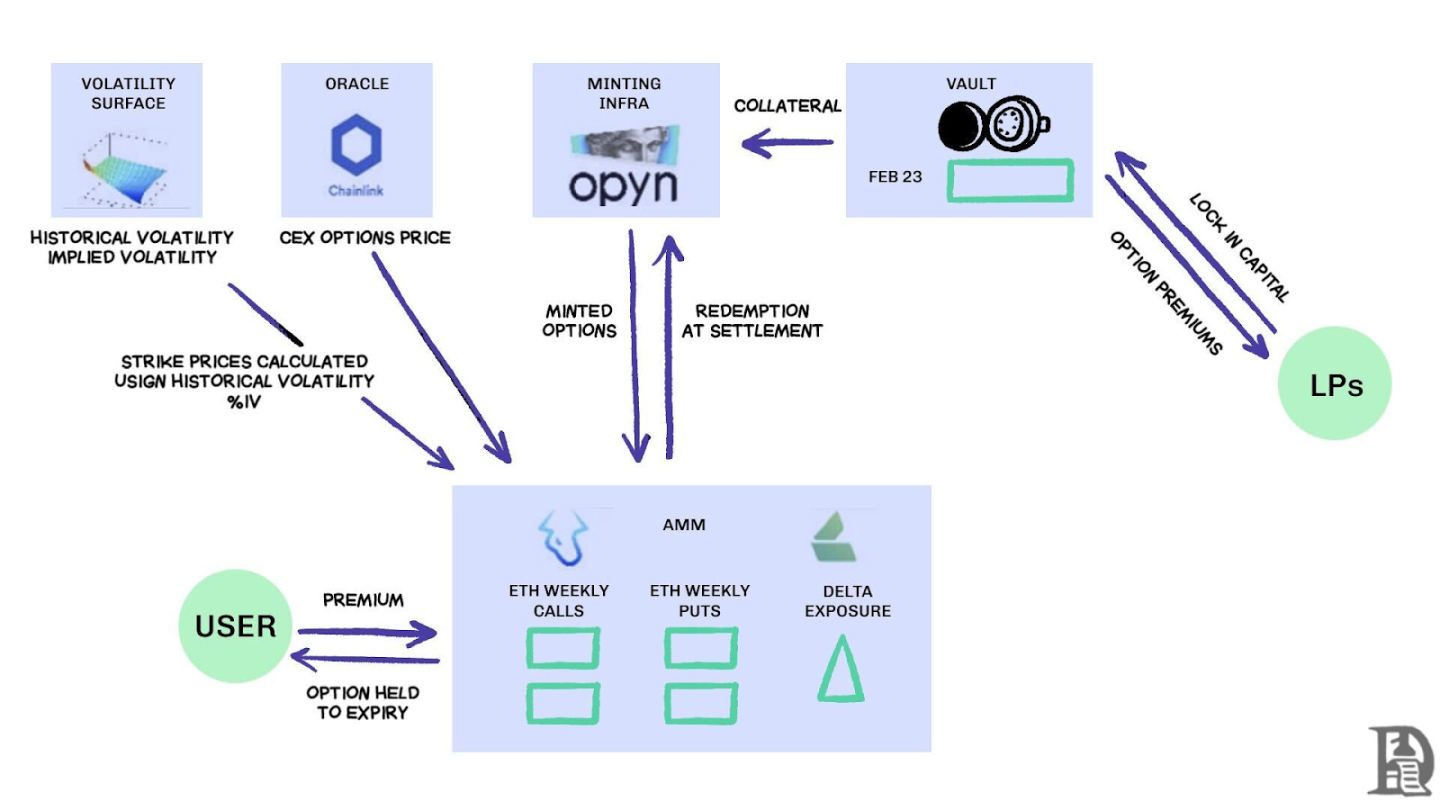

In March 2020, Opyn initiated the democratization of options issuance: locking ETH as collateral, selecting strike prices and expiration dates, and smart contracts would mint ERC20 tokens representing the rights. These tokens could be traded on any platform supporting ERC20: Uniswap, SushiSwap, or even directly transferred between wallets.

