Bitcoin.com CEO Corbin Fraser recently made a provocative claim: “Canadians are dead broke.” Pointing to a stagnant economy, high inflation, and political dysfunction, he argues that Canadians should protect their wealth by derisking from the loonie—and instead, buy Bitcoin. He even suggests seriously considering what, for most Canadians, remains unthinkable: joining the U.S. as the 51st state.

Paycheck-to-Paycheck Struggles in Canada

Corbin Fraser, a Canadian who has lived abroad for nearly a decade and now resides in the UAE, shared that “most of my friends and family are living paycheck to paycheck.” One friend, who runs a cross-border transportation business, says rising tariffs have crushed margins and cut access to key U.S. markets. While Canadian media often blames former U.S. President Donald Trump’s trade policies, Corbin argues that domestic politicians and media share responsibility for supporting policies that worsened the economic mess. “They’re unable to see that their own leaders created this environment,” he said.

The economic cracks are impossible to ignore. Inflation peaked at 7.6% in July 2022, the highest level since 1983, according to Statistics Canada. Although inflation has cooled somewhat, the cost of essentials like food, housing, and fuel remains elevated. Canada’s GDP grew by just 0.6% in Q1 2024 and is forecast to grow only 1.2% in 2025, lagging behind the U.S. and OECD peers (OECD). Meanwhile, the country is grappling with a housing crisis, with average home prices still hovering above $700,000 CAD, and a record 20% of renters spending more than 50% of their income on rent (CMHC).

Brain Drain: Successful Canadians Fleeing

Fraser points to a growing “brain drain” as one of Canada’s most urgent economic challenges: “The most successful Canadians leave.” A 2023 report from the Fraser Institute found that over 94,000 high-income earners left Canada in a single year. Many of them head to the U.S. or other jurisdictions with lower taxes and fewer regulatory barriers. In the crypto sector, Fraser says, the exodus is even more pronounced. Stringent Canadian regulations have driven blockchain developers, founders, and investors to friendlier hubs like Dubai, Miami, and Singapore — eroding domestic innovation and deepening frustration among those still trying to build in Canada.

You Can’t Say That In Canada

Watching from the UAE, Fraser says Canada’s political establishment feels increasingly out of touch — especially with voters in Western provinces who prioritize economic freedom, energy development, and smaller government. “Neither the Liberals nor the Conservatives represent real Canadian values anymore,” he argues. He cites the Conservative Party’s 2025 election loss under Pierre Poilievre as evidence of this disconnect, calling Poilievre’s failure to resonate “a symptom of deeper political rot.”

Fraser sees potential in the People’s Party of Canada (PPC), led by Maxime Bernier, which advocates reduced government intervention and fiscal conservatism. But the party continues to struggle for mainstream visibility — a challenge Fraser blames on Canada’s tightly controlled media landscape. “You’ve got government-backed outlets like the CBC, ideologically driven universities, and censorship that kept Maxime out of the 2025 debates,” he says.

He points to mass immigration as a key issue stifled by political correctness. “It’s the elephant in the room. Everyone talks about it in private, but no one dares bring it up in public discourse,” Fraser says.

Canada has experienced an unprecedented surge in immigration over the past few years. In 2023 alone, the country welcomed 471,550 new permanent residents — a historic record and an 81% increase from 2013, when just 258,953 were admitted (Immigration.ca, Government of Canada data). The rapid influx pushed Canada’s population growth to its fastest pace since 1957, with over 1.27 million new residents added in a single year, largely due to immigration (Reuters). While often framed as an economic necessity, Fraser argues that the scale and speed of this growth is contributing to rising costs, housing shortages, and a growing sense of political and cultural dislocation.

For Canadians who feel politically voiceless, he offers a stark reminder: “You don’t have to vote in a broken system. You can vote with your money.”

Bitcoin as a Financial Hedge

The CEO of Bitcoin.com argues that Bitcoin can help Canadians protect their wealth from economic instability. With a fixed supply of 21 million coins, Bitcoin is immune to central bank policies that devalue the loonie. Its price surged past $100,000 USD ($135,000 CAD) in late 2024, making it a top performing asset for those seeking to hedge against inflation and a weakening currency. The 2022 Emergencies Act, under Justin Trudeau’s Liberal government, which allowed banks to freeze funds during the Trucker protests in Ottawa, underscored Bitcoin’s appeal as a decentralized asset for Canadians wary of government overreach.

