Author: Renmin University Institute of Financial Technology

The Technical Core and Evolution Path of Stablecoins

Stablecoins, as emerging digital financial tools, have served as a bridge connecting crypto assets and the traditional financial system since their inception. Their fundamental mission is to provide a low-volatility digital value carrier through a value anchoring mechanism, serving both decentralized finance (DeFi) and being able to integrate into mainstream payment, settlement, and financing scenarios in traditional finance.

According to Deloitte's report "2025: The Year of Payment Stablecoins," payment stablecoins (PSC) are defined as "digital currencies based on 1:1 fiat currency reserves, with instant redemption capabilities, and legally not constituting securities." This asset form has rapidly expanded globally, becoming an indispensable trading intermediary in the crypto asset market and gradually penetrating into the real economy sectors such as cross-border payments and supply chain settlements. Roland Berger defines stablecoins as "digital value units based on blockchain distributed ledger technology, anchored to high-credit assets, characterized by low volatility and high transparency," emphasizing their decentralized and programmable attributes as a potential restructuring force for global capital flows.

Stablecoins integrate the advantages of traditional currencies and digital technology: they rely on blockchain to record transactions, and their value is anchored by holding cash, government bonds, and other highly liquid assets, achieving high transparency, low intermediary costs, and high capital velocity, providing new ideas for the construction of digital financial infrastructure in emerging markets.

Stablecoins can be categorized into three types based on collateral models and value maintenance methods: fiat-collateralized (supported by cash, short-term government bonds, etc., at a 1:1 ratio or over-collateralized), crypto-collateralized (maintaining anchoring through over-collateralization of crypto assets), and algorithmic (not relying on real asset collateral, maintaining anchoring through supply-demand algorithms). Table 1 compares the three models and their risk cases:

Both Roland Berger and Deloitte's reports point out that the technology of stablecoins has undergone three stages of evolution:

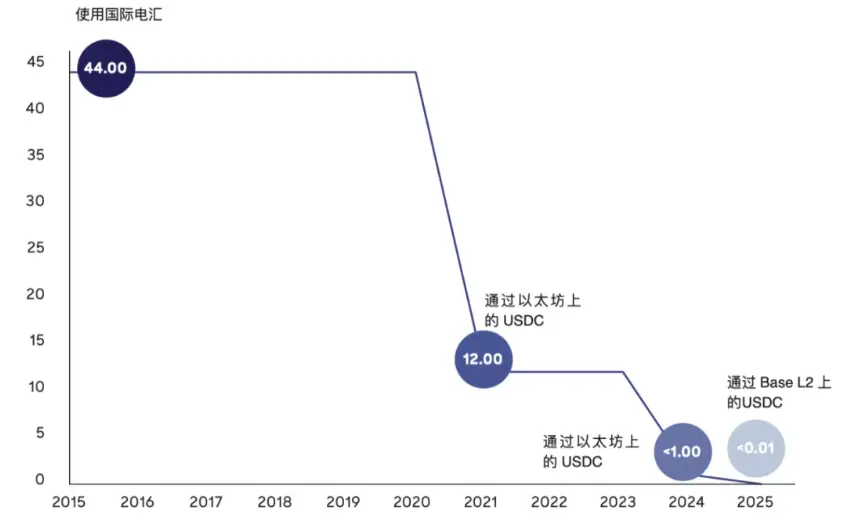

First Stage: Transaction Medium Function (2015-2020). During this stage, stablecoins were primarily used to serve crypto asset exchanges, acting as hedging and fund settlement tools for trading pairs.

Second Stage: Payment and Settlement Infrastructure (2021-2024). With the optimization of on-chain technology, stablecoins began to be applied in scenarios such as cross-border payments and supply chain settlements. Data from Roland Berger shows that the average cost of cross-border transfers using the early version of USDC on the Ethereum chain was $12 per transaction, with a delivery time of about 10 minutes. After optimization on the Base chain, the current cost has dropped to $0.01 per transaction, with delivery time reduced to 5 seconds.

