Written by: White55, Mars Finance

As the price of Hyperliquid (HYPE) approaches the $50 mark in July 2025, the market's attention is drawn to prominent whale addresses and public company announcements. However, beneath the surface, a more substantial capital force is continuously consuming circulating chips in a programmatic manner — the platform's fee buyback mechanism, which forms the most resilient value foundation for HYPE.

The design of this mechanism is ingenious: Hyperliquid injects the daily generated trading fees into an automatic buyback fund, continuously purchasing HYPE on the open market and destroying it. This process creates a closed-loop economic model that directly converts platform growth into token deflationary pressure.

Data shows that the total amount of tokens destroyed by the protocol has reached 26 million HYPE, valued at over $1.2 billion at current prices. As the platform's trading volume climbs to an average of tens of billions daily, the annual buyback fund scale will rise to $1 billion, becoming an inexhaustible "bullish perpetual motion machine" in the market.

What is even more concerning is its leverage effect: the buyback intensity increases exponentially with the rise in token price. When HYPE rises from $20 to $40, the number of tokens that can be purchased with the same amount of funds is halved, forcing the protocol to increase its buying efforts to meet destruction targets. This positive feedback loop leads to a rapid contraction of the circulating supply — currently, the platform's treasury holdings account for 7.8% of the circulating supply, and if the price breaks $100, this ratio could jump to over 15%, fundamentally reshaping the market's supply-demand structure.

Ecological Expander: The "Franchise Ticket" of One Million HYPE

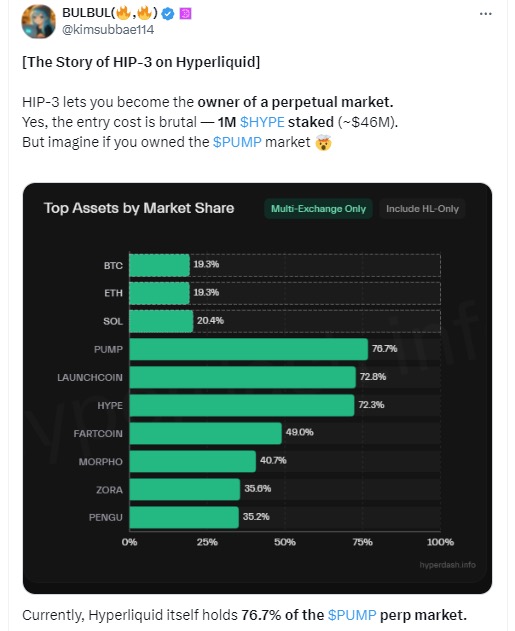

In May 2025, Hyperliquid launched the HIP-3 protocol, sparking a capital arms race. This rule allows external institutions to stake 1 million HYPE (approximately $5 million) to create exclusive derivative trading markets and share in the fee revenue. This is akin to opening a VIP hall license in an "on-chain casino" with a daily trading volume of $10 billion, instantly igniting capital competition.

- The scarcity of licenses has led to a coin hoarding competition: HIP-3 is essentially an on-chain financial franchise, and the number of licenses is limited by the total amount of staked tokens. Early entrants like Eyenovia hoarded 1.04 million HYPE at an average price of $34 million, realizing a floating profit of $17 million within three months. As more institutions realize that "holding a license = sharing in Hyperliquid's growth dividends," the staking threshold may rise from 1 million to 2 million tokens.

- Ecological verification nodes become a new leverage: Eyenovia further partnered with the staking protocol Kinetiq to launch verification nodes, converting HYPE staking into node revenue rights. This "holding tokens + nodes + fee sharing" triple revenue model attracts listed companies like Tony G and Lion Group to replicate, creating an arms race among institutions.

Short Squeeze: The "Fuel Supply" of the Derivative Market

When HYPE broke through $40 in June, a bloody short liquidation storm became a booster. Data shows that its derivative open interest surged from $5 billion to $9 billion within two months.

The forced buying from short liquidations creates a unique upward momentum. For example, at the beginning of July, a whale's failed short led to a $23 million liquidation, and the exchange's automatic buyback behavior instantly consumed market liquidity. This "short fuel" phenomenon has repeatedly played out with HYPE: when the price broke $30 in May, shorts lost $8 million in a single day, and when it hit $40 in June, the liquidation amount reached $2.95 million.

The expansion of the derivative market itself is a confidence indicator. When open interest exceeds $1 billion, it indicates that institutional investors are using futures to build risk exposure, and the $1.8 billion position has surpassed most second-tier public chains, confirming the market's recognition of Hyperliquid as the "King of DeFi Derivatives."

Ecological Developer: The "Infrastructure Bet" of EVM

Although Hyperliquid is known for its high performance on the native chain, its HyperEVM compatibility layer is attracting developers to incorporate HYPE into the underlying economic system. Currently, the EVM ecosystem has locked up 24 million HYPE, becoming the second-largest hoarder after the platform treasury.