Each option is an independent tradable token: a $1,000 call option for July is one token, and a $1,200 call option is another, leading to a fragmented user experience, but the market could operate normally. At expiration, "in-the-money" option holders could exercise their options, receive profits, and the contract would return the remaining collateral to the seller. More troublesome is that the seller must lock up the full notional value: selling a call option on 10 ETH requires freezing 10 ETH until expiration to earn a premium of 0.5 ETH.

This system worked well until the arrival of DeFi Summer. When gas fees soared to $50-200 per transaction, the cost of issuing an option often exceeded the premium itself, causing the entire model to collapse almost overnight.

Developers turned to a Uniswap-style liquidity pool model. Hegic led this transformation, allowing anyone from retail investors to whales to deposit ETH into a public treasury. Liquidity providers (LPs) pooled collateral into one pool, and smart contracts would quote prices for buying and selling options. Hegic's interface allowed users to select strike prices and expiration dates.

If a trader wanted to buy a call option for 1 ETH for the following week, the automated market maker (AMM) would price it using the Black-Scholes model, obtaining ETH volatility data from external oracles. After the trader clicked "buy," the contract would withdraw 1 ETH from the pool as collateral, mint an NFT recording the strike price and expiration date, and send it directly to the buyer's wallet. The buyer could resell the NFT on OpenSea at any time or wait until expiration.

For users, this was almost magical: a transaction completed without a counterparty, with premiums flowing to LPs (minus protocol fees). Traders enjoyed the one-click experience, while LPs appreciated the returns; the treasury could issue options with multiple strike prices/expiration dates simultaneously without active management.

This magic lasted until September 2020. Ethereum experienced a severe crash, and Hegic's simple pricing rules led to put options being sold too cheaply. Put option holders exercised their options, forcing the treasury to pay out far more ETH than expected. In just one week, a year's worth of premium income evaporated, and LPs learned a painful lesson: issuing options in a calm market may seem easy, but without proper risk management, a storm can deplete everything.

AMMs must lock collateral to underwrite options.

Lyra (now renamed Derive) attempted to solve this problem by combining liquidity pools with automated risk management: after each trade, Lyra would calculate the net delta exposure of the pool (the sum of the deltas of all options across strike prices and expiration dates). If the treasury had a net short exposure of 40 ETH, it meant that for every $1 increase in ETH price, the treasury would lose $40. Lyra would establish a long position of 40 ETH on Synthetix perpetual contracts to hedge directional risk.

The AMM used the Black-Scholes model for pricing, offloading expensive on-chain calculations to off-chain oracles to control gas fees. Compared to unhedged strategies, this delta hedging reduced treasury losses by half. Despite its clever design, the system relied on Synthetix's liquidity.

When the Terra Luna collapse triggered panic, traders withdrew from the Synthetix staking pool, leading to liquidity depletion and skyrocketing hedging costs for Lyra, with spreads widening significantly. Complex hedging requires deep liquidity sources, which DeFi has struggled to reliably provide.

