"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. Based on the extensive coverage of real-time information each week, the Planet Daily also publishes many high-quality in-depth analysis articles, but they may be hidden among the information flow and trending news, passing you by.

Therefore, our editorial team will select some quality articles worth spending time reading and saving from the content published in the past 7 days every Saturday, providing you with new insights from the perspectives of data analysis, industry judgment, and opinion output, as you navigate the crypto world.

Now, let's read together:

Investment and Entrepreneurship

Reflections After the Surge: What Stage Are We in the Macro Cycle?

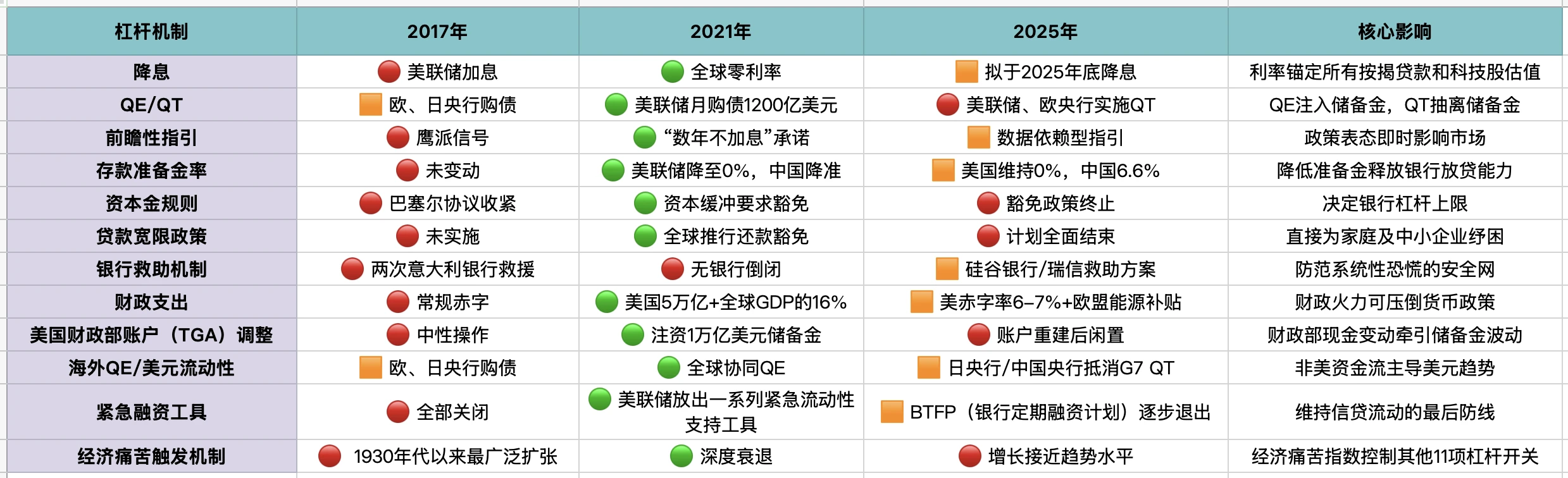

Comparison of liquidity in 2017, 2021, and 2025:

“🔴” indicates inactive, “🟠” indicates mildly active, “🟢” indicates strongly active. Additionally, it should be noted that the last leverage item will control the other 11 leverage items.

We have not yet entered a new round of "massive liquidity injection."

The author also proposed four major observation signals:

Inflation = 2%, and policy announcement risk is balanced; Focus: Fed/ECB statements shift to neutral wording; Significance: Clears the last rhetorical barrier before rate cuts.

QT pause (100% reinvestment of maturing bonds); Focus: FOMC/ECB announces full reinvestment; Significance: Stops draining liquidity, shifts to neutral reserves.

FRA-OIS spread greater than 25 basis points, or repo rates surge; Focus: 3-month FRA-OIS or GC repo trades jump to over 20 basis points; Significance: Indicates dollar financing pressure, often forcing liquidity interventions.

The People's Bank of China fully cuts the reserve requirement ratio by 25 basis points; Focus: Deposit reserve ratio drops below 6.35%; Significance: Releases 400 billion in base currency, often the first domino in easing for emerging markets.

Multiple favorable factors are working together to accelerate the pace of the industry. On one hand, the global macro environment is stabilizing, and tariff policies have eased, providing a friendlier backdrop for capital flow and asset allocation. On the other hand, several countries and regions around the world have introduced multiple friendly policies for the development of the cryptocurrency industry, and traditional financial markets are beginning to actively embrace cryptocurrencies, linking token structures with traditional financial assets to achieve a "financialization" of capital structures.