Third Stage: Integration into the Financial System (2025-Present). Starting in 2025, stablecoins are gradually being incorporated into mainstream financial infrastructure, becoming important tools for inter-institutional fund allocation, corporate financial settlements, and cross-border trade payments.

The significant value of stablecoins lies not only in anchoring fiat currencies and reducing volatility but also in the financial innovation potential brought by programmability. Combined with smart contracts, stablecoins can support conditional payments, fund custody, and split settlements, promoting the upgrade of financial products from static contracts to dynamic capital flows.

Global Market Landscape and Impact on Traditional Banks

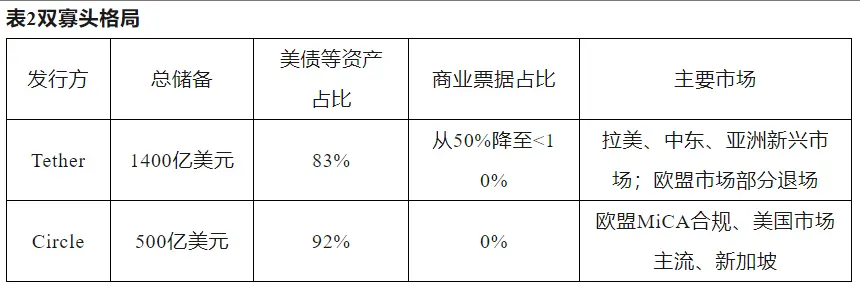

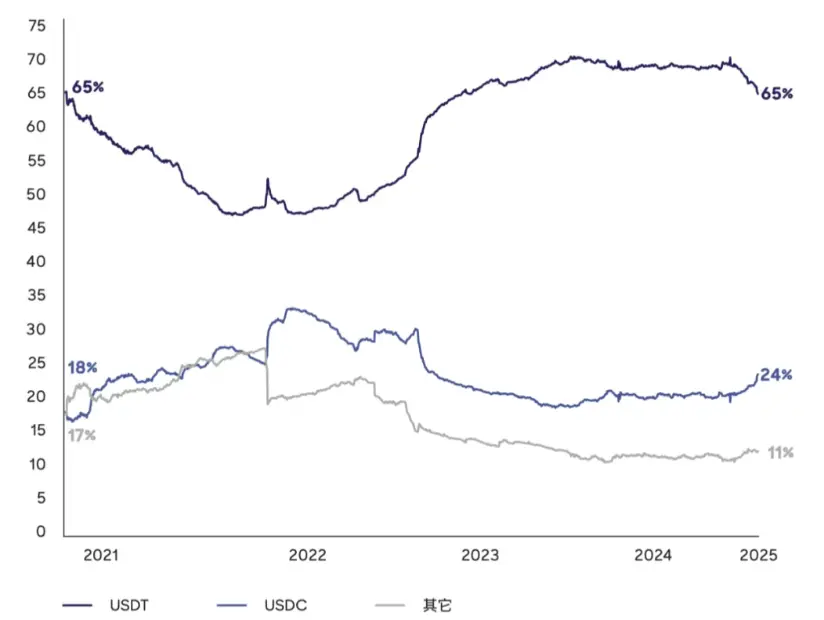

In the past five years, stablecoins have transitioned from marginal tools to mainstream financial infrastructure. According to data from Bain, Roland Berger, and Deloitte (2025), the global circulating market value of stablecoins has increased from less than $2 billion in 2019 to over $200 billion by early 2025. By 2025, USDT (Tether) and USDC (Circle) account for over 85% of the stablecoin market. Tether primarily serves emerging markets, with high liquidity assets such as U.S. Treasury bonds in its reserves amounting to $116 billion, accounting for 58% of global stablecoin reserves. USDC, with its compliance and transparency advantages, is widely used in developed markets such as the EU and Singapore, with reserves exceeding $50 billion.

In terms of regional distribution, the acceptance of stablecoins is particularly prominent in emerging markets and high-inflation economies. For example, in Turkey, due to the continuous depreciation of the local currency, residents' use of stablecoins (mainly USDT) for asset preservation and cross-border payments has been steadily increasing, with USDT holders accounting for 34% of the country's total population by 2024. Similar phenomena are observed in countries like Nigeria and Argentina, where the amount of remittances received through stablecoins has significantly increased, with Nigeria receiving a total of $20 billion in cross-border remittances through stablecoins in 2024, accounting for over 30% of the country's total remittances.