Looking for Sparks

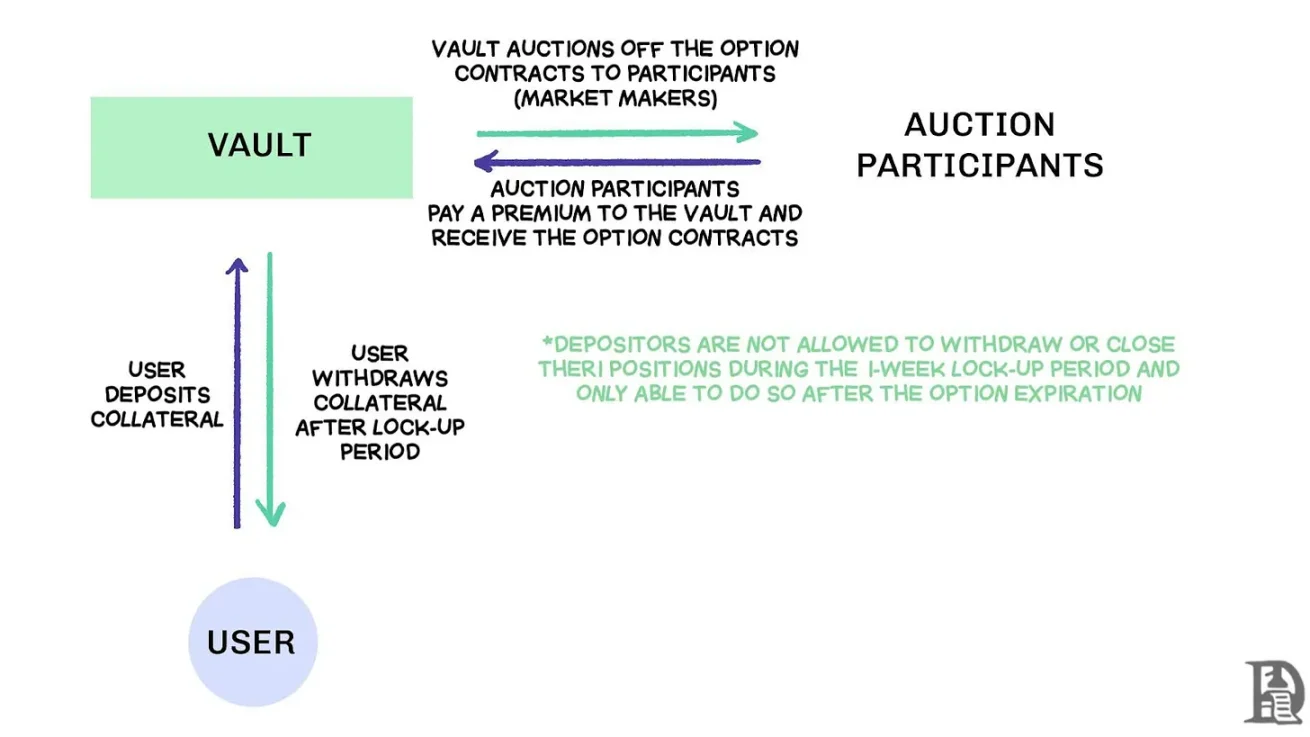

Decentralized Options Vaults (DOVs) sell order flow through auctions, source: Treehouse Research.

In early 2021, Decentralized Options Vaults (DOVs) emerged. Ribbon Finance pioneered this model, with a simple strategy: users deposit ETH into the vault, and every Friday, covered call options are sold through off-chain auctions. Market makers bid for the order flow, with premiums returned as profits to depositors. After options settle on Thursdays and collateral is unlocked, the entire process resets.

During the bull market of 2021, implied volatility (IV) remained above 90%, and weekly premiums translated into astonishing annualized yields (APYs). Weekly auctions continued to generate substantial returns, and depositors enjoyed seemingly risk-free ETH earnings. However, when the market peaked in November and ETH began to decline, the vaults started to show negative returns, with premium income insufficient to cover ETH's drop.

Competitors Dopex and ThetaNuts replicated this model and added rebate tokens to cushion the impact during loss periods, but still failed to address the core vulnerability of dealing with significant volatility. In both AMM and DOV models, funds must be locked until expiration. Users depositing ETH to earn premiums find themselves in trouble when ETH drops, unable to close positions when needed.

Order Books

The Solana ecosystem team learned from the limitations of early options protocols with AMMs and adopted a fundamentally different approach. They attempted to replicate Deribit's Central Limit Order Book (CLOB) model on-chain, achieving near-instant settlement with a complex order matching engine and introducing market makers as counterparties for each option.

First-generation products like PsyOptions tried to place the entire order book on-chain, with each quote occupying block space, requiring market makers to lock 100% collateral, resulting in scarce quotes. Second-generation products like Drift and Zeta Markets moved the order book off-chain, matching orders before settling on-chain. The Ribbon team returned to the battlefield with Aevo, placing the order book and matching engine on the high-performance Optimism Layer 2.

More importantly, these products support both perpetual contracts and options on the same platform, equipped with a combined margin system that can calculate the net exposure of market makers. This aligns with the success factors of Deribit, allowing market makers to reuse collateral.