The narrative around on-chain derivatives continues to heat up, with Hyperliquid becoming a phenomenal leader, with daily trading volumes repeatedly approaching or surpassing some centralized exchanges, and native tokens consistently outperforming the market, becoming one of the strongest performing assets.

Trader's Memoir: How Did I Make a 100% Profit Using Soros' Method?

Heavy bets on rare opportunities: PEPE listed on Robinhood and Coinbase.

When VCs Hit the Sell Button: The Wealth Transfer Game Behind the Polychain Sell-off

Recently, Polychain sold TIA worth $242 million.

It is unfair to solely target Polychain: Polychain's job is to take risks and earn returns, just like everyone else.

There is a significant issue with the profitability of cryptocurrencies: most protocols do not make money themselves, and they do not consider profitability at all. The main problem in the industry is that some teams treat token sales as profits and build business models based on that, without considering the consequences. Token economics is not the main issue; the tokens themselves are.

Moreover, technological innovation is unrelated to token prices.

A comprehensive valuation method should be based on traditional cash flows of the enterprise, with on-chain revenue (staking income minus transaction fees) as the core verification element. Continuously focusing on staking yield, real-time traffic indicators, and scenario analysis can keep the valuation method up to date, which is the only way to attract traditional capital into the market.

The token transparency framework aims to enhance market clarity and attract more institutional funds into the token market.

Tokenization of stocks is reshaping financial markets, improving efficiency and expanding global capital access.

Facts obscured by emotions, algorithms, and false KOL noise: Interaction ≠ Success, Venture Capital ≠ Value, Hype ≠ Growth.

What successful projects actually do: Focus on building what people truly want to use; Set reasonable prices for tokens at issuance; Communicate sincerely with the audience; Measure what truly matters, rather than just looking at likes.

Also recommended: "2025 Web3 Job Market Report: With 10,000 People Competing for 28 Positions, How Can You Win?".

Policy and Stablecoins

Stablecoins: A Cashless Payment Reform for 5 Billion People

Stories of large-scale adoption of stablecoins in Latin America, Southeast Asia, and Africa.

Also recommended: "Trump Media Group Continues to Apply for Crypto ETF, U.S. SEC Advances Unified Standards to Simplify Approval Process" and "Tech Accelerationists' Ecstasy: Latest Updates on Stablecoins, Many Things You Don't Know (and Projects)".

Airdrop Opportunities and Interaction Guide

This Week's Featured Interactive Projects: Cysic and Bless on Kaito; Mawari Earns Points

Meme

"Official" Platforms Emerge, What Concepts Are Being Hyped in the Post-Pump Era?

Token concepts lack a main line, with official endorsements becoming a core element.

