Source: Bitcoin Versus The IMF

Compiled & Edited by: LenaXin, ChainCatcher

Note: The 111-page "Policy under the Medium-Term Loan Arrangement" section of the country report on El Salvador published by the International Monetary Fund in March 2025 is being generated through a word cloud generator.

International Monetary Fund

In 2004, years before the advent of Bitcoin, author John Perkins published the influential book “Confessions of an Economic Hitman”. This semi-autobiographical work chronicles Perkins' career as an "economic hitman"—he traveled to emerging market countries, persuading local governments to accept loans from the International Monetary Fund (IMF) and the World Bank, which often came with harsh conditions and employed highly controversial methods. Perkins vividly referred to these economic agents as "jackals."

For readers hoping to understand the economic liberalism background and potential mission behind the birth of Bitcoin, this work is a must-read classic. Perkins' exposé provides early Bitcoin supporters with an important perspective on the value of this emerging monetary system. Like many members of the Bitcoin community, our understanding based on such works leads us to maintain a cautious attitude towards the IMF. Overall, Bitcoin supporters not only question the central banking system but also remain vigilant towards multinational financial institutions such as the IMF, World Bank, and Bank for International Settlements. Accordingly, it is not difficult to understand the IMF insiders' aversion to Bitcoin.

IMF's Narrative Control

In May 2011, years after Bitcoin's emergence, then-IMF President Dominique Strauss-Kahn (DSK) was accused of sexually assaulting a hotel maid in New York. This political figure, who was expected to run for the French presidency, was involved with a victim who was an immigrant from Guinea. Notably, Guinea was still indebted to the IMF for as much as $472 million, a significant portion of the country's GDP (3 billion Canadian dollars).

Many readers familiar with John Perkins' work, including some Bitcoin holders, immediately connected this sexual assault allegation to the IMF's predatory financial nature towards developing countries. From the victim's dual plight: she was forced to emigrate due to the economic pressures imposed by the IMF on her homeland and directly became a victim of the organization's power holders. Although the sexual assault case received widespread coverage that year, mainstream media largely overlooked this darkly ironic connection, maintaining a consistent respectful stance towards the IMF in their reporting.

DSK subsequently resigned, and current European Central Bank President Christine Lagarde took over as IMF President. Notably, Lagarde herself has a criminal record and has repeatedly held a negative stance towards Bitcoin. In January 2025, she intervened to prevent the Czech Republic from including Bitcoin in its official foreign exchange reserves.

Lagarde: I believe… Bitcoin will not enter the reserves of any central bank in the Governing Council

Lagarde's term as President of the European Central Bank will end in 2027, and there are already rumors that she may succeed Klaus Schwab as the chair of the World Economic Forum. If true, this would mark Lagarde's second time taking over a top international economic organization position vacated due to a sexual assault scandal.

The Invisible Game with Bitcoin

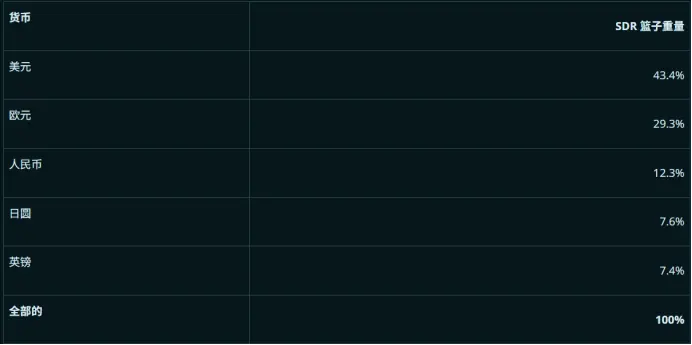

Currently, the International Monetary Fund (IMF) has issued $173 billion in outstanding loans to 86 countries (most of which are relatively poor). Through its Special Drawing Rights (SDR) system, the organization has the potential to issue loans of up to $1 trillion. SDRs, as a "global reserve asset," are valued against a basket of national currencies and are essentially financial instruments created out of thin air through a debt mechanism.

It is noteworthy that although the IMF has 191 member countries, the distribution of voting power is heavily skewed towards Western countries. The United States holds 16.49% of the voting power (this proportion gives it effective veto power over new loan projects that require an 85% majority approval), while most major European countries maintain voting power between 3% and 5%. In contrast, China's voting power in the IMF is only 6.1%—this proportion was obtained after a voting power reform, as previously, China's voting power was even comparable to that of Belgium.