The results have been mixed. Since market makers can frequently update quotes without incurring high gas fees, spreads have narrowed. However, the weaknesses of the CLOB model become apparent during non-trading hours: when U.S. professional market makers go offline, liquidity evaporates, and retail traders face significant spreads and poor execution prices. This reliance on active market makers leads to temporary "dead zones," while AMMs, despite their flaws, have never experienced such issues. Teams like Drift have completely shifted to perpetual contracts, abandoning options.

Teams like Premia are exploring a hybrid model of AMM-CLOB, seeking a middle ground between a fully on-chain order book providing 24/7 liquidity and market makers that can increase depth. However, the total value locked (TVL) has never exceeded $10 million, and large trades still require market maker intervention, resulting in high slippage.

Why Options Struggle

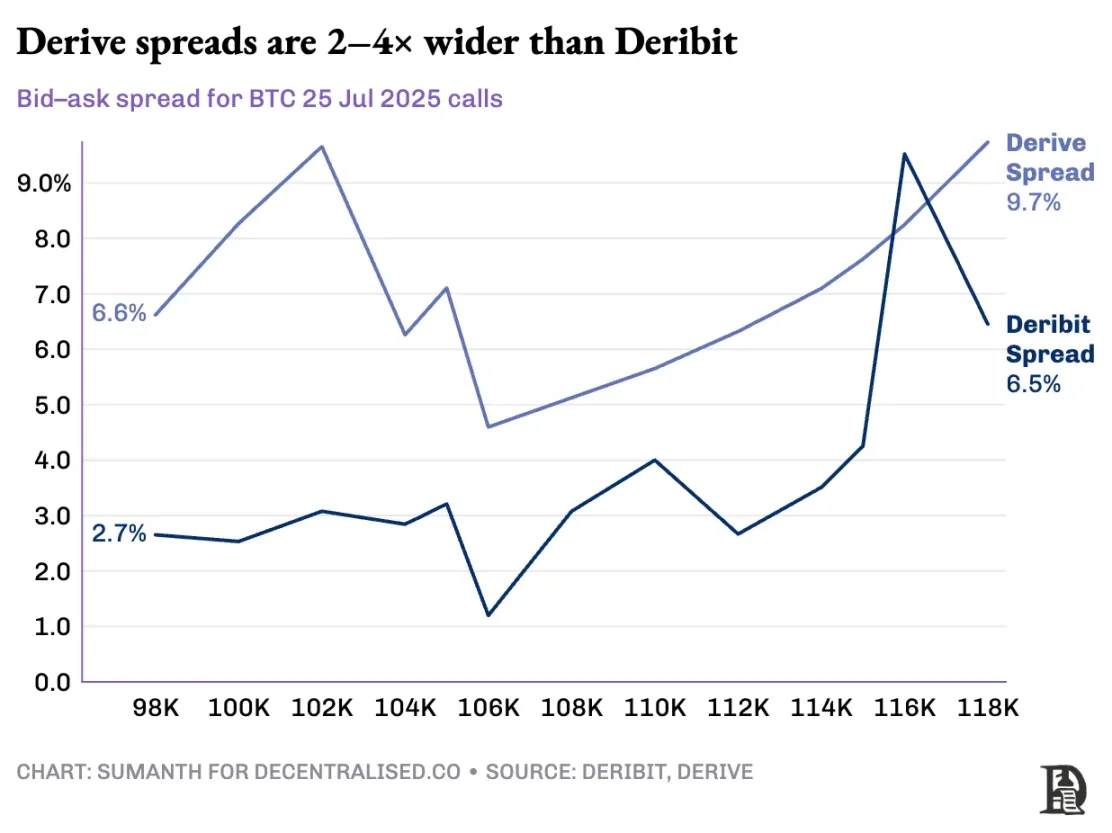

Options liquidity is shifting from AMMs to order books. Derive has disabled its on-chain AMM and rebuilt the exchange around an order book, equipped with a cross-margin risk engine. This upgrade has attracted firms like Galaxy and GSR, and the platform now handles about 60% of on-chain options trading volume, becoming the largest decentralized options exchange in DeFi.

Vlad discusses limit order book design.