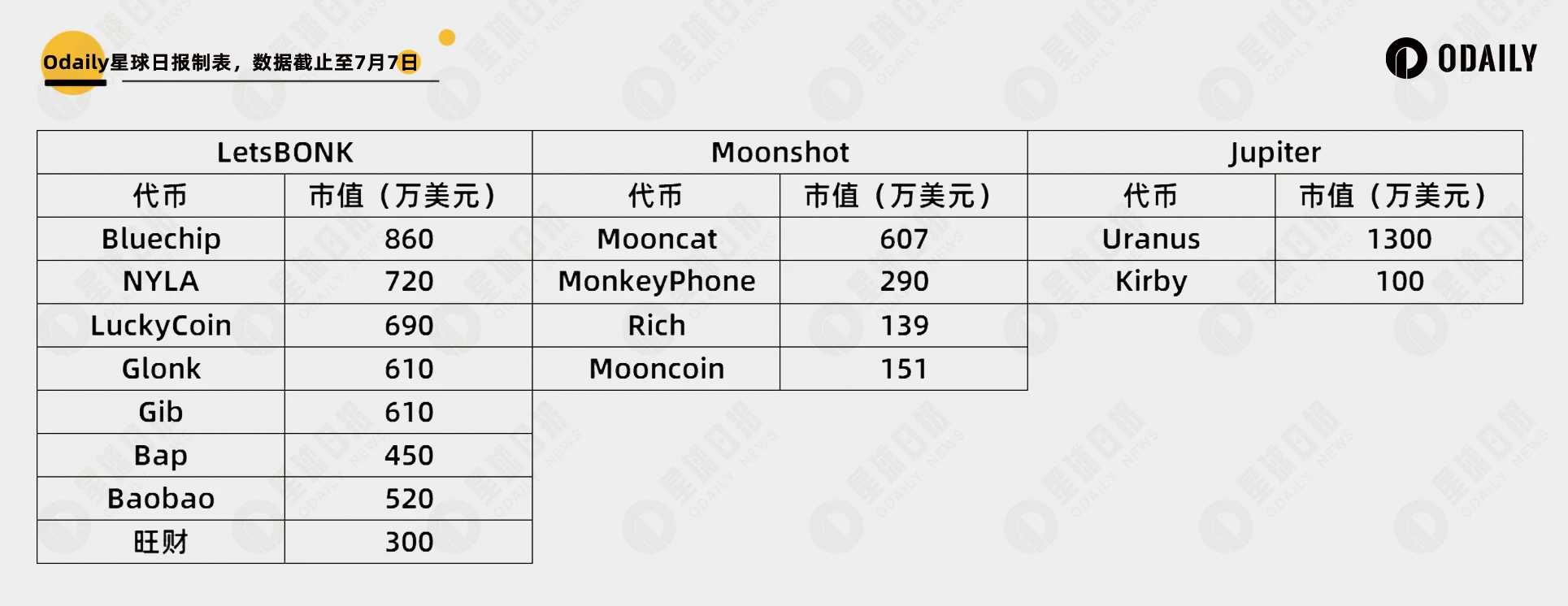

Token Issuance Volume Surpasses Pump.fun for the First Time, What’s on Letsbonk.fun?

Market share has reached 51%, with leading platform projects including USELESS, Hosico, and IKUN.

Ethereum and Scaling

Five Major Upward Logics Are Becoming Clearer, ETH May Welcome a Structural Reversal

Policy boundaries are becoming clearer, institutional capital is flowing back, EF is self-correcting, on-chain data shows divergence, and industry narratives are refocusing.

For ETH to Break Through the $10,000 Barrier, Ethereum Needs a New Growth Narrative

Many challenges facing Ethereum can be summarized into one core theme: there is a disconnect in the value capture supply chain between Ethereum's utility and the value of ETH.

If the superior value capture supply chain of ETH becomes a core part of the ETH narrative, just like in 2021.

Rollups have synchronous composability, eliminating the need for network bridging. Lower Layer 1 block times allow market makers to offer tighter spreads, leading to greater on-chain trading volume. Price execution power is significantly enhanced.

Ethereum's robust MEV infrastructure can ultimately be used to provide traders with the best execution (on Memecoins, etc.), rather than the approximately 20% of profits they find elsewhere.

Cross-chain liquidity is flowing back to Layer 1, while Native+Based Rollups can seamlessly access Layer 1 liquidity, increasing trading volume.

Based+Native Rollups consume 10 to 100 times less gas than current L2s while providing shared liquidity and composability, meaning all these activities on Rollups will actually consume a significant amount of ETH.

Tokenized assets on Rollups are accessible to other parts of the Ethereum ecosystem. Ethereum's position as a platform for issuing and trading tokenized assets will be further enhanced.

Thus, the feedback loop between Ethereum's utility and ETH value capture will be restored.

Also recommended: "Odaily Exclusive Interview with Yi Lihua: Why Hold 182,000 ETH at the Bottom with a Floating Profit of $130 Million and Not Sell?".

Multi-Ecosystem

Not Just Trading: A Review of Early GameFi and SocialFi Projects on HyperLiquid

CeFi & DeFi

Deep Dive into BlackRock's BUIDL Fund: How It Affects the RWA Landscape

Product Essence: BUIDL is fundamentally a regulated traditional money market fund (MMF), with underlying assets consisting of highly liquid, low-risk cash, U.S. Treasury bonds, and repurchase agreements. Its innovation lies in tokenizing fund shares into BUIDL tokens that circulate on a public blockchain, achieving on-chain ownership records, transfers, and profit distribution.

Business Process: The investment process reflects the core idea of "licensed finance." Investors must be "qualified purchasers" as defined by U.S. securities law and pass Securitize's KYC/AML review, with their wallet addresses whitelisted in the smart contract. The subscription (minting tokens) and redemption (burning tokens) processes connect off-chain fiat currency circulation with on-chain token operations. Among these, Circle's USDC instant redemption channel is a key innovation, resolving the fundamental contradiction between traditional financial settlement cycles and the 24/7 instant liquidity demands of the crypto world through a smart contract.

