Author: Prathik Desai

Translation: Block unicorn

In April 2024, Bitcoin's fourth halving quietly reset the game rules for miners. The reward for each block dropped from 6.25 BTC to 3.125 BTC. Initially, the market did not care. Prices barely fluctuated. But for miners, whose profits were already thin, the math became much more difficult overnight.

This meant they had to put in the same effort but received only half the reward.

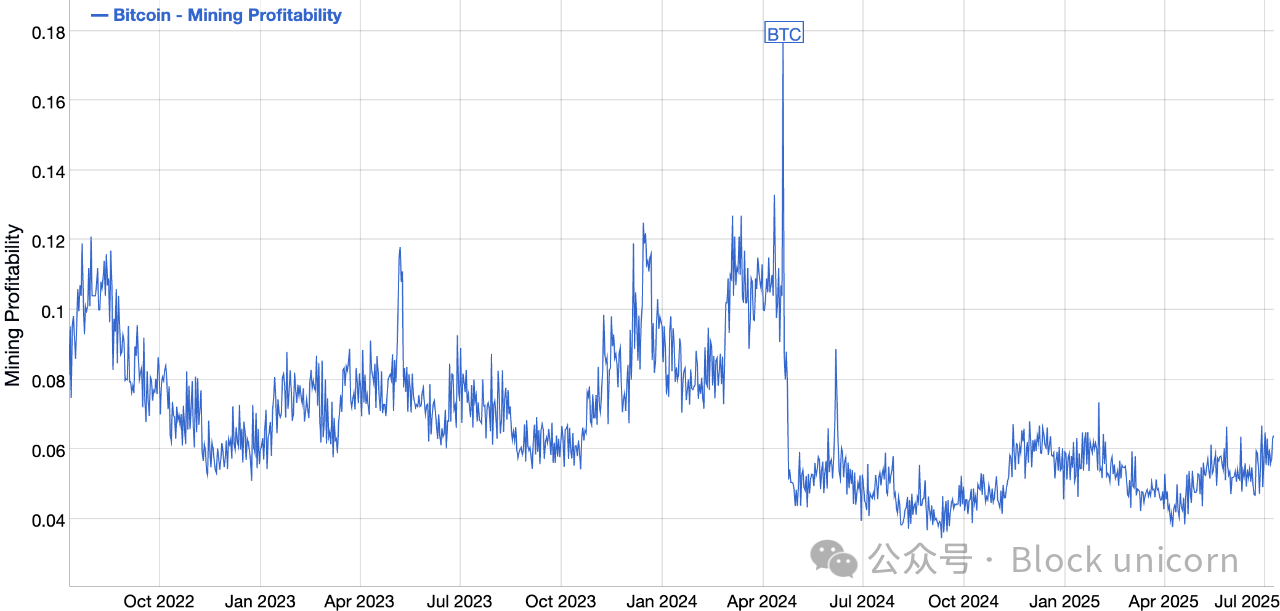

Maintaining the original model meant paying energy costs and upgrading equipment. Some tried, but most saw their income decrease. Mining profitability fell from an average of about $0.08 per day (1 TH/s) to $0.055 per day (1 TH/s).

Everyone knew the halving was coming. Most prepared for a business transformation, stopping the sale of the Bitcoin they mined. With costs unchanged and income reduced, profit margins shrank. They turned to hoarding Bitcoin, betting on its long-term value.

They did not stop. Michael Saylor's Strategy (then known as MicroStrategy) had already set a template with its bet on Bitcoin.

Marathon Mining had become the largest miner by treasury size, adding over 30,000 BTC to its balance sheet in just over a year since the halving. The company mined at least 8,900 BTC and purchased over 21,000 BTC from the open market.

Riot retained every satoshi (about 5,000 BTC) it mined in the 12 months following the halving and purchased over 5,000 BTC during that period. Even Hut 8, which had relatively lower output, added over a thousand BTC since the halving, almost not selling any of its hoarded Bitcoin.

Hive recovered from the wave of transitioning to proof of stake (PoS) from Ethereum, with its Bitcoin reserves growing by over 25% since the halving, subsequently selling part of its reserves to support expansion. Core Scientific, after emptying its wallet post-bankruptcy, has increased its holdings by over 900 BTC since the halving, with 700 BTC coming from one quarter. This is unusual for a miner that once sold every coin to survive.

These actions are not typical of Bitcoin miners' normal operations but rather desperate attempts to evolve.

This indicates one thing: hoarding Bitcoin is no longer a stopgap measure. It shows confidence in Bitcoin's rise but also reveals something else.

Building Bitcoin treasury helps in long-term price appreciation. However, asset appreciation does not equate to income, which cannot cover daily operating expenses.