When market makers sell a $120,000 BTC call option and hedge with spot BTC, the system recognizes these offsetting positions and calculates margin requirements based on net portfolio risk rather than individual positions. The engine continuously evaluates each position: underwriting a $120,000 call option expiring in January 2026, shorting next week's weekly contract, buying spot BTC, and requiring traders to post margin based on net directional exposure.

Hedging can offset risks, freeing up collateral to redeploy into the next quote.

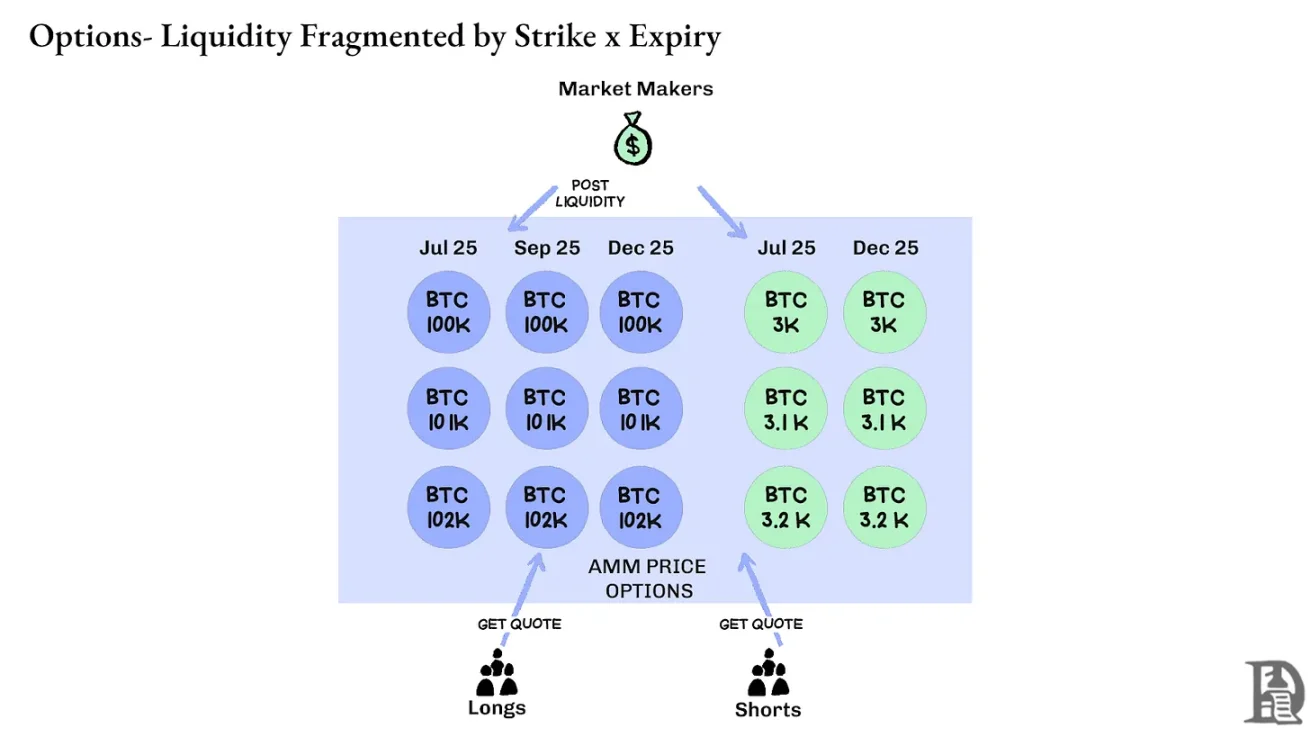

On-chain protocols break this cycle when tokenizing each strike price and expiration date into their respective ERC-20 token pools. A $120,000 call option minted next Friday cannot recognize the hedge from the BTC perpetual contract. Although Derive has partially addressed this issue by adding perpetual contracts within its clearinghouse to enable cross-margining, spreads remain significantly higher than Deribit; the spreads for equivalent positions are typically 2-5 times higher.