The IMF has long maintained a tradition of having a European president and an American president of the World Bank, further highlighting the power imbalance in the global financial governance system.

Source: International Monetary Fund (as of 2022)

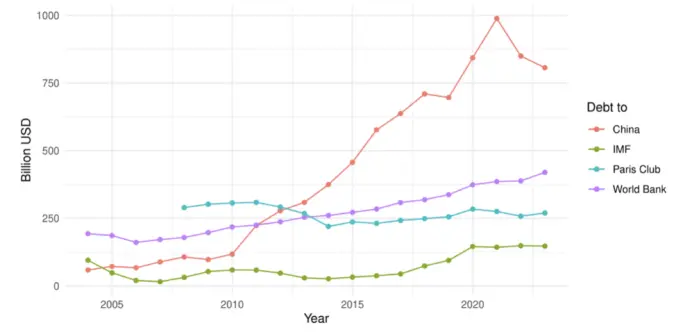

Over the past 15 years (since the DSK incident, we do not imply a causal relationship), the relative influence of the IMF and World Bank has shown a downward trend, with their loan balances experiencing only moderate growth. During this period, China has risen to become a major financier of infrastructure projects in developing countries. This shift may benefit smaller developing countries—enhancing their bargaining power and potentially avoiding the harsh conditions typically attached to IMF loans (which often require borrowing countries to cede control of key state-owned assets to foreign enterprises).

However, the new dependency may lead these countries to shift from reliance on the IMF to excessive concession to Chinese influence. Any form of external financing dependency can undermine the autonomy of sovereign nations, prompting some smaller economies to seek alternative solutions. Data shows that China has become the most competitive alternative to the IMF, and in recent years has clearly gained the upper hand in this game. In stark contrast, during this period, the United States has invested hundreds of billions of dollars in military operations in countries like Iraq and Afghanistan, rather than in economic development aid.

Source: https://cepr.org/voxeu/columns/rise-china-international-lender

Measured by modern financial standards, the International Monetary Fund (IMF) has a relatively limited balance sheet size—currently comparable to the market value of commercial firm MicroStrategy (MSTR US), accounting for only 6% of Bitcoin's total market value. Notably, since the DSK incident, Bitcoin has experienced exponential growth far exceeding the size of the IMF's balance sheet (although this article does not present specific price charts).

To some extent, Bitcoin is forming a competitive relationship with the IMF: vying for the status of global reserve asset and serving as an alternative for infrastructure financing in emerging market countries. However, Special Drawing Rights (SDRs) have never developed into a true competitor and ultimate ruler of Bitcoin as some observers expected in 2011.

The following will focus on two distinctly different case countries: El Salvador and Bhutan. It should be noted that our analysis is based on publicly available information and has not involved on-site investigations of these two countries. This "armchair research" approach may not gain the approval of political commentators like Douglas Murray, who emphasize field research.

El Salvador

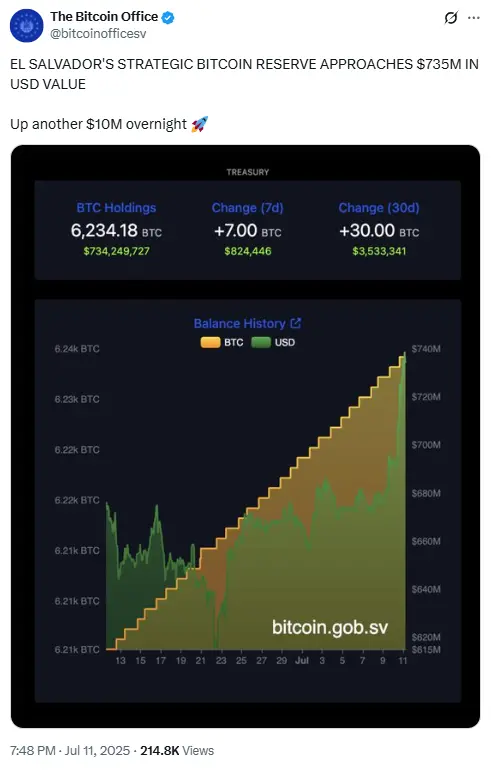

On June 5, 2021, at the Bitcoin conference held in Miami, Jack Mallers introduced El Salvador's President Nayib Bukele to the attendees. Bukele announced a landmark decision at the conference: to establish Bitcoin as the country's legal tender. Since then, El Salvador has implemented a series of Bitcoin-supportive policies, including the establishment of a national strategic Bitcoin reserve. As of the time of writing, this reserve holds 6,234.18 Bitcoins, valued at approximately $735 million.