Post-halving, profit margins are tighter. The cost of mining Bitcoin is higher than ever, and many realize that the old model—mine, sell, repeat—is no longer viable. Some miners found they had the foundation for transformation: facilities built for high-energy machines. They began repurposing their infrastructure for AI computing.

Core Scientific took the lead with a high-profile move. In June 2024, it signed a 12-year, $3.5 billion GPU infrastructure hosting agreement with AI cloud provider CoreWeave. This is one of the largest AI hosting deals ever. The contract provides Core with a long-term revenue source that is almost unrelated to Bitcoin prices, sparking a quiet competition in the mining sector.

Riot also took similar steps. In January 2025, Riot paused its expansion plans for its 600 MW Bitcoin mining facility in Corsicana and began reselling the site to hyperscale data centers and AI companies. The company shifted from expanding computing power to seeking AI tenants. The Corsicana facility was originally designed for scaling, with 1 GW of power and a massive footprint. Riot believes it is better to rent it out to AI operators than to install more ASICs.

Hut 8 chose a different direction. It spun off its entire mining division into a separate entity called American Bitcoin, retaining 80% of the shares. This allowed the parent company to focus on data center infrastructure and AI services. In September 2024, Hut 8 launched Highrise, a GPU-as-a-service division, starting with a thousand Nvidia H100s and signing a five-year contract with a cloud customer. Earlier this year, it announced plans to build a 300 MW high-performance computing campus in Louisiana.

Hive, leveraging its long history of GPU mining before the Ethereum merge, relied on its traditional advantages. It repurposed over 4,000 old GPUs for cloud computing and then deployed H100 and H200 clusters in Quebec. By early 2025, Hive's AI annual revenue run rate reached $20 million, with plans to hit $100 million the following year. It sold some Bitcoin in 2024 but retained most of what it mined that year.

Even Marathon, the most steadfast supporter of Bitcoin, adjusted its direction. In September 2024, it appointed two AI industry veterans to its board. The company developed immersion cooling equipment designed specifically for AI inference workloads. By early 2025, the company began exploring data center hosting services for AI clients. As of May 2025, the company held over 49,000 BTC, having sold almost none of its mining proceeds since April 2024.

Iris Energy is fully betting on AI. It sold all the Bitcoin it mined and focused on expanding its data centers. By mid-2025, it had deployed over 4,000 GPUs and was building facilities in Texas and British Columbia to accommodate 20,000 GPUs. Although funding remains tight, its infrastructure is rapidly developing.

Some miners view Bitcoin as a strategic reserve. Others see it as liquid inventory to support growth. But in any case, they are trying to extend the same assets—cheap land, idle energy, grid access, and specialized cooling systems—into areas more useful than mere mining.

Simply relying on mining can no longer guarantee survival.

Electricity prices remain unchanged. Computing power continues to rise. Surviving miners have achieved this by increasing optionality. Some have become service providers, some cloud computing suppliers, and many are still experimenting to find a way out.

Currently, most miners are still mining Bitcoin. But this is no longer their entire business. It is just one of many revenue sources, which may include AI hosting, GPU leasing, energy brokering, and even sovereign-level computing infrastructure in the future.

It is still too early to judge whether miners' shift to AI is successful, and the data is too sparse. Although the high-performance computing (HPC) business has not fully scaled for everyone, the profit margins for AI computing per megawatt are significantly higher than for mining, which helps.

For some, signs are already beginning to show.

Iris Energy's AI service revenue grew from negligible to $2.2 million by June 2025. This relatively new business segment has a profit margin of 98%, while the mining business has a profit margin of 75%.

However, this is not a foolproof strategy. Building AI facilities is costly. It requires not just power but also networking, redundancy, cooling, and customers who can continuously fill the racks. Not every miner will succeed. Some will overbuild, some will miss market opportunities, and some will still rely entirely on Bitcoin years later.

The industry is no longer singular.

They started by stacking blocks. Then they began hoarding Bitcoin. Now, they are stacking GPUs. However, Bitcoin mining has not stopped.

Most miners turning to AI are still mining Bitcoin.

Last month, Bitcoin's hash rate hit an all-time high, far exceeding levels at the time of the halving. This indicates increased mining difficulty and costs, as miners need to invest more computing resources to solve blocks and earn rewards.

In this context, selling mined Bitcoin at lower profit margins becomes economically unfeasible for businesses. Unless Bitcoin prices rise or transaction fees soar, only the most efficient operations can turn a profit.

Improving efficiency may mean lowering electricity and computing costs. It may even mean holding Bitcoin and only selling when prices far exceed the post-halving average. This explains why most miners are turning to AI for higher returns on investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。