Note: Let’s explain using mango prices. Suppose I sell someone the right to buy mangoes at $10, charging a $1 premium. These mangoes will ripen in three days. As long as I have the mangoes (the spot asset), I can collect the premium ($1) without worrying about the market price of mangoes rising.

I won’t incur a loss (thus achieving a hedge) unless the price of mangoes rising incurs an opportunity cost. If Sumanth buys this option (paying me $1), he can turn around and sell the mangoes for $15, netting $4 after deducting the premium. Those three days are the expiration date of the option. At the end of the trade, I either still hold the mangoes or receive a total of $11 ($10 for the mangoes + $1 premium).

In a centralized exchange, my mango farm and the market are in the same town, and they know the collateral I’m trading, so I can use the premium paid by Sumanth as collateral to offset other expenses (like labor costs). But in an on-chain market, the two markets are theoretically in different locations and do not trust each other. Since most markets rely on credit and trust, this model has low capital efficiency — I might lose money just transferring Sumanth’s payment to the logistics provider.

Deribit benefits from years of API development and numerous algorithmic trading platforms optimized for its system. Derive's risk engine has been online for just over a year, lacking the deep order books required for effective hedging in both spot and perpetual contract markets. Market makers need instant access to deep liquidity from multiple tools to manage risk; they need to hold options positions while easily hedging through perpetual contracts.