El Salvador's cooperation with the International Monetary Fund (IMF) dates back to 1959. As of April 2020, the IMF had provided 23 financing programs to the country. Before the implementation of Bitcoin policy, the last loan was a $389 million COVID-19 special loan approved in April 2020. In February 2025, after the implementation of the Bitcoin policy, the IMF Board approved a new $1.4 billion, 40-month deferred loan mechanism. As of June 27, 2025, $231 million had been disbursed under this mechanism.

It is noteworthy that the complete loan agreement between El Salvador and the IMF remains confidential, and the public cannot access its specific terms. This lack of transparency is puzzling, as intergovernmental agreements should be more publicly accessible. Nevertheless, the IMF has released a substantial amount of related documents. We focused on two core documents: a 111-page report released on March 3, 2025, and a 98-page report released on March 19, 2025.

The IMF's excessive focus on Bitcoin is astonishing. In these two reports, totaling 209 pages, the term "Bitcoin" appears 319 times. Through word cloud analysis, we found that in the core chapters discussing credit policy, "Bitcoin" is the second most frequently mentioned term, only behind the generic term "financial." This clearly indicates that within the IMF's assessment framework, Bitcoin is viewed as a primary source of risk related to El Salvador.

The report views Bitcoin almost entirely from a negative perspective—all related discussions presuppose that Bitcoin is risky and harmful, yet never provide substantial arguments. The IMF completely ignores any potential positive impacts of Bitcoin, only mentioning that "widespread adoption of crypto assets may threaten macroeconomic stability and increase fiscal risks." The report even considers low Bitcoin usage rates as a positive, reasoning that "price volatility is severe and public trust is insufficient." In the IMF's logic, low adoption rates equate to low risk.

The report dedicates multiple chapters to discussing how to "mitigate Bitcoin risks" and proposes seven specific policy recommendations:

- Legal Aspect: Repeal the legal tender status of Bitcoin

- Payment System: Cancel the obligation for public and private sectors to accept Bitcoin payments

- Tax System: Clearly stipulate that taxes must be paid only in US dollars

- Government Payments: Ensure that national debt is not settled in Bitcoin

- Chivo Wallet: Publish audit reports and terminate government involvement by July 2025

- Regulatory Framework: Focus on preventing money laundering risks, following FATF recommendations

- Investment Restrictions: Restrict government investments in Bitcoin

Among these loan conditions, some terms appear excessively harsh. For instance, allowing enterprises to choose their payment methods is a reasonable demand, but forcing sovereign nations to amend laws through loan conditions (using foreign funds) raises ethical concerns. However, this is precisely the IMF's consistent modus operandi. This imposition of ideological preferences on borrowing countries corroborates the power dynamics revealed by John Perkins in "Confessions of an Economic Hitman."

The restrictions on government investments in Bitcoin have garnered the most attention, especially since the government has been purchasing Bitcoin and promoting it extensively. The following two excerpts from the reports articulate this theme most clearly:

During the implementation of this plan, the authorities commit not to accumulate Bitcoin.

In the context of this plan, the public sector will not voluntarily accumulate Bitcoin.

Due to the inability to access the actual loan agreement text, it is difficult to confirm the specific commitments of the Salvadoran government. However, from public statements, the IMF's requirements appear quite clear. Yet, the reality presents an intriguing contradiction—the country continued to increase its Bitcoin holdings in 2024, albeit at a slowed pace of one Bitcoin per day. When Forbes reporter Javier Bastardo inquired about this apparent inconsistency with the IMF, the response was vague:

This flexibility in policy execution has sparked numerous speculations: perhaps the agreement restricts the proportion of Bitcoin investments relative to GDP, allowing for increased purchasing limits as the economy grows; or El Salvador has designed a system that categorizes Bitcoin assets outside the "public sector." Regardless, one evident fact is that despite the IMF's strong anti-Bitcoin stance, the Salvadoran government is clearly seeking some balance—wishing to maintain cooperation with the IMF while formally limiting the scope of Bitcoin policy, yet insisting on exploring greater economic sovereignty and independence through Bitcoin. This "tightrope walking" strategy reflects the real dilemmas and wisdom of small nations within the global financial system.