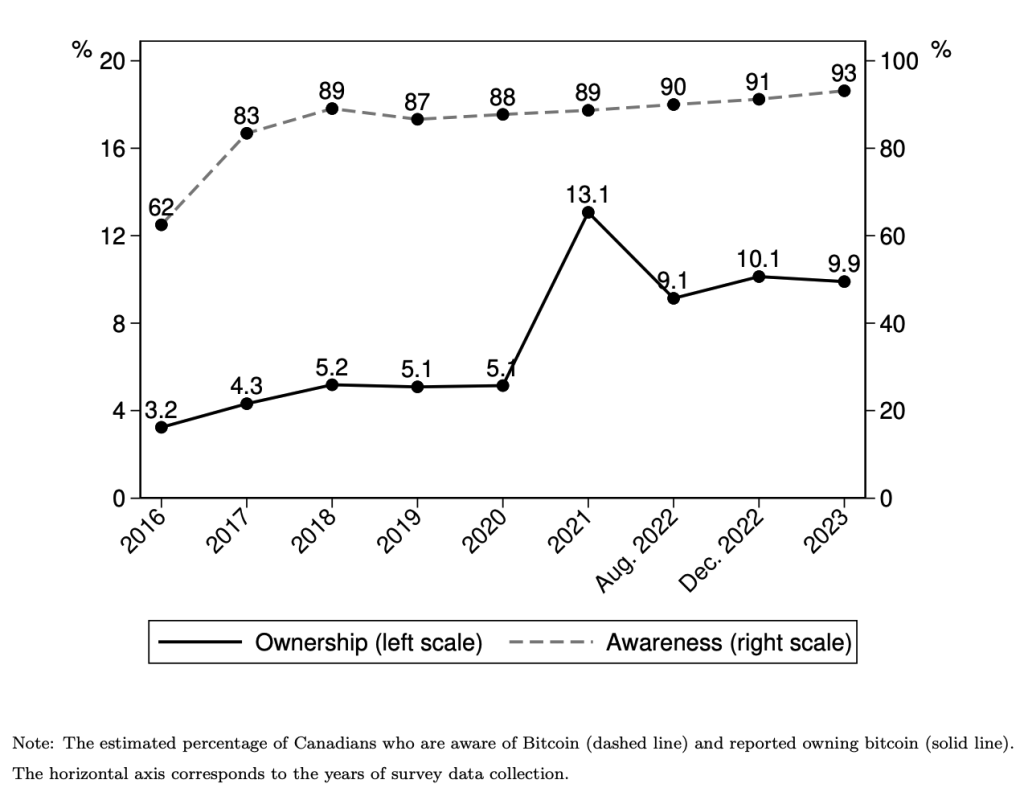

While risks like market volatility exist, Bitcoin’s potential as a financial hedge is gaining attention. Like everyone else in the world, Canadians have access to self custody solutions like those offered by Bitcoin.com. For people looking for centralized/custodial solutions, regulated platforms like Kraken and Coinbase Canada offer accessible ways to invest. Advocates argue that Bitcoin’s decentralized nature empowers individuals to take control of their finances. The Bank of Canada’s Bitcoin Omnibus Survey reported that approximately 10% of Canadians owned Bitcoin or other cryptoassets in 2023, down from 13% in 2021. This translates to roughly 4 million Canadians.

The 51st State: A Radical Proposal

As economic frustration deepens, some — including Fraser — have begun entertaining a once-unthinkable idea: Canada becoming the 51st U.S. state. The notion, floated during the Trump administration, has resurfaced as a kind of political thought experiment. Fraser argues that integration could offer access to a larger market, lower taxes, less brain drain, and better opportunities — especially for small businesses like his friend’s cross-border transportation company, which has struggled under rising tariffs.

“Trump’s threats shook things up, but the real problem is at home,” Fraser says. “Canadian politicians fumbled trade policy and let the media turn everything into a blame-Trump story — instead of fixing what’s broken domestically.”

Still, Fraser acknowledges that the 51st state proposal is more symbolic than practical. “Canadians value their sovereignty and culture — and fair enough,” he says. Prime Minister Mark Carney, elected in 2025, has shown little appetite for radical change. His administration is focused on economic stabilization, regulated digital currencies, and maintaining strong public institutions — not U.S. integration, and certainly not pro-Bitcoin policies.

Fraser puts it bluntly: “If Canadians can’t even talk openly about immigration policy without fear of backlash, I doubt they’ve got the stomach for something as radical as joining the U.S. — even if it might actually help the average person.”

Charting a Path Forward

The CEO of Bitcoin.com’s call to invest in Bitcoin reflects a desire for financial autonomy amid economic hardship. The brain drain, political disconnect, and media suppression of parties like the PPC highlight systemic issues. Bitcoin offers a promising hedge for some, with regulated platforms providing a starting point, though investors should research thoroughly. The 51st state proposal, while appealing to those frustrated with Canada’s trajectory, remains unlikely due to political and cultural hurdles.

As Fraser sees it, Canadians are “dead broke” not just in wallet, but in options. Whether through Bitcoin or broader systemic reform, those seeking relief may need to start by opting out — and choosing financial sovereignty.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。