- The VC token auction mechanism is innovative: project parties need to stake 500-2,000 HYPE to obtain token issuance rights, with an estimated annual consumption of 140,000 to 200,000 tokens. This design forces emerging projects to source tokens from the market, creating a strong demand on the development side.

- Liquidity fission accelerates: Once institutional nodes like Eyenovia are activated, they output credit resources to ecological projects through "staking lease agreements." For example, trading institutions can bind node wallets to obtain fee discounts without directly holding HYPE. This model transforms node holdings into ecological liquidity, amplifying the token's utility scenarios.

Exchanges: The "Token Puppet" Forced into the Game

Centralized exchanges have a contradictory sentiment towards Hyperliquid: they fear its DEX will erode spot trading while coveting the perpetual contract fee gold mine. This torn stance has led to absurd scenarios — exchanges have become passive large holders of tokens.

- User deposits force platforms to hold tokens: KuCoin users voluntarily deposited 4.4 million HYPE, forcing the platform to urgently launch spot trading. Gate.io and Bitget quickly followed, with the three exchanges accumulating 7.7 million tokens, accounting for 2.3% of the circulating supply.

- Staking activities expose inventory anxiety: Bybit launched a "limit storage of 20 HYPE for 30% returns" campaign, revealing its insufficient token holdings. As more exchanges follow suit, the industry may spark a HYPE reserve competition, as contract trading depth needs to be backed by sufficient spot liquidity.

Whales and Institutions: The "Order Creators" Entering the Game Openly

On-chain data reveals an institutional blitz:

- Amber Group: In January, spent $7.22 million at an average price of $21.06 to build a position of 340,000 tokens, now holding 730,000 tokens with a floating profit of $6.56 million.

- Galaxy/Manifold: Injected $30 million at the end of June.

- Mysterious whale: On July 11, split into five wallets to buy 139,662 tokens, costing $6.37 million.

Individual whales are also making significant moves:

- Suzhu: Publicly holds 460,000 tokens.

- Pima: On-chain address holds over 500,000 tokens.

- Dayu: Early $5 million position, current position unknown due to trading operations.

The endorsement of traditional financial veterans carries more signal significance. BitMEX founder Arthur Hayes publicly holds a position and is bullish up to $100, calling it a "beast mode" protocol. Grayscale included HYPE in its top 20 recommended assets in its Q1 2025 institutional report, attracting more conservative capital to enter.

Public Companies: The "New Currency Weapon" of Wall Street

After MicroStrategy's Bitcoin gamble yielded a thousandfold profit, struggling public companies found a sharper lifeline — HYPE.

Eyenovia's transformation is textbook-level: this eye drug company, with an annual revenue of only $56,000, announced a $50 million all-in on HYPE, causing its stock price to soar 134% in a single day, with market capitalization jumping from $20 million to $80 million. Its new CIO Hyunsu Jung (former architect at DARMA Capital) stated, "The deflationary model of HYPE is more suitable as collateral than BTC."

- Tony G: Purchased 10,000 HYPE for $43,000, driving a $57 million market cap increase.

- Lion Group: Secured $600 million in financing to initiate treasury plans.

- Nuvve: Issued $4.8 million in stock to raise funds, clearly stating that part of the funds would be invested in HYPE.

The strategic logic of these companies is highly consistent: using the scarcity of HYPE to replace stock liquidity. When a company holds 0.1% of the market's circulating HYPE (about 330,000 tokens), its stock becomes the only channel to share in HYPE's premium in the secondary market, driving more public companies to join the coin hoarding ranks.

Scarcity Storm: The "Liquidity Black Hole" of Multi-Party Collusion

The essence of HYPE breaking through $50 is a liquidity black hole created by the combined forces of platform buybacks, institutional staking, short liquidations, ecological construction, exchange reserves, whale hoarding, and public company allocations. Its terrifying aspect lies in:

The deflationary spiral self-reinforces: The destruction mechanism causes the circulating supply to decrease by 0.5% each month, while institutional staking locks up at least 20 million tokens (accounting for 6% of circulation), leading to an actual liquidity pool of less than 100 million tokens;

Capital leverage nesting: Public companies use equity financing to buy tokens → stake to obtain node revenue → node credit supports ecological development → developers consume HYPE to obtain resources, forming a closed loop of capital proliferation;

Short fuel cycle: Every 10% price increase triggers about $2 million in short liquidations, forcing buying pressure to boost the next wave of price increases.

When Arthur Hayes shouts a $100 target, he may be hinting at a harsh reality: HYPE has become an arena for institutions, and retail investors have already been pushed out of the table — with only over 140,000 holding addresses, the average holding value exceeds $70,000 under a market cap of $10 billion, representing a new capital order colluded by whales and public companies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。