Market Impact and Strategic Significance: The launch of BUIDL is not only a key step in BlackRock's digital asset strategy but also serves as a significant catalyst and validation for the entire RWA tokenization field. It quickly surpassed early competitors to become the world's largest tokenized Treasury bond fund, with its assets under management (AUM) growth primarily driven by B2B demand from crypto-native protocols like Ondo Finance and Ethena using it as reserves and collateral. This indicates that BUIDL's success does not stem from traditional investors but rather from its precise fulfillment of the DeFi ecosystem's urgent need for compliant, stable, yield-generating on-chain dollar assets, thus establishing itself as a cornerstone of institutional-grade DeFi.

Written After the Hacker Attack: Is There Really Risk-Free Yield in the DeFi World?

There is no truly risk-free interest rate in DeFi.

The "pseudo-risk-free" yield options in DeFi include AAVE, Curve Finance, and tokenized U.S. Treasury bonds. However, we must also recognize that AAVE's supply-demand mechanism, Curve's revenue model relying on trading volume, and the "safety" of tokenized U.S. Treasury bonds cannot completely avoid potential risks associated with blockchain failures and the so-called "criminal hotbed" risks that DeFi OGs jokingly refer to.

The article also introduces the risk characteristics and operational logic corresponding to various yield enhancement strategies in DeFi protocols.

Prudent verification of on-chain data and self-borne risks are always the first tenet of DeFi.

Also recommended: "Lazy Investment Strategy | Upshift Releases First 'Acceleration Task'; Perena Vault Opens Applications (July 9)".

Web3 & AI

Vitalik's View on "AI 2027": Will Super AI Really Destroy Humanity?

Weekly Hotspot Recap

In the past week, ETH broke through the 3000 mark, BTC hit a new high; Musk established the "American Party", related memes surged temporarily, and the "American Party" will embrace Bitcoin, as fiat currency has lost hope; pump.fun launched the PUMP token through its first token issuance (Token Issuance Interpretation); BR experienced a flash crash, Bedrock stated it will publicly clarify LP addresses and confirm no withdrawal, and proposed special airdrop compensation; GMX was hacked for over $40 million; the hackers subsequently returned the stolen funds; ZachXBT again criticized Circle for inaction against the hacking: GMX attackers used CCTP to transfer stolen funds to Ethereum;

Additionally, in terms of policy and macro markets, the UAE officially clarified that digital currency investors do not qualify for the golden visa; Chen Maobo: Hong Kong-listed ETPs anchor assets including digital assets, and also track U.S. stock products like Coinbase; Yiwu local association responded to stablecoin settlement: almost none, with low recognition making it difficult to form widespread circulation;

In terms of opinions and voices, Musk: U.S. Treasury Secretary Yellen is a puppet of Soros, he is a political science major who can't even learn math; Matrixport: the market lacks new driving factors, retail trading activity continues to be weak; Bitcoin Magazine: Beware of the Bitcoin vault company bubble, Strategy will eventually fall below net asset value per share; Robinhood spokesperson: indirectly holds shares in OpenAI through a certain SPV, the price of OpenAI tokens is linked to the value of shares held by that SPV; STIX founder: has received off-market sell orders from a dozen WLFI whales, but buyers are few; Arthur Hayes: the altcoin season is coming, has increased bullish positions; OKX Star: only about 1% of users will receive inquiries about the source of funds or work and residence information, aimed at ensuring the platform is not abused; "Staking TON for UAE golden visa" was denied by officials;

In terms of institutions, large companies, and leading projects, Strategy hinted at pausing increases (Impact Interpretation); FTX liquidation excludes Chinese creditors (Self-Rescue Record); Greenland Holdings: Greenland Jinchuang holds Hong Kong licenses 4 and 9, supporting virtual asset business; the Ethereum Foundation proposed L1 zkEVM real-time proof standards, promoting the mainstreaming of zero-knowledge proofs; Truth Social will launch a utility token; Polymarket is once again embroiled in truth controversy over "Zelensky in a Suit" (Truth Controversy);

In terms of security, Shenzhen: Beware of illegal fundraising under the guise of stablecoins; Beijing Internet Finance Industry Association: Beware of illegal fundraising using new concepts like "stablecoins"; ZachXBT: will not take on cases related to the Sui ecosystem, as the ecosystem has not received support… well, it has been another eventful week.

Attached is the portal to the "Weekly Editor's Picks" series.

See you next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。