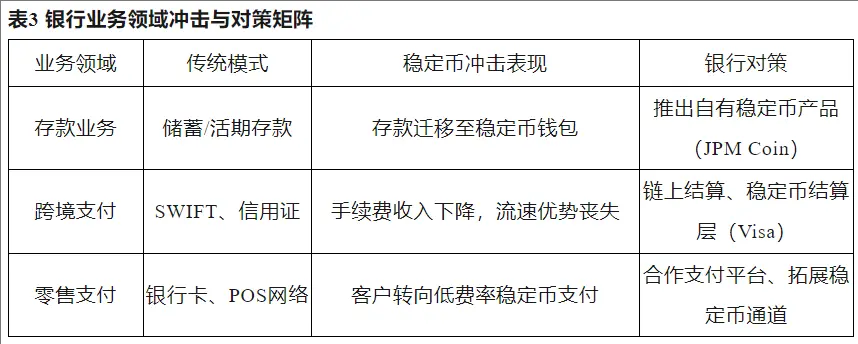

The rapid development of stablecoins poses systemic challenges to the traditional banking system, particularly in the following aspects: first, deposit diversion. Stablecoin wallets and non-custodial accounts, as alternative value storage methods, are gradually diverting demand for demand deposits and savings deposits that traditionally belong to banks. Second, payment business income is being squeezed. The low-cost and high-efficiency characteristics of stablecoins directly impact traditional payment channels like SWIFT. It is estimated that banks are losing about $30 billion in annual fee income. The main strategies banks are adopting include spontaneously launching stablecoins, building on-chain settlement networks, and collaborating with stablecoin issuers.

Ecosystem Participants and Profit Model Analysis

The core participants in the stablecoin ecosystem are issuing institutions, whose business models and reserve management methods directly determine the credibility and market acceptance of stablecoins. By early 2025, the global stablecoin market has formed a dual oligopoly structure dominated by Tether (USDT) and Circle (USDC). Their profit models mainly derive from the following aspects: first, income from reserve assets. The large-scale holdings of U.S. Treasury bonds, repurchase agreements, deposits, and other assets by issuers can generate substantial interest income. For example, Tether's investment income from U.S. Treasury bonds and equivalent assets reached billions of dollars in 2024, becoming its core profit source. Second, transaction fees and commissions. Third, ecosystem profit sharing. Commissions and settlement shares formed through partnerships with payment platforms, banks, and wallet service providers. Nevertheless, the sustainability of their profit models remains highly dependent on the safety of reserve assets, market trust, and changes in regulatory conditions.

In the stablecoin ecosystem, custodians and payment infrastructure play a bridging role connecting reserve assets, on-chain assets, and end users, with main functions including: custodianship of reserve assets to ensure asset safety and high liquidity; providing on-chain asset custody and key management services; supporting payment networks, merchant settlements, and clearing services. Traditional financial institutions are gradually deepening their participation in this segment to hedge against the impact of stablecoins on their business while sharing in the industry dividends.

The stablecoin ecosystem is gradually presenting a "multi-layered collaboration + micro-profit high-frequency" profit pattern. Although income from reserve assets remains the core profit source for issuers, the future profit models of stablecoin issuers will face three major challenges due to increased regulation, rising compliance costs, and intensified market competition (such as the entry of traditional banks):

First, narrowing interest margins. Fluctuations in reserve asset yields and a declining interest rate cycle will compress the profit space for stablecoins. Second, rising compliance costs. For example, the EU's Markets in Crypto-Assets Regulation (MiCA) imposes monthly CPA verification and daily disclosure requirements for reserves, increasing operational costs. Third, squeezed ecosystem shares. Banks and payment giants are launching their own stablecoins and on-chain settlement solutions to compete for market share. Deloitte's report points out that "the future profit model of stablecoins must transition from a simple reserve interest logic to a diversified model of data value addition, ecosystem collaboration, and financial innovation; otherwise, it will be difficult to maintain long-term competitiveness."

