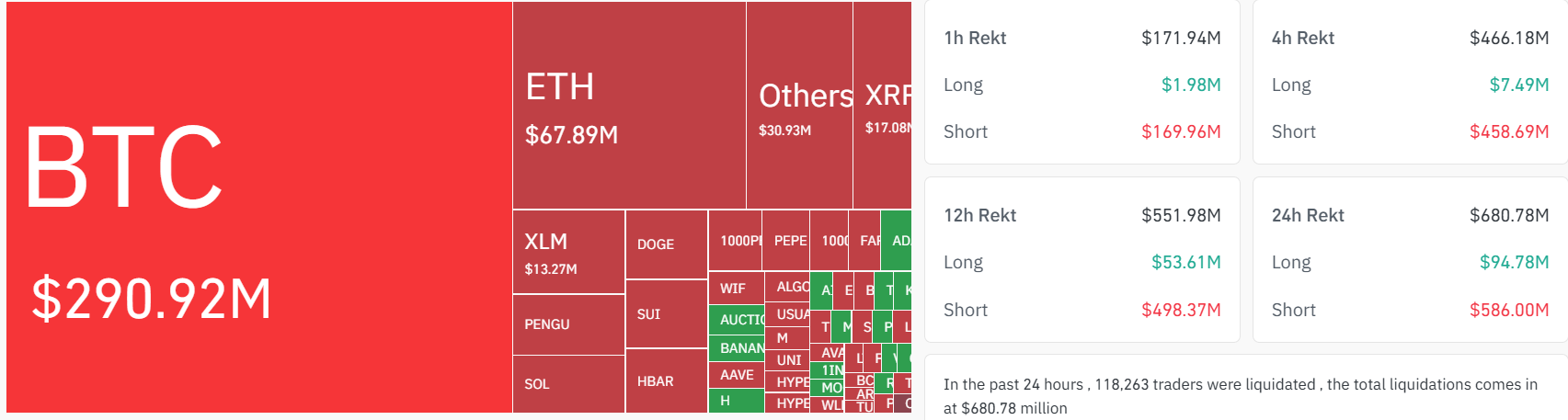

More than $680 million in crypto positions were liquidated over the past 24 hours with short traders taking the bulk of the pain as a bitcoin (BTC) breakout above $121,000 triggered a chain reaction across derivatives markets.

Roughly $426 million of the total liquidations came from bearish bets, according to Coinglass data, making it one of the largest weekend liquidation events in recent months. The largest single order, a $92.5 million BTC short, was flushed on HTX.

BTC alone saw $291 million in forced closures, with futures tracking ether (ETH) and XRP (XRP) following at $68 million and $17 million, respectively. XLM (XLM) and pepecoin (PEPE) also posted elevated activity, signaling that the squeeze extended deep beyond major tokens.

Meanwhile, dogecoin (DOGE), Solana's SOL (SOL), and SUI (SUI) saw rising open interest, though with relatively smaller drawdowns, indicative of higher spot-based demand.

Liquidations occur when traders using leverage are forced to close their positions due to margin calls. While they often signal excessive positioning, they also serve as a reset mechanism for markets, flushing weak hands and clearing the way for new directional flow.

Bitcoin’s rally in the past week has sparked a broader breakout across major crypto assets. Traders say that market structure is evolving under the weight of institutional influence — with eyes on the $130,000 mark in the short term.

Read more: Bitcoin, Ether Traders Bet Big With Tuesday's U.S. Inflation Data Seen as Non-Event

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。