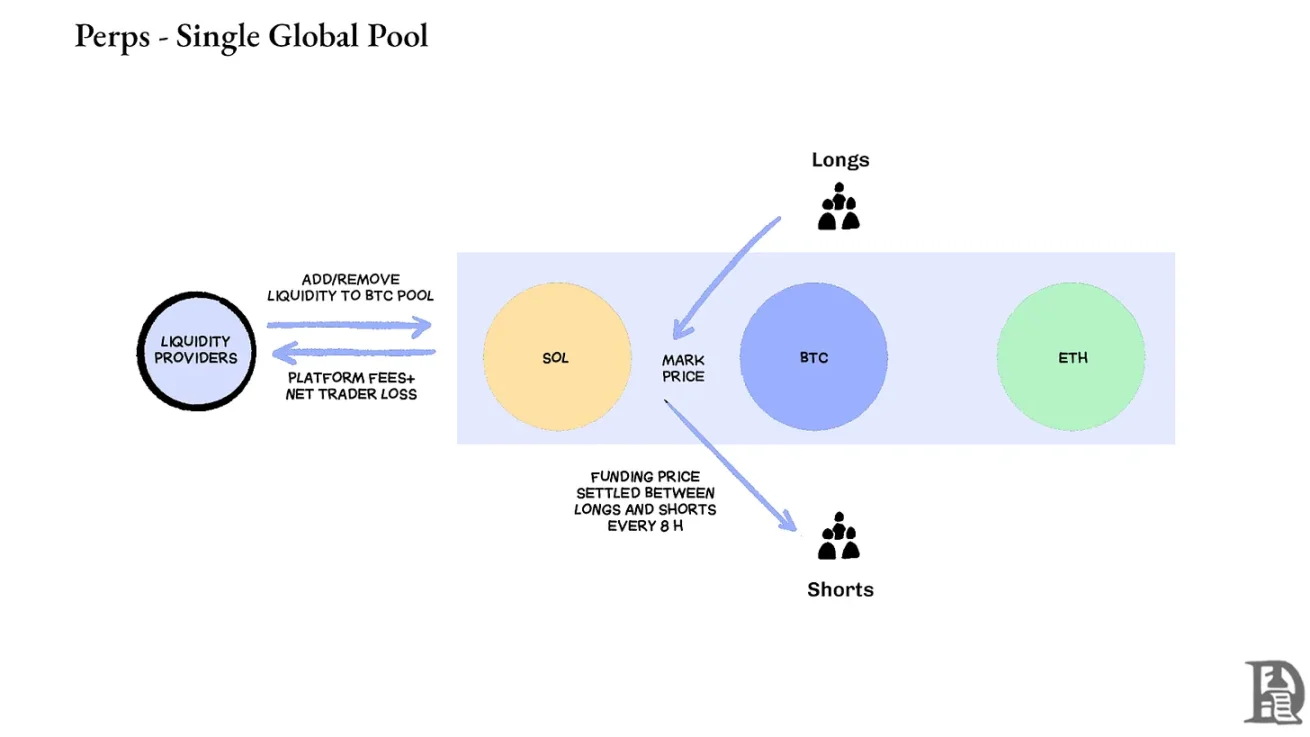

Decentralized exchanges for perpetual contracts have solved the liquidity problem by completely eliminating fragmentation. All perpetual contracts for the same asset are identical: one deep pool, one funding rate, and regardless of whether traders choose 2x or 100x leverage, liquidity is unified. Leverage only affects margin requirements and does not impact market structure.

This design has led to significant success for platforms like Hyperliquid: their treasury typically acts as a counterparty to retail trades, distributing trading fees to treasury depositors.

In contrast, options disperse liquidity across thousands of "micro-assets": each strike price-expiration date combination forms an independent market with unique characteristics, leading to fragmented capital and making it nearly impossible to achieve the depth required by mature traders. This is the core reason why on-chain options have failed to take off. However, given the liquidity emerging on Hyperliquid, this situation may change soon.

The Future of Cryptocurrency Options

Looking back at the launch of all major options protocols over the past three years, a clear pattern emerges: capital efficiency determines survival. Protocols that force traders to lock separate collateral for each position, regardless of how complex their pricing models or how smooth their interfaces are, ultimately lose liquidity.

Professional market makers operate on very thin profit margins, and they need every penny to work efficiently across multiple positions. If a protocol requires them to post $100,000 in collateral for a Bitcoin call option and another $100,000 for a hedging perpetual contract, rather than treating these collaterals as offsetting risks (which might only require $20,000 in net margin), then participating in the market becomes unprofitable. Simply put: no one wants to lock up a large amount of capital for minimal returns.

Source: TheBlock

Spot markets on platforms like Uniswap often exceed $1 billion in daily trading volume with minimal slippage; decentralized exchanges for perpetual contracts like Hyperliquid handle hundreds of millions in daily trading volume, with spreads competitive with centralized exchanges. The liquidity foundation urgently needed by options protocols now exists.

The bottleneck has always been infrastructure: the "pipelines" that professional traders take for granted. Market makers need deep liquidity pools, instant hedging capabilities, immediate liquidation when positions deteriorate, and a unified margin system that treats the entire portfolio as a single risk exposure.

We have previously written about Hyperliquid's shared infrastructure approach, which creates a positive-sum state that DeFi has long promised but rarely achieved: each new application strengthens the entire ecosystem rather than competing for scarce liquidity.

We believe that options will eventually go on-chain through this "infrastructure-first" approach. Early attempts focused on mathematical complexity or clever token economics, while HyperEVM addresses the core "pipeline" issues: unified collateral management, atomic execution, deep liquidity, and instant liquidation.

We see several core aspects of market dynamics changing:

After the FTX collapse in 2022, the number of market makers willing to participate in new primitives and take on risk has decreased; now, traditional institutional participants are returning to the cryptocurrency market.

There are more proven networks capable of meeting higher trading throughput demands.

The market is more accepting of certain logic and liquidity not being fully on-chain.

If options are to make a comeback, three types of talent may be needed: developers who understand how the product works, experts who understand market maker incentives, and individuals who can package these tools into retail-friendly products. Can on-chain options platforms enable some people to earn life-changing wealth? After all, Memecoins have done it — they have made the dream of turning a few hundred dollars into millions a reality. The high volatility of Memecoins makes this work, but they lack the "Lindy effect" (the longer something exists, the more stable it becomes).

In contrast, options have both the Lindy effect and volatility, but they are difficult for the average person to understand. We believe there will be a class of consumer-grade applications focused on bridging this gap.

The current cryptocurrency options market resembles the state before the Chicago Board Options Exchange (CBOE) was established: a collection of experiments, lacking standardization, primarily speculative rather than hedging. However, as cryptocurrency infrastructure matures and becomes commercially operational, this situation will change. Institutional-level liquidity will be brought on-chain through reliable infrastructure, supporting cross-margin systems and composable hedging mechanisms.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。