Main Risks and Governance Framework

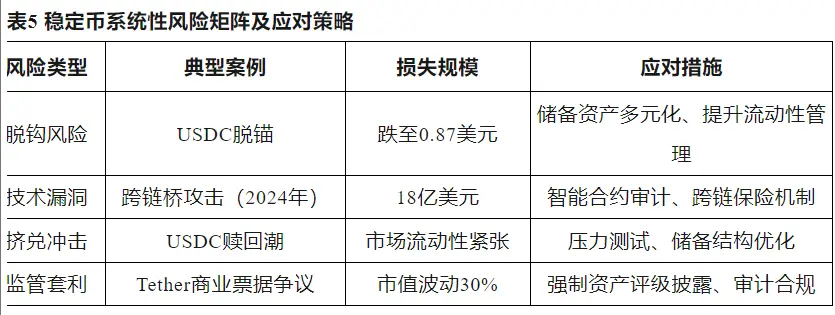

The main risks of stablecoins are reflected in the following four aspects: first, decoupling and liquidity risks. If reserve assets depreciate or liquidity tightens, it can easily trigger decoupling and large-scale redemptions, impacting financial markets. Second, technical security risks. Stablecoins relying on blockchain and smart contracts face risks of hacking. In 2024, a cross-chain bridge vulnerability incident caused losses of $1.8 billion, becoming a serious security incident. Third, bank runs and market shocks. When the reserve structure is opaque, it is easy to trigger a wave of redemptions due to panic or rumors. In 2023, USDC experienced a redemption of $3.8 billion in one day due to the Silicon Valley Bank incident, with its price dropping to $0.87 at one point. Fourth, regulatory arbitrage. Different countries have varying regulations, allowing issuers to evade oversight by exploiting gray areas. Tether has faced regulatory pressure from multiple countries due to a high proportion of commercial paper in its reserve assets.

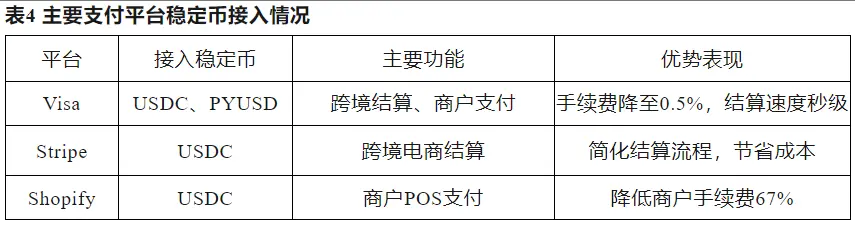

To address these "systemic risks," the report suggests that stablecoin governance should be advanced in layers, forming a multi-dimensional collaborative protection system of "regulatory layer - financial institutions - technical layer." At the regulatory level, it is necessary to promote the unification of global regulatory standards, implement reserve asset disclosure, cross-border data sharing, and stress testing (referencing the EU MiCA and UK's FCA regulatory sandbox experience). At the financial institution level, commercial banks can defend against deposit outflow risks by issuing their own stablecoins (such as JPM Coin) while promoting on-chain settlement innovations; payment platforms (such as Visa) should also integrate stablecoin settlement layers to enhance competitiveness in cross-border business. At the technical level, it is essential to strengthen third-party audits of smart contracts, establish cross-chain bridge insurance mechanisms, and promote the development of anti-MEV (Maximum Extractable Value) protocols to prevent front-running and manipulation risks in on-chain transactions.

Global Regulatory Dynamics

The rapid development of stablecoins has attracted global regulatory attention, with countries striving to find a balance between encouraging financial innovation and controlling risks. Since 2023, the United States, the EU, Singapore, the UAE, and others have successively introduced regulatory frameworks to standardize key aspects such as reserve management, issuance qualifications, and information disclosure. Institutions like Deloitte believe that clear regulation is a necessary condition for stablecoins to transition from the margins to the mainstream financial system.