Bhutan

Bhutan, along with Paraguay and Laos, forms a unique group of countries—these nations possess abundant hydropower resources, often generating electricity far exceeding domestic grid demand. This energy endowment presents dual opportunities: traditionally, surplus electricity is exported through cross-border transactions (Bhutan to India, Paraguay to Brazil, Laos to Thailand and Vietnam), but this trade model gives importing countries excessive bargaining power, as they are the only real channels for absorbing surplus electricity.

However, Bitcoin mining offers these countries a breakthrough option. Bhutan was the first to explore this path, maximizing the value of its natural resources by converting surplus electricity into digital currency. Theoretically, this innovative model could position Bhutan, Paraguay, and Laos as potential winners in the Bitcoin economy, while the relative advantages of traditional electricity importing countries may be diminished.

Nestled in the Himalayas, Bhutan is renowned for its unique natural landscapes and spiritual pursuits. This country, with an annual GDP of about $3.3 billion, prioritizes Gross National Happiness (GNH) and sustainable development over traditional economic growth metrics. Tourism (accounting for 15% of GDP) is one of its economic pillars—though this industry only opened to the outside world in 1974. It is precisely this unique economic structure that caused Bhutan to suffer particularly severe impacts during the COVID-19 pandemic, prompting the country to actively seek innovative economic solutions like Bitcoin.

Bhutan also faces the challenge of talent outflow. To address this issue, the government announced a 50% overall increase in public sector salary standards in 2023. Unlike El Salvador, Bhutan has not purchased Bitcoin on the open market but has fully utilized its surplus hydropower resources for Bitcoin mining. To date, the country has accumulated 11,611 Bitcoins (valued at approximately $1.4 billion), equivalent to 42% of its GDP. This strategic move significantly enhances Bhutan's economic autonomy—not only reducing dependence on external funding from the IMF but also providing financial support for domestic infrastructure development and public sector growth.

Although Bhutan has not borrowed from the IMF, it still receives some support from the World Bank. In the latest 125-page country partnership report released by the World Bank, Bitcoin is only briefly mentioned three times, far less than the IMF's reports. However, the World Bank has criticized Bhutan for the lack of transparency in its Bitcoin mining operations. It is foreseeable that without the economic buffer provided by Bitcoin, Bhutan might have been forced to seek loan support from the IMF. This alternative financial path allows this Himalayan nation to maintain its unique GNH development philosophy while gaining more policy autonomy.

Recently, Bhutan announced a forward-looking "Mindful City" plan, which will adopt a special legal framework different from other regions in the country (see video materials for details). While global economic special zone models are not uncommon, Bhutan's concept is distinctive: centered on sustainable development, it employs natural engineering methods to address flood risks, designs important cultural facilities as cross-river bridges, and even integrates temples into the colorful hydropower station architecture.

This city project, infused with Buddhist wisdom, may partially rely on Bitcoin mining revenues as a funding source. In fact, Bhutan has already become a successful example of the Bitcoin economy—by converting surplus hydropower into digital assets, the country not only advances infrastructure development in an ecologically friendly manner but also significantly increases public sector salaries. More importantly, these achievements have been made while maintaining national independence and avoiding intervention from so-called "economic jackals."

Looking ahead, if Bitcoin's value continues to grow, coupled with the Bhutanese government's prudent governance and political wisdom, this "Land of the Thunder Dragon" and its people are likely to become the most successful strategic beneficiaries in the era of digital currency. Perhaps in the near future, we will witness Bhutan becoming the first classic case of a sovereign nation empowered by Bitcoin.

Disclaimer

The content of this article does not represent the views of ChainCatcher. The opinions, data, and conclusions in the text represent the personal positions of the original author or interviewees. The compiler maintains a neutral stance and does not endorse their accuracy. This does not constitute any professional advice or guidance, and readers should exercise caution based on independent judgment. This compilation is for knowledge-sharing purposes only; readers should strictly adhere to the laws and regulations of their respective regions and refrain from engaging in any illegal financial activities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。