In the flickering of digital currency, opportunities and challenges coexist; each flicker is a test of the courage to command. Even if entering this realm feels like being in a fog, those with ambition and determination will surely carve out their own wealth in these turbulent waters.

Hello everyone, starting today, we officially log into AICOIN. We will provide the most timely and accurate trend advice from both macro and technical perspectives, starting from mainstream currencies. Paying attention is the beginning of wealth accumulation.

Citing previous works by Li Mu, the shift in the macro market has laid the foundation for this round of upward momentum. The expectation of interest rate cuts and the influx of ETH have promoted this upward trend. Recently, Bitcoin has approached the 120,000 mark, reaching a peak of 118,880, with Ethereum rising in sync, breaking through the mid-line resistance to above 3,000. Firm holders are bound to be ecstatic, while those who bet against the trend will regret it. However, there is no medicine for regret in life; one must keep their eyes on the future.

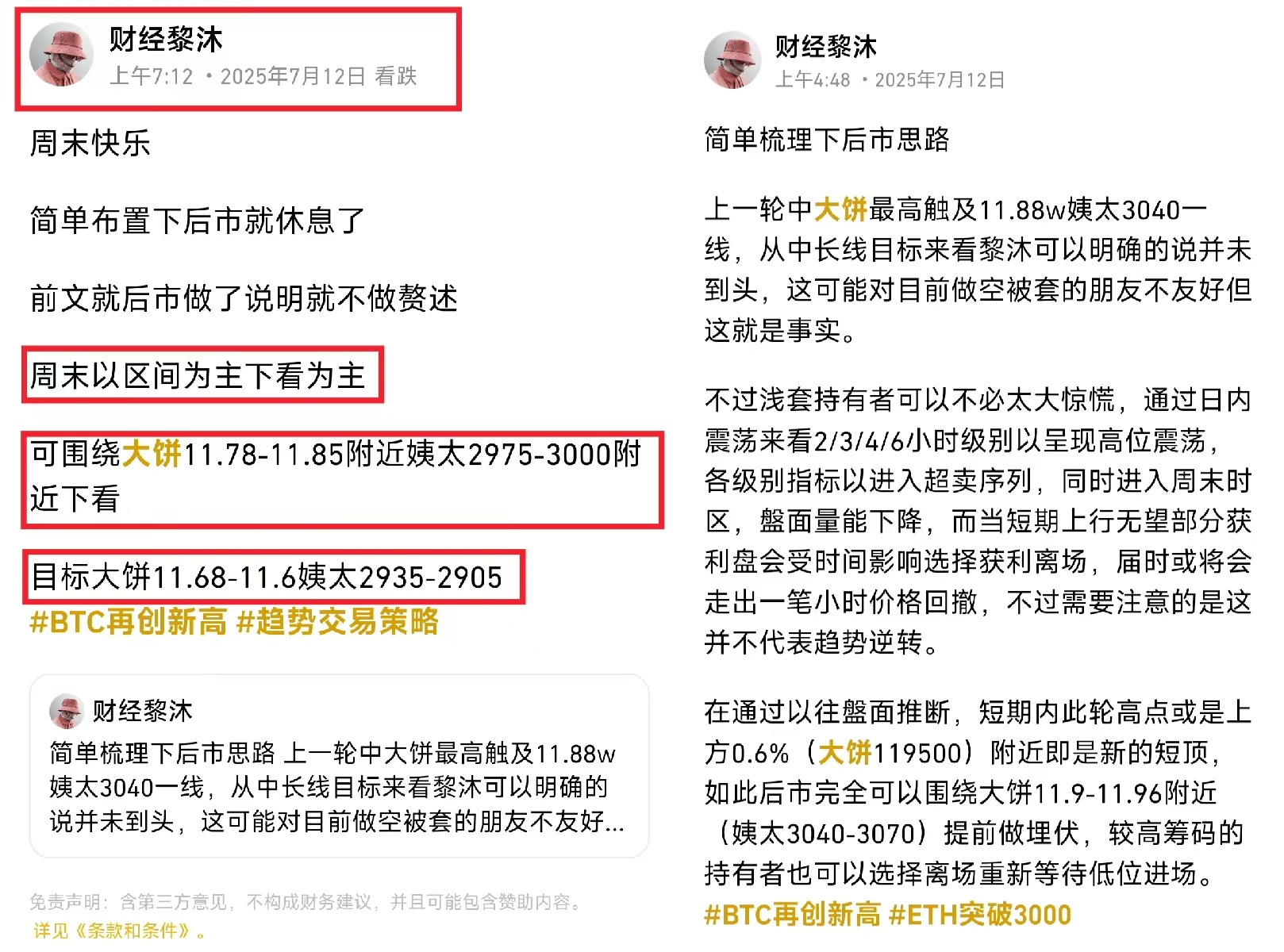

At this moment, everyone may be more concerned about whether Bitcoin can continue to rise and whether this round is a top that can be shorted. Li Mu's answer is: both are possible. We must look back at the market. First, the strong upward movement of Bitcoin at the daily level has laid the groundwork for the continuation of the monthly and even quarterly upward trends. The mid-line resistance for Ethereum has been broken, which is expected to push it further up. At the same time, considering the macro market sentiment, there is certainly more room for upward movement. In Li Mu's view, with the macro positive factors yet to materialize, Bitcoin standing above 128,000 and even 130,000 is foreseeable within the year. However, behind this simple expectation lies hidden undercurrents; the continuation at high levels will inevitably be accompanied by corrections, which leads to the short-term layout direction.

Shorting is possible. Here, we can also refer to Li Mu's previous article. In yesterday morning's sharing, Bitcoin formed high-level fluctuations at 2/3/4/6/8H, with various indicators showing an oversold sequence. As the short-term decline over the weekend occurred, the continuation of fluctuations is highly likely to be accompanied by corrections. The lack of short-term profit will also promote profit-taking, thus creating space for the market to decline. However, it is important to note that under the influence of the macro trend, even if a pullback occurs, it is merely a continuation of the market's downward movement. After reaching support, it will still lead to a new round of upward movement.

Looking ahead: Through structural observation, there are currently two obvious retracement points. The first is around 116,200 for Bitcoin, which corresponds to the first false retracement point of this round of upward movement, and also serves as support for the 60-minute MA60. In similar structures, the 60-minute MA60 support often provides good buying opportunities. The second is around 113,500 for Bitcoin and 2,800 for Ethereum, which corresponds to the mid-point of the market's upward movement and is also the main position for the previous round of trapped positions. As the trend corrects, it will provide corresponding structural moving average support, making this the best starting point for further upward movement in the future.

The article has a review delay, and the market is ever-changing. It is better to delve into the thought process than to copy answers. For more real-time trades, analysis ideas, potential coin ambushes, and methods to break free from traps, please follow the public account: Li Mu has something to say.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。