(1) The U.S. GENIUS Act

As a global financial innovation center, the United States serves as a model for regulatory pathways. The pending "GENIUS Act" (General Examination of New Issuance of United Stablecoins Act) aims to unify national stablecoin regulatory standards and address the fragmentation of state and federal oversight. Key provisions include: 1. Issuance qualifications: Non-bank institutions and bank subsidiaries can issue stablecoins, with federal approval required for those exceeding $10 billion in scale. 2. Reserve requirements: 100% high liquidity assets (with U.S. Treasury bonds ≥80%), subject to monthly audits. 3. Redemption and disclosure: T+1 redemption, mandatory monthly CPA reports, and pilot real-time disclosures. 4. Regulatory jurisdiction: The OCC will oversee national issuers while retaining state licensing approval rights. However, challenges include conflicts between state and federal jurisdictions, disputes over reserve transparency, and interest bans on payment stablecoins, which may raise concerns in the industry about restricted innovation and increased compliance costs.

(2) EU MiCA Framework

The EU's Markets in Crypto-Assets Regulation (MiCA) will take effect in 2024, establishing a full lifecycle regulatory system. Key requirements include: first, issuers must be licensed credit or payment institutions; second, reserve assets must be highly liquid and subject to daily audits; third, real-time reserve disclosures are mandatory, with non-compliance leading to expulsion (Tether has already been delisted from some platforms). The MiCA model has successfully promoted industry transparency and standardization but has also significantly raised the entry barriers for the industry.

(3) Pilot Programs in Asia and the Middle East

Economies such as Singapore and the UAE have chosen to advance stablecoin management through a "regulatory sandbox + flexible regulation" approach. The Monetary Authority of Singapore (MAS) requires stablecoin issuers to hold reserves primarily in AAA-rated assets and to accept monthly information disclosures and redemption commitments. There is a strong emphasis on encouraging financial innovation alongside regulatory progress. The Central Bank of the UAE has approved policies for commercial banks to pilot the issuance of AED stablecoins for local retail payment scenarios, creating a model for the application of local currency stablecoins in consumer payments and microfinance.

The experiences of these countries indicate that phased and sector-specific pilot programs during the early stages of regulation can help balance innovative development with risk control.

Future Development Path and Strategic Insights

Currently, stablecoins are evolving from auxiliary tools for crypto asset trading to important components of global financial infrastructure, profoundly impacting payment systems, cross-border capital flows, banking operations, and monetary policy. The report indicates that the future of stablecoins will be driven by technological innovation, regulatory improvements, and the adaptability of the financial system, accelerating applications in high-value areas such as corporate payments, cross-border settlements, and supply chain finance, leveraging their advantages of low cost and high efficiency to upgrade the global payment system.

As the regulatory framework gradually improves, stablecoins that do not meet reserve and transparency requirements will be eliminated from the market, accelerating the industry's compliance process. At the same time, stablecoins are expected to achieve interoperability with central bank digital currencies (CBDCs), jointly fulfilling global payment and settlement functions. The development of technological standardization and reserve transparency will promote the full integration of stablecoins into the global financial system.

However, the development of stablecoins also faces multiple challenges. On one hand, the innovation capacity of stablecoins in payment and financial services is constrained by stringent regulations, making the balance between innovation and safety a key focus for regulators worldwide. On the other hand, while their efficient payment and near-instant settlement enhance cross-border payment efficiency, they also amplify the speed of financial risk transmission. Additionally, the large-scale anchoring of stablecoins to U.S. dollar assets exacerbates "digital dollarization," putting pressure on the stability of local currencies and the independence of monetary policy in emerging markets.

For emerging economies like China, the development of stablecoins offers three insights: first, pilot programs should be initiated in closed scenarios such as cross-border e-commerce, regional trade, and offshore settlements to accumulate experience; second, a dual focus on technology and compliance should be promoted, enhancing reserve transparency and on-chain security, and facilitating interoperability and mutual recognition between the digital yuan and controllable stablecoins; third, active participation in global governance mechanisms such as the BIS and IMF should be pursued to jointly promote the formulation of digital financial regulations, striving for the interests and voice of more